Gigabit Passive Optical Network Market Report Scope & Overview:

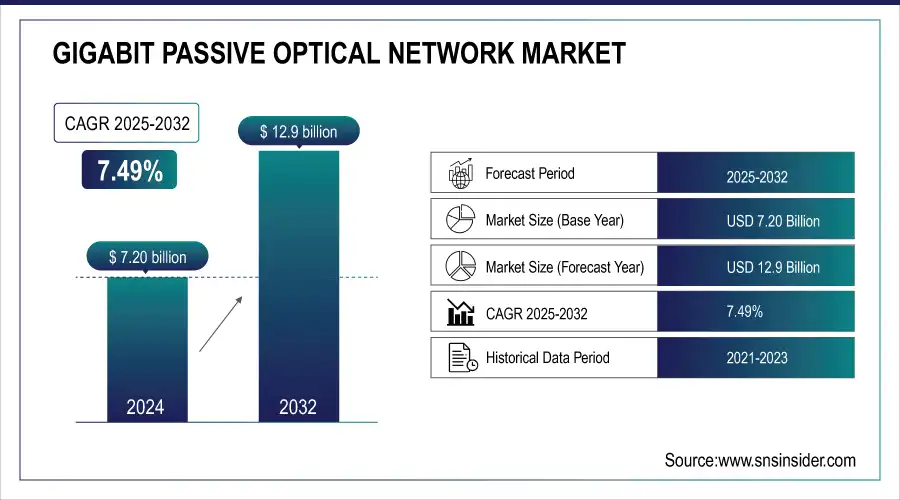

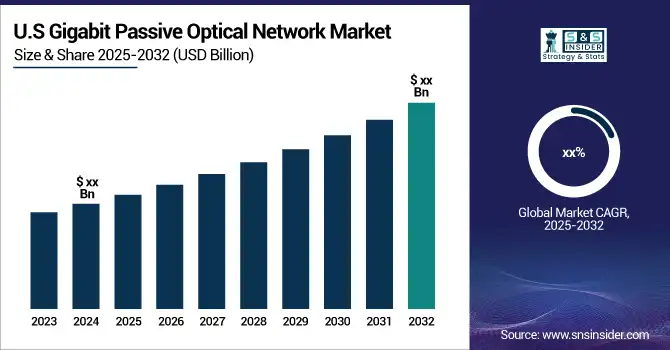

The Gigabit Passive Optical Network Market was valued at USD 7.20 Billion in 2024 and will reach USD 12.9 billion by 2032, growing at a CAGR of 7.49% from 2025-2032.

To get more information on Gigabit Passive Optical Network Market - Request Free Sample Report

The adoption of emerging technologies such as AI-driven network optimization and software-defined GPON solutions is accelerating the market's expansion. Regional network infrastructure investments vary, with Asia-Pacific leading due to rapid urbanization and fiber deployment initiatives. Cybersecurity incidents affecting GPON networks have increased, driving demand for enhanced encryption and authentication measures, while cloud services integration is rising, enabling seamless remote network management. The report consists of sustainability initiatives in GPON deployment, AI-driven network automation, the impact of 5G backhaul on GPON demand, and regulatory policies shaping fiber-optic network expansion.

Market Size and Forecast:

-

Market Size in 2024 USD 7.20 Billion

-

Market Size by 2032 USD 12.9 Billion

-

CAGR of 7.49% From 2025 to 2032

-

Base Year 2024

-

Forecast Period 2025-2032

-

Historical Data 2021-2023

Gigabit Passive Optical Networks (GPON) Market Trends:

-

GPON technology is increasingly integrated into 5G infrastructure due to its high data speeds, scalability, and cost-effectiveness.

-

Point-to-multipoint architecture enables dense 5G small cell deployments, reducing backhaul costs and system complexity.

-

Upgrades to XGS-PON and NG-PON2 allow GPON networks to achieve speeds of 10 Gbps or more, supporting future 5G demands.

-

Energy efficiency of GPON networks aligns with sustainability goals while lowering operational costs for telecom operators.

-

Growing demand for high-speed internet in residential, commercial, and industrial sectors drives GPON adoption, supporting smart cities, IoT, and broadband expansion.

Gigabit Passive Optical Networks (GPON) Market Growth Drivers:

-

GPON's ability to support high data rates makes it essential for the growing deployment of 5G infrastructure.

The Gigabit Passive Optical Network is set to play an integral part in 5G infrastructure deployments thanks to G-PON's ability to deliver high data speeds, scaling ability, and cost-effectiveness. In particular, GPON with a max of 2.5 Gbps downstream and a maximum of 1.25 Gbps upstream is bandwidth available for 5G that would make it capable of well able to support the types of high-bandwidth applications characteristic of augmented reality, virtual reality, Internet of Things devices, and low-latency real-time communication between 5G BS and the core network.

GPON was designed with point-to-multipoint architecture, making it ideal for 5G small cell dense deployments, drastically reducing 5G backhaul costs and traditional backhauling system complexity. Moreover, GPON networks are extremely scalable and can be evolved to address higher speed needs via XGS-PON or NG-PON2 enabling speeds of 10 Gbps or more and GPON is crafted to be future-ready to meet 5G consumption and delivery challenges. Besides the obvious performance benefits, GPON has the added advantage of being energy-efficient compared to other broadband technologies, thus meeting the sustainability goals of the telecom operators while reducing operational costs. This energy efficiency makes it an ideal solution for deploying 5G infrastructure most efficiently and cost-effectively, particularly in large-scale connectivity applications.

|

Gigabit Passive Optical Network Features |

Benefits of 5G |

|

High Bandwidth |

Supports data-intensive 5G applications like IoT, AR, and VR. |

|

Symmetrical Data Speeds |

Ensures low latency for real-time applications. |

|

Scalability |

Can be upgraded to XGS-PON or NG-PON2 for future 5G needs. |

|

Energy Efficiency |

Minimizes power consumption, supporting sustainable network expansion. |

Gigabit Passive Optical Networks (GPON) Market Restraints:

-

Operational costs such as system upgrades and maintenance can be relatively high compared to other broadband solutions.

Gigabit Passive Optical Networks are widely regarded as cost-effective in the long run, but they come with substantial ongoing operational expenses, especially when compared to alternative broadband technologies. A key factor driving these costs is the need for regular system upgrades and maintenance, which require specialized skills and expensive equipment. In contrast to traditional copper broadband, GPON relies on fiber-optic infrastructure that demands careful installation, continuous monitoring, and frequent maintenance to ensure high-quality performance. As technology evolves, upgrading GPON networks is essential, particularly with the rollout of faster standards like XGS-PON and NG-PON2, which can handle speeds greater than 10 Gbps. These upgrades often involve replacing outdated components, leading to additional costs for telecom providers. Moreover, fiber-optic networks are more susceptible to physical damage from environmental conditions or construction activities, which necessitates ongoing maintenance to prevent service disruptions. The shortage of skilled technicians trained in fiber-optic installation and GPON-specific technologies is another challenge that raises operational costs.

Gigabit Passive Optical Networks (GPON) Market Opportunities:

-

The increasing need for high-speed internet across residential, commercial, and industrial sectors is driving the demand for GPON technology.

Growing demand for GPON technology can be attributed to its increased need for high-speed internet in residential, commercial, and industrial sectors. Until now, fiber-optic networks are likely to be one of the important infrastructures for increasing smart cities and IoT applications and actually expanding 5G deployment. GPON provides higher bandwidth, more scalability, and low-cost fiber to the home solutions that appeal to telecom operators and ISPs. Fiber, and massive investments geared towards the construction of broadband infrastructure by the government, for its part, are opening up wide opportunities for both GPON solutions providers and network operators across the globe.

Gigabit Passive Optical Networks (GPON) Market Segment Analysis:

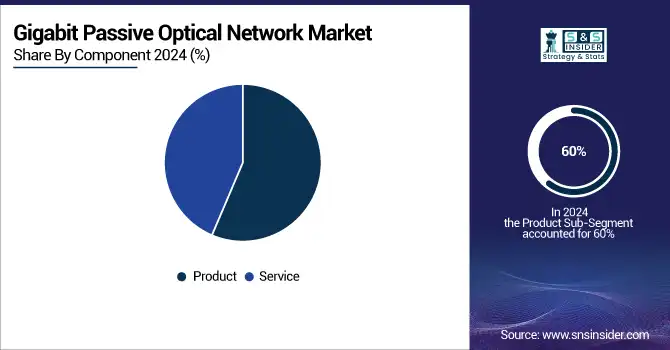

By Component

The product segment dominated the Market and represented a significant revenue share of 60% in 2024, aiding in the deployment of high-speed infrastructure for broadband. It comprises vital hardware components required for the operable consumption of GPON systems, including optical line terminals (OLTs), optical network units (ONUs), and crucial components like optical splitters. The high-speed internet driven by video streaming, remote work, telemedicine, and other bandwidth-intensive applications has generated a significant demand for these goods. And, the continuous movement towards faster speeds and wider area coverage, particularly in underdeveloped areas, also helps to amplify the demand for GPON products. The demand is only expected to grow as telecom operators transition towards an XGS-PON solution that delivers greater than 10 Gbps speeds.

The service segment of the GPON market is expected to register the fastest compound annual growth rate during the forecast period, Due to the increasing need for installation, maintenance, and optimization services, the Telecom providers are adding new GPON infrastructure in the field, but the addition of this equipment increases the complexity of system deployment, and the move away from GPON to higher-speed technologies such as XGS-PON creates a demand for specialized services such as network management, troubleshooting, and continual hardware and software upgrades. This need for solution is further expedited with the expansion of GPON networks, both in urban and rural areas. Also, the growing dependence on GPON for the 5G backhaul solution promotes the growth of this market.

By Application

The Fiber To The Home segment dominated the market and represented a significant revenue share of 46% in 2024. owing to the rising need for high-speed internet worldwide for business and domestic applications. FTTH technology provides dedicated fiber-optic connections directly to homes or businesses, enabling improved speed and reliability in Internet access over broadband solutions previously available. As more and more bandwidth-hungry services come to the fore over the Internet — including video streaming, online gaming, and remote work — FTTH can play an integral role in the digital infrastructure. Moreover, FTTH networks are driven by government-led programs for boosting broadband access inclusion, especially in neglected areas.

The mobile backhaul segment is expected to witness the highest compound annual growth rate in the GPON market, owing to the rapid deployment of 5G networks. Mobile backhaul is the connectivity between mobile base stations and the core network and is a key enabler for the migration to high-speed mobile services. The sharp uptick in mobile data traffic, especially created by IoT, AR, and VR, means mobile backhaul infrastructure now requires high-capacity solutions such as GPON. The increase in 5G subscriptions will drive the demand for mobile backhaul services, which will make this segment one of the fastest-growing parts of the market.

By Technology

The 2.5 GPON segment dominated the market and accounted for the largest market share owing to its extensive utilization in fiber-to-the-home and fibre-to-the-building applications. Costs are stable, performance unstable and so is the 2.5 GPON which is still being used by many of the telecom operators and the ISPs when we talk about Gigabit-speed broadband. Even with the new technology developments, 2.5 GPON is still extremely common for home and small-business broadband connections. Nonetheless, the rapid growth in high-bandwidth and super-high-speed Internet demand is likely to spark an uptick in next-gen GPON deployment shortly.

NG-PON2 is expected to experience the fastest CAGR growth. With capabilities of 40Gpbs, this technology is suited for enterprise and smart city applications, allowing the delivery of multi-gigabit broadband services to consumers by service providers. NG-PON2 is gaining traction with the increasing deployment of 5G networks, cloud computing and other high-bandwidth applications.

By End-Use

The IT & Telecom segment dominated the market and captured the largest market share in 2024. Due to the increasing demand for high-speed internet and network reliability from telecom operators and data centers, The accelerated growth of 5G networks, cloud services, and data-hungry applications has facilitated the deployment of GPON in this area. Telecoms are continuously updating their infrastructure to accommodate the increased data traffic and make sure that connectivity never breaks down.

Healthcare is projected to have the fastest CAGR because there is an increasing need for high-speed secure data transfer in hospitals, clinics, and research institutions. As telemedicine, digital health records, and AI-driven diagnostics become commonplace, healthcare facilities will need their broadband infrastructure to be turbocharged to manage the massive throughput of data from an increasingly high patient turnover.

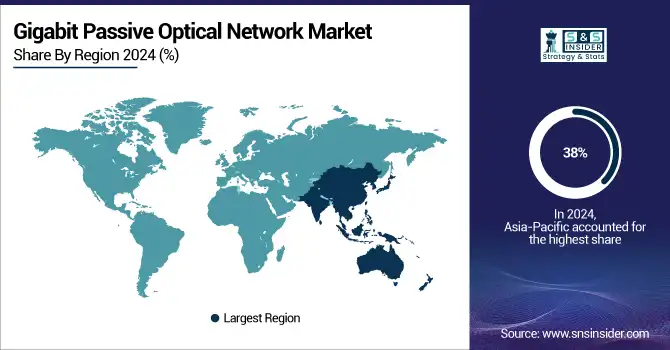

Gigabit Passive Optical Networks (GPON) Market Regional Analysis:

Asia Pacific Gigabit Passive Optical Networks (GPON) Market Insights

In 2024, Asia-Pacific dominated the market and represented a significant revenue share of 38%, growing due to the rising demand for high-speed internet in the APAC region, along with government initiatives to support broadband penetration. China, India, Japan, and South Korea are at the forefront of implementing FTTH and GPON infrastructure, removing barriers that have had in providing high-speed services to urban and rural areas. Governments are focused on expanding broadband access to citizens—for example, India has started BharatNet—but nothing can reach the scale of incumbents who are pouring money into building these networks.

Get Customized Report as per Your Business Requirement - Enquiry Now

North America Gigabit Passive Optical Networks (GPON) Market Insights

North America is expected to register the highest CAGR during the forecast period, Owing to the uninterrupted deployment of fiber-optic networks across the region as well as the introduction of 5G infrastructure. With both the public and private sector news focused on next-generation broadband technologies, the U.S. and Canada are investing heavily in new technologies to improve overall internet speeds and coverage. With the rise in remote working, telemedicine, and e-learning, the need for high-speed internet services is driving the adoption of GPON systems.

Europe Gigabit Passive Optical Networks (GPON) Market Insights

Europe’s GPON market is driven by the rapid deployment of 5G networks, smart city initiatives, and growing demand for high-speed broadband connectivity. Investments in fiber-optic infrastructure, government support for digital transformation, and increasing adoption of residential and enterprise broadband solutions are fueling growth. Telecom operators are leveraging GPON’s scalability, energy efficiency, and cost-effectiveness to enhance network performance, support IoT applications, and meet rising consumer and industrial connectivity demands across the region.

Latin America (LATAM) and Middle East & Africa (MEA) Gigabit Passive Optical Networks (GPON) Market Insights

The GPON market in LATAM and MEA is expanding due to increasing investments in broadband infrastructure, growing smartphone penetration, and rising internet demand in residential, commercial, and industrial sectors. Governments are promoting digital inclusion and smart city projects, while telecom operators focus on cost-effective high-speed connectivity solutions. GPON’s scalability, energy efficiency, and ability to support 5G and IoT deployments make it an attractive solution for expanding network coverage across these emerging regions.

Gigabit Passive Optical Networks (GPON) Market Key Players:

Some of the Gigabit Passive Optical Networks (GPON) Market Companies are

-

Huawei Technologies – MA5800 GPON OLT

-

ZTE Corporation – ZXA10 C300 GPON OLT

-

Nokia Corporation – 7360 ISAM FX GPON

-

FiberHome Telecommunication Technologies Co. Ltd. – AN6000 GPON OLT

-

Calix Inc. – GigaCenter GPON

-

Cisco Systems, Inc. – ASR 9000 Series Aggregation Services Routers

-

Palo Alto Networks, Inc. – GPON Security Gateway

-

Adtran, Inc. – Total Access 5000 GPON OLT

-

Juniper Networks, Inc. – MX Series 3D Universal Edge Routers (GPON support)

-

Vertiv Co. – Liebert EXM2 (used in GPON backhaul)

-

Tellabs, Inc. – Tellabs 8600 GPON Series

-

Mitsubishi Electric Corporation – MELCO GPON OLT

-

Samsung Electronics Co., Ltd. – Samsung GPON OLT

-

Marconi Communications Ltd. – GPON OLT Systems

-

NEC Corporation – GPON OLT solutions

-

Prysmian Group – Fiber Optic Cables for GPON networks

-

Dasan Zhone Solutions – GX Series GPON OLT

-

Arris International – E6000 CER (GPON support)

-

Tatung Company – GPON ONU (Optical Network Units)

-

AFL Telecommunications – GPON Network Solutions

Competitive Landscape for Gigabit Passive Optical Networks (GPON) Market:

Huawei is a global leader in telecommunications, providing advanced GPON solutions for high-speed broadband, 5G backhaul, and fiber-to-the-home (FTTH) deployments. Its GPON portfolio, including the MA5800 series, offers scalable, energy-efficient, and cost-effective networks. Huawei’s innovations enable telecom operators to support smart cities, IoT, and high-bandwidth applications, strengthening its position in the expanding global GPON market.

-

January 2024 – Huawei has advanced its XGS-PON solutions to support higher bandwidth demands for smart city initiatives and broadband expansions

Calix is a leading provider of GPON solutions, offering scalable and high-performance fiber-to-the-home (FTTH) and broadband networks. Its GigaCenter and GPON portfolio enable telecom operators to deliver high-speed internet, support 5G backhaul, and enhance smart home and IoT services. With a focus on energy efficiency, reliability, and network optimization, Calix strengthens connectivity infrastructure and drives growth in the global GPON market.

-

February 2024 – Calix introduced innovations focused on scaling GPON deployments and improving fiber-to-the-home (FTTH) services for underserved areas

|

Report Attributes |

Details |

| Market Size in 2024 | USD 7.20 Billion |

| Market Size by 2032 | USD 12.9 Billion |

| CAGR | CAGR of 7.49% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

|

Report Scope & Coverage |

Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

|

Key Segments |

• By Component (Product, Service) |

|

Regional Analysis/Coverage |

North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

|

Company Profiles |

Huawei Technologies, ZTE Corporation, Nokia Corporation, FiberHome Telecommunication Technologies Co. Ltd., Calix Inc., Cisco Systems, Inc., Palo Alto Networks, Inc., Adtran, Inc., Juniper Networks, Inc., Vertiv Co., Tellabs, Inc., Mitsubishi Electric Corporation, Samsung Electronics Co., Ltd., Marconi Communications Ltd., NEC Corporation, Prysmian Group, Dasan Zhone Solutions, Arris International, Tatung Company, AFL Telecommunications |