Resin Market Report Scope & Overview:

Get PDF Sample Copy of Resin Market - Request Sample Report

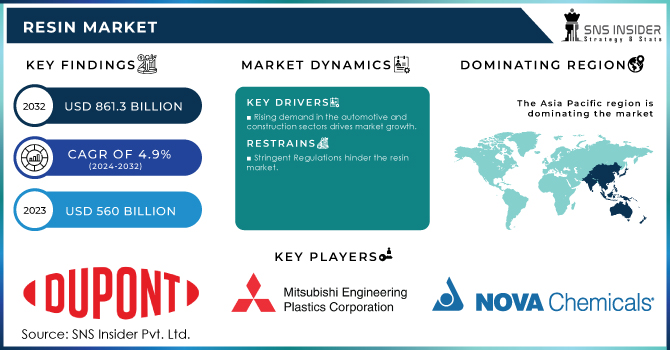

The Resin Market size was valued at USD 560 Billion in 2023. It is expected to grow to USD 861.3 Billion by 2032 and grow at a CAGR of 4.9% over the forecast period of 2024-2032.

Advancements in resin technology help to enhance product performance, and they become more and more suitable for use in high-performance applications. The constant development of resins may result in thermal stability improvements, chemical resistance, and greater mechanical strength, which are especially important for such sectors as aerospace, electronics, smart textile, and medical devices. Moreover, the development of 3D print technologies has boosted the creation of resins with special properties: they cure faster and are used to produce goods in the healthcare industry (e.g., prosthetics), automotive industry (prototypes), and consumer goods.

However, according to the U.S. Department of Energy, the use of advanced materials, which also refer to high-performance resins, is vital for enhancing energy efficiency and reducing negative environmental impact. For example, by 2030, the U.S. government plans to reduce energy use in manufacturing by 25%. This will be achieved by the numerous energy-saving innovations, which involve materials like advanced resins, that enable greater durability and performance of final products.

Resins play a vital role in the electronics industry. They are widely used for the encapsulation and insulation of electronic components, where high thermal conductivity and electrical insulation play an important role. The enlargement of the global market for consumer electronics and smart devices contributes to the increased demand for resins that are durable, flexible, and lightweight. It is relevant to wearable electronics, including fitness trackers and smartwatches, but it is also applicable to consumer electronics such as smartphones and home appliances. In this case, the peculiar characteristics of the identified type of polymer allow promoting the work of modern devices and extending its lifespan.

According to the U.S. International Trade Commission, the demand for advanced materials, which include one of the specialized resins, is related to the increasing use of electronic devices in the United States. Electronics and other end products together form 29% of the total electronic component market, and this trend suggests the necessity for developing and applying more advanced forms of resins that meet new challenges of insulation and durability.

Drivers

Rising demand in the automotive and construction sectors drives market growth.

The resin market has been experiencing remarkable growth in the automotive and the construction industry. In the automotive industry, demand for resins has been on the rise due to the lightweight and durable properties of most resins. These generally translate to higher fuel efficiencies and a corresponding increase in the performance of the vehicle. In addition, the shift of manufacturers from petroleum vehicles to electric vehicles has led to an increase in the demand for new advanced materials among them resins that could stand high temperatures and act as isolators for the electrical components of the vehicle. Concerning this development, both resins and plastics have been experiencing high demand in the automotive industry. In the construction industry, demand for resins has also been high as resins are used to develop adhesives, coatings, and composites that could increase the durability and resistance of the structures to environmental effects that compromise the structure of buildings.

Furthermore, as the demand for resin grows, they will be particularly needed in developing urbanization and the growth of infrastructures in the developed markets which would stimulate increased demand for resins in the construction industry. According to the U.S. Department of Energy, high-performance resins and other advanced materials are crucial to the reduction of energy consumption in both the automotive and construction sectors. The department adds that the use of lightweight materials such as resins in vehicles would lower vehicle energy use by 5 to 6% by national goals concerning the energy efficiency of vehicles.

Restraint

-

Stringent Regulations hinder the resin market

The Environmental Protection Agency (EPA), the Occupational Safety and Health Administration (OSHA), and the Consumer Product Safety Commission (CPSC) are other government entities that regulate the usage of resins. These organizations implement resin-use laws to protect human health and the environment. These government bodies' requirements might make it more difficult and expensive for resin manufacturers to promote their goods. This may result in a fall in resin demand and a slowing in resin market growth.

Opportunities

Rapid Growth in the packaging industry

The packaging industry's rapid growth, as well as rising demand for packaging solutions from the food and beverage, consumer goods, pharmaceutical, and e-commerce industries, will provide profitable prospects for the market. Plastics are widely utilized in the packaging of various items in the form of films, corrugated boxes, poly bags, foil-sealed bags, trays, and rigid boxes. Electrical and electrical industries, as well as pharmaceutical producers, have advanced the plastic packaging business. Furthermore, flexible packaging is favored by food and beverage makers, which enhances the packaging solutions industry and influences plastic demand growth.

Market segmentation

By Type

Polyethylene (PE) held the largest market share around 22% in 2023. It is the most commonly used thermoplastic resin in the resin market due to its toughness, chemical resistance, and ease of processing. It is applied in the manufacture of both flexible and rigid packaging materials across the globe and is tough and economical. Notably, in the packaging industry, the resin is used to develop plastic bags, containers, and films due to its excellent barrier properties. It is also highly valued in the construction and automotive industry because of its lightweight and tough nature.

Therefore, in the construction industry, the material is used for pipes and insulation, while in the automobile industry, it is used to develop body panels and other components. Its low cost and wide availability as compared to other resins used across the world make it superior. It is also efficient due to its recyclability nature and resilience in ecologically diverse environments. According to the U.S. Environmental Protection Agency, polyethylene is one of the most recycled plastics and accounts for more than 34% of the plastic recycling stream.

Moreover, Polyurethane resin is the fastest-growing segment in the resin market. Polyurethane resin is an elastic and flexible resin that is often used in foams, cushions, and seals. Other Epoxy resin, Silicone resin, and acrylic resins are used in adhesives, coatings, manufacture of lenses, windows, gaskets, seals, and molds.

By End-Use

The packaging segment accounted for the largest share around 24% in 2023. and it is expected to maintain its lead throughout the forecast period. The increasing requirement for proper packaging solutions from several industries such as consumer goods, food & beverage, electrical & electronics, and construction is driving the growth of this segment. Moreover, growing consumption of frozen and ready-to-eat foods is also supporting the growth of this segment.

The building & construction segment also holds a significant share of the market in 2023. The growth of the segment can be ascribed to the increasing urbanization and infrastructural developments in the developing nations, and the renovation of the existing and old constructions. Resins are used to manufacture several construction & building products that consist of flooring, countertops, roofing, pipes & fittings, coatings, and adhesives.

The growth of the automotive & transportation segment is due to the increasing usage of plastics in automobiles. It is possible to substitute vehicle metal parts & components with plastics as they are lighter in weight and possess similar physical properties.

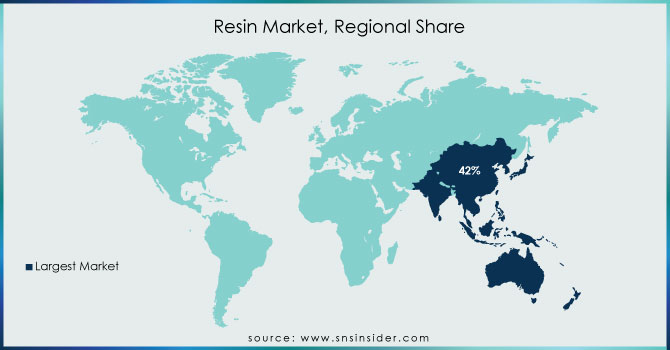

Regional Analysis

The Asia Pacific region held the highest market share around 42% in 2023 in the resin market. It is expanding due to rising demand for resins in the automotive, construction, and packaging industries. The demand is due to the presence of major resin producers, exporters, and consumers in countries like China and India. China is a big producer of electronics such as televisions, laptop computers, and smartphones.

According to the Ministry of Economy, Trade, and Industry (METI) in Japan, the region’s resin production capacity has significantly increased, with China alone accounting for over 30% of the global production of plastic resins, including polyethylene, in recent years. This extensive production capacity supports the Asia-Pacific's dominance in the market, as regional manufacturers can meet local and global demand efficiently, contributing to the region's leading market share.

The rising demand for packages from the food and beverage and cosmetics industries is expected to drive the North American industry. The region is expected to increase significantly due to rising demand for packaging materials, consumer goods, electronic gadgets, and other products. This rising packaging requirement will create new opportunities for North American end products.

Europe is mostly expanding due to increased plastic usage in the automotive industry. Because of their features such as electrical insulation, corrosion suppression, and other aspects, plastics are employed in automobiles. Furthermore, car pollution rules have encouraged automakers to increase the amount of plastic in their vehicles, supporting market development.

Latin America is expected to rise significantly as a result of increased investments, pharmaceutical disposal income, and new infrastructure initiatives. Packaging demand from textile and beverage applications influences the Middle East and Africa.

Get Customised Report as per Your Business Requirement - Enquiry Now

Key Players

-

Dupont (Delrin Acetal Resin)

-

Mitsubishi Engineering-Plastics Corporation (Novarex Polycarbonate Resin)

-

Nova Chemicals (SCLAIR Polyethylene Resin)

-

Arkema (Rilsan Polyamide Resin)

-

BASF SE (Ultrason Polysulfone Resin)

-

LyondellBasell (Purell Polypropylene Resin)

-

INEOS Holdings Ltd. (Eltex Polyethylene Resin)

-

Qenos (Alkathene LDPE Resin)

-

Hexion (Epon Epoxy Resin)

-

Invista (Rynite PET Resin)

-

Dow Chemical Company (VERSIFY Elastomer Resin)

-

SABIC (Lexan Polycarbonate Resin)

-

Sumitomo Chemical (Evolue Polyethylene Resin)

-

ExxonMobil Chemical (Exceed XP Polyethylene Resin)

-

Celanese Corporation (Celcon Acetal Copolymer Resin)

-

Solvay (Radel Polyphenylsulfone Resin)

-

Evonik Industries (VESTAMID Polyamide Resin)

-

Teijin Limited (Panlite Polycarbonate Resin)

-

Toray Industries (Amilan Polyamide Resin)

-

Formosa Plastics Corporation (Formolene Polyethylene Resin)

Recent Development:

-

In 2023 INEOS Solution commercialized K-Resins KR21 by Asian household appliance makers, specifically refrigerator-in liners

-

In 2023 Sabic promote bio-based variants of all NORYL resin grades to promote the bio-economy of plastics

-

In 2023 BASF Shanghai Coatings, as well as the resin facility of BASF Coatings in Caojing, Shanghai, all declared their intention to use 100% renewable energy and begin operations

| Report Attributes | Details |

|

Market Size in 2023 |

US$ 560 Billion |

|

Market Size by 2032 |

US$ 861.32 Billion |

|

CAGR |

CAGR of 4.90% From 2024 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2032 |

|

Historical Data |

2020-2022 |

|

Report Scope & Coverage |

Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

|

Key Segments |

• By Type (Polypropylene, Polystyrene, Polyvinyl chloride, Polyurethane, Acrylonitrile, Polyethylene terephthalate, Polyamide, Polyethylene, polycarbonate) |

|

Regional Analysis/Coverage |

North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

|

Company Profiles |

Dupont, Mitsubishi Engineering-Plastics corporation, Nova Chemicals, Arkema, BASF SE, LynondellBasell, INEOS Holdings Ltd., Qenos, Hexion, Invista |

|

Key Drivers |

• Growing demand from end-use industries |

|

Market Opportunity |

• Rapid Growth in the packaging industry |