Genitourinary Drugs Market Overview:

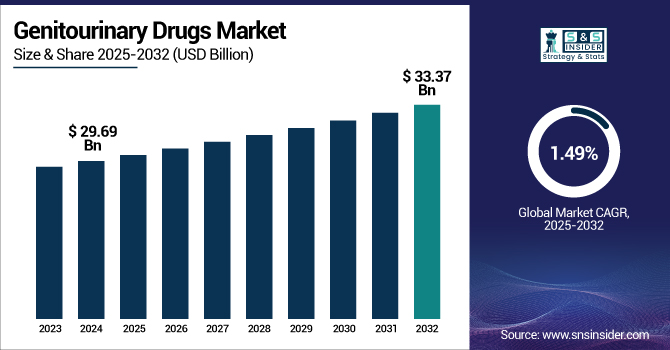

The Genitourinary Drugs Market size was valued at USD 29.69 billion in 2024 and is expected to reach USD 33.37 billion by 2032, growing at a CAGR of 1.49% over the forecast period.

To Get more information on Genitourinary Drugs Market - Request Free Sample Report

The genitourinary drugs market addresses urinary tract infections to prostate problems and reproductive health issues. It covers a broad spectrum of illnesses influencing the urine and reproductive systems. Urinary tract infections (UTIs) account for a majority of cases globally, further driving the genitourinary drugs market growth. As the fifth most common healthcare-associated infection, UTIs infect an estimated 62,700 patients in acute care hospitals, making it more than 9.5% of all reported infections.

A common originator for these infections is indwelling urinary catheter (IUC) use, which is found in 12%–16% of adult inpatients, with a 3%–7% daily risk for catheter-associated urinary tract infection (CAUTI) acquisition. These infections have the potential to progress to serious complications, such as pyelonephritis, prostatitis, gram-negative bacteremia, and meningitis, resulting in extended hospital stay, increased health expenditure, and higher mortality.

More than 13,000 deaths occur every year due to UTIs. This troubling burden has caused hospitals and physicians to increasingly use efficient genitourinary drugs such as broad-spectrum antibiotics as well as newer agents to treat and prevent UTI-related complications, thereby boosting demand for markets. For instance, the demand to treat antibiotic-resistant uropathogens and to prevent secondary complications, such as sepsis, has driven pharma innovation and institutional purchase of targeted antimicrobial agents in the genitourinary drugs category.

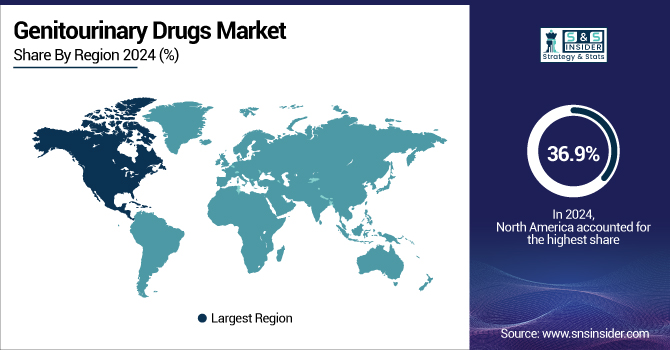

Government efforts in areas related to reproductive and urological health including nationwide screening campaigns, along with campaigns for wider awareness, have added to early detection and treatment rates. In 2023, the U.S. dominated the genitourinary drugs market, with approximately 76% share in the North American market.

For instance, the U.S. government's continued support for reproductive health services and efforts by the Centers for Disease Control and Prevention (CDC) to monitor trends in urological diseases, have resulted in increased demand for genitourinary drugs.

Genitourinary Drugs Market Dynamics

Drivers

-

Growing Urological Diseases’ Incidence and Increasing Aging Population to Drive Market Growth

The major factor responsible for the growth of the market for genitourinary drugs is the surging incidence of urological diseases, such as chronic kidney disease, UTI, and bladder. These diseases particularly recur in the case of older adults, as the demographic transition toward an aging world is leading to increased patient volumes. Aging causes a natural decline in renal function and increases susceptibility to genitourinary complications, thereby propelling persistent demand for genitourinary drugs.

For instance, According to the 2024 Urologic Diseases in America (UDA) Annual Data Report, claims-based urinary incontinence (UI) occurrence in people over 65 years old grew from 6.1% in 2021 for Medicare Fee-for-Service (FFS), but in contrast, Medicare Advantage (MA) registration witnessed an even steeper increase from 6.3% in 2015 to 8.5% in 2021.

Over 650,000 individuals were newly diagnosed with UI each year, and 43% of these developed prescription fills on genitourinary drugs within five years, illustrating high pharmaceutical demand. Interestingly, use of antimuscarinic agents, one of the most common classes used to treat UI, fell by 34% in 2021. The industry also experiences increased drug use due to associated diseases. Older adults with UI often experience hypertension (83%), diabetes (36%), and urinary tract infections (UTIs) (41%), further enhancing pharma dependence.

The confluence of an aging demographic expansion and rising rates of diagnosis highlights an ongoing increase in demand for efficient genitourinary drugs globally. Other factors driven by lifestyle, including smoking, obesity, and physical inactivity, also place increasingly high burdens on urological disease among younger patient populations, thereby expanding consumption. The global healthcare systems are making more investments in urology services, broadening access to diagnosis and treatments. Pharmaceutical companies are responding to the trend by broadening their lists of medicines targeting diseases, such as benign prostatic hyperplasia (BPH), incontinence, and erectile dysfunction.

Restraints:

-

Side Effects and Safety Issues Related to Genitourinary Drugs Can Impede Market Expansion

Side effects and long-term safety issues related to genitourinary drugs are having far-reaching effects on patient adherence and on the overall results. Several drugs in this class, in particular, those taking treatment for overactive bladder, erectile dysfunction, and prostate enlargement, have side effects that include dizziness, weakness, gastrointestinal discomfort, and sexual dysfunction. These side effects discourage patients from following their prescribed regimens, further reducing the efficacy of care. In addition, some drugs, notably hormone-based therapies or immunotherapies applied in treating prostate and bladder cancer, pose serious long-term risks to health, such as cardiovascular disease, hormonal imbalances, or suppression of the immune system.

In older populations, who constitute most users, side effects and drug interactions pose an even greater risk owing to polypharmacy and failing organs. Fear of adverse reactions often leads to underreporting of symptoms, non-adherence, or complete discontinuation of therapy. Not just patient health ramifications, but healthcare system burdens in terms of higher emergency consultations and complications also arise.

Genitourinary Drugs Market Segmentation Analysis:

By Indication

In 2023, the prostate cancer segment held 27% of the genitourinary drugs market share. This dominance is primarily driven by the high global incidence of prostate cancer and the substantial investments in therapeutic development. The alarmingly high numbers emphasize the need for efficient treatments, exerting fueling efforts by investing in research and development by both the government and private sectors. Governmental bodies have taken crucial steps by launching nationwide screening campaigns, early intervention campaigns, and subsidizing advanced treatments.

The segment is also driven by demographic growth due to an aging male population that is more prone to developing prostate cancer. BPH and Prostate cancer in men are common comorbidities. As per Urologic Diseases in America, 28% of males and 51% of females with any Urinary incontinence (UI) between the ages of 18-64 have experienced Prostate cancer. And 45% of females and 34% of males with Common comorbidities for any UI by gender, 65+ years old, experienced Prostate cancer in 2021. As per the Centers for Disease Control and Prevention (CDC) and other such agencies in Asia and Europe have witnessed increased rates in men age above 60 years, further augmenting patient numbers in need of treatment.

For instance, as per the American Society of Clinical Oncology (ASCO), more than 1.4 million men were diagnosed with prostate cancer in 2020 worldwide, while the American Cancer Society estimated about 288,300 new cases and 34,700 fatalities in the U.S. alone in 2023.

The interstitial cystitis indication segment is projected to grow with the fastest CAGR during the forecast period of 2025-2032. In the United States, the condition affects approximately 1 to 4 million men and 3 to 8 million women. Elmiron (pentosan polysulfate sodium) is currently the only FDA-approved oral drug available for relieving the pain and discomfort linked to this condition.

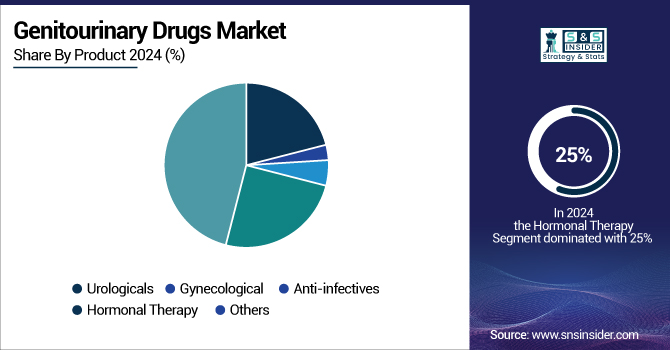

By Product

The hormonal therapy segment held significant revenue share of 25% the genitourinary drugs market in 2024 owing to its central role in treating malignant and benign genitourinary diseases. Hormonal treatments, such as androgens, estrogens, and several other hormone-modulating agents, play crucial roles in treating prostate cancer, benign prostatic hyperplasia (BPH), and certain gynecological diseases. Governmental health reports point toward higher incidence rates for such diseases that demand hormonal treatment. For instance, benign prostatic hyperplasia is reported by the National Institutes of Health (NIH) to afflict an increasingly larger proportion of older men, with rates rising dramatically after 60 years.

The increasing incidence of hormonal disorders and the impact of changing lifestyle habits. Polycystic ovary syndrome (PCOS), one of the most prevalent hormonal disorders, is reported by the World Health Organization to afflict 6–13% of women of reproductive age, and 70% of these cases may go undiagnosed. The incidence is 3.7% to 22.5% in India, and development is very closely related to sedentary living, dietary habits, and obesity, as pointed out by the Department of Science and Technology, Government of India. In addition to PCOS, hormonal treatments increasingly treat menopause, hypothyroidism, and male hypogonadism. For instance, menopause-related symptoms affect up to 87.7% of women in some developing countries, fueling demand for hormone replacement therapy (HRT). Extensive use of hormonal treatments is further facilitated by their effectiveness in slowing disease progression, reducing symptoms, and enhancing quality of life.

The gynecological segment is expected to grow with a significant CAGR over the forecast period of 2025-2032, driven by the rising demand for products addressing women's reproductive health. Growing therapeutic needs and increased government efforts to improve women's reproductive care are expected to boost the segment's growth opportunities.

Genitourinary Drugs Market Regional Insights:

In 2023, the North American region dominated the genitourinary drugs market and accounted for 36.9% of the overall revenue share. The growth is propelled by its advanced healthcare facilities, high per-capita healthcare expenditure, and an active regulatory environment that expedites approval and adoption processes. The U.S. alone generated over USD 8.34 billion in 2023, citing high patient numbers, high disease incidence, and broad accessibility to new treatments.

Government bodies, such as the U.S. Department of Health and Human Services, the FDA, and the CDC have mounted far-reaching programs on genitourinary health, such as nationwide screenings, funded research, and public health awareness campaigns. The U.S. Food and Drug Administration (FDA) approved 26 genitourinary (GU) cancer drugs between January 2020 to October 2024, 10.2% of 255 oncology medicines that were licensed overall over this timeline. The approvals were split across urothelial (12 approvals), prostate (9), and renal cancers (5), with zero for testicular, penile, or adrenal cancers. Phase III trials were in the majority in terms of clinical developments (20 approvals), followed by phase II (4), and dual phases IB/II as well as II/III (1 for each). GU cancers account for an immense majority in terms of world cancer burden, and that relatively small proportion of approvals testifies to areas that have unmet needs.

The Asia Pacific region is projected to grow with the fastest CAGR over the forecast period. This high growth is underpinned by rising healthcare consciousness, high incidence rates for genitourinary diseases, and high development in healthcare infrastructure. Governing bodies in regional countries, such as China, Japan, and India have initiated large-scale campaigns to enhance reproductive and urological health, such as subsidized screenings and increased insurance coverage. The high patient base in the vast populations of Asia Pacific is supplemented by efforts in public health campaigns, education, which have increased early intervention and detection. The Asia Pacific market is also supported by the rising R&D efforts, as local governing bodies offer incentives for evidence-based pharma development as well as for carrying out clinical trials.

Europe held a significant share of the market owing to its growing healthcare infrastructure and substantial government investments. Countries, such as Germany, France, and the U.K. are at the forefront, with Germany growing significantly because of its aging population and proactive healthcare policies. The UK's National Health Service (NHS) ensures widespread access to treatments, addressing conditions including prostate cancer, urinary incontinence, and sexually transmitted infections.

The genitourinary drugs market across the LAMEA region is steadily expanding due to rising disease prevalence, better healthcare access, and government health initiatives. In Latin America, countries like Brazil are seeing increased demand for treatments related to urinary tract infections and prostate disorders, driven by a growing elderly population and improved public health spending. In the Middle East, African nations, such as Saudi Arabia and the UAE are investing heavily in healthcare infrastructure under national vision plans (Saudi Vision 2030), supporting wider availability of urological medications and cancer therapies.

Get Customized Report as per Your Business Requirement - Enquiry Now

Genitourinary Drugs Companies

The key players operating in the market for genitourinary drugs are Abbott, Genentech, Inc., Teva Pharmaceutical Industries Ltd., Bristol-Myers Squibb Co., Novartis AG, F. Hoffmann-La Roche Ltd., Ionis Pharmaceuticals, Inc., Antares Pharma, Eli Lilly and Company, Pfizer, Inc., AstraZeneca, GlaxoSmithKline, Merck & Co., Inc., Bayer AG, and Allergan.

Recent Developments

-

In March 2023, Pfizer Inc. disclosed a definitive merger deal with Seagen Inc., an ADC (antibody-drug conjugate) innovation leader, to advance precision-directed treatments for such cancers related to prostate and bladder. ADCs constitute an important step toward minimizing side effects while maximizing efficacy in genitourinary cancers.

-

GSK plc announced encouraging data from EAGLE-2 and EAGLE-3 phase III trials in April 2023 for gepotidacin, an oral first-in-class antibiotic for treating female adolescents and adults with uncomplicated urinary tract infections (uUTIs). This represents an important advancement in combating drug resistance and enhancing outcomes for prevalent genitourinary infections.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 29.69 Billion |

| Market Size by 2032 | USD 33.37 Billion |

| CAGR | CAGR of 1.49% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Urologicals, Gynecological, Hormonal Therapy, Anti-infectives, Others) • By Indication (Prostate Cancer, Ovarian Cancer, Erectile Dysfunction, Bladder Cancer, Cervical Cancer, Renal Cancer, Urinary Tract Infections, Urinary Incontinence & Overactive Bladder, Haematuria, Sexually Transmitted Diseases, Interstitial Cystitis, Benign Prostatic Hyperplasia) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Abbott, Genentech, Inc., Teva Pharmaceutical Industries Ltd., Bristol-Myers Squibb Co., Novartis AG, F. Hoffmann-La Roche Ltd., Ionis Pharmaceuticals, Inc., Antares Pharma, Eli Lilly and Company, Pfizer, Inc., AstraZeneca, GlaxoSmithKline, Merck & Co., Inc., Bayer AG, Allergan. |