Garage and Overhead Doors Market Report Scope & Overview:

To Get More Information on Garage and Overhead Doors Market - Request Sample Report

The Garage and Overhead Doors Market size was estimated at USD 6.97 billion in 2023 and is expected to reach USD 11.40 billion by 2032 at a CAGR of 5.65% during the forecast period of 2024-2032.

The Garage and Overhead Doors Market is experiencing significant growth, driven by a blend of innovation and evolving consumer preferences. Recent years have seen a transformation in garage doors, positioning them as more than mere functional components; they are now integral to home aesthetics and smart living. Notably, garage door replacements offer the highest return on investment (ROI) among home improvements. In 2024 homeowners can expect an impressive 193.9% ROI from a garage door replacement, significantly boosting resale value, with an average increase of USD 8,751 for a typical investment of USD 4,513.

As technology advances, the garage door industry is witnessing exciting trends that enhance both functionality and appeal. One prominent development is the integration of smart technology. Smart garage door openers provide enhanced security and convenience, allowing homeowners to control their doors remotely through mobile apps. This trend aligns with the broader shift towards smart home ecosystems, making homes more interconnected and efficient.

Additionally, sustainability is becoming a focal point in garage door manufacturing. There is a growing preference for eco-friendly materials, with manufacturers increasingly adopting recycled steel and composite materials. These sustainable options not only cater to environmentally conscious consumers but also offer enhanced durability and aesthetic benefits, appealing to a modern audience. Another trend gaining traction is the integration of LED lighting into garage door openers. This innovation improves visibility and safety while reducing energy costs, offering a practical enhancement for homeowners.

MARKET DYNAMICS

DRIVERS

- The surge in residential construction activities, fueled by increasing population and housing needs, significantly boosts the demand for garage doors as new homes are built and renovated.

The increasing demand for residential construction is a significant driver of the garage and overhead doors market. As populations grow and urban areas expand, there is a heightened need for new housing developments. This surge in residential construction activities is fueled by several factors, including economic growth, rising disposable incomes, and favorable mortgage rates, which have fallen to around 3.3% in recent years, making homeownership more accessible to a larger demographic.

New homes are often equipped with modern amenities and features, including garages, which not only provide secure storage for vehicles but also enhance the overall aesthetic appeal and value of the property. According to a National Association of Home Builders report, about 85% of new homes built in the U.S. include a garage, demonstrating the integral role garages play in home design. As homebuyers increasingly prioritize functionality and security, the demand for high-quality garage doors rises correspondingly. Builders and contractors are thus compelled to source reliable and innovative garage door solutions to meet homeowners' expectations.

Moreover, the trend toward larger and more elaborate homes often includes multi-car garages, further boosting the market for garage doors. The growing popularity of energy-efficient and insulated garage doors also plays a crucial role, as homeowners seek products that offer improved thermal performance and contribute to energy savings. Additionally, about 35% of new homes are now being equipped with smart home technologies, creating opportunities for advanced garage door systems that can be controlled remotely.

- Technological advancements like smart garage door openers and improved security features are boosting consumer interest by offering increased convenience and safety.

Technological advancements in home automation are revolutionizing everyday tasks, particularly in garage door systems. Innovations like smart garage door openers have emerged as key solutions that enhance both convenience and security for homeowners. According to recent surveys, about 70% of consumers express interest in smart home technology, with over 40% specifically looking for solutions that enhance security. Smart garage door openers allow users to operate their garage doors remotely via smartphone apps, enabling seamless entry and exit without the need for traditional remotes or manual operation. This remote access not only simplifies the process of entering or leaving the garage but also offers features like real-time notifications, allowing homeowners to monitor their garage door status from anywhere, ensuring peace of mind.

Enhanced security features further amplify the appeal of smart garage door systems. Many models incorporate advanced technologies such as rolling codes and encrypted signals, making unauthorized access significantly more difficult. Research indicates that homes with smart security systems can deter up to 60% of potential break-ins. Additionally, some systems can be integrated with home security cameras, providing users with visual confirmation when the garage door opens or closes. The ability to set unique access codes for family members or trusted visitors adds another layer of security, preventing the need for physical keys or shared remotes. These technological advancements are particularly attractive to tech-savvy consumers looking to streamline their daily routines while enhancing their home’s safety. As smart home technology continues to evolve, the integration of intelligent systems into everyday devices like garage doors not only offers unparalleled convenience but also addresses the growing demand for home security solutions, positioning these products as essential elements of modern living.

RESTRAIN

- High-quality garage and overhead doors require a significant upfront investment for purchase and installation, which may discourage potential buyers.

The cost of installing a new garage door range from USD 750 to USD 6,325, with an average price of USD 2,743. This extensive variety is due to various factors that can impact the ultimate cost, including the type of door, material, size, and extra features. Furthermore, labor costs may fluctuate based on where you are located and the level of difficulty of the installation. If your current garage door opener is not equipped to support the weight of a new garage door, you may need to replace it along with the door, increasing the overall cost. In addition to the basic factors like door material, size, and location, various other elements can impact the total expenses of replacing your garage door. Insulating your garage door enhances energy efficiency, though it typically costs an extra USD 1,037. Take into account the climate in your area and the frequency with which you utilize the garage to determine if insulation is a good investment. Installation of electrical wiring in a garage without it for an automatic opener will necessitate hiring an electrician and incurring extra expenses.

Some quotes might involve taking out and getting rid of your old door, while others could require an additional fee. Anticipate spending between USD 30 and USD 200 for removal and disposal. In the event that your current door opener requires repairs while being replaced, this will increase the total cost. Although tipping is not required, some people may choose to give a USD 10 to USD 20 tip to installers who impress them with their professionalism or efficiency. Requirements for garage door replacements may vary by location, with building permits possibly being necessary. Permits can cost anywhere from USD 40 to USD 120. Manual garage doors are usually cheaper to install than automatic ones with openers. The average cost of manual installation is USD 1,375, whereas automatic installation costs USD 2,125 on average.

KEY SEGMENTATION ANALYSIS

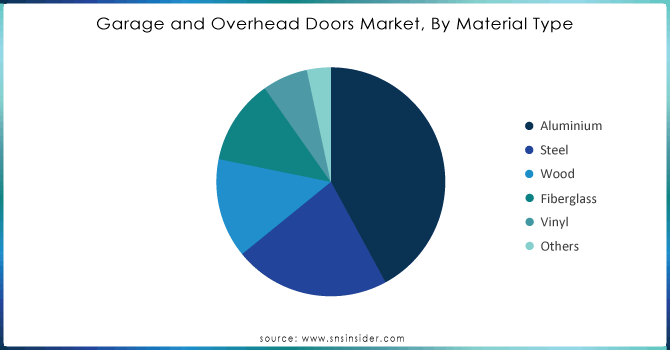

By Material Type

In 2023, the steel segment dominated the market share over 42 % due to its increasing popularity for exterior doors. This is because they easily roll into the roof space, can be rolled out again effortlessly, and provide great advantages. It reduces noise levels, provides thermal insulation to protect against extreme temperatures, and helps make homes more eco-friendly. Steel doors are built with multiple layers. A door with one layer consists of steel only, a door with two layers has a steel layer and a vinyl-backed foam insulation layer inside, and a door with three layers has steel layers on both the inside and outside, with insulation between them. 24-gauge galvanized steel is the top-quality steel utilized in garage door manufacturing. The thicker the steel, the lower the gauge when using steel. Doors of superior quality are constructed with 24 or 25 gauge, while doors of builder grade are made with 25 or 26 gauge, and doors that are inexpensive and of low quality are manufactured with 27 or 28 gauge.

Do You Need any Customization Research on Garage and Overhead Doors Market - Inquire Now

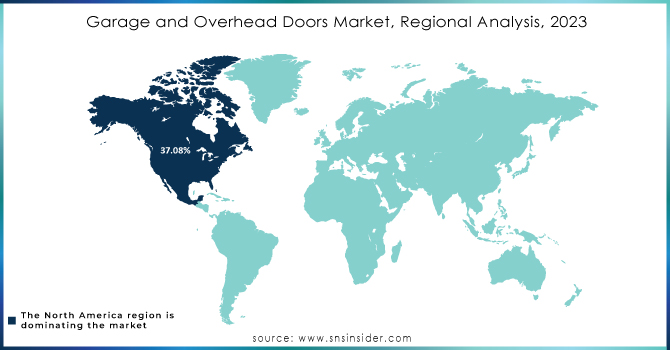

REGIONAL ANALYSIS

In 2023, North America region dominated the market share over 47.27% in the garage and overhead door market, with expectations to maintain this dominance throughout the forecast period. This stronghold can be attributed to several factors, including the escalating demand for these products in both residential and commercial sectors. The region is home to several prominent manufacturers and suppliers, which bolsters its market position and enables a robust supply chain that meets the growing consumer needs.

The Asia-Pacific (APAC) region is set to experience notable growth, driven primarily by rapid urbanization and industrialization in major economies such as China, India, and several Southeast Asian nations. These developments lead to an increasing need for modern infrastructure, which includes advanced garage and overhead door solutions.

KEY PLAYERS

Some of the major key players of Garage and Overhead Doors Market

- Clopay Corporation (Garage Doors, Overhead Doors)

- Sanwa Holdings Corporation (Overhead Doors, Garage Doors)

- Wayne Dalton (Garage Doors, Overhead Doors)

- CHL Overhead Doors (Industrial Overhead Doors)

- Raynor Garage Doors (Residential Garage Doors, Commercial Doors)

- PerforMax Global (Overhead Doors, Insulated Doors)

- Dynaco (Rolling Doors, High-Speed Doors)

- Rite Hite (Loading Dock Equipment, High-Speed Doors)

- Rytec Corporation (High-Speed Doors, Commercial Doors)

- Chase Doors (Flexible Doors, Overhead Doors)

- Goff's Enterprises (Industrial Doors, Strip Doors)

- Hormann Group (Garage Doors, Industrial Doors)

- Amarr Garage Doors (Residential and Commercial Garage Doors)

- Overhead Door Corporation (Overhead Doors, Garage Doors)

- Marantec (Garage Door Openers, Smart Technology Solutions)

- LiftMaster (Garage Door Openers, Access Control Systems)

- C.H.I. Overhead Doors (Residential and Commercial Garage Doors)

- Sommer USA (Garage Door Openers, Accessories)

- B&D Doors (Roller Doors, Sectional Doors)

- Aluroll (Roller Shutters, Garage Doors)

RECENT DEVELOPMENTS

-

In 2024: The garage door industry is seeing innovations like sleek designs using advanced materials and smart technology integration for enhanced convenience and security. Energy-efficient features are also gaining traction, focusing on sustainability while offering homeowners better temperature control and lower utility bills.

-

In June 2024: Windsor Door announced a USD 21 million expansion at its Little Rock facility, which will add a new production line to meet increasing demand for its residential and commercial garage doors. This investment will boost manufacturing capacity, create jobs, and support the local steel industry.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 6.60 billion |

| Market Size by 2032 | USD 11.03 billion |

| CAGR | CAGR of 5.68% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Material Type (Aluminium, Steel, Wood, Fiberglass, Vinyl, Others) • By End User (Residential, Commercial) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Clopay Corporation, Sanwa Holdings Corporation, Wayne Dalton, CHL Overhead Doors, Raynor Garage Doors, PerforMax Global, Dynaco, Rite Hite, Rytec Corporation, Chase Doors, Goff's Enterprises, Hormann Group, Amarr Garage Doors, Overhead Door Corporation, Marantec, LiftMaster, C.H.I. Overhead Doors, Sommer USA, B&D Doors, Aluroll. |

| Key Drivers | • The surge in residential construction activities, fueled by increasing population and housing needs, significantly boosts the demand for garage doors as new homes are built and renovated. • Technological advancements like smart garage door openers and improved security features are boosting consumer interest by offering increased convenience and safety. |

| RESTRAINTS | • High-quality garage and overhead doors require a significant upfront investment for purchase and installation, which may discourage potential buyers. |