Green Coatings Market Report Scope & Overview:

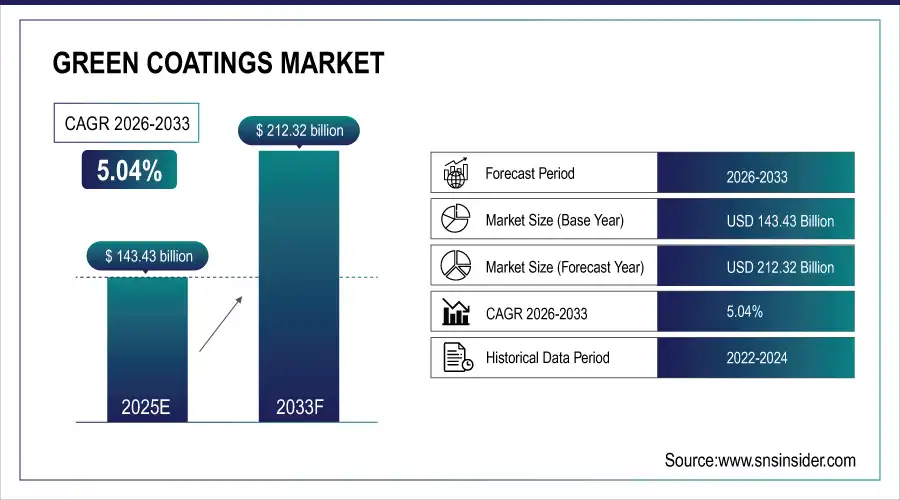

The Green Coatings Market Size size is valued at USD 143.43 Billion in 2025E and is expected to reach USD 212.32 Billion by 2033 and grow at a CAGR of 5.04% over the forecast period 2026-2033.

The Green Coatings Market has been thriving, driven by rising environmental awareness and government regulations promoting sustainability. Our report explores how regulations, including energy efficiency standards and eco-certifications, are stimulating demand for eco-friendly coatings. Alongside these regulations, significant research and development investments by key players are fueling innovations in coating technologies, enhancing their performance while staying environmentally responsible. Our report covers the latest advancements in formulations and application methods, which are making green coatings more effective and accessible. Furthermore, pricing trends are evolving as manufacturers scale up production and optimize material sourcing, leading to cost reductions. By analyzing these factors, our report provides a clear picture of how regulations, innovation, and cost dynamics are shaping the Green Coatings Market’s growth.

Market Size and Forecast:

-

Market Size in 2025: USD 143.43 Billion

-

Market Size by 2033: USD 212.32 Billion

-

CAGR: 5.04% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get more information on Green Coatings Market - Request Free Sample Report

Green Coating Market Trends:

-

Increasing adoption of waterborne and bio-based coatings due to VOC regulations.

-

Growth in sustainable construction driving demand for eco-friendly coating solutions.

-

Automotive industry shifting to low-emission coatings for electric and hybrid vehicles.

-

Manufacturers investing in R&D for durable, high-performance green coatings.

-

Rising consumer preference for low-toxicity products influencing market growth globally.

-

Expansion of smart cities and infrastructure projects boosting eco-friendly coating usage.

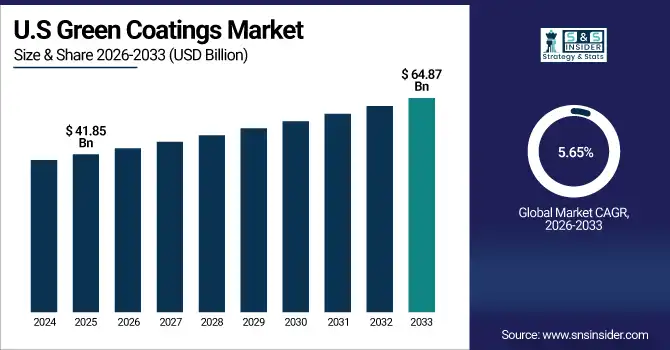

The U.S. Safety Lancets Market size is USD 41.85 Billion in 2025E and is expected to reach USD 64.87 Billion by 2033, growing at a CAGR of 5.65% over the forecast period of 2026-2033,

The U.S. Green Coating Market is witnessing strong growth as industries shift toward eco-friendly solutions. Strict regulations on VOC emissions, coupled with rising demand from construction, automotive, and industrial sectors, are driving adoption. Increasing consumer awareness and sustainability-focused initiatives by companies are further fuelling the market’s expansion.

Green Coating Market Growth Drivers:

-

Stringent Environmental Regulations Accelerating Adoption of Low-VOC Green Coatings

One of the strongest drivers of the Green Coating Market is the enforcement of strict environmental regulations aimed at reducing volatile organic compound (VOC) emissions. Governments across North America, Europe, and Asia Pacific have introduced low-VOC and zero-VOC standards for industrial, architectural, and automotive coatings. These regulations are compelling manufacturers to replace traditional solvent-based coatings with waterborne, powder, and bio-based alternatives. As compliance becomes mandatory rather than optional, demand for green coatings continues to rise steadily across multiple end-use industries.

Green Coating Market Restraints:

-

High Initial Costs and Performance Perceptions Limiting Widespread Market Penetration

A major restraint for the green coating market is the relatively higher initial cost compared to conventional coatings, especially in price-sensitive markets. Bio-based raw materials, advanced resins technologies, and specialized production processes increase manufacturing expenses. Additionally, some end users still perceive green coatings as offering lower durability or slower curing times in extreme industrial environments. These cost and performance concerns can limit adoption among small manufacturers and in regions with limited regulatory enforcement.

Nearly 68–72% of coating manufacturers have reformulated at least part of their product portfolio to meet mandatory VOC emission standards.

Green Coating Market Opportunities:

-

Rising Demand from Sustainable Construction and Automotive Industries Creating Strong Growth Opportunities

The rapid expansion of green buildings and sustainable automotive production presents a significant growth opportunity for the green coating market. Increasing investments in energy-efficient infrastructure, smart cities, and electric vehicles are driving demand for eco-friendly, low-emission coating solutions. Green coatings support green building certifications and lightweight vehicle designs while maintaining performance standards. As sustainability becomes a core business strategy, these sectors are expected to create long-term demand and open new revenue streams for green coating manufacturers.

Over 45–50% of newly constructed commercial buildings globally now target green building certifications (such as LEED, BREEAM, or equivalent), significantly increasing demand for low-VOC and eco-friendly coating solutions.

Green Coating Market Segmentation Analysis:

-

By Resin Type: In 2025, Epoxy led the market with a share of 34.82%, while Polyurethane is the fastest-growing segment with a CAGR of 5.69%.

-

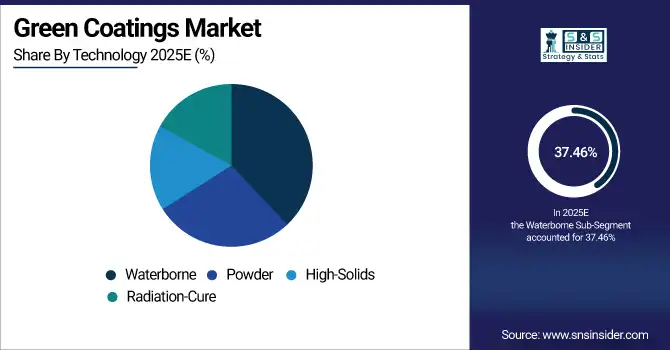

By Technology: In 2025, Waterborne technology led the market with a share of 37.46%, while Radiation-Cure is the fastest-growing segment with a CAGR of 6.12%.

-

By Application: In 2025, Architectural led the market with a share of 36.50%, while Automotive applications are the fastest-growing segment with a CAGR of 6.34%.

-

By End-Use Industry: In 2025, Automotive & Transportation led the market with a share of 40.06%, while Electronics & Electrical Appliances is the fastest-growing segment with a CAGR of 6.10%.

By Resin Type, Epoxy Lead Market and Polyurethane Fastest Growth

Epoxy resins dominate the green coating market due to their excellent mechanical strength, chemical resistance, and strong adhesion properties. These characteristics make epoxy-based green coatings highly suitable for industrial, infrastructure, and protective applications. The availability of low-VOC and bio-based epoxy formulations further supports regulatory compliance, ensuring sustained demand across construction, marine, and heavy-duty industrial sectors.

Polyurethane resins are the fastest-growing segment owing to their superior flexibility, abrasion resistance, and high-quality surface finish. These coatings are increasingly preferred in automotive, furniture, and premium architectural applications. Continuous innovation in bio-based polyols and low-emission curing technologies is accelerating polyurethane adoption, particularly in performance-driven and design-focused end uses.

By Technology, Waterborne Lead Market and Radiation-Cure Fastest Growth

Waterborne segment currently largest share to the green coating market due to their low VOC emissions, ease of application, and strong regulatory acceptance. They are widely used in architectural, industrial, and packaging applications where environmental compliance and worker safety are critical. Growing restrictions on solvent-based coatings and increasing sustainability mandates continue to strengthen the dominance of waterborne technologies.

Radiation-cure coatings are the fastest-growing technology segment due to their ultra-low emissions, rapid curing time, and high energy efficiency. These coatings are increasingly adopted in wood finishing, electronics, and packaging applications where fast production cycles and reduced energy consumption are essential. Their ability to deliver high performance with minimal environmental impact is driving rapid market expansion.

By Application, Architectural Lead Market and Automotive Fastest Growth

Architectural applications lead the green coating market driven by rising construction activities and strict indoor air quality regulations. Green coatings are widely used in residential and commercial buildings due to their low toxicity, minimal odor, and compliance with green building standards. Increasing adoption of sustainable construction practices continues to fuel strong demand in this segment.

Automotive applications represent the fastest-growing segment as vehicle manufacturers increasingly adopt sustainable materials to meet emission and efficiency targets. Green coatings support lightweight vehicle designs, corrosion protection, and aesthetic performance while complying with environmental regulations. Growth in electric vehicle production and eco-friendly manufacturing practices is accelerating demand for green automotive coatings.

By End-Use Industry, Automotive & Transportation Lead Market and Electronics & Electrical Appliances Fastest Growth

Automotive and transportation dominate the green coating market due to high coating consumption volumes and strict environmental compliance requirements. Green coatings are extensively used for exterior and interior vehicle components to enhance durability while reducing environmental impact. The ongoing shift toward electric and fuel-efficient vehicles further reinforces this segment’s leadership.

Electronics and electrical appliances are the fastest-growing segment due to rising demand for low-emission, non-toxic, and protective coatings. Growth in consumer electronics, miniaturization of components, and stringent safety regulations are driving adoption. Green coatings offer insulation, moisture resistance, and thermal protection, making them increasingly essential in this rapidly expanding industry.

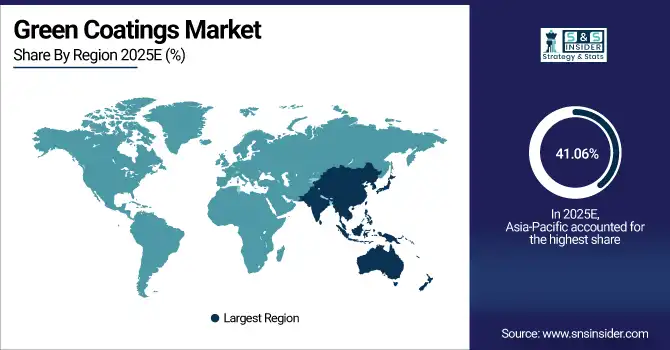

Green Coating Market Regional Analysis:

Asia Pacific Green Coating Market Insights:

Asia Pacific dominates the green coating market with a 41.06% share due to its massive industrial base, large construction sector, and high-volume manufacturing in countries such as China, India, Japan, and South Korea. The region has the highest consumption of coatings, driven by rapid urbanization, infrastructure projects, and strong automotive and electronics production. Moreover, the region's affordable manufacturing, access to raw materials, and growing use of low-VOC rules have led to a broad use of green coatings, making Asia Pacific the largest market.

Get Customized Report as per Your Business Requirement - Enquiry Now

Simultaneously, Asia Pacific is the fastest-growing region, with a CAGR of 5.69%, due to accelerating environmental regulations, rising sustainability awareness, and expanding investments in smart cities and electric vehicle production. Governments across the region are strengthening emission norms and promoting eco-friendly construction, which is rapidly increasing demand for waterborne and bio-based coatings. Moreover, rapid industrial expansion in emerging economies, foreign direct investments, and growing consumer demand for sustainable products are driving higher growth rates compared to other regions.

China and India Green Coating Market Insights

China and India drive green coating demand through rapid urbanization, infrastructure expansion, and strong growth in automotive and electronics manufacturing. Increasing VOC regulations, green building initiatives, and rising electric vehicle production are accelerating adoption of waterborne and bio-based coatings.

North America Green Coating Market Insights:

North America holds a significant share of the Green Coating Market, supported by strict environmental regulations enforced by agencies such as the EPA and growing demand for low-VOC products. The region benefits from early adoption of advanced coating technologies, strong presence of major manufacturers, and high usage in architectural, automotive, and industrial applications. Increasing renovation activities, green building initiatives, and corporate sustainability commitments continue to support stable demand for environmentally friendly coating solutions.

U.S and Canada Green Coating Market Insights

The U.S. and Canada show strong adoption of green coatings due to strict environmental regulations, high awareness of sustainability, and widespread use in architectural and automotive applications. Renovation activities and corporate ESG commitments continue to support steady market growth.

Europe Green Coating Market Insights

Europe represents a mature and regulation-driven market for green coatings, with stringent environmental policies and sustainability frameworks such as REACH driving adoption. Strong demand from architectural and industrial sectors, coupled with high penetration of green building standards, supports market growth. Countries like Germany, France, and the UK emphasize eco-friendly materials in construction and automotive manufacturing. Continuous innovation in bio-based coatings and circular economy initiatives further strengthen regional market development.

Germany and U.K. Green Coating Market Insights

The U.K. and Germany lead Europe’s green coating market, driven by stringent environmental policies, advanced manufacturing, and high penetration of green building standards. Strong automotive production and innovation in bio-based coating technologies support sustained market development.

Latin America (LATAM) and Middle East & Africa (MEA) Green Coating Market Insights

Latin America and the Middle East & Africa are emerging regions in the Green Coating Market, driven by growing construction activities, industrial expansion, and gradual implementation of environmental regulations. Rising infrastructure investments in Brazil, Mexico, Saudi Arabia, and the UAE are creating demand for sustainable coatings. Increasing awareness of VOC reduction, coupled with foreign investments and modernization of manufacturing facilities, is expected to gradually boost green coating adoption across these regions.

Green Coating Market Key Players

-

AkzoNobel N.V. (Dulux Trade Ecosure, International® Marine Coatings)

-

ALDO COATINGS (Aldo EcoShield, Aldo GreenCoat)

-

Asian Paints Limited (Royale Atmos, APEX Ultima)

-

Axalta Coating Systems, LLC (Alesta Powder Coatings, Spies Hecker® Waterborne Coatings)

-

BASF SE (BASF Coatings Solutions, Eco-friendly automotive coatings)

-

Beckers Group (Beckry®Eco, Beckers Industrial Coatings)

-

Berger Paints India Limited (BERGER Breathe Easy, Berger WeatherCoat)

-

Chimar Hellas S.A. (Chimar Green, EcoCoat)

-

DAW SE (Caparol® Eco Coatings, Alpina Eco)

-

Diamond Vogel (Diamond Vogel EcoCoat, Valspar® EcoCoat)

-

Dow Inc. (DOWSIL® EcoCoat, EcoFlex® Coatings)

-

DuPont de Nemours, Inc. (DuPont™ Industrial Coatings, DuPont™ Tyvek® Coatings)

-

Eastman Chemical Company (Eastman™ Waterborne Coatings, Eastman™ Eco-friendly Industrial Coatings)

-

Eco Smart Coatings, LLC (EcoSmart Coatings™ for Wood, EcoSmart Coatings™ for Metals)

-

Greenkote PLC (Greenkote® Coating for Steel, Greenkote® EcoCoat for Metals)

-

Hempel A/S (Hempel® Marine Paints, Hempel® Ecofriendly Coatings)

-

IGL Coatings Ltd. (IGL Eco Coating, IGL Nano Coatings)

-

Jotun A/S (Jotun Jotashield® Eco, Jotun Marine Coatings)

-

Kansai Paint Co., Ltd. (Kansai EcoCoat, Kansai Waterborne Coatings)

-

Nippon Paint Holdings Co., Ltd. (Nippon EcoCoat, Nippon Waterborne Coatings)

Green Coating Market Competitive Landscape:

PPG Industries is a global leader in paints, coatings, and specialty materials, focusing on sustainable solutions for industrial, automotive, and architectural applications. The company has accelerated adoption of eco-friendly coatings such as waterborne, powder, and recycled-content products. Through innovations like PPG EnviroLuxe Plus and initiatives to reduce VOC emissions and carbon footprint, PPG continues to expand its presence in markets demanding high-performance, environmentally responsible coating solutions.

-

In May 2025, PPG Industries launched PPG EnviroLuxe Plus powder coatings, a sustainable innovation containing up to 18% recycled plastic (rPET) and free from PFAS, significantly reducing the carbon footprint by approximately 30% compared to standard powders while maintaining high performance for industrial applications like shelving and fencing.

Nippon Paint Holdings is a major player in the Asia-Pacific coatings market, recognized for its eco-conscious product portfolio spanning automotive, industrial, and decorative applications. The company emphasizes sustainable innovations, including low-VOC, bio-based, and energy-efficient coatings. Strategic partnerships, such as collaborations with Covestro and advancements in in-mold coating technology, support its green growth strategy, enabling Nippon Paint to meet regulatory requirements while promoting environmental responsibility and performance-driven solutions.

-

In December 2025, Nippon Paint Holdings Co., Ltd. Unveiled the ‘Beyond Paint’ Sustainable Surface Engineering Portfolio at IGBC Mumbai 2025, showcasing advanced coatings like Cool Tec and N‑Shield that improve energy efficiency and support green building certifications.

Sika AG specializes in advanced construction chemicals and industrial coatings, offering solutions that enhance sustainability and performance. The company focuses on low-emission epoxy, concrete, and protective coatings that reduce environmental impact while maintaining durability. Initiatives like Sika® Carbon Compass for calculating product carbon footprints and strategic acquisitions expand its footprint in green building and infrastructure projects. Sika’s emphasis on sustainable innovation positions it as a key contributor to the global green coatings market.

-

In March 2025, Sika AG launched a low‑emission epoxy hardener in collaboration with BASF, reducing VOC emissions by up to 90% and supporting sustainable construction coatings, while maintaining excellent adhesion and durability for concrete and steel structures.

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 143.43 Billion |

| Market Size by 2033 | USD 212.32 Billion |

| CAGR | CAGR of 5.04% From 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Resin Type (Acrylic, Epoxy, Polyurethane, Alkyd, Other Bio based Resins) • By Technology (Radiation Cure, High Solids, Powder, Waterborne) • By Application (Product Finishes, Packaging, Wood, High Performance, Industrial, Automotive, Architectural) • By End Use Industry (Automotive & Transportation, Construction & Architecture, Packaging, Wood & Furniture, Electronics & Electrical Appliances, Marine & Aerospace) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Akzo Nobel N.V., PPG Industries, Inc., The Sherwin-Williams Company, BASF SE, Axalta Coating Systems LLC, Nippon Paint Holdings Co., Ltd., RPM International Inc., Kansai Paint Co., Ltd., Jotun A/S, Hempel A/S, Asian Paints Limited, Berger Paints India Limited, Tikkurila Oyj, DAW SE, Sika AG, Allnex Netherlands B.V., Henkel AG & Co. KGaA, Masco Corporation, Walter Wurdack Inc., and GLOBAL Encasement Inc. |