Global Gynecological Devices Market Overview:

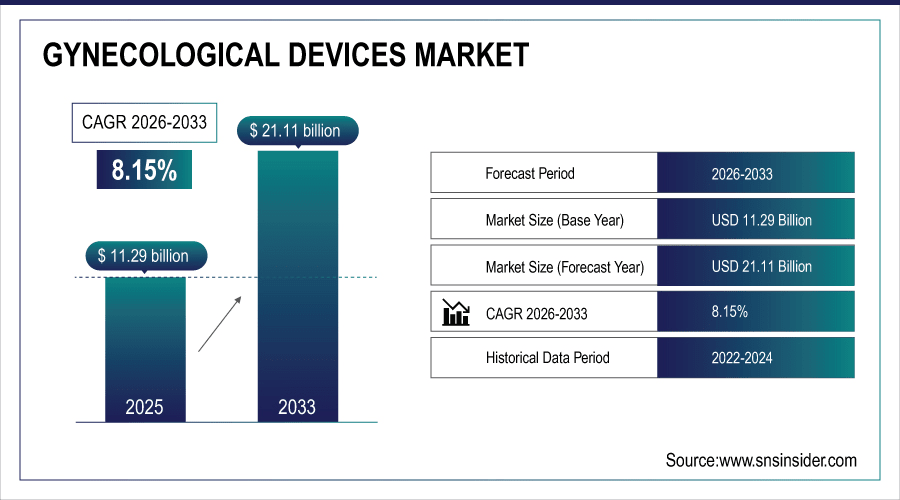

The Global Gynecological Devices Market size was valued at USD 11.29 billion in 2025E and is projected to reach USD 21.11 billion by 2033, growing at a CAGR of 8.15% during the forecast period 2026–2033.

Gynecological devices are commonly used; diagnosing and treating conditions which include fibroids, endometriosis and cervical cancer. More than 12.5 million women worldwide had a gynecological procedure performed in 2025, and of those, 35% were minimally invasive. Just shy of 51% of the procedures took place in hospitals. Escalating incidence of infertility treatments, growing pervasiveness of gynecological ailments and surge in the adoption of sophisticated imaging devices are contributing to market growth.

Surgical devices accounted for 42% of all gynecological procedures, showing their dominance in treatment options.

To Get More Information On Gynecological Devices market - Request Free Sample Report

Gynecological Devices Market Size and Forecast:

-

Market Size in 2025: USD 11.29 Billion

-

Market Size by 2033: USD 21.11 Billion

-

CAGR: 8.15% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

Gynecological Devices Market Trends:

-

Global gynecological procedures are anticipated to rise over 13 million in 2025 with uterine fibroid treatment accounting for almost 36% of the same.

-

The U.S. is projected to perform around 3.2 million procedures per year, mostly for endometriosis and for fertility-related treatments.

-

Europe (Germany, France and Italy) will provide almost 2.8 million procedures per year with robust use of minimally invasive surgical devices.

-

Approximately 35% of procedures are minimally invasive and laparoscopic, indicating high patient demand for a less invasive approach with shorter recovery.

-

Over 51% of treatments are handled by hospitals and specialty gynecology clinics, indicating extended dominant in advanced device portrayal.

U.S. Gynecological Devices Market Insights:

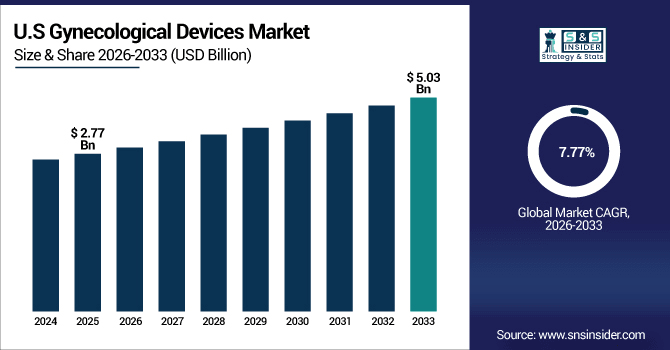

The U.S. Gynecological Devices Market was USD 2.77 billion in 2025E, projected to reach USD 5.03 billion by 2033 at a CAGR of 7.77%. Over 3.0 million procedures were performed in 2025, driven by uterine fibroids, endometriosis, fertility treatments, and rising adoption of minimally invasive and robotic-assisted surgeries.

Gynecological Devices Market Growth Drivers:

-

Increasing Uterine Fibroid Treatments Drive Higher Adoption of Minimally Invasive Gynecological Devices.

The Gynecological Devices market is witnessing robust growth, strongly driven by the burden of uterine fibroids. In 2025, almost 3.8 million of fibroid surgeries were performed globally accounting for approximately 31% of all gynecological cases having treatment. Advanced surgical instruments were used in 44% of these procedures, thus ascribing to precision and less adversity. Specialist gynecology clinics treated about 48% of all fibroid procedures, underlining the importance they play in accommodating increased patient demand and as worldwide device drivers.

Uterine fibroid cases represented nearly 31% of global gynecological procedures in 2025, underscoring their strong contribution to market growth.

Gynecological Devices Market Restraints:

-

Limited Access to Advanced Gynecological Devices in Low-Income Regions Restrains Global Market Penetration.

Limited access to advanced gynecological devices in low-income regions remains a significant barrier to market expansion. In 2025, almost 29% of women in developing countries had no access to minimally invasive gynecological interventions, as opposed to just 8% in high-income areas. Cost restrictions, a lack of trained personnel and scarce hospital resources are the rearing factors. Regulatory barriers and reimbursement issues also slow the adoption, limiting worldwide market growth despite unfolding fibroid, endometriosis and infertility epidemics.

Gynecological Devices Market Opportunities:

-

Growing Adoption of Robotic-Assisted and Minimally Invasive Gynecological Surgeries Creates Significant Market Expansion Potential.

The rising adoption of robotic-assisted and minimally invasive gynecological surgeries is unlocking major growth opportunities. By 2025, over 1.6 million robot-assisted gynecologic procedures were practiced worldwide, which accounted for approximately 13% of overall surgeries combined. This number is estimated to grow beyond 2.9 million cases in 2033, powered by precision, decreased recovery and increased patient acceptance. Already, hospitals and specialist clinics provide close to 58% of such sophisticated surgeries pointing to robust global growth prospects.

Robotic-assisted gynecological surgeries are projected to grow at over 7.8% annually, boosting precision care and expanding global market reach.

Gynecological Devices Market Segmentation Analysis:

-

By Product Type, Surgical Devices held the largest market share of 39.25% in 2025, while Diagnostic Imaging Systems are expected to grow at the highest CAGR of 9.42%.

-

By Application, Uterine Fibroids contributed the highest market share of 31.40% in 2025, while Endometriosis is forecasted to expand at the fastest CAGR of 9.28%.

-

By End User, Hospitals accounted for the largest share of 51.60% in 2025, while Ambulatory Surgical Centers are expected to grow at the fastest CAGR of 8.87%.

-

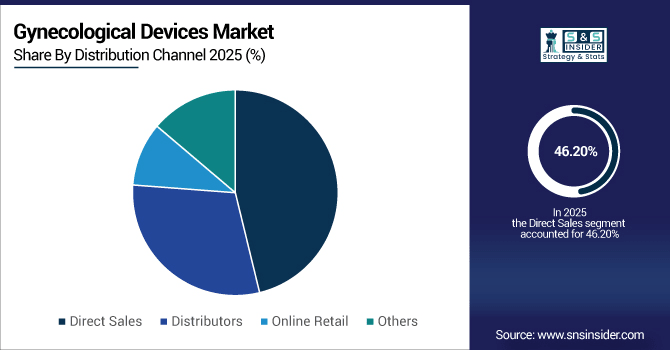

By Distribution Channel, Direct Sales held the largest share of 46.20% in 2025, while Online Retail is anticipated to grow at the fastest CAGR of 9.54%.

By Distribution Channel, Direct Sales Lead While Online Retail Expands Rapidly:

Direct selling provided 5.2 million gynecological devices and instruments to users worldwide by 2025, providing hospitals, clinics with easy access to equipment. The direct sales are leading the market since the bigger healthcare facilities favor direct acces to manufacturers for bulk orders and follow up services. Online retail, few at 1.7 million units in the year 2025 is growing rapidly which will reach up to 3.5 million units in the year 2033 due to home use devices, digital surge and telemedicine penetration.

By Product Type, Surgical Devices Lead While Diagnostic Imaging Expands Rapidly:

Surgical devices cornered the gynecological market, performing more than 4.4 million procedures globally in 2025, and largely focused on removing fibroids, hysterectomies and other major intervention. They are in the lead because they can be used for various gynecological diseases and have been applied in hospitals. Diagnostic imaging systems are advancing rapidly, with the number of diagnostic procedures growing from 2.5 million in 2025 to an estimated 4.8 million by 2033, facilitated by early detection, minimally invasive interventions and fertility planning.

By Application, Uterine Fibroids Dominate While Endometriosis Grows Fast:

The most frequent treatments for UF were represented by 3.8million procedures worldwide in 2025, due to the increasing number of cases and standardized surgical strategies. Fibroids are a bread-and-butter topic as the indications for surgery in gynecology outnumber minimally invasive treatment options. Endometriosis treatments were 2.3 million in 2025, growing to 4.1 million in 2033 as diagnosis of the condition improves, fertility-preserving minimally invasive surgeries grow and patients become more aware.

By End User, Hospitals Lead While Ambulatory Surgical Centers Expand Rapidly:

Hospitals around the world performed over 6.4 million gynecological procedures in 2025, including complex surgeries and inpatient care. Infrastructure, trained manpower and capability to perform complex surgeries are their strength. Ambulatory surgical centers performed 2.4 million procedures, and by 2033 that number was expected to jump to 4.6 million surging as patients continue to favor outpatient treatments, minimally invasive interventions and quick recovery times.

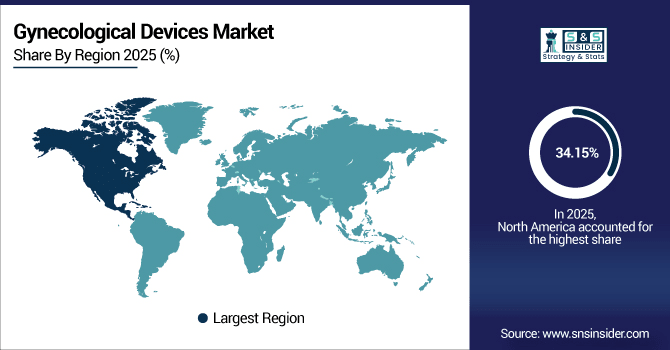

Gynecological Devices Market Regional Analysis:

North America Market Insights:

North America dominates the Gynecological Devices market with a 34.15% share in 2025, supported by advanced healthcare infrastructure and high awareness of women’s health. More than 4.1 million gynecological procedures were performed in hospitals and specialty clinics in the year 2025. Gravitation toward minimally invasive and robot-assistance procedures, a rise in fertility treatment rates and investments in diagnostic imaging systems will fuel the market’s growth trajectory along with advancement until 2033.

In 2025, over 1,800 U.S. hospitals and women’s specialty gynecology practices carried out complex procedures for fibroids, endometriosis and fertility treatments. With the growing adoption of minimally invasive procedures and use of robotic-assisted devices, rising patient awareness and investments in healthcare are anticipated to have a favorable impact on the U.S. Gynecological Devices market over 2033.

Get Customized Report as Per Your Business Requirement - Enquiry Now

Asia-Pacific Market Insights:

The Asia-Pacific Gynecological Devices market is projected to grow at a CAGR of 9.13% during 2026–2033, making it the fastest-growing region globally. In 2025, over 2.8 million gynecological surgeries were completed in hospitals, specialty clinics and outpatient facilities. Fast growth in the market is credited to changing lifestyle patterns, increase in prevalence of fibroids, endometriosis & fertility disorders, rise in demand for minimally invasive and robotic assisted surgical procedures, increasing awareness towards patients, and government health-care investments across developing countries.

China Market Insights:

China is the dominant Asia-Pacific Gynecological Devices market, with over 1.2 million procedures forecast by 2025. Increasing incidence of uterine fibroids, endometriosis & fertility-related issues, growing hospital infrastructure and the adoption rate of minimally invasive and robotic-assisted surgeries will spur growth. Greater patient consciousness and government healthcare schemes are anticipated to stimulate market growth.

Europe Market Insights:

In 2025, the Europe Gynecological Devices market recorded more than 1.6 million procedures across Germany, France, and the UK. Rise in prevalence of uterine fibroids, endometriosis, and infertility as well as advanced hospital infrastructure and rise in insurance coverage propel the growth. Increasing preference for minimally invasive and robot-assisted surgeries, increasing demand for diagnostic imaging and supportive government healthcare policies are fuelling product innovation and helping Europe maintain its dominance in the worldwide gynecological devices market.

Germany Market Insights:

Gynecological Devices market is the biggest in Europe and saw 620,000 procedures performed in hospitals, specialty gynecology clinics and outpatient centers. High incidence of uterine fibroids, endometriosis and fertility treatments, well developed hospital infrastructure, early implementation of minimally invasive and robotic-assisted surgeries and favorable government healthcare programs contribute to Germany’s dominance in Europe.

Latin America Market Insights:

The Latin America Gynecological Devices market reached over 450,000 procedures in 2025, with Brazil, Mexico, and Argentina leading adoption. Increasing investment in the private healthcare hospitals, government programs for women health infrastructure, access to skilled service provider gynecologists and awareness towards minimally invasive & robotic assisted surgeries are some of the driving factors for the market. High-end diagnostic imaging and surgical instruments are also used to enhance accessibility and treatment results among patients in the region.

Middle East and Africa Market Insights:

Middle East & Africa Gynecological Devices Market exceeded 280 thousand procedures in 2025 with rising geriatric population and awareness about benefits of gynecological devices birthrate. Increasing incidence of uterine fibroids, endometriosis and fertility-related issues, growing hospital infrastructure, rise in the number of trained gynecologists, and increasing acceptance for minimally invasive and robotic surgeries are few factors supporting regional market growth.

Gynecological Devices Market Competitive Landscape:

Medtronic is a global leader in the gynecological devices market, with over 1.5 million gynecological procedures performed using its technologies in 2025. The company has a broad product portfolio that includes robotic-assisted systems such as the Hugo™ RAS system and diagnostic imaging systems. Medtronic has strong R&D capabilities and deep hospital collaborations, as well as its wide-range product portfolio which help maintain its market leadership.

-

In May 2025, Medtronic launched the “But First, My Health” campaign in India to raise awareness about abnormal uterine bleeding.

CooperSurgical, Inc. is a prominent player in the gynecological devices market, with more than 500,000 procedures utilizing its products in 2025. The company focuses on women’s health, providing surgical devices, diagnostic products and fertility therapies. CooperSurgical's commitment to innovation, quality and service has established it as a leading worldwide provider of women s health products.

-

In June 2025, CooperSurgical showcased its latest reproductive health technologies at the ESHRE conference in Paris.

Richard Wolf GmbH is a key contributor to the gynecological devices market, with approximately 300,000 procedures supported by its equipment in 2025. With a reputation for high-quality endoscopic instruments and applications, Richard Wolf Gmbh is a worldwide supplier. The company's dedication to accuracy and technological development has given it a high standing in the industry.

-

In April 2025, Richard Wolf GmbH expanded its endoscopic instrument portfolio for minimally invasive gynecological procedures.

Key Players in the Gynecological Devices Market:

-

Hologic, Inc.

-

Boston Scientific Corporation

-

Olympus Corporation

-

GE Healthcare

-

Stryker Corporation

-

Karl Storz GmbH & Co. KG

-

Ethicon, Inc. (Johnson & Johnson MedTech)

-

Smith & Nephew

-

Intuitive Surgical

-

GE Healthcare

-

Bioteque America

-

Gynex Corporation

-

Gynomed

-

Samsung Medison

-

Sonio SAS

-

Veol Medical Technologies

-

Minerva Surgical

| Report Attributes | Details |

|---|---|

| Market Size in 2025 | USD 11.29 Billion |

| Market Size by 2033 | USD 21.11 Billion |

| CAGR | CAGR of 8.15% From 2026 to 2033 |

| Base Year | 2025 |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product Type (Surgical Devices, Diagnostic Imaging Systems, Hand Instruments, Gynecological Chairs, Endoscopy Devices, Others) • By Application (Uterine Fibroids, Ovarian Disorders, Cervical Cancer, Endometriosis, Pregnancy & Fertility, Others) • By End User (Hospitals, Gynecology Clinics, Ambulatory Surgical Centers, Diagnostic Centers, Academic & Research Institutes) • By Distribution Channel (Direct Sales, Distributors, Online Retail, Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Medtronic, CooperSurgical, Inc., Richard Wolf GmbH, Hologic, Inc., Boston Scientific Corporation, Olympus Corporation, GE Healthcare, Stryker Corporation, Karl Storz GmbH & Co. KG, Ethicon, Inc. (Johnson & Johnson MedTech), Smith & Nephew, Intuitive Surgical, GE Healthcare, Bioteque America, Gynex Corporation, Gynomed, Samsung Medison, Sonio SAS, Veol Medical Technologies, Minerva Surgical |