Handheld Imagers Market Size & Growth:

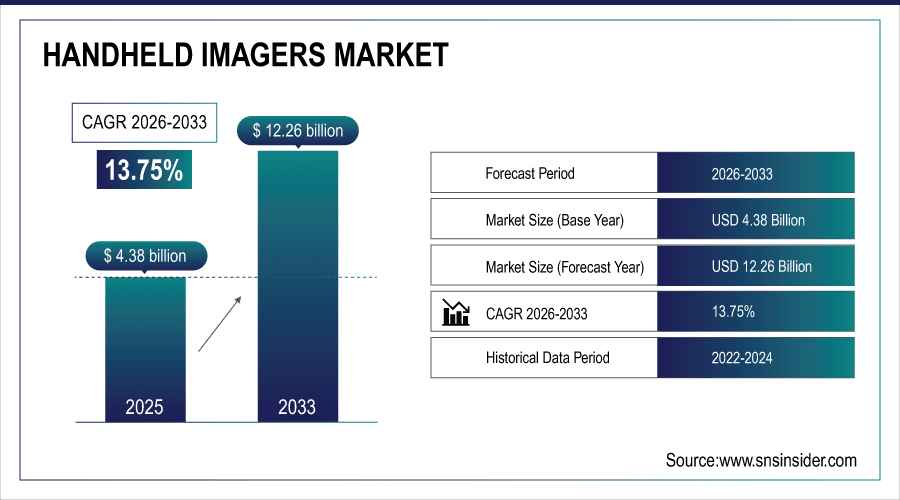

The Handheld Imagers Market size was valued at USD 4.38 Billion in 2025E and is projected to reach USD 12.26 Billion by 2033, growing at a CAGR of 13.75% during 2026-2033.

The Handheld Imagers Market is expanding due to the increasing security and surveillance application across the globe wherein mobile scanning machine contribute towards public safety and border control. Medical imaging is also a key driver for growth, with handheld units enabling point-of-care diagnostics and telemedicine. In construction and industrial inspection, imagers can help identify faults, increase safety and reduce downtime.

Mobile scanning solutions for contraband detection (drugs, weapons, explosives) grew 28% YoY in 2024, with over 120,000 new units shipped to security agencies.

To Get More Information On Handheld Imagers Market - Request Free Sample Report

Market Size and Forecast:

-

Market Size in 2025: USD 4.38 Billion

-

Market Size by 2033: USD 12.26 Billion

-

CAGR: 13.75% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

Handheld Imagers Market Trends

-

Increasingly Portable, Handheld image analysis is AI-powered to get the job done fast the increased diagnostic and decision making power that comes from better images support proactive preventive maintenance in a wide range of industries.

-

Below, we outline attributes that manufacturers are concentrating on: small hand-held imagers with long battery life so they can be easily carried and used in field implement action.

-

Increased demand for >5 MP CMOS sensors in handheld imagers leads to higher-quality images, enabling security, industrial inspection and medical diagnosis improvements.

-

Healthcare industry quickly embraces handheld imagers with point-of-care diagnostics, thermal screening and telemedicine offering huge prospects across the globe.

-

Growing economies see faster uptake of handheld imagers as infrastructure develops and the cost gets lower on more advanced imaging instruments while security needs arise.

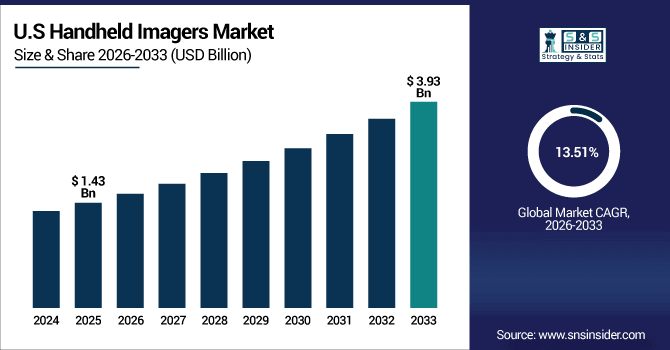

The U.S. Handheld Imagers Market size was valued at USD 1.43 Billion in 2025E and is projected to reach USD 3.93 Billion by 2033, growing at a CAGR of 13.51% during 2026-2033. Handheld Imagers Market growth is driven by growing acceptance in the medical industry for point-of-care diagnostics and thermal screening is also driving expansion. Handheld imagers for maintenance, safety checks and energy audits have gained ground in industrial inspection and construction applications. Advances in CMOS sensors, AI-based image processing and wireless connectivity result in devices of improved efficiency and portability.

Handheld Imagers Market Growth Drivers:

-

Rising security, medical, and industrial demand coupled with technological advancements accelerating handheld imagers market growth.

Handheld imagers market is growing considerably as they can be used for various purposes in security, medical, and industrial sectors. Advances in CMOS sensors, AI-based imaging, and the end of single-purpose cameras have made mobile structure photography more efficient, affordable and accessible than ever. Increasing infrastructure initiatives and defense modernization, combined with the growth in telemedicine usage that is driving demand for point-of-care imaging devices make hand-held imagers indispensable across industries.

92% of new handheld imagers launched in 2024 use advanced CMOS sensors (vs. 70% in 2020), enabling higher resolution, lower power, and better low-light performance.

Handheld Imagers Market Restraints:

-

High product costs, limited awareness, and technical complexities restricting handheld imagers widespread market penetration

Although handheld imagers carry the advantage of extreme portability, there are inhibitors in this field including high initial cost especially for developing countries. Small focused industrial shop operations are also less likely to adopt the technology due its technicality, calibration and difficult operation which requires relatively skilled labour. Low end-user awareness and budget restraints in emerging markets act as hindering factors, which is a major challenge that hampers the growth of the handheld imagers market across the world.

Handheld Imagers Market Opportunities:

-

Expanding medical diagnostics, AI integration, and emerging market adoption creating significant handheld imagers growth opportunities

The handheld imagers industry has enormous opportunities in the field of healthcare as portable imaging enables point-of-care diagnostics and drives telemedicine. Handheld imagers for security and construction will soon be a common in developing countries due to price reduction. Adoption of AI, higher resolution sensors and wireless features will create use cases that provide opportunities for long-term market growth.

Over 620,000 handheld medical imagers were deployed globally in 2024, with 70% used in primary or remote care settings to enable same-visit diagnosis. Telemedicine-integrated devices surged 60% YoY, with 85% of users reporting reduced referral delays.

Handheld Imagers Market Segment Analysis

-

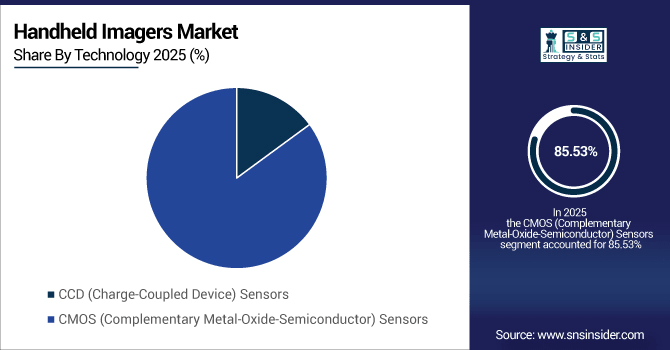

By Technology: CMOS (Complementary Metal-Oxide-Semiconductor) Sensors accounted for 85.53% of the market in 2025E and are also anticipated to be the fastest growing technology segment, advancing at a CAGR of 8.43%.

-

By Product: IR Scanners led the handheld imagers market with a 45.72% share in 2025E, while Millimeter Wave Scanners are projected to be the fastest growing segment, expanding at a CAGR of 16.10%.

-

By Application: The Security segment dominated with 32.45% share in 2025E, whereas the Medical segment is expected to grow at the fastest pace with a CAGR of 14.78%.

-

By Resolution: Handheld imagers with 1 to 5 MP resolution held the largest share of 55.61% in 2025E, while devices with more than 5 MP resolution are forecasted to record the fastest growth at a CAGR of 11.50%.

By Technology, CMOS (Complementary Metal-Oxide-Semiconductor) Sensors Lead as well as Registers Fastest Growth

In 2025, the handheld imagers market is dominated by the CMOS sensors which are cost-effective, consume less power, and can be integrated compactly while meeting the image sensing requirements. They have applications in security and transport, medicine and healthcare; they are replacing older generation CCD sensors; they are used in industrial imaging and gaming. CMOS sensors lead the growth rate as well, thanks to technologies that support high resolution, AI capability and wireless communication. Scalable, better-performing and more affordable, these factors combine to drive adoption so quickly that CMOS continues to be the largest and most dynamic segment of all technologies.

By Product, IR Scanners Leads Market While Millimeter Wave Scanner Registers Fastest Growth

IR scanners hold the largest market share in handheld imagers as they are widely used for industrial inspection, construction monitoring, and security purposes. Affordable, accurate and convenient, they are a popular choice for field workers. On the other hand, so-called millimeter wave scanners which today account for only a smaller chunk of the overall market are seeing the fastest surge in demand as they are gaining traction in security screening and defense by meeting demands from airport surveillance applications requiring high frequency image characteristics to achieve superior detection and safety performance.

By Application, Security Dominate While Medical Shows Rapid Growth

Security continues to be the leading application area for handheld imagers, with applications ranging in border control, defense, law enforcement and public safety infrastructure. The increased threat and surveillance requirement still help to keep security as the main source of revenue. On the other hand, medical applications are emerging to grow fast where handheld imagers will be applicable for point-of-care diagnostics, thermal screening and telemedicine. Rise in the investment on health tech adoption as well as portable diagnostics is also bolstering medical applications demand across the worldwide.

By Resolution, 1 to 5 MP Lead While More than 5 MP Grow Fastest

In 2025, the 1 to 5 MP resolution segment leads the handheld imagers market, striking a balance between cost and acceptable image clarity for industrial, construction, security inspections. This is the upper limit on adoption, given practical and efficient concerns. But the handheld imagers with More Than 5 MP are growing faster due to increasing demand for HD imaging in medical diagnostics, security surveillance and high-end industrial that need high precision and detail.

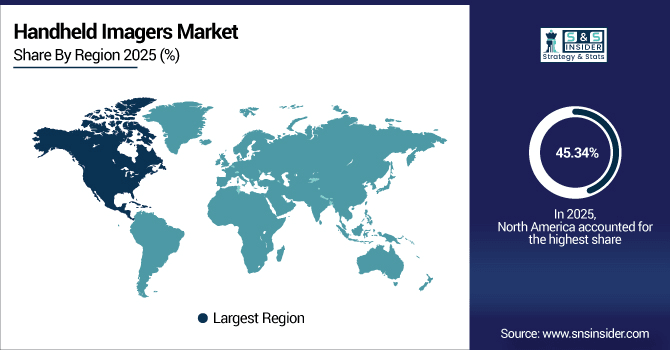

Handheld Imagers Market Regional Analysis:

North America Handheld Imagers Market Insights

In 2025E North America dominated the Handheld Imagers Market and accounted for 45.34% of revenue share, this leadership is due to the well-structured and upfront adoption. Security solutions for airports, defence and law enforcement continue to act as major demand intake. The healthcare for area also experiences good adoption, using handheld imagers in diagnostics and thermal screening. Industrial maintenance and predictive inspection are increasingly becoming the use-cases.

Get Customized Report as Per Your Business Requirement - Enquiry Now

U.S. Handheld Imagers Market Insights

U.S. is seen as the largest contributor to the North American handheld imagers market due to strong demand from security, defense and industrial sectors. Dominance is solidified through adoption at airports, government institutions and critical infrastructure.

Asia-pacific Handheld Imagers Market Insights

Asia-pacific is expected to witness the fastest growth in the Handheld Imagers Market over 2026-2033, with a projected CAGR of 14.56% due to owing to increase of industrial automation, infrastructural development and security. Rapidly emerging imaging device use in the manufacturing and healthcare sectors of countries including the India, Japan, and South Korea is also enhancing market growth. Increasing construction activities also contribute to drives the demand for inspection & safety applications.

China Handheld Imagers Market Insights

The China market is to witness the fastest growth in the Asia-Pacific handheld imagers market as a result of its large manufacturing sector and rapid uptake of surveillance. Government emphasis on public safety and securing the border generates much of that demand.

Europe Handheld Imagers Market Insights

Strict safety norms, well-established industrial base and increasing healthcare applications are key factors for Europe handheld imagers market growth. Countries such as France, Italy, and the UK allocate large budgets for imaging technology regarding security checks and industry inspections. Adoption in construction and the energy industry is ramping up. R&D Europe -Supported research and development projects on European level, aiming at innovation and device sustainability.

Germany Handheld Imagers Market Insights

Germany is leading Europe and increasing demand from its progressive automotive and manufacturing industries. Key expansion areas include predictive maintenance and quality control. Security uses cases, also in public facilities increasingly improve the uptake.

Latin America (LATAM) and Middle East & Africa (MEA) Handheld Imagers Market Insights

The Handheld Imagers Market is experiencing moderate growth in the Latin America (LATAM) and Middle East & Africa (MEA) regions, due to growing steadily due to increasing security requirements, defense spending, and infrastructure development. Brazil and Mexico are the largest LATAM demand centers, while the MEA region is primarily driven by Gulf countries with extensive security investments. Both regions see increasing usage of these technologies in airports, law enforcement, and industrial inspection.

Handheld Imagers Market Competitive Landscape:

Omron, a global leader in automation and sensing technology, is dedicated to advancing the imagers market with innovative haldheld imaging solutions. Capitalizing on its knowledge of industrial automation and healthcare devices, the company produces high-quality imaging products. Omron innovations in sensing and control technology enable you to monitor and control your process accurately, medical devices for patient safety, check out our products available wireless switch, healthcare.

-

In July 2025, Omron announced the launch of the V410-H Series handheld barcode reader, the latest addition to its extensive portfolio. This reader is designed for industrial automation solutions, offering enhanced performance and versatility in barcode scanning applications.

Cognex Corporation is a world leader in machine vision and industrial barcode reading, capturing strong positions in handheld imagers segment. Its handheld products provide highly accurate, fast and long-lasting performance for use in logistics, manufacturing and security applications. Featuring AI-powered vision technology and rugged design, Cognex handheld imagers are widely used in every type of automation to eliminate defects, verify assembly, monitor production and read codes throughout the supply chain.

-

In January 2025, Launched AI-powered DataMan barcode readers for low-quality codes. Revamped leadership team under new CEO to drive growth. Strong push toward AI and computer vision expansion.

Toshiba Tec., imaging and printing solution knowledge across hand held imagers for Compact integration-friendly image systems for security, retail and healthcare are the company's focus. Continued investment in R&D Toshiba Tec its products to be both portable and affordable, while complementing the switch toward digital workflows. Its ground breaking add-ons fulfill increasing demands for online imaging and inspection in various industries across the world.

-

In January 2025, Unveiled modular self-service and POS hardware integrating AI and computer vision. Expanded retail-focused solutions at NRF 2025. Toshiba Teli showcased advanced industrial cameras at OPIE ’25.

Optex is the pioneer and industry leader in sensing and detection devices, with integrated handheld imaging products that serve security, industrial and healthcare applications. The firm products are known for their precision, endurance and superior sensing capability. Optex is broadening its product line up and developing new state of the art imaging investments for Food & Beverage, processing and packaging industry in response to growing demand in the global market for quality control, safety inspection capabilities.

-

In September 2024, Optex introduced the Olarm MAX, a Graded Dual-Path digital communicator designed to upgrade existing alarm systems to smart, smartphone-controlled solutions. Initially launched in the UK, this device addresses the phase-out of the Public Switch Telephone Network (PSTN) by enabling remote monitoring and management of security systems via the Olarm app.

Handheld Imagers Market Key Players:

Some of the Handheld Imagers Market Companies are:

-

Omron

-

Cognex

-

Toshiba Tec

-

Optex

-

Vision Research

-

SICK

-

Zebra Technologies

-

Microscan

-

Neology

-

Honeywell

-

Keyence

-

Datalogic

-

Panasonic

-

Banner Engineering

-

Teledyne FLIR

-

Fluke Corporation

-

Seek Thermal

-

Testo

-

Hikvision

-

Bosch

| Report Attributes | Details |

|---|---|

| Market Size in 2025 | USD 4.38 Billion |

| Market Size by 2033 | USD 12.26 Billion |

| CAGR | CAGR of 13.75% From 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (IR Scanners, Stud Finders, Millimeter Wave Scanner, Microbolometers and Others) • By Application (Construction, Industry, Security, Medical and Others) • By Technology (CCD (Charge-Coupled Device) Sensors and CMOS (Complementary Metal-Oxide-Semiconductor) Sensors) • By Resolution (Less than 1 MP, 1 to 5 MP and More than 5 MP) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Omron, Cognex, Toshiba Tec, Optex, Vision Research, SICK, Zebra Technologies, Microscan, Neology, Honeywell, Keyence, Datalogic, Panasonic, Banner Engineering, Teledyne FLIR, Fluke Corporation, Seek Thermal, Testo, Hikvision, Bosch |