Endometriosis Treatment Market Size Analysis

The Endometriosis Treatment Market size was valued at USD 1.96 billion in 2024 and is expected to reach USD 4.95 billion by 2032, growing at a CAGR of 12.30% over the forecast period of 2025-2032.

To Get more information on Endometriosis Treatment Market - Request Free Sample Report

Fast expansion in the endometriosis treatment industry is driven by raised awareness, improved diagnostics, and a trend toward minimally invasive treatments. 10% of women of reproductive age globally get endometriosis. Still prevalent, nevertheless, are delays in diagnosis ranging up to 9 years, particularly in underdeveloped areas such as Latin America and portions of Asia (WHO, 2024). Growing early intervention and development in the endometriosis diagnosis industry are driven by this unmet demand. Particularly in the U.S. endometriosis treatment market, rising pediatric populations combined with a known rise in congenital heart defects (CHD) and urinary tract problems are driving early identification and management decisions.

For instance, the endometriosis diagnosis market is far more sophisticated, with a 2024 MedRxiv study indicating 80%+ accuracy in identifying endometriosis through AI applied to electronic health data.

R&D expenditure and non-hormonal therapies for endometriosis are on the increase as biomarker-driven diagnosis, AI-assisted imaging, and minimally invasive therapies take huge leaps forward. To answer business urgency and patient pressure, the FDA has stepped up approval pathways for drugs and devices aimed at managing endometriosis pain and surgical treatment. Firms are emphasizing hormonal therapy for endometriosis and innovative prescription medications with fewer side effects. Along with the development of global healthcare infrastructure, particularly in underdeveloped nations with few newborn screening facilities, the endometriosis treatment market trends is expected to increase five to tenfold over the next decade.

The Endometriosis Foundation of America's 2025 conference facilitated long-term endometriosis treatment market growth by highlighting non-invasive diagnostic innovation and expanding funding for early detection research.

Endometriosis Treatment Market Dynamics

Drivers:

-

Expanding Therapeutic Pipeline and Increasing Healthcare Access Boost Market Momentum

The expansion of the therapeutic pipeline, increased funding of women's health research, and improved access to care are driving the endometriosis drugs market to gain traction. With over 65 ongoing clinical trials globally aimed at next-generation therapies, such as GnRH antagonists, anti-inflammatory agents, and targeted biologics, pharmaceutical R&D is progressing (ClinicalTrials.gov, 2025). Monthly injectables, vaginal rings, and two-action hormone modulators are among the new delivery systems that firms such as AbbVie, Myovant Sciences, and ObsEva are working on.

Monitoring symptoms in the early stages is simplified by digital integration with health; Flo Health and Ovia both offer modules for endometriosis on their platforms. Government healthcare budgets in current times involve separate funds, e.g., the USD 30 million women's health strategy fund (2023–2025), for endometriosis research and diagnostic tools. Underpinned by updated ACOG and ESHRE guidelines, technical developments in robot-assisted laparoscopic surgery are increasing procedural safety and reducing hospital stays. Additionally, expanding access, particularly in urban settings, are public–private collaborations and subsidies for fertility-sparing treatment options. These demand drivers are transforming the endometriosis pain market and enabling increased patient flow and increased pharma engagement across both non-hormonal treatments and prescription medication.

Restraints:

-

Infrastructure Gaps, Clinical Limitations, and Socioeconomic Barriers Impede Growth

The absence of specialist treatment facilities is a major challenge in underdeveloped nations, where only 5 out of 20 tertiary hospitals have established gynecologic pain units. Limited reimbursement for high-end imaging (MRI, transvaginal ultrasounds with bowel prep) restricts early, accurate diagnosis even in high-income countries. Clinically, non-invasive biomarker has yet achieved uniform validation, which makes screening difficult and contributes to underdiagnosis. The majority of hormonal therapies are not indicated for women attempting to conceive, thus creating an as yet unfilled therapeutic niche in most markets. In addition, surgical interventions are costly due up to 40% of the women within five years require multiple laparoscopies, considerably straining public health systems. Social disparities also restrict treatment.

For instance, a 2024 JOGNN study found Black and Hispanic Americans in the U.S. are 28% less likely to receive timely endometriosis treatment referrals.

In addition, international supply chain dynamics, including 2023–2024 shortages of leuprolide acetate, are attributed to ongoing treatment availability. Of particular concern for marginalized communities and early-stage endometriosis detection market strategies, these limitations hinder uniform disease control and postpone advancements.

Endometriosis Treatment Market Segmentation Overview

By Type

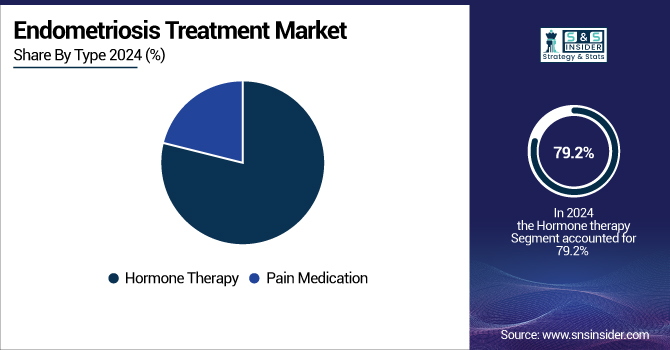

Hormone therapy held a dominant position in the endometriosis treatment market analysis in 2024, accounting for 79.2% of the revenue share. This is largely owing to its established capacity to stem the growth of endometrial tissue and govern estrogen levels. Strongly recommended for prolonged control of extensive or severe symptoms, it consists of oral contraceptives, progestins, and GnRH analogues. Availability, established efficacy in clinical situations, and payment by insurance provide a partial explanation of their popularity. Additionally, for those persons unwilling or ineligible for surgery, hormone medication at times is the treatment of first resort.

During the forecast period, the pain management segment is anticipated to exhibit the fastest growth. The increasing diagnosis of early endometriosis and a movement toward individualized treatment approaches facilitate this growth. Most women are increasingly opting for NSAIDs and other painkillers to manage pain, particularly those attempting to maintain fertility or with contraindications to hormone therapy. Additionally, the reduced cost and availability of painkillers facilitate this trend.

By Drug Class

In 2024, gonadotropin-releasing hormone (GnRH) therapies dominated the endometriosis treatment market with a 52.2% share, mainly due to clinical efficacy in stopping menstruation and controlling ectopic endometrial development. Strong results in both disease control and pain reduction have come from these treatments, which include leuprolide acetate and elagolix. This section has been strengthened even more by the growing use of GnRH antagonists, requiring shorter treatment times and reducing the risk of bone density loss. In cases of recurring or severe disease where first-line treatments have failed, GnRH therapy is also quite favored.

Drug class is also projected to grow at the fastest rate over the forecast period, supported by new pharma approvals with improved dosing options and side effect profiles, and continued clinical trials. Investing in new formulations, such as once-daily oral forms, pharma firms like AbbVie and Myovant Sciences are enhancing tolerance and compliance. These advances, combined with growing awareness of GnRH therapies globally, shape future endometriosis therapy.

By Route of Administration

The oral route of administration led the endometriosis treatment market in 2024, propelled by its simplicity, non-invasiveness, and great patient compliance. This section rules since most first-line hormonal treatments, including oral contraceptives and GnRH antagonists, are easily prescribed, stored, and administered in pill form. Due to the simplicity of titration and lower clinical intervention requirements, the oral route is generally recommended for long-term maintenance. Furthermore, developments in extended-release oral formulations have lowered dosage frequency and increased therapeutic results.

The injectable segment is poised for the fastest growth. As a result, in large measure due to the increasing need for long-acting therapies that provide extended symptom control. These products will be especially suitable for patients who need intensive treatment or who have difficulty taking their daily doses, including depot injections of medroxyprogesterone and leuprolide. Also in the works are new injectable biologics with customized, hormone-free replacements. Increased adoption of these injectables within specialty care facilities is behind the sector's swift growth.

By Distribution Channel

Retail pharmacies captured the largest share of the endometriosis treatment market in 2024 due to their high availability, efficient supply chains, and integration into insurance networks. New and repeat prescriptions are sold at these pharmacies due to they are the primary point of distribution for oral medications such as NSAIDs, birth control pills, and hormonal therapy. Especially for individuals with chronic conditions, the convenience and ease of access offered by local retail outlets encourage high patient traffic and repeat business. In addition to this, the services of pharmacists' advice are increasingly becoming a key function of directing patients onto and through sustained treatment courses.

The "others" channel is predicted to expand at the fastest pace. Increased telemedicine, increased use of digital health platforms, and patients' demand for rapid, at-home therapy all contribute to driving the trend. Investing in direct-to-consumer delivery systems and specialty packaging enables endometriosis treatment market companies to expand market reach and access as well.

Endometriosis Treatment Market Regional Insights

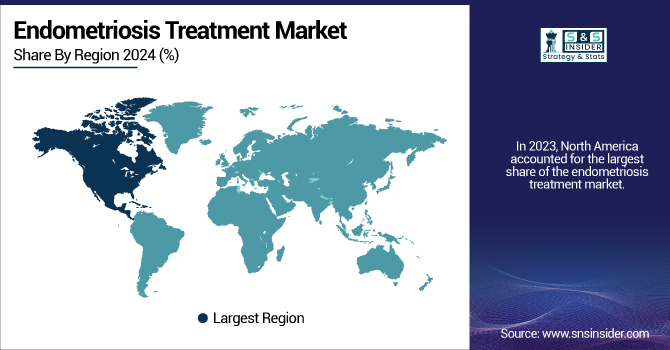

North America dominated the global endometriosis treatment market driven by robust pharmaceutical sector, rapid biologics innovation, and high healthcare use rates. The U.S. endometriosis treatment market size was valued at USD 0.62 billion in 2024 and is expected to reach USD 1.47 billion by 2032, growing at a CAGR of 11.39% over the forecast period of 2025-2032. Faster FDA approvals and more insurance coverage have led to extensive use of next-generation hormone treatments, including oral GnRH antagonists in the U.S. New acceptance of companion diagnostics and tailored medicine drives targeted treatments. Particularly in Ontario and British Columbia, the Canadian government's focus on women's reproductive health has spurred money for community-based diagnostics and the least invasive treatments.

Europe remains an important region with its concerted medical policies and strong support for gynecological health services. France is leading the initiative with state-sponsored screening programs and widening access to fertility preservation treatment through national health care. Italy is also taking strides through education campaigns in schools and primary care designed to reduce the existing seven-year average diagnostic delay. With Brexit, indigenous pharma innovation is given more prominence in the UK under newly accelerated MHRA approval, thus facilitating access to non-hormonal treatments as well as digital health interventions.

For instance, the first-ever daily oral pill ever sanctioned by the UK National Institute for Health and Care Excellence (NICE) specifically to treat endometriosis in March 2025 represents an important regulatory step towards non-surgical treatment options.

Asia-Pacific is the region of most rapid growth throughout the forecast period due to countries accelerating innovation, boosting diagnosis campaigns, and reducing treatment expenses. With government-funded centers of excellence and national awareness campaigns, such as the National Action Plan for Endometriosis, Australia is ahead in R&D funding per capita for endometriosis. India is increasing mobile clinics and AI-powered gynecological platforms to extend to poor rural communities, where diagnosis is occasionally delayed by over eight years. Increased health insurance reforms in China now include cutting-edge treatments in Tier 1 and Tier 2 cities, such as laparoscopic removal and fertility-preserving hormonal therapy.

LAMEA is increasing its pace in the endometriosis treatment market with healthcare digitization and policy-implemented awareness. Subsidies for maternal health and awareness campaigns for reproductive-aged women have led Argentina to see a rise in early diagnosis. Licensing of more contemporary hormone-modulating drugs in Brazil over recent times has expanded treatment choices accessible in both commercial and public hospitals. Initiating numerous women's wellness initiatives, the UAE has spurred robot-assisted operations and outpatient hormone therapy.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players in the Endometriosis Treatment Market

Leading companies in the endometriosis treatment market comprise Bayer AG, Pfizer Inc., AbbVie Inc., AstraZeneca, ObsEva SA, Teva Pharmaceuticals, Zydus Healthcare, Astellas Pharma Inc., Gedeon Richter Plc, and Takeda Pharmaceutical Co. Ltd.

Recent Developments

-

In January 2025, Gesynta Pharma raised USD 29 million to accelerate the clinical development of its innovative non-hormonal treatment for endometriosis, aiming to provide safer long-term relief options without hormone-related side effects.

-

In Oct 2024, Hope Medicine Inc. announced successful results from a global Phase 2 study of a first-in-class endometriosis therapy, which also received Breakthrough Therapy Designation, highlighting its potential to meet significant unmet clinical needs.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 1.96 Billion |

| Market Size by 2032 | USD 4.95 Billion |

| CAGR | CAGR of 12.30% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Pain Medication, Hormone Therapy) • By Drug Class (NSAIDs, Oral Contraceptives, Gonadotropin-Releasing Hormone, and Others) • By Route of Administration (Oral, Injectable, and Others) • By Distribution Channel (Hospital pharmacy, Retail pharmacy, and Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Bayer AG, Pfizer Inc., AbbVie Inc., AstraZeneca, ObsEva SA, Teva Pharmaceuticals, Zydus Healthcare, Astellas Pharma Inc., Gedeon Richter Plc, and Takeda Pharmaceutical Co. Ltd. |