Metal Shredder Machine Market Report Scope & Overview:

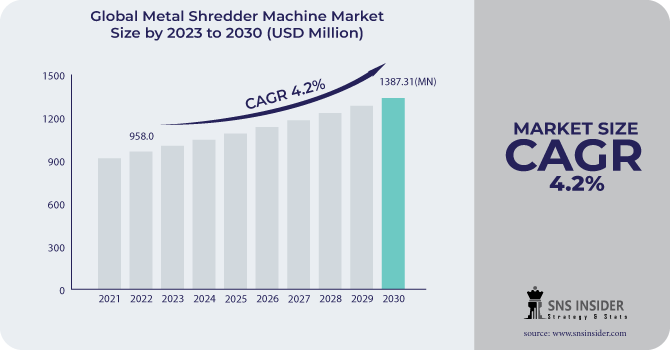

The Metal Shredder Machine Market size was estimated at USD 996.77 Million in 2023 and is expected to reach USD 1411.50 Million by 2032 at a CAGR of 3.94% during the forecast period of 2024-2032. This report highlights the integration of the Internet of Things (IoT) which refers to the evolution of smart technologies that allow for continual monitoring and predictive maintenance, resulting in improved productivity and reduced downtime. It also offers insights into next-gen shredding solutions, including smart automation, AI-powered monitoring, and low-noise, high-efficiency shredders. This report highlights trends in electric-powered shredders, modular designs for scalable operations, and enhanced dust and emissions control systems.

To get more information on Metal Shredder Machine Market - Request Free Sample Report

The process of metal shredders helps in recycling metals, of which more than 70% are steel and aluminum metals, thus helping save the atmosphere from 60% carbon emissions. The growing manufacturing of electric vehicles is still staggering the demand for critical metals recycling technology.

Market Dynamics:

Drivers

-

Technological advancements in automation, artificial intelligence, energy efficiency, and smart monitoring systems for greater productivity and sustainability.

The Metal Shredder Machine Market is estimated to see significant with the need for automating industrial processes, manufacturers are using an increasing number of automated and smart systems, integrated with AI (artificial intelligence) and IoT (Internet of Things) based functionalities that can assist manufacturer with efficiency, operational cost, and scrap processing. Shredder operators improve material recovery rates using AI-powered shredders that can automatically detect and sort various metal types. Moreover, the increasing adoption of energy-efficient shredders with low power consumption and minimal emissions is in line with the sustainability objectives worldwide. Intelligent monitoring systems are also catching on where real-time machine performance monitoring and predictive maintenance to eliminate downtime are being made possible. Due to the limited space and mobility availability in several industries, this shredder will find its demand in the coming years with high-capacity, mobile, and modular features, as they will gain traction in the waste recycling sector further augmenting market trends. This will contribute to market growth, as the next-generation shredders will be increasingly adopted across industrial verticals, including automotive, construction, and electronics, to stimulate sustainable recycling. Such innovations will provide a higher level of productivity, safety, and environmental compliance and hence contribute towards the growth of the market.

Restraint

-

High initial investment costs are restricting new entrants, particularly SMEs, in the metal shredder machine market

The high capital investment of buying and installing sophisticated shredding machinery can pose an entry and growth barrier to the market. This has been the case for quite a long time now, but trends are changing, and as technology advances and competition in the market increases, the prices of some shredders have come down. Cost-effective recycling of metals will push many SMEs to better the financing options available, provided they have the optimum returns, lease models, and government incentives to balance out these efforts when it comes to the demand for metal recycling on the back of increasing sustainability laws and the need for raw materials from recycled metals. Yet despite their high initial cost, companies are beginning to appreciate the lasting advantages of using shredders, including reduced waste disposal charges, improved recycling efficiency, and increased income from materials processed. The market is growing as reflected by trends in automation for energy-efficient and smaller as well as modular shredding solutions which drive down capital investment barriers for smaller businesses.

Opportunity

-

The growing demand for efficient recycling technologies and sustainable practices is boosting the growth of the metal shredder machine market

The prominence of the metal shredder machine market is primarily influenced by government incentives for recycling initiatives. Regard for recycling scrap metals is anticipated to grow globally due to government agencies offering tax breaks, subsidies, and financial incentives to further encourage recycling. Such policies push businesses to embrace processes involving high-end tools for recycling, including metal shredders, to achieve targets towards sustainability. As a result, industries are shifting towards eco-friendly waste management practices, leading to higher demand for shredding equipment. It is most prevalent in developed economies as waste elimination legislation becomes stricter. Furthermore, the increasing government support for recycling in emerging markets provides plenty of opportunities for the metal shredder market to be lucrative. On this account, such incentives by organizations assist in bringing down the operational expenses of doing activities, improve the recycling waste, and help to stimulate the market’s development and technological process of lesser metal waste.

Challenges

-

Logistical issues, such as inefficient scrap collection and inadequate infrastructure, hinder the steady supply of metal waste to shredding plants, limiting market growth in certain regions.

Poor infrastructure for collecting scrap (e.g., recycling centers, transportation, and sorting) complicates the provision of a reliable, high-quality metal waste stream to shredding plants. This breaks the supply chain delays the process and makes it less performed in the recycling process. In addition, areas with low availability of high-tech waste management facilities commonly face poor segregation of scrap; this causes contamination of material and hence, lower quality raw materials. Hence, this might not lead to optimum metal shredder demand. Nevertheless, there are trends visible in the market that are being introduced to overcome these challenges, including mobile shredders and modular systems that allow scrap to be processed on-site. Further, the logistics restriction restraining the growth of the market is likely to be reduced by the collection infrastructure improvements done for scrap collection and other waste management initiatives from various government bodies.

Segment Analysis:

By Type

The Mechanical Shredder Machine segment dominated with a market share of over 62% in 2023, due to its wide-ranging applications in scrap yards and metal recycling operations. These machines reduce metal to various standardized shapes and sizes to further enable the processing of the materials. They are capable of processing a variety of materials from white goods, home appliances, sorted light scrap to end-of-life vehicles, and ferrous and non-ferrous metals. The machines are also known to operate efficiently as they are designed in a way that they run with less noise, sparking, and dust & heat which, in turn, results in a safer working environment. Because of these properties and also their effectiveness as well as versatility, these have been broadly used in different markets as well as strengthening their reigned placement in the marketplace.

By Application

The Iron and Steel segment dominated with a market share of over 39% in 2023. This is mainly due to the high demand for scrap metal processing from different industries, especially the construction, automotive, and manufacturing industries. The most known recycled metals are Iron and steel, because of the massive usage of Iron and steel development in all infrastructure, vehicle production, and all superstructure usage in massive machinery. The increasing trend of recycling scrap metals to conserve natural resources and reduce environmental impact is also driving the market for metal shredders. As one of the primary drivers of overall global iron & steel market growth and stability, this segment is also expected to continue benefiting from the rising demand within iron and steel-dependent industries such as construction and automotive manufacturing.

Key Regional Analysis:

Asia-Pacific region dominated with a market share of over 38% in 2023. Key economies are very rapidly industrializing cities, with robust government efforts for recycling and waste management, driving this dominance. Not to mention, China, India, and Japan are the major contributors to this growth due to their key investments in modern waste management facilities and technologies. Furthermore, due to the increase in the production of metal scrap, these nations are also embracing sustainable development space breathing life by increasing the demand for metal shredder machines. Due to this, Asia-Pacific represents the highest regional market share while also indicating a strong need for the development of recycling and waste processing technologies.

Europe is projected to be the fastest-growing region in the metal shredder machine market, with an emphasis on sustainability and environmental responsibility. Increasing recycling and resource recovery is being driven in part by stringent regulations, such as the EU Circular Economy Action Plan. Advanced practices like zero-waste economies by countries such as Germany, the U.K., and France exert a greater appeal for metal shredding equipment as well. Key factors driving this growth are the demand for better waste processing infrastructure and the necessity to achieve recycling targets. Furthermore, the demand for efficient metal shredders will dramatically increase with the commitment towards landfill avoidance and improved material recovery rates in Europe, making up a major share of global market growth.

.png)

Need any customization research on Metal Shredder Machine Market - Enquiry Now

Some of the major key players in the Metal Shredder Machine Market:

-

Metso – Metso Metal Shredders, Waste Shredders

-

Shredding Systems – Dual Shaft Shredders, Waste Shredders

-

UNTHA – XR Class Shredder, RS Series Shredders

-

WEIMA – Single Shaft Shredders, Industrial Shredders

-

BCA Industries – Waste Shredders, Material Recovery Equipment

-

Hammermills International – Heavy Duty Hammermills, Industrial Shredders

-

MOCO – Metal Shredders, Granulators

-

Ecostan – Shredder Machines, Briquette Machines

-

Rapid Granulator – Granulators, Recycling Shredders

-

ANDRITZ – Metal Shredders, Recycling Equipment

-

SSI Shredding Systems – Quad Shaft Shredders, Industrial Shredders

-

Vecoplan – Shredding Machines, Recycling Equipment

-

ZATO – Metal Shredders, Scrap Metal Processing

-

JMC Recycling – Shears, Shredders, Recycling Equipment

-

EuRec – Industrial Shredders, Recycling Equipment

-

Harris – Metal Shredders, Hydraulic Scrap Shears

-

Lindner-Recyclingtech – Industrial Shredders, Granulators

-

Terex Ecotec – Waste Shredders, Mobile Shredders

-

Doppstadt – Shredders, Waste Processing Machines

-

Changshu Shouyu Machinery Co., Ltd. – Metal Shredders, Recycling Machines

Suppliers for (high-efficiency shredders with advanced technology for reducing metal waste. They focus on durable, high-capacity shredders with low maintenance) on Metal Shredder Machine Market

-

Metso

-

Shredding Systems

-

UNTHA

-

WEIMA

-

BCA Industries

-

Hammermills International

-

MOCO

-

Ecostan

-

Rapid Granulator

-

ANDRITZ

Recent Development:

In January 2024: Lindner Shredder Helps Loacker Recycling, based in Wonfurt, Germany, and part of the Loacker Recycling GmbH family business headquartered in Götzis, Austria, specializes in waste cable recycling. Thanks to a recycling concept developed in-house, the company achieves the highest possible copper recovery at low processing costs. As part of its operation, the company utilizes a Lindner Polaris 2800 single-shaft shredder with rotor cooling.

In April 2024: Zato’s Blue Devil twin-shaft shredder has helped Allied Scrap Processors Inc. produce high-quality material for steel mills. The shredder, in use since 2021 at Allied Scrap’s Lakeland, Florida facility, operates seven hours a day, five days a week, with minimal maintenance. It’s described as simple and reliable, producing high-grade scrap comparable to No. 1 heavy melting steel, helping to create a clean No. 2 HMS product approved by steel mill customers.

| Report Attributes | Details |

|---|---|

|

Market Size in 2023 |

USD 996.77 Million |

|

Market Size by 2032 |

USD 1411.50 Million |

|

CAGR |

CAGR of 3.94% From 2024 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2032 |

|

Historical Data |

2020-2022 |

|

Report Scope & Coverage |

Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

|

Key Segments |

• By Type (Mechanical Shredder Machine, Shock Wave Shredder Machine) |

|

Regional Analysis/Coverage |

North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

|

Company Profiles |

Metso, Shredding Systems, UNTHA, WEIMA, BCA Industries, Hammermills International, MOCO, Ecostan, Rapid Granulator, ANDRITZ, SSI Shredding Systems, Vecoplan, ZATO, JMC Recycling, EuRec, Harris, Lindner-Recyclingtech, Terex Ecotec, Doppstadt, Changshu Shouyu Machinery Co., Ltd. |