Global Diagnostic Imaging Market Overview:

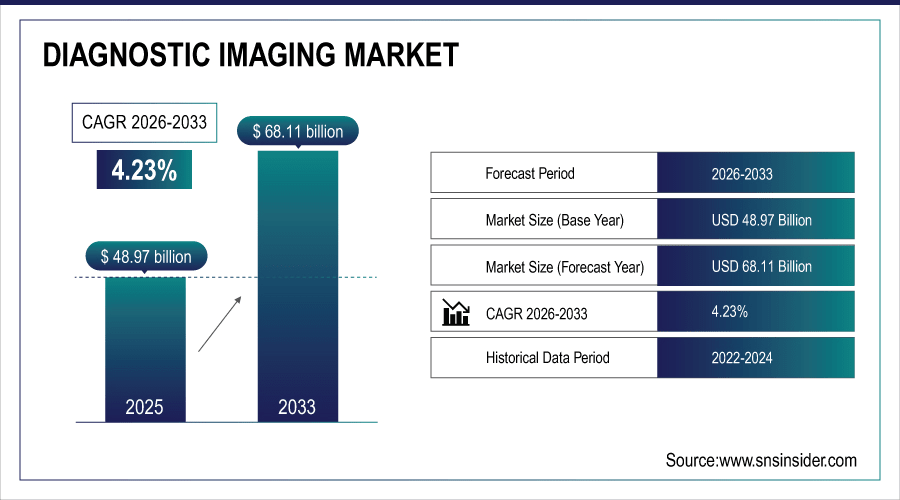

The global diagnostic imaging market size is estimated at USD 48.97 billion in 2025 and is projected to reach USD 68.11 billion by 2033, growing at a CAGR of 4.23% during the forecast period 2026–2033.

The worldwide diagnostic imaging market is expanding steadily, with over 4.5 billion imaging procedures performed annually by 2025. Contributing more than 55% of the global usage, X-ray and ultrasound claim a fair share owing to cost-efficacy and availability, however MRI and CT continue to witness robust adoption in advanced diagnostics. In particular, portable systems and also hand-held systems are becoming attractive especially in developing countries. Digital enhancements, AI and hybrid imaging solutions are driving worldwide acceptance in healthcare organizations.

X-ray and ultrasound systems together comprised over 55% of diagnostic imaging demand in 2025.

To Get More Information On Diagnostic Imaging Market - Request Free Sample Report

Diagnostic Imaging Market Size and Forecast:

-

Market Size in 2025: USD 48.97 Billion

-

Market Size by 2033: USD 68.11 Billion

-

CAGR: 4.23% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

Diagnostic Imaging Market Trends:

-

Fusion imaging using PET-CT and PET-MRI will be performed in greater than 15% of nuclear imaging studies by 2030.

-

CT and MRI volumes will rise by almost 30% from 2025 to 2029 with advanced diagnostics tests for diseases growing.

-

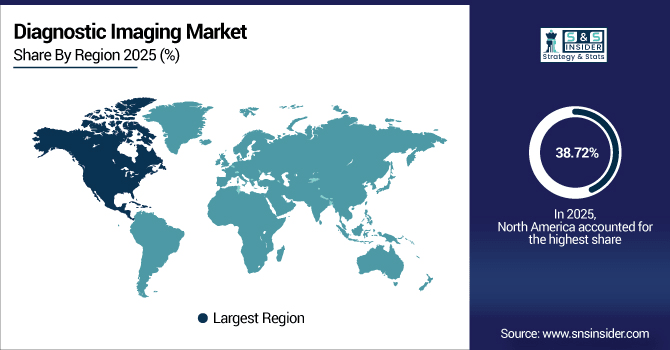

North America is predicted to hold over 38% of global diagnostic imaging revenues in 2027, with the region benefiting from high reimbursement and early uptake.

-

Oncology and cardiology screening programs are expected to lead imaging demand to grow by 25% by 2028.

-

Portable and hand-held imaging to capture more than a fifth of the global market for installations by 2030 as adoption grows for point-of-care diagnostics.

U.S. Diagnostic Imaging Market Insights:

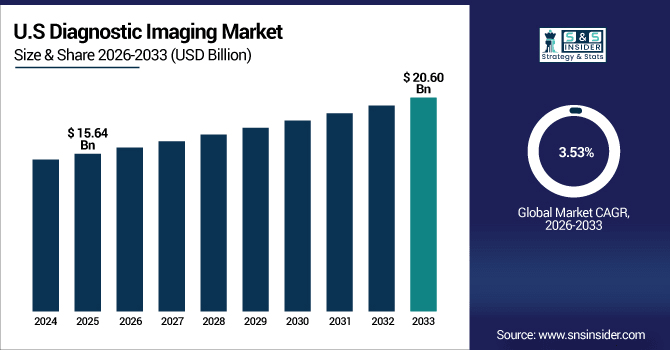

The U.S. dominates the North American diagnostic imaging market estimated at USD 15.64 billion in 2025 and projected to reach USD 20.60 billion by 2033, growing at a CAGR of 3.53%. With over 80 million CT and MRI scans annually and strong AI-driven adoption, the U.S. remains the hub of advanced imaging innovation.

Diagnostic Imaging Market Growth Drivers:

-

AI Integration and Digital Advancements in Imaging Systems Enhance Accuracy, Efficiency, and Global Adoption Across Healthcare Facilities.

AI and digital innovations are key market drivers for the diagnostic imaging sector. By 2025, more than 35% of new imaging systems installed worldwide will have integrated AI-based capabilities rapidly extending beyond detection into workflow efficiencies and predictive analytics. These systems can increase the diagnostic accuracy by 20%, and reduce reporting time significantly. Hospitals and imaging centers equipped with AI-based imaging will be able to improve their throughput, and as a result benefit from higher patient-level care while providers experience greater clinical productivity.

In 2025, AI-enabled imaging systems grew by nearly 15% year-on-year, making them the fastest-growing segment in diagnostic imaging.

Diagnostic Imaging Market Restraints:

-

High Equipment and Maintenance Costs Limit Accessibility of Advanced Imaging Systems in Low- and Middle-Income Regions.

Heavy equipment and high maintenance are the leading impediments in the market of diagnostic imaging. State-of-the-art MRI machines weigh upwards of 7 tons and need custom installation and climate control. Its annual service requirements mean systems can be unavailable up to 10% of the time. Less than 5 MRI scanners per million people are available in low- and middle-income countries compared with over 40 per million in high-income regions, limiting access to advanced imaging.

Diagnostic Imaging Market Opportunities:

-

Expanding Preventive Screening Programs and Early Disease Detection Initiatives Create Significant Growth Opportunities for Diagnostic Imaging Providers.

Few other prominent opportunities can also be seen for the diagnostic imaging market including growth of preventive screening programs. By 2025, nearly 50% of adults in the world will receive at least one image examination each year (mostly due to screenings). For instance, worldwide breast cancer screening programs have driven a 22% increase in mammography use since 2020 and CT lung screening has risen by 18% in high-risk populations. These initiatives highlight the increasing importance of imaging in early detection and long-term health trends.

In 2025, preventive screening accounted for nearly 48% of global diagnostic imaging procedures, creating strong opportunities for early detection services.

Diagnostic Imaging Market Segmentation Analysis:

-

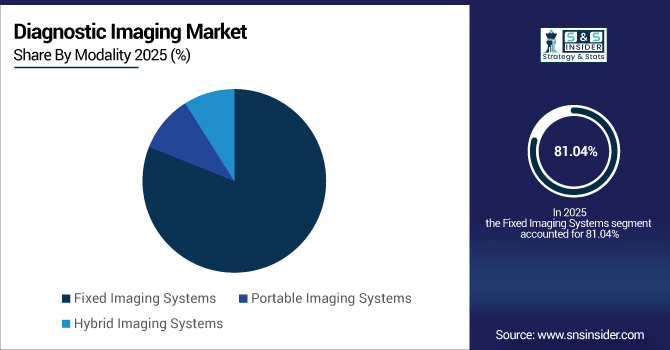

By Modality, Fixed Imaging Systems dominated with a share of 81.04% in 2025E, whereas Portable Imaging Systems are set to expand at the highest CAGR of 6.52%.

-

By Product Type, X-ray Systems dominated the market with a share of 29.53% in 2025E, while Computed Tomography (CT) Scanners are growing at the highest CAGR of 5.96%.

-

By Application, Cardiology accounted for 58.27% in 2025E, followed by Neurology which is expected to grow at a CAGR of 6.10%.

-

By Technology, 2D Imaging led with the largest share of 52.30% in 2025E, while Fusion Imaging is projected to grow fastest at a CAGR of 7.25%.

-

By End User, Hospitals captured the largest share of 56.75% in 2025E, while Diagnostic Imaging Centers are projected to grow at a CAGR of 7.10%.

-

By Distribution Channel, Direct Sales accounted for 48.60% in 2025E, followed by Online Retail which is expected to grow rapidly at a CAGR of 12.34%.

By Modality, Fixed Imaging Systems Lead While Portable Imaging Gains Traction:

Fixed imaging systems dominate due to established infrastructure in hospitals and diagnostic centers, with large-scale installations supporting millions of CT, MRI, and X-ray scans annually. But there is strong adoption of mobile imaging systems. There were more than 450,000 units of POCUS sold worldwide in 2025 due to point-of-care diagnosis, emergency medicine and rural healthcare. Such instruments are becoming more and more important in underprivileged and isolated areas because of being portable, flexible and capable to provide a quick diagnosis.

By Product Type, X-ray Systems Dominate While CT Scanners Grow Rapidly:

X-ray remains the most widely used imaging method, with over 3.6 billion procedures performed annually worldwide by 2025. Substitution rate, speed, and indispensable necessity in critical context of emergency and routine care guarantee the supremacy. In the meantime, CT volumes are growing rapidly, increasing 18% worldwide between 2020 and 2025. Fueling growth is oncology and cardiovascular diagnostics, in which advanced CT technology offers detailed 3D imaging for early detection of disease.

By Application, Oncology Leads While Neurology Expands Fastest:

Cancer screening and management drive diagnostic imaging, with over 19 million new cancer cases worldwide in 2025 requiring regular imaging for detection, staging, and monitoring. Oncology applications are driven by mammography, CT and PET scans, and are some of the tallest piles in healthcare. But neurology is seeing an increased interest due to increasing burden of Alzheimer’s and stroke which affect over 400 million people worldwide. MRI, especially when it comes to brain and spinal diagnostics, is evolving as the frontrunner modality.

By Technology, 2D Imaging Dominates While Fusion Imaging Surges:

Conventional 2D imaging continues to dominate as the backbone of diagnostic workflows, representing the foundation of X-ray, ultrasound, and CT usage worldwide. Billions of 2D scans are performed on an annual basis because the method is reliable and available across many developed and developing world settings. Fusion imaging, however is advancing at a rapid pace, and the use of PET-CT and PET-MRI for applications outside of oncology such as cardiology and neurology are growing. Fusion techniques should represent more than 15% of nuclear imaging volumes by 2030.

By End User, Hospitals Dominate While Diagnostic Imaging Centers Expand:

Hospitals remain the primary users of diagnostic imaging, conducting over 60% of global imaging procedures by 2025, driven by inpatient care, surgical planning, and emergency cases. But diagnostic imaging centers are growing at a faster rate, especially in North America and Asia. More than 45,000 independent centers operate across the globe, relieving outpatient demand and easing pressure on hospitals. Their quicker service turnaround time and cost-effectiveness make them a desirable option for patients who are in need of specialized imaging services.

By Distribution Channel, Direct Sales Lead While Online Retail Rises Quickly:

Direct sales remain the leading distribution route as major hospitals and health systems procure imaging systems directly from manufacturers, ensuring tailored service contracts and long-term support. But online retailing channels are growing especially for portable ultrasound and handheld devices. Over 20% of handheld ultrasound devices were sold online by 2025. Ease of access through internet-based purchase is opening up the technology to smaller clinics and research centers, while service models which are pay-as-you-go model are speeding up uptake.

Diagnostic Imaging Market Regional Analysis:

North America Diagnostic Imaging Market Insights:

North America dominates the global diagnostic imaging market with a 38.72% share in 2025E, driven by advanced healthcare infrastructure and strong reimbursement frameworks. The United States alone performs more than 80 million CT and MRI scans annually, using over 6,000 accredited imaging centers. Early adoption of AI-based imaging, dynamic government support and the existence of leading MedTech companies drive innovation, thereby promoting sustainable growth and technology leadership within the region.

Get Customized Report as Per Your Business Requirement - Enquiry Now

U.S. Market Insights:

U.S. is imaging innovation leader with 6000+ accredited diagnostic centers and over 80 million CT and MRI techniques per year. The U.S. projected to have over 300 FDA cleared imaging devices by 2025, such as AI-enabled CT, hybrid PET-MRI and handheld ultrasound, will further consolidate the nation to be at center for state-of-the-art diagnostic technology.

Asia-Pacific Market Insights:

The Asia-Pacific diagnostic imaging market is projected to expand at a CAGR of 5.34%, making it the fastest-growing region globally. The area will of more than 120 million CT and MRI scans by 2025 as healthcare expenditure grows and urbanisation continues apace. China and India are demanding low-cost imaging access, whereas Japan and South Korea are adopting advanced modalities. In addition, increasing AI adoption and demand for portable imaging continue to drive market growth.

China Market Insights:

China serves as the largest Asia-Pacific diagnostic imaging industry, conducting more than 50 million CT scans per year and contributing up to almost a third of regional income. With over 40,000 hospitals and clinics providing imaging services, expansion is fuelled via government spending as part of the “Healthy China 2030” project and increasing penetration of hi-tech MRI & PET-CT technologies.

Europe Market Insights:

Europe is a central hub for diagnostic imaging, performing more than 100 million radiology examinations annually across Germany, France, the UK, and Italy. MRI penetration in the EU is also one of the highest internationally; the EU average lies at 120 MRI scanners per million population. Tax-payer funded; Imaging access is available to over 90% of population; High reinmbursement. With no fewer than 7,500 accredited imaging centers) and EUR funded R&D projects Europe is in the driving seat for hybrid solutions and AI-driven diagnostics.

Germany Market Insights:

The German market is Europe's largest and every year more than 25 million CT and MRI scans are carried out in Germany's 1,800 plus hospitals with imaging capabilities. Wide MRI usage (35 scanners per million people on average) and full public insurance uptake spur demand, aided by generous government investment in radiology research.

Latin America Market Insights:

The Latin American diagnostic imaging market is growing at a sustainable rate, with more than 45 million diagnostic imaging procedures carried out annually in Brazil, Mexico and Argentina. Brazil dominates with 60% of regional revenue sustained from over 3,500 diagnostic centers. Increasing Government Spending, Lower Cost and Increasing Number of Private Hospitals to Accelerate MRI And CT Adoption Among Urban Population.

Middle East and Africa Market Insights:

The Middle East & Africa diagnostic imaging market is expanding, with over 20 million imaging procedures a year expected by 2025. Saudi Arabia is the leading adopter with some 1,200+ hospitals fitted out with an imaging system, and South Africa accelerates as private healthcare expands. A growing incidence of non-communicable diseases, urbanisation and government spending are fuelling demand for CT and MRI scans.

Diagnostic Imaging Market Competitive Landscape:

Siemens Healthineers dominates diagnostic imaging with over 240,000 imaging systems installed worldwide across MRI, CT, and X-ray. Its AI-Rad Companion is installed in 5,000+ hospitals for automated image analysis to assist in first read detection and segmentation. With 19,000 patents and presence in over 70 countries, Siemens is the undisputed innovation leader in hybrid PET-CT and advanced MRI - A trusted partner for premium and high-volume healthcare providers alike.

-

In Sept 2025, installed the first U.S. Naeotom Alpha.Pro photon-counting CT at University Hospitals, Cleveland.

GE Healthcare has a strong presence with more than 1 million imaging devices installed globally, including leadership in CT and ultrasound. Its Edison AI platform fuels 50+ FDA cleared applications that are used in every day diagnostics. Working with more than 100 academic institutions across the globe, GE is advancing precision health through its handheld ultrasound systems, currently used in over 100 countries and serving as an essential tool in many developing and rural areas.

-

In July 2025, received FDA clearance for Aurora dual-head SPECT/CT and Clarify DL AI-powered image reconstruction.

Philips Healthcare stands out with 7,000+ high-field MRI systems installed worldwide, emphasizing strong capabilities in neuro and cardiac imaging. Its IntelliSpace AI workflow solutions run in over 2,500 hospitals driving efficiency and reducing scan times. With a presence in more than 120 countries, Philips is leading modern imaging development by connecting sustainable planning, digital platforms and AI to become the world’s leader in patient-centered technology for pathology diagnosis and precision radiology.

-

In March 2025, launched AI-enabled imaging systems and cloud services at ECR 2025 to enhance radiology workflows.

Diagnostic Imaging Market Key Players:

Some of the Diagnostic Imaging Market Companies are:

-

Canon Medical Systems

-

FUJIFILM Holdings

-

Hitachi Ltd.

-

Carestream Health

-

Agfa-Gevaert

-

Hologic, Inc.

-

Samsung Medison

-

Shimadzu Corporation

-

Mindray Medical International

-

Esaote S.p.A.

-

Konica Minolta, Inc.

-

CurveBeam LLC

-

United Imaging (China)

-

Allengers Medical Systems

-

Neusoft Medical Systems

-

Bracco S.p.A.

-

Varian Medical Systems

| Report Attributes | Details |

|---|---|

| Market Size in 2025 | USD 48.97 Billion |

| Market Size by 2033 | USD 68.11 Billion |

| CAGR | CAGR of 4.23% From 2026 to 2033 |

| Base Year | 2025 |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product Type (X-ray Systems, Ultrasound Systems, Computed Tomography (CT) Scanners, Magnetic Resonance Imaging (MRI) Systems, Nuclear Imaging Systems (PET, SPECT), Mammography Systems, Others) • By Application (Cardiology, Oncology, Neurology, Orthopedics, Gynecology, Gastroenterology, Others) • By Technology (2D Imaging, 3D/4D Imaging, Fusion Imaging, Portable/Handheld Imaging Systems) • By Modality (Fixed Imaging Systems, Portable Imaging Systems, Hybrid Imaging Systems) • By End User (Hospitals, Diagnostic Imaging Centers, Ambulatory Surgical Centers, Research & Academic Institutes, Others) • By Distribution Channel (Direct Sales, Distributors, Online Retail, Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Siemens Healthineers, GE Healthcare, Philips Healthcare, Canon Medical Systems, FUJIFILM Holdings, Hitachi Ltd., Carestream Health, Agfa-Gevaert, Hologic, Inc., Samsung Medison, Shimadzu Corporation, Mindray Medical International, Esaote S.p.A., Konica Minolta, Inc., CurveBeam LLC, United Imaging (China), Allengers Medical Systems, Neusoft Medical Systems, Bracco S.p.A., Varian Medical Systems. |