Overactive Bladder Treatment Market Size Analysis:

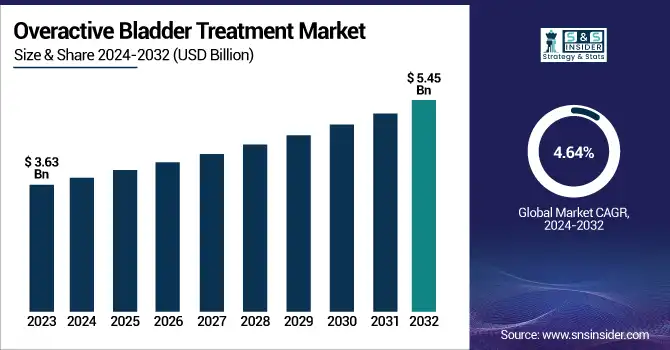

The Overactive Bladder Treatment Market size was valued at USD 3.63 billion in 2023 and is expected to reach USD 5.45 billion by 2032, growing at a CAGR of 4.64% over the forecast period 2024-2032.

Get more information on Overactive Bladder Treatment Market - Request Sample Report

The Overactive Bladder (OAB) Treatment Market Report provides key statistical insights and trends shaping the industry. It covers incidence and prevalence rates across regions, highlighting demographic patterns. The report analyzes prescription trends, identifying the most prescribed drugs, regional variations, and emerging treatment preferences. Drug volume trends assess the production and consumption of OAB pharmaceuticals, reflecting supply-demand shifts. Additionally, healthcare spending analysis breaks down costs by government, private insurers, and out-of-pocket expenditures. The report also explores treatment preference trends, comparing pharmacological vs. non-pharmacological solutions. Lastly, it highlights emerging innovations and pipeline drugs, showcasing clinical advancements and regulatory developments shaping the future market landscape. The overactive bladder (OAB) treatment market is driven by the increasing prevalence of urinary disorders, aging populations, and advancements in therapeutic interventions. According to ReliefWeb, the global population aged 65 and older is projected to rise from 10% in 2022 to 16% in 2050, significantly increasing the demand for OAB treatments.

Overactive Bladder Treatment Market Dynamics

Drivers

-

The increasing occurrence of overactive bladder, especially among the aging population, is significantly driving market growth.

The rise in the cases of overactive bladder (OAB) is one of the major factors responsible for the growth of the OAB treatment market. This trend has been underscored in recent studies, and the need for good management practices is becoming increasingly critical. A systematic meta-analysis with 53 studies and 610,438 participants published in February 2025 estimated the global prevalence of OAB to be 20% (95% CI 0.18-0.21). OAB prevalence increased from 18.1% to 23.9% during the previous 20 years. The analysis also found that women were more likely to have depression (21.9%) than men (16.1%). Moreover, the highest prevalence of OAB at 28.3% was found in those aged 60 years and older, highlighting the burden of age on OAB prevalence.

In Japan, the OAB prevalence was reported in the 2023 Japan Community Health Survey (JaCS 2023), which showed that the rate was 11.9% in the population aged 20 years and older, with the prevalence rate increasing with age. This condition was present in 69.8% of patients with OAB symptoms and was identified as urgency urinary incontinence. Despite the high prevalence, only 16% of participants had received medical treatment for OAB, demonstrating a disparity between symptom presence and treatment. But treatment rates are low; only about 19% of diagnosed patients ever receive prescription medications. This results in a need for awareness and more treatment plans accordingly. These figures highlight the increasing prevalence of OAB, particularly in the older population, and the need for improved treatment strategies to combat this growing health problem.

Restraints:

-

Regular recalls of OAB medications due to manufacturing issues are hindering market expansion.

The overactive bladder (OAB) treatment market is faced with a key concern, which is frequent product recalls due to manufacturing issues. For example, Zydus Pharmaceuticals (USA) Inc. in September 2023 recalled 7,248 bottles of Oxybutynin Chloride extended-release tablets due to product dissolution specifications that had not been met. Such recalls can disrupt the supply chain, creating medication shortages and restricting treatment options for patients. Healthcare professionals may have to resort to prescribing alternative therapies that may not have the same level of effectiveness or tolerability, leading to suboptimal patient outcomes. Additionally, such events may erode patient trust in the efficacy of treatments, potentially reducing adherence and undermining the perceived reliability of OAB medications. These manufacturing challenges need to be addressed to have a stable availability of medications and to maintain confidence in OAB therapies.

Opportunities:

-

Ongoing research and development efforts are leading to innovative treatment options, presenting significant growth opportunities.

The emergence of new therapies is a major opportunity in the OAB treatment landscape, filling the gaps of existing therapies and covering the large unmet medical needs. Although OAB has a staggering global prevalence of around 335 million adults, only about 5% of OAB patients are treated with drug therapy because of low diagnosis rates and an unfavorable risk-benefit profile for currently available medications. Older antimuscarinic medications like oxybutynin hydrochloride and tolterodine tartrate have been linked with a higher risk of cognitive limitations and dementia. Oxybutynin hydrochloride and tolterodine tartrate posed a 31% higher risk and a 27% higher risk, respectively, in a study that analyzed the health data of 170,742 patients over 55 with dementia in England. Such safety concerns lead to low adherence rates and dissuade patients from seeking treatment. In response, pharmaceutical companies are investing in the development of novel therapies with improved safety and efficacy profiles. Examples of new drugs include the beta-3 adrenergic agonist, vibegron, which had been approved for medical use in the United States as of December 2020 and in the European Union as of June 2024. URO-902, a gene therapy under investigation in Phase II trials by Urovant Sciences, is also expected to meet the unmet needs of orally refractory patients. URO-902, if approved, is projected to represent close to 29% of US sales in 2030. The integration of digital health technologies also offers opportunities for real-time symptom management, enhancing patient engagement and adherence to treatment regimens. These advancements underscore the potential of novel therapies to transform OAB management, improving patient outcomes and expanding the treatment landscape.

Challenges:

-

The embarrassment associated with OAB symptoms often prevents individuals from seeking medical help, posing a challenge to market growth.

Patients with Overactive Bladder (OAB) life is significantly impacted, resulting in significant isolation and feelings of embarrassment. A qualitative study of participants with OAB found that social stigma is a major problem that only exacerbates symptoms and affects life adjustment, resulting in individuals Withdrawal from social settings and avoidance of discussion of their condition with others, including HCPs. In Hong Kong, a survey found that 54% of respondents had never heard of OAB, and although 83% could recognize bladder-related symptoms, over half of respondents had never visited a doctor regarding it. Furthermore, two-thirds of the respondents said that people with bladder problems experience psychological effects such as embarrassment and concern. Such unawareness and stigma often delays patients from pursuing proper medicare timely to them further deteriorating their symptoms affecting their quality of life. Addressing this challenge requires increased public education to normalize conversations around OAB and encourage individuals to seek appropriate treatment without fear of judgment.

Overactive Bladder Treatment Market Segmentation Analysis

By Type

Mirabegron dominated the market in 2023 with a share of 26%, owing to its good safety profile and the ability to relieve symptoms of overactive bladder. Mirabegron has fewer side effects than anticholinergics, including a lower risk of dementia, which makes it a better treatment option for patients and physicians. As a beta-3 adrenergic receptor agonist, it relaxes the detrusor muscle without affecting the cognitive functions. It has consolidated its position in the market by gaining regulatory approvals and further increasing adoption for the management of frequent urination and urgency. Government-sponsored programs facilitating research on new drugs have also been a major factor. For instance, the FDA's priority review acceptance for Mirabegron in pediatric neurogenic detrusor overactivity treatment highlights its expanding applications. The drug's extended-release formulation has potentially ensured patient compliance, allowing it to claim dominance in the type segment during the assessment period.

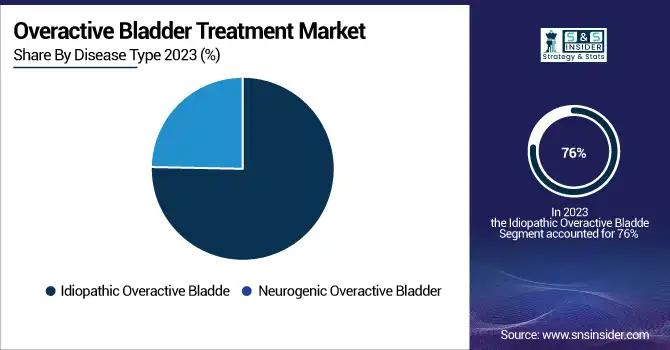

By Disease Type

In 2023, the idiopathic OAB segment held the largest market share of 76% 2023 due to its high incidence rate in OAB patients with no notable neurological findings. This is because of faulty nerves to the bladder, and it affects quite a few in the population. More than 60% of adult women develop urinary incontinence from things such as obesity and aging, according to the American Urogynecology Society. Rising knowledge and government backing for idiopathic OAB cures have powered growth in such segments. As an example, non-neurogenic OAB treatment algorithms suggested in clinical guidelines from the American Urological Association emphasize pharmacologic therapies specifically anticholinergics and beta-3 adrenergic receptor agonists. Additionally, advancements in neuromodulation therapies targeting idiopathic OAB have contributed to segmental growth.

By Distribution Channel

Retail pharmacies accounted for the largest market share of 48% in 2023, owing to their widespread accessibility and convenience. With large pharmacy chains like CVS Health and Walgreens, overactive bladder medications are widely available. Retail pharmacies have existing networks that provide both prescription and OTC drugs. Government policies supporting cost-effective healthcare services have increased patient access to retail pharmacies. For example, programs supporting reimbursement for OAB therapies have driven medication utilization via retail channels. With the adoption of digitalisation in retail pharmacies, their dominance is further extended, where they can manage their inventory and patient services efficiently.

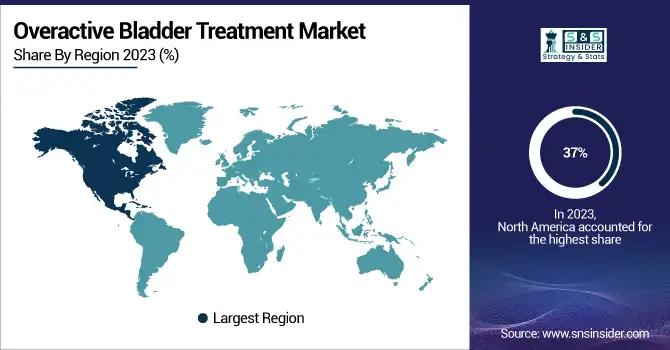

Regional Insights

The North America region accounted for the largest overactive bladder treatment market share 37% in 2023. There are several reasons for this dominance, including its advanced healthcare infrastructure and a high prevalence of such conditions as overactive bladder (OAB). The region hosts significant research and development (R&D) investments by large pharmaceutical players, including Pfizer Inc. and AbbVie Inc. This segment of the market has rich growth potential further due to advancements and solutions developed from this investment. Also, supportive government policies are also significantly helping to enhance access to treatment, making sure that many types of patients have access to these novel therapies. The large geriatric population and the growing expenditure on healthcare are the other factors contribute to the growth of the overactive bladder market in North America.

Over the forecast period, the Asia-Pacific region has been identified as the fastest-growing market for the overactive bladder market growing with a significant CAGR. There are a number of reasons behind this rapid growth. One is the potential growth of healthcare budgets in high-population countries such as China and India, which increases the willingness to pay for OAB treatments. Second, there is growing demand for medications because of an increase in awareness about OAB conditions in the general population. Innovations that enhance pharmaceutical manufacturing technologies can also significantly contribute to the generation of effective and sustainable medicines. Additionally, government efforts to augment healthcare infrastructure throughout the region make medical services more accessible, further driving market growth.

Need any customization research on Overactive Bladder Treatment Market - Enquiry Now

Overactive Bladder Treatment Market Key Players

Key Service Providers/Manufacturers

-

Astellas Pharma Inc. (Vesicare, Myrbetriq)

-

Pfizer Inc. (Detrol, Toviaz)

-

AbbVie Inc. (Botox, BOTOX)

-

Teva Pharmaceutical Industries Ltd. (Solifenacin Succinate Tablets, Fesoterodine Fumarate Tablets)

-

Medtronic Plc. (InterStim Therapy, Implantable Tibial Neuromodulation Device)

-

Viatris Inc. (Oxybutynin Chloride Tablets, Tolterodine Tartrate Tablets)

-

Hisamitsu Pharmaceutical Co., Inc. (OABLOK PATCH, Oxybutynin Transdermal Patch)

-

Johnson & Johnson (Doxazosin Mesylate Tablets, Alfuzosin Hydrochloride Tablets)

-

Endo Pharmaceuticals Inc. (Sanctura XR, Valturna)

-

Alembic Pharmaceuticals Limited (Fesoterodine Fumarate Extended-Release Tablets, Solifenacin Succinate Tablets)

-

Axonics Modulation Technologies, Inc. (Axonics F15, Sacral Neuromodulation System)

-

Apotex Inc. (Oxybutynin Chloride Extended-Release Tablets, Tolterodine Tartrate Extended-Release Capsules)

-

Aurobindo Pharma Limited (Solifenacin Succinate Tablets, Tolterodine Tartrate Tablets)

-

Cogentix Medical Inc. (Urgent PC Neuromodulation System, PrimeSight Endoscopy Systems)

-

Intas Pharmaceuticals Ltd. (Solifenacin Tablets, Tolterodine Tablets)

-

Macleods Pharmaceuticals Ltd. (Oxybutynin Chloride Tablets, Tolterodine Tartrate Tablets)

-

Mylan N.V. (Oxybutynin Chloride Extended-Release Tablets, Tolterodine Tartrate Extended-Release Capsules)

-

Sanofi (Noctiva, Uroxatral)

-

Sumitomo Pharma America, Inc. (Urovant Sciences) (Gemtesa, Vibegron)

-

Alembic Pharmaceuticals Limited (Fesoterodine Fumarate Extended-Release Tablets, Solifenacin Succinate Tablets)

Recent Developments in the Overactive Bladder Treatment Market

-

In January 2024, Astellas Pharma released a new product, Mirabegron, with improved absorption rates for managing cases requiring increased doses, such as severe overactive bladder (OAB).

-

In March 2023, MSN Labs introduced Fesobig, a generic version of Fesoterodine Fumarate tablets indicated for Overactive Bladder (OAB) and urinary incontinence.

-

Mirabegron extended-release 25 mg tablets were released in the U.S. in April 2024, further expanding Zydus Lifesciences' portfolio and overall strength of urinary disorders in the United States.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 3.63 Billion |

| Market Size by 2032 | USD 5.45 Billion |

| CAGR | CAGR of 4.64% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Disease Type (Neurogenic Overactive Bladder, Idiopathic Overactive Bladder) • By Type (Anticholinergics, Neuromodulation, Mirabegron, Botox, Other) • By Distribution Channel (Hospital Pharmacies, Retail Pharmacies, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Astellas Pharma Inc., Pfizer Inc., AbbVie Inc., Teva Pharmaceutical Industries Ltd., Medtronic Plc., Viatris Inc., Hisamitsu Pharmaceutical Co., Inc., Johnson & Johnson, Endo Pharmaceuticals Inc., Alembic Pharmaceuticals Limited, Axonics Modulation Technologies, Inc., Apotex Inc., Aurobindo Pharma Limited, Cogentix Medical Inc., Intas Pharmaceuticals Ltd., Macleods Pharmaceuticals Ltd., Mylan N.V., Sanofi, Sumitomo Pharma America, Inc. (Urovant Sciences), Alembic Pharmaceuticals Limited. |