Green Tea Market Report Scope & Overview:

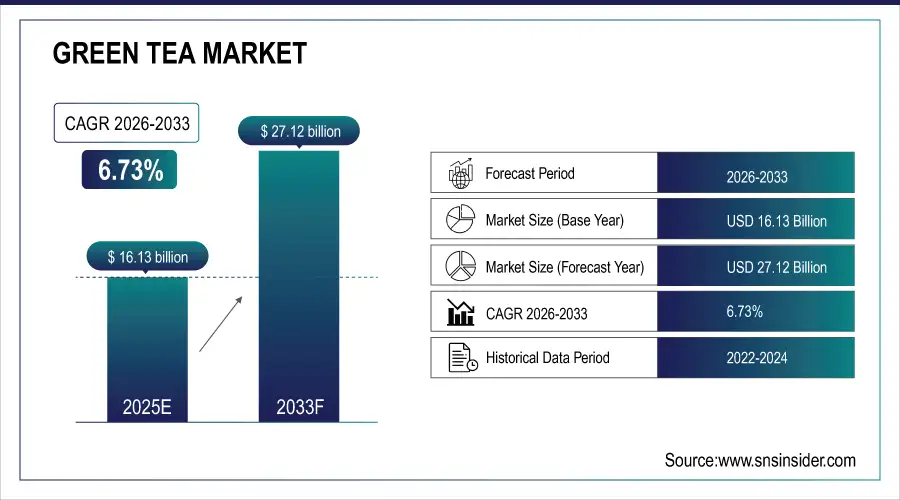

The Green Tea Market size is valued at USD 16.13 Billion in 2025E and is projected to reach USD 27.12 Billion by 2033, growing at a CAGR of 6.73% during 2026-2033.

The Green Tea Market analysis highlights the growing consumer shift toward healthier beverages driven by rising awareness of antioxidants and natural wellness benefits. Increasing demand for organic and flavored variants is fueling product innovation and diversification.

In 2025, 68% of global consumers associated green tea with high antioxidant content and chose it over sugary drinks for long-term health benefits

Market Size and Forecast:

-

Market Size in 2025E: USD 16.13 Billion

-

Market Size by 2033: USD 27.12 Billion

-

CAGR: 6.73% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get more information on Green Tea Market - Request Free Sample Report

Green Tea Market Trends

-

Increasing consumer preference for pesticide-free, sustainably sourced green tea drives organic product launches worldwide.

-

Convenient, on-the-go green tea formats gain popularity among health-conscious and busy urban consumers.

-

Manufacturers introduce fruit, herbal, and floral-infused green teas to enhance taste diversity and attract younger demographics.

-

Online platforms boost accessibility, offering premium brands, subscription boxes, and personalized tea selections to global consumers.

-

Growing adoption of eco-friendly packaging and fair-trade certified sourcing strengthens brand reputation and consumer loyalty.

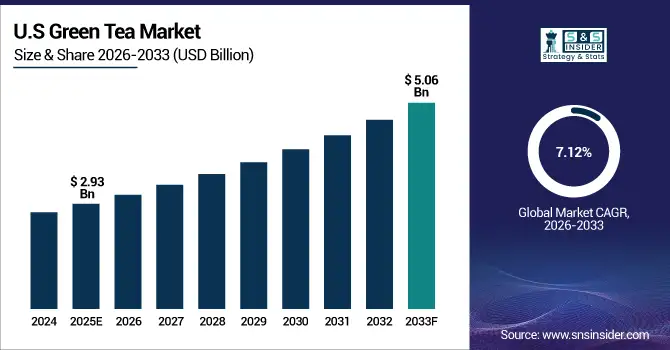

The U.S. Green Tea Market size is valued at USD 2.93 Billion in 2025E and is projected to reach USD 5.06 Billion by 2033, growing at a CAGR of 7.12% during 2026-2033. Green Tea Market growth is driven by rising health consciousness and demand for natural beverages. Consumers increasingly favor green tea for its antioxidant and metabolism-boosting benefits.

Green Tea Market Growth Drivers:

-

Rising Health Awareness and Preference for Natural, Antioxidant-Rich Beverages Boosts Green Tea Demand

Growing global awareness of the health benefits of green tea, including weight management, improved metabolism, and reduced risk of chronic diseases, is a major market driver. Consumers are increasingly shifting from sugary drinks to natural alternatives, positioning green tea as a daily wellness beverage. The surge in fitness and detox trends, coupled with endorsements from health experts, continues to strengthen its demand across both developed and emerging markets.

In 2025, 72% of consumers in North America and Europe cited green tea’s role in metabolism support and chronic disease prevention as key reasons for regular consumption

Green Tea Market Restraints:

-

Fluctuating Raw Material Costs and Limited Availability of High-Quality Tea Leaves Affect Production Stability

The green tea market faces challenges due to price volatility of tea leaves caused by changing climate conditions, unpredictable rainfall, and limited cultivation regions. Smallholder farmers often experience inconsistent yields, leading to supply-demand imbalances and cost increases for manufacturers. Additionally, ensuring consistent quality and flavor across global supply chains is difficult, particularly for premium and organic segments, which depend heavily on specific environmental and cultivation standards.

Green Tea Market Opportunities:

-

Product Diversification and Expansion into Functional and Flavored Green Tea Categories Drive Growth

Manufacturers are capitalizing on the growing trend of functional beverages by introducing innovative green tea blends infused with superfoods, vitamins, and herbal ingredients. Flavored and ready-to-drink (RTD) variants are attracting younger consumers seeking taste variety and convenience. The rising popularity of organic and sustainably sourced products also presents opportunities for premium positioning, while expanding digital retail channels allow brands to reach broader health-conscious audiences globally.

64% of Gen Z and millennial consumers chose RTD green tea for its portability and taste variety, with citrus, peach, and mint as top flavor preferences

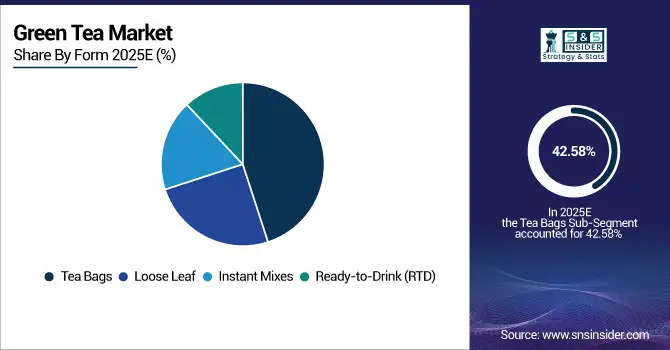

Green Tea Market Segment Analysis

-

By Form, tea bags accounted for the largest market share at 42.58%, while the Ready-to-Drink (RTD) segment is projected to record the fastest growth with a CAGR of 8.50%.

-

By Application, the Beverages segment dominated the market with a 75.10% share in 2025, whereas Dietary Supplements are expected to grow at the fastest rate, registering a CAGR of 7.51%.

-

By Type, Unflavored Green Tea led the market with a 55.28% share in 2025, while Matcha Green Tea is anticipated to be the fastest-growing segment, expanding at a CAGR of 7.20%.

-

By Distribution Channel, Supermarkets & Hypermarkets held the largest share of 48.34% in 2025, whereas Online Retail is forecasted to witness the fastest growth, achieving a CAGR of 12.40%.

By Form, Tea Bags Leads Market While Ready-to-Drink (RTD) Registers Fastest Growth

Tea bags dominate the green tea market due to their convenience, portion control, and widespread availability across supermarkets and retail stores. Consumers prefer tea bags for their ease of preparation and consistent flavor, making them ideal for both home and office use. However, the Ready-to-Drink (RTD) segment is witnessing the fastest growth, driven by the demand for on-the-go, healthy beverage options. The RTD category appeals particularly to younger, urban consumers seeking quick, refreshing, and functional wellness drinks.

By Application, Beverages Dominate While Dietary Supplements Shows Rapid Growth

The beverages segment leads the market as green tea continues to be a popular daily drink among health-conscious consumers. Its antioxidant and metabolism-boosting properties make it a preferred alternative to sugary beverages. Meanwhile, the dietary supplements segment is expanding rapidly as green tea extracts are increasingly used in capsules, powders, and tablets for weight management and detoxification. Rising demand for natural ingredients in nutraceuticals and functional foods further accelerates the adoption of green tea-based supplements worldwide.

By Type, Unflavored Green Tea Lead While Matcha Green Tea Registers Fastest Growth

Unflavored green tea remains the most consumed type due to its authentic taste, affordability, and minimal processing. It appeals to traditional consumers who prefer pure, natural tea with no added ingredients. However, matcha green tea is emerging as the fastest-growing segment, supported by its high antioxidant concentration and versatility in beverages, desserts, and skincare. The rising popularity of Japanese culture, wellness trends, and social media influence has fueled global demand for premium matcha-based products.

By Distribution Channel, Supermarkets & Hypermarkets Lead While Online Retail Grow Fastest

Supermarkets and hypermarkets dominate green tea market owing to their extensive product availability, brand variety, and consumer trust in in-store purchases. They remain the primary shopping destination for packaged tea products. While, online retail is expanding rapidly, driven by the convenience of home delivery, exclusive brand offers, and the rise of e-commerce platforms. Digital marketing, subscription models, and personalized tea assortments are further boosting online green tea sales, especially among tech-savvy and health-conscious urban consumers.

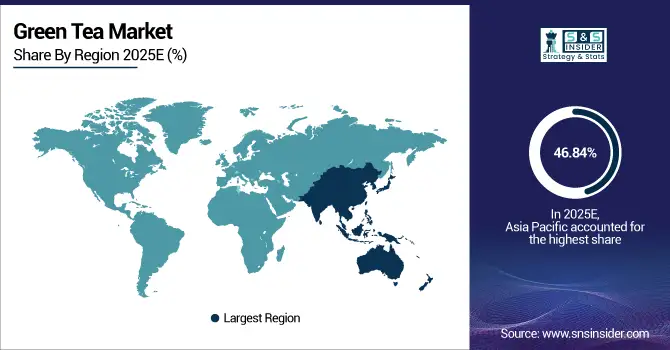

Green Tea Market Regional Analysis:

Asia-pacific Green Tea Market Insights

In 2025 Asia-Pacific dominated the Green Tea Market and accounted for 46.84% of revenue share, this leadership is due to the strong cultural consumption in countries like China and Japan. The region benefits from abundant tea cultivation, traditional tea-drinking habits, and growing health awareness. Increasing demand for organic and premium variants is fueling product innovation. Expanding retail infrastructure and the popularity of ready-to-drink green tea continue to boost market penetration.

Get Customized Report as per Your Business Requirement - Enquiry Now

China Green Tea Market Insights

China remains the largest producer and consumer of green tea, accounting for a major share of global production. Its long-standing tea culture and vast cultivation regions such as Zhejiang and Anhui ensure steady domestic and export supply.

North America Green Tea Market Insights

North America is expected to witness the fastest growth in the Green Tea Market over 2026-2033, with a projected CAGR of 7.38% due to rising health consciousness and wellness trends. Consumers are increasingly shifting from carbonated drinks to natural, antioxidant-rich beverages. Ready-to-drink formats and flavored variants are popular among millennials and working professionals. The U.S. leads regional consumption, supported by major beverage brands and strong retail networks.

U.S. Green Tea Market Insights

The U.S. green tea market is witnessing consistent growth fueled by the demand for functional and healthy beverages. Consumers are drawn to green tea’s detox, weight management, and antioxidant properties. The market features strong competition among multinational and local brands introducing RTD and flavored variants.

Europe Green Tea Market Insights

In 2025, Europe emerged as a promising region in the Green Tea Market, due to increasing awareness of health benefits and rising organic preferences. Western European countries like the U.K., France, and Germany are witnessing higher consumption of flavored and matcha varieties. The region’s emphasis on sustainability and natural products has encouraged eco-friendly packaging and fair-trade sourcing. Cafés and specialty tea shops are promoting premium blends, enhancing consumer exposure.

Germany Green Tea Market Insights

Germany is one of Europe’s most prominent green tea markets, driven by growing interest in wellness and natural nutrition. Consumers favor organic and fair-trade certified products, reflecting strong environmental consciousness. Matcha and flavored blends are gaining popularity among younger demographics.

Latin America (LATAM) and Middle East & Africa (MEA) Green Tea Market Insights

The Green Tea Market is experiencing moderate growth in the Latin America (LATAM) and Middle East & Africa (MEA) regions, due to the rising disposable incomes, urbanization, and awareness of health benefits are boosting consumption. In LATAM, Brazil and Mexico are leading adopters, while in MEA, the UAE and Saudi Arabia show strong import-driven demand. The popularity of premium and flavored teas is growing, especially among younger consumers.

Green Tea Market Competitive Landscape:

AMORE Pacific Corp is a leading player in the green tea market, leveraging its expertise in skincare and wellness. The company integrates green tea extracts into both beverages and beauty products. Its premium “OSULLOC” brand emphasizes organic cultivation, sustainability, and heritage-based tea craftsmanship, appealing to health-conscious and luxury consumers globally.

-

In April 2024, the group launched Meta Green Calorie Cut Jelly under its Vital Beautie brand—featuring green-tea catechin with vitamin C and B5 for body-fat reduction, followed by e-commerce rollout from April 1.

Arizona Beverage Company is a major contributor to the ready-to-drink (RTD) green tea segment. Its iconic iced green tea products combine refreshing taste with mass-market affordability. The brand’s strong distribution network and focus on innovative packaging have helped it maintain a dominant presence in North American beverage retail markets.

-

In March 2025, Arizona Beverage Company collaborated with 7-Eleven, Inc. to introduce the “Southland Reserve” cold-brew tea line, featuring green tea varieties, expanding its premium ready-to-drink offerings across U.S. convenience stores nationwide.

Associated British Foods LLC, through its Twinings brand, holds a strong position in the global green tea market. The company emphasizes premium-quality teas and diverse flavor profiles catering to evolving consumer preferences. Its commitment to ethical sourcing and sustainability enhances brand credibility, supporting steady growth across Europe, North America, and Asia-Pacific.

-

In September 2024, Twinings (Associated British Foods LLC) launched a new ready-to-drink sparkling tea line infused with Chinese green tea and vitamins (Refresh, Defence and Boost flavours).

The Coca-Cola Company plays a key role in the green tea market through its popular brands like Honest Tea and Ayataka. The company focuses on ready-to-drink and low-calorie formulations targeting wellness-oriented consumers. Leveraging its extensive global distribution and marketing power, Coca-Cola continues expanding its green tea offerings worldwide.

-

In April 2025, Coca-Cola officially launched its RTD tea brand Fuze Tea in Spain, at its Sevilla (La Rinconada) plant. The company dedicated four production lines in that facility to Fuze Tea and rolled out new flavours such as Lemon, Green Tea – Passionfruit, Mango-Pineapple and Peach, targeting younger consumers and aiming to capture the under-penetrated RTD tea market in Spain.

Green Tea Market Key Players:

Some of the Green Tea Market Companies are:

-

AMORE Pacific Corp

-

Arizona Beverage Company

-

Associated British Foods LLC

-

The Coca-Cola Company

-

Tata Global Beverages

-

Unilever

-

Cape Natural Tea Products

-

Celestial Seasonings

-

Finlays Beverages Ltd.

-

Frontier Natural Products Co-Op.

-

Hambleden Herbs

-

Hankook Tea

-

Honest Tea, Inc.

-

ITO EN

-

Kirin Beverage Corp.

-

Metropolitan Tea Company

-

Northern Tea Merchants Ltd.

-

Numi Organic Tea

-

Oishi Group Plc.

-

Yogi Tea

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 16.13 Billion |

| Market Size by 2033 | USD 27.12 Billion |

| CAGR | CAGR of 6.73% From 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Form (Loose Leaf, Tea Bags, Instant Mixes, and Ready-to-Drink (RTD)) • By Application (Beverages, Dietary Supplements, Cosmetics & Personal Care, and Pharmaceuticals) • By Type (Flavored Green Tea, Unflavored Green Tea, Organic Green Tea, and Matcha Green Tea) • By Distribution Channel (Supermarkets & Hypermarkets, Specialty Stores, Online Retail, and Convenience Stores) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | AMORE Pacific Corp, Arizona Beverage Company, Associated British Foods LLC, The Coca-Cola Company, Tata Global Beverages, Unilever, Cape Natural Tea Products, Celestial Seasonings, Finlays Beverages Ltd., Frontier Natural Products Co-Op., Hambleden Herbs, Hankook Tea, Honest Tea, Inc., ITO EN, Kirin Beverage Corp., Metropolitan Tea Company, Northern Tea Merchants Ltd., Numi Organic Tea, Oishi Group Plc., Yogi Tea |