Garlic Oleoresin Market Report Scope And Overview:

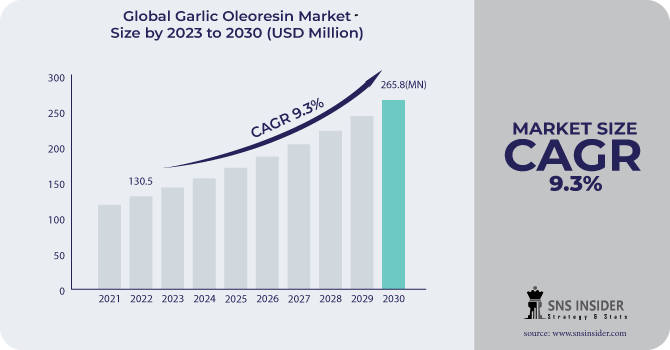

The Garlic Oleoresin Market size was USD 130.5 million in 2022 and is expected to Reach USD 265.8 million by 2030 and grow at a CAGR of 9.3% over the forecast period of 2023-2030.

Garlic oleoresin is a concentrated garlic extract that retains the fresh herb's flavor and perfume. It is made by employing a solvent or supercritical fluid to extract the volatile oils and other flavor components from garlic cloves. Garlic oleoresin is a viscous liquid that ranges in color from light orange to amber.

Based on nature, the conventional segment of the garlic oleoresin market holds a market share of around 92.9% in 2022. In the conventional segment, garlic oleoresin is generated utilizing traditional extraction techniques such as solvent extraction and supercritical fluid extraction. These techniques are more affordable and effective than the natural methods used to make organic garlic oleoresin.

Based on end users, the food & beverage segment holds a majority of the market share of around 74.9% with a value of USD 96.9 Million in 2022. Garlic oleoresin is a popular ingredient in a wide range of food and beverage items including frozen products, ready-to-eat snacks, and meat products. Ethnic cuisines such as Indian, Chinese, and Mexican cuisines are gaining popularity all over the world. Garlic is frequently used as a prominent element in many cuisines, which drives demand for garlic oleoresin.

MARKET DYNAMICS

KEY DRIVERS

-

Health benefits associated with garlic

Garlic oleoresin contains anti-inflammatory characteristics that can aid in the reduction of inflammation throughout the body. People suffering from arthritis, asthma, and inflammatory bowel disease may benefit from this. Garlic oleoresin has been found to lower total cholesterol, LDL (bad) cholesterol, and triglyceride levels. This can assist in lowering the risk of cardiovascular disease and stroke. According to the World Health Organisation, the prevalence of headache disorders among adults is estimated to be over 50%. Half to three-quarters of adults aged 18 to 25 in the world have suffered headaches in the recent year, with 30% or more reporting migraines.

RESTRAIN

-

High cost of garlic oleoresin

Garlic oleoresin extraction is a complicated process that necessitates the use of specialized equipment. Furthermore, raw material supply can be limited, particularly during the off-season. Price volatility and supply interruptions may result as a result. Because of the high cost of manufacture, garlic oleoresin may be less competitive in the market, particularly when compared to synthetic flavors. It might also make it harder for new entrants to enter the market. Garlic oleoresin manufacturers can reduce manufacturing costs and assure the long-term survival of their enterprises.

OPPORTUNITY

-

Use of garlic oleoresin in various applications

Garlic oleoresin is used to treat illnesses such as excessive cholesterol, high blood pressure, and heart disease in various pharmaceuticals and nutraceutical products. It is also used to strengthen the immune system and combat infections. Garlic oleoresin is frequently used in the food and beverage industries to flavor a wide range of items, including processed meals, sauces, dressings, beverages, and confectionery. It's included in several functional meals and beverages like cholesterol-lowering spreads and blood pressure-lowering drinks. Garlic oleoresin is also found in several skincare products to help with circulation and irritation.

CHALLENGES

-

Negative side effects of garlic

Some people are allergic to garlic, and garlic oleoresin can cause allergic reactions. Hives, swelling, difficulty breathing, and anaphylaxis are all symptoms of an allergic reaction to garlic oleoresin. Certain drugs, such as blood thinners and diabetes medications, may interact with garlic oleoresin. Garlic oleoresin contains allicin, the chemical responsible for garlic's distinctive odor. Allicin is taken into the bloodstream and released through the lungs and sweat glands when garlic oleoresin is ingested, resulting in poor breath and body odor. The growth of the market is hampered by the potential side effects of garlic.

IMPACT OF RUSSIAN-UKRAINE WAR

The Russia-Ukraine conflict has had a negative influence on the spices market like garlic, cinnamon, etc market. Ukraine is a large garlic producer, accounting for approximately 10% of global production. The war has hindered the production and shipping of garlic from Ukraine, resulting in a global shortage of garlic oleoresin. The price increase for garlic oleoresin is predicted to have a detrimental impact on the food and beverage industry since it will raise the cost of producing food and beverage goods. Due to a lack of garlic oleoresin in Ukraine, demand for garlic oleoresin from alternate sources such as China and India has surged in 2022.

IMPACT OF ONGOING RECESSION

A recession is likely to have a negative impact on the garlic oleoresin market. It has also impacted on the spice market. Garlic consumption in the United States has decreased by 9%. Furthermore, a downturn in the pharmaceutical and nutraceutical industries can reduce demand for garlic oleoresin. This is because, during a recession, customers are less likely to spend money on supplements and other non-essential healthcare products. Farmers in several countries are experiencing a severe financial crisis since the price of garlic is rising, and the demand for garlic is decreasing in 2022.

MARKET SEGMENTATION

By Nature

-

Organic

-

Conventional

By Extraction Method

-

Solvent Extraction

-

SCFE

By Distribution Channel

-

Supermarkets/Hypermarkets

-

Specialty Stores

-

Online Sales

-

Others

By End User

-

Food & Beverage Industry

-

Pharmaceutical

-

Retail / Household

-

Nutraceuticals

.png)

REGIONAL ANALYSIS

Asia Pacific is the largest market for garlic oleoresin, accounting for over 58.3% of the global market share in 2022. This is due to garlic is widely consumed in Asian countries such as China, India, and Bangladesh. Garlic is a common ingredient in many Asian dishes, although its use varies considerably across countries. Garlic is employed in traditional medicine in many Asian cultures, in addition to its culinary use.

North America is the second-largest market for garlic oleoresin, accounting for over 19.9% of the global market share in 2022. The U.S. holds a market share of approximately 72.9% in 2022. The increasing demand for natural and healthy food products is driving the expansion of the garlic oleoresin market in North America. Furthermore, the growing popularity of ethnic cuisines such as Indian and Mexican cuisines, which include garlic as a prominent ingredient, is fueling market expansion.

Europe is the significant market for garlic oleoresin, accounting for over 15% of the global market share in 2022. The increasing demand for garlic oleoresin in the food and beverage, pharmaceutical, and supplemental industries is driving the expansion of the European garlic oleoresin market. Garlic is a well-known component in European cooking. It's used in soups, stews, sauces, and marinades, among other things.

Latin America is the emerging garlic oleoresin market, accounting for less than 5% of the world market in 2022. The Brazil region holds a market share of 50.9%. However, the Latin American garlic oleoresin market is predicted to develop at the fastest CAGR over the forecast period.

REGIONAL COVERAGE

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

KEY PLAYERS

Some major key players in the Garlic Oleoresin Market are Mane KANCOR, Akay, Universal Oleoresins, Bioingredia Natural Pvt Ltd., Synthite Industries Ltd., Manohar Botanical Extracts Pvt. Ltd., AVT Natural Products Limited, Plant Lipids Private Limited, Vidya Herbs Pvt. Ltd., BOS Natural Flavors Pvt. Ltd., HDDES Group, Sami Spices, and other key players.

Mane KANCOR-Company Financial Analysis

RECENT DEVELOPMENTS

In 2022, Mane Kancor collaborated with Nature's Spices to establish Mane Kancor Spices Pvt Ltd. This new company specializes in ground cracked and milled spices and seasoning mixtures.

| Report Attributes | Details |

| Market Size in 2022 | US$ 130.5 Million |

| Market Size by 2030 | US$ 265.8 Million |

| CAGR | CAGR of 9.3% From 2023 to 2030 |

| Base Year | 2022 |

| Forecast Period | 2023-2030 |

| Historical Data | 2019-2021 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Nature (Organic, Conventional) • By Extraction Method (Solvent Extraction, Supercritical Fluid Extraction) • By Distribution Channel (Supermarkets/Hypermarkets, Speciality Stores, Online Sales, Others) • By End User (Food & Beverage Industry, Pharmaceuticals, Retail / Household, Nutraceuticals) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | Mane KANCOR, Akay, Universal Oleoresins, Bioingredia Natural Pvt Ltd., Synthite Industries Ltd., Manohar Botanical Extracts Pvt. Ltd., AVT Natural Products Limited, Plant Lipids Private Limited, Vidya Herbs Pvt. Ltd., BOS Natural Flavors Pvt. Ltd., HDDES Group, Sami Spices |

| Key Drivers | • Health benefits associated with garlic |

| Market Opportunity | • Use of garlic oleoresin in various applications |