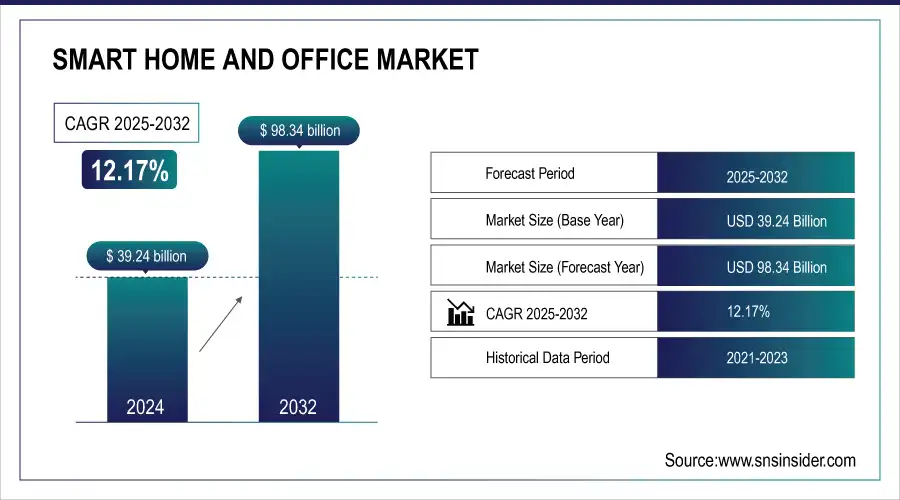

Smart Home and Office Market Size & Growth:

The Smart Home and Office Market Size was valued at USD 39.24 Billion in 2024 and is expected to reach USD 98.34 Billion by 2032 and grow at a CAGR of 12.17% over the forecast period 2025-2032.

Smart Home and Office devices are in high demand because the convergence of rising disposable income, increasing urbanization, and growing adoption of Internet of Things (IoT) devices, they promise to win and develop the user's trust, reliability, safety, and security as a trending concept, as well as to improve the overall look and vibe of the location where the market services and devices are used and installed. Also, which allows devices to connect and share data. This creates a network of smart appliances, thermostats, security systems, and more, all controllable from a smartphone or voice assistant. The number of IoT connections is expected to explode in the coming years, fueling the market's growth.

Smart Home and Office Market Size and Forecast:

-

Market Size in 2024: USD 39.24 Billion

-

Market Size by 2032: USD 98.34 Billion

-

CAGR: 12.17% from 2025 to 2032

-

Base Year: 2024

-

Forecast Period: 2025–2032

-

Historical Data: 2021–2023

Get more information on Smart Home And Office Market - Request Sample Report

For instance, there will be an estimated 25 billion global connections by 2025, up from just 10.3 billion in 2018. This surge in interconnected devices presents a significant opportunity for companies developing and integrating smart home and office technologies. Furthermore, the population of the developed economies operating on a global scale is witnessing an increase in income, which is converting them into target audience due to the developed interest in the market's devices and services.

Smart Home and Office Market Highlights:

-

The market is witnessing strong growth driven by rising demand for convenience, security, and automation in residential and commercial spaces.

-

Automated lighting, smart locks, connected sensors, and remote monitoring systems are key technologies enhancing comfort, safety, and energy efficiency.

-

Growing digital awareness and adoption of voice assistants and smartphone-controlled systems are fueling rapid market expansion.

-

Lack of standardized communication protocols across devices remains a key restraint, creating interoperability and integration challenges for users.

-

The aging global population is creating new opportunities for smart home solutions that promote independent living, safety, and remote health monitoring.

-

Collaboration between manufacturers to develop open platforms and unified ecosystems is essential for achieving seamless connectivity and sustained market growth.

Smart Home and Office Market Drivers:

-

Growing Demand for Convenience and Security like automated lighting, smart locks, and remote monitoring address these needs.

The growing demand for convenience and security is a major driver of the smart home and office market. Consumers and businesses increasingly seek integrated solutions that enhance comfort, efficiency, and safety through technologies such as automated lighting, smart locks, connected sensors, and remote monitoring systems. These innovations enable users to control and manage their environments seamlessly using smartphones, voice assistants, or centralized platforms, offering both peace of mind and energy savings. The ability to monitor premises in real time, automate daily routines, and enhance access control appeals to modern lifestyles and corporate efficiency goals. As awareness of digital convenience and safety rises, adoption of smart home and office systems continues to accelerate across residential and commercial spaces.

Smart Home and Office Market Restraints:

-

Different Smart Home and Office devices may use incompatible protocols or require separate apps, creating a fragmented user experience.

Different smart home and office devices often operate on incompatible communication protocols or require separate mobile applications for control, leading to a fragmented and sometimes frustrating user experience. This lack of standardization limits interoperability between devices from different manufacturers, reducing the efficiency and convenience that smart systems are meant to provide. Users may struggle to integrate various products into a single ecosystem, which can complicate setup, maintenance, and daily operation. As a result, many potential consumers hesitate to adopt multiple smart technologies due to concerns about compatibility and system complexity. Addressing this challenge through unified platforms, open-source standards, and cross-brand collaborations is essential to achieving a truly seamless and connected smart environment.

Smart Home and Office Market Opportunities:

-

The growing aging population creates a demand for smart home solutions that promote independent living and safety.

The growing aging population is driving significant demand for smart home solutions that support independent living, safety, and improved quality of life for seniors. Smart technologies such as fall detection sensors, voice-assisted systems, automated lighting, and remote health monitoring enable elderly individuals to live more comfortably and securely in their own homes. Family members and caregivers can also monitor their well-being in real time, ensuring timely assistance in emergencies. As life expectancy increases and healthcare systems emphasize home-based care, the integration of smart devices designed for aging populations is becoming a vital component of modern, connected living environments.

Smart Home and Office Market Segment Analysis:

By Product

The Smart Home and Office market is segmented into Lighting Controls, HVAC Controls, Surveillance Products, and Access Controls, with the Access Controls segment emerging as the dominant category. This dominance is driven by the growing emphasis on robust security solutions that provide remote monitoring, real-time alerts, and personalized access management. Consumers and businesses increasingly prioritize smart locks, biometric systems, and integrated access technologies to enhance safety and convenience. Leading companies such as Amazon, through their Ring product line—including the Spotlight Cam Plus and Ring Spotlight Cam Pro—are advancing the segment by integrating radar and 3D motion detection for superior precision and security performance in connected environments.

By Standard

The Smart Home and Office market can be segmented based on communication standards such as Zigbee, Z-Wave, Wi-Fi, and KNX, with KNX emerging as the leading revenue-generating standard. The increasing focus on energy efficiency and the growing burden of rising electricity costs are driving demand for KNX-based solutions. KNX offers strong interoperability and ecosystem compatibility, enabling seamless integration of various building systems such as lighting, heating, ventilation, and cooling. By intelligently coordinating these systems, KNX technology optimizes energy consumption, potentially reducing overall usage by up to 60%. Its ability to deliver both comfort and cost savings makes KNX a preferred choice in smart home and office automation worldwide.

Smart Home and Office Market Regional Analysis:

North America Smart Home and Office Market Trends:

North America dominates the Smart Home and Office market, driven by a rising number of smart homes and growing consumer demand for security, energy efficiency, and convenience. The region’s adoption of smart access control systems, advanced security cameras, and integrated monitoring technologies is propelling market expansion. With a long history of embracing new technologies, North America has a population well-versed in connected device usage. The established smart home ecosystem and strong presence of major players create a fertile environment for continued growth in both residential and commercial smart automation markets.

Need any customization research on Smart Home And Office Market - Enquiry Now

Europe Smart Home and Office Market Trends:

Europe represents a mature and innovation-driven market for smart home and office technologies. Growth is fueled by strict energy efficiency standards, sustainability goals, and the region’s strong emphasis on smart building infrastructure. Countries such as Germany, the UK, and France are leading the adoption of lighting automation, HVAC control, and energy management systems. Government incentives for low-carbon solutions and digital transformation initiatives further encourage the integration of smart technologies across homes and workplaces, making Europe a key contributor to the global smart automation landscape.

Asia-Pacific Smart Home and Office Market Trends:

The Asia-Pacific Smart Home and Office market is expanding rapidly, supported by a large, young, and tech-savvy population embracing connected living. Governments across the region are actively advancing smart city initiatives, which include smart homes and offices, driving infrastructure development. Developed economies such as Japan, South Korea, and Australia lead in innovation and adoption, while emerging markets like India, China, and Southeast Asia are witnessing accelerating growth due to urbanization, affordability of smart devices, and expanding internet connectivity.

Latin America Smart Home and Office Market Trends:

The Latin American market is witnessing steady growth, driven by digital transformation, urbanization, and increasing awareness of smart energy and security systems. Countries such as Brazil and Mexico are leading in adoption, supported by the rising availability of IoT-enabled devices and improved network infrastructure. The growing middle class and demand for affordable automation solutions are fostering market expansion. However, challenges such as limited infrastructure in rural areas and economic variability slightly restrain the market’s overall pace of adoption.

Middle East & Africa Smart Home and Office Market Trends:

The Middle East and Africa region is experiencing emerging growth in the Smart Home and Office market, fueled by investments in smart city projects and rising focus on sustainable development. Countries like the UAE, Saudi Arabia, and South Africa are leading with initiatives promoting digital transformation and energy-efficient building automation. Increasing urbanization, rising disposable income, and government-backed smart infrastructure projects are supporting adoption. Although still in early stages compared to other regions, MEA presents significant long-term growth potential for smart automation technologies.

Smart Home and Office Companies are:

-

United Technologies Corporation

-

Schneider Electric SE

-

Sony Corporation

-

Siemens AG

-

Honeywell International Inc.

-

Samsung Electronics Co., Ltd.

-

Legrand SA

-

Eaton Corporation plc

-

Amazon.com, Inc.

-

Google LLC (Alphabet Inc.)

-

ABB Ltd.

-

LG Electronics Inc.

-

Panasonic Corporation

-

Cisco Systems, Inc.

-

Crestron Electronics, Inc.

-

Lutron Electronics Co., Inc.

-

Philips Lighting (Signify N.V.)

-

Control4 Corporation (Snap One Holdings Corp.)

Smart Home and Office Market Competitive Landscape:

Johnson Controls International plc, established in 1885, is a global leader in smart, safe, and sustainable building solutions, offering advanced technologies for energy efficiency, building automation, and digital infrastructure. Headquartered in Cork, Ireland, the company focuses on transforming commercial spaces through intelligent HVAC, security, and integrated smart building systems.

- In August 2025 Johnson Controls completed the USD 8.1 billion sale of its Residential and Light Commercial HVAC business to Bosch Group, positioning itself as a pure-play provider of innovative smart building solutions and advancing its strategic transformation.

Robert Bosch GmbH, established in 1886, is a leading global technology and services company specializing in mobility, industrial technology, consumer goods, and energy solutions. Headquartered in Stuttgart, Germany, Bosch is a key innovator in smart home and building automation, offering intelligent devices, sensors, and connected solutions that enhance comfort, safety, and efficiency.

- In November 2024, Bosch released a major software update for its Smart Home System, introducing data backup and recovery, automation widgets, enhanced temperature control, and improved firmware for thermostats and smart lamps, reinforcing its commitment to smarter, more secure home automation solutions.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 39.24 Billion |

| Market Size by 2032 | USD 98.34 Billion |

| CAGR | CAGR of 12.17% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Lighting Controls, Hvac Controls, Surveillance Products, Access Controls) • By Standard (Wi Fi And Infrared, En Ocean, Bac Net, Z Wave, Zigbee, Dali, Knx) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles |

Johnson Controls International plc, United Technologies Corporation, Schneider Electric SE, Robert Bosch GmbH, Sony Corporation, Siemens AG, Honeywell International Inc., Samsung Electronics Co., Ltd., Legrand SA, Eaton Corporation plc, Amazon.com, Inc., Google LLC (Alphabet Inc.), ABB Ltd., LG Electronics Inc., Panasonic Corporation, Cisco Systems, Inc., Crestron Electronics, Inc., Lutron Electronics Co., Inc., Philips Lighting (Signify N.V.), and Control4 Corporation (Snap One Holdings Corp.). |