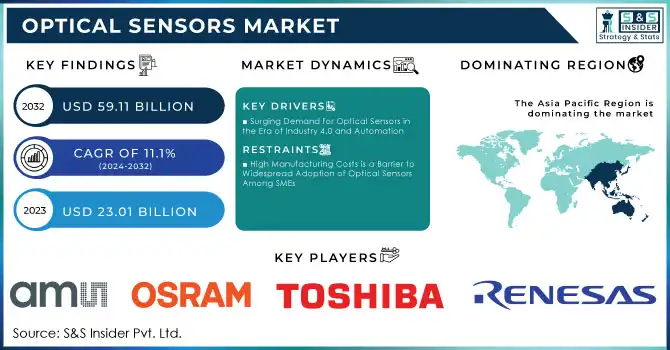

Optical Sensors Market Size & Overview:

The Optical Sensors Market Size was valued at USD 23.01 Billion in 2023 and is expected to reach USD 59.11 Billion by 2032 and grow at a CAGR of 11.1% over the forecast period 2024-2032.

The Optical Sensor Market is witnessing significant growth, driven by advancements in technology, including increased demand for automation, plus the increased adoption of optical sensors in other industries. Optical sensors are some of the most crucial devices, which convert light into electric signals in huge applications such as consumer electronics, automotive, industrial automation, and medical equipment. Given that industries are only bound to evolve further, the demand for these optical sensors is ever likely to grow and provide all stakeholders with massive opportunities in manufacturing.

Get More Information on Optical Sensors Market - Request Sample Report

The optical sensors market is becoming a rapidly growing market with the daily increasing requirements of various industries. Optical sensors are applied in the industrial area mainly in the fields of detecting objects, sensing position, and quality inspection. For example, optical sensors constitute over 50% of sensor use for manufacturing processes. In consumer electronics, about 60% of smartphones have optical sensors. These allow features including camera functionality and screen brightness adjustment. Optical sensors are becoming part of more sophisticated driver assistance systems. Biomedical applications also play a very crucial role in the application of optical sensors in vital sign monitoring and non-invasive diagnostic techniques. Statistics for all these diverse applications account for a huge size of the market for optical sensors.

Optical Sensors Market Dynamics

Key Drivers:

-

Surging Demand for Optical Sensors in the Era of Industry 4.0 and Automation

Increased Demand in Industrial Automation The industry is slowly moving towards Industry 4.0 and has therefore looked increasingly towards automating some of the processes involved in manufacturing. Optical sensors have become an important item in operation efficiency through the accurate detection of objects, position sensing, and quality control. As the industries continue along the path of becoming more automatic and incorporating smart manufacturing, the use of optical sensors will also increase.

The optical sensors market is also expanding due to various factors. For starters, the industrial automation trend is on the rise. Since approximately 80% of manufacturers would like to automate to achieve efficiency and overcome staff shortages, these trends will lead to further growth in the market. The Internet of Things would increase demand for advanced sensing technologies that will pave the way for the processing of data in real-time and the integration of smart systems. The increasing adoption of optical sensors in the automotive, healthcare, and consumer electronics sectors has further driven the growth in the market.

-

Driving Innovation: The Expanding Role of Optical Sensors in Consumer Electronics and Automotive Safety

Integration of optical sensors within consumer electronics, such as smartphones and smart home gadgets, is also promoting the market's growth. For instance, ambient light sensors are integrated into most smartphones to manage screen illumination. In the automotive industry, optical sensors are used for ADAS, or advanced driver-assistance systems, to enhance safety features and enable companies to design autonomous vehicles.

The optical sensors market is on the rise, mainly with the help of a wide array of factors, mainly in consumer electronics and automotive applications. Smartphones now employ optical sensors, mainly ambient light sensors, to optimize the brightness of the display and thereby enhance user experiences in consumer electronics. A revolution in the automotive industry is to be expected, as it integrates optical sensors in advanced driver-assistance systems (ADAS). Most likely to be included, optical sensors will be fitted in vehicles aiming to include functionalities like lane departure warnings and automatic emergency braking among others.

Restrain:

-

High Manufacturing Costs is a Barrier to Widespread Adoption of Optical Sensors Among SMEs

Advanced optical sensors would thus require expensive manufacturing and the use of proprietary materials, which adds to their cost. Such factors can thus limit their adoption, primarily because small and medium-sized enterprises cannot afford to invest in such technologies within their limited budgets. Thus, larger corporations would adopt these optical sensors for greater functionality, while prevention of market growth is the same reason preventing the utilization of such sensors by smaller ones. There is a phenomenal influence of growth in access for SMEs towards smart manufacturing in the optical sensors market. As of recent studies, it has been noted that about 77% of SMEs have prioritized digital transformation initiatives that directly improve efficiency and competitive advantages in operations. The strides that are being made by technologies such as the Industrial Internet of Things (IIoT) have made it easier for SMEs to put optical sensors across all operations. For instance, with optical sensors, production processes and, accordingly, quality control can be improved, important to maintain competitive advantages.

Optical Sensors Market Segmentation Overview

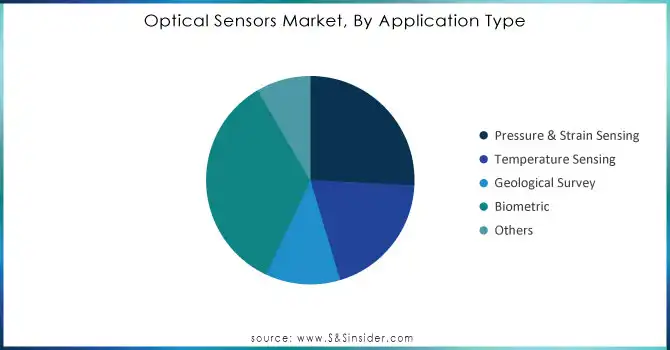

By Application Type

Biometric Applications dominated the market in 2023. The inclusion of a biometric sensor in the contactless payment card enables individuals to personally verify each transaction using a distinctive credential, such as their fingerprint. The increase in contactless payment globally is expected to increase the demand for biometric optical sensors.

The Temperature Sensing application market will have the highest CAGR of 13.52% in the forecasted period. Application of developments in materials science and optical technology in this line has been proven to increase sensitivity in measuring temperatures. Novel materials are currently being used in optimizing the techniques applied in light modulation and detection, thus creating such products. Temperature sensors are becoming an integral part of the system in IoT and smart networks, and currently are applied in a broad range of applications-including residential automation, industrial control, and healthcare sectors. For example, they are indispensable in monitoring patient vitals and management of environmental conditions in the healthcare sector.

Need Any Customization Research On Optical Sensors Market - Inquiry Now

By Sensor Type

In 2023, Optical Temperature Sensors led the market, driven by the rising adoption of Industrial Internet of Things (IIoT) technologies and smart manufacturing processes. Temperature monitoring is, therefore, important for the realization of operational efficiency and the prevention of failures in the deployment of renewable energy and traditional power generation. This would lead to an increased requirement for precise temperature measurement to safeguard effective performance and avoid breakdowns, mainly in the renewable energy sector.

The Biomedical Sensors segment is anticipated to grow at a remarkable CAGR of 13.37% throughout the forecast period. These electronic devices convert various non-electrical measurements into easily detectable electrical signals, making them invaluable in healthcare analysis. This technology plays a crucial role in collecting vital human physiological and pathological data, thereby enhancing medical diagnostics and monitoring.

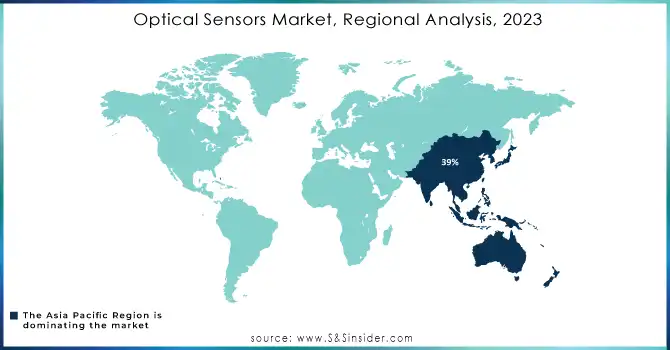

Optical Sensors Market Regional Analysis

Asia Pacific dominated the market and accounted for a 39% market share in 2023. Expansion in automotive sales and technological advancement in consumer electronics in the Asia Pacific region is expected to fuel the market growth. The region has a rising demand for smartphones, tablets, PCs, and smartwatches. Furthermore, adoption rates for biometric payment solutions are anticipated to rise, with estimates indicating that 70% of consumers in the region prefer biometric methods for authentication. This growth is driven by the increasing demand for secure and convenient payment solutions in the digital economy driving the optical sennsors market.

North America is expected to experience the highest CAGR of 13.09% during the forecast period 2024-2032, driven by the increasing use of smartphones, electric vehicles, and smart home technologies. The integration with major social media platforms enhances the visibility of live commerce events. In the U.S., there is a notable rise in demand for advanced safety systems and vehicle technology. Additionally, growing consumer focus on road safety and heightened government initiatives to reduce road accidents are significant factors driving the adoption of optical sensors in Advanced Driver-Assistance Systems (ADAS) and blind spot detection.

Key Players in Optical Sensors Market

Some of the major players in the Optical Sensors Market are:

-

ams-OSRAM AG (ams TOSA Modules, ams PIN Photodiodes)

-

Semiconductor Components Industries, LLC (onsemi) (onsemi Photodiodes, onsemi Phototransistors)

-

TOSHIBA CORPORATION (Toshiba Photodiodes, Toshiba Phototransistors)

-

Texas Instruments Incorporated (Texas Instruments Photodiodes, Texas Instruments Phototransistors)

-

Renesas Electronics Corporation (Renesas Photodiodes, Renesas Phototransistors)

-

ROHM CO., LTD (ROHM Photodiodes, ROHM Phototransistors)

-

STMicroelectronics (STMicroelectronics Photodiodes, STMicroelectronics Phototransistors)

-

Rockwell Automation (Rockwell Automation Optical Sensors, Rockwell Automation Machine Vision Systems)

-

SICK AG (SICK Optical Sensors, SICK Machine Vision Systems)

-

Vishay Intertechnology, Inc. (Vishay Photodiodes, Vishay Phototransistors)

-

Honeywell International Inc. (Honeywell Optical Sensors, Honeywell Machine Vision Systems)

-

ifm electronic gmbh (ifm Optical Sensors, ifm Machine Vision Systems)

-

KEYENCE CORPORATION (KEYENCE Optical Sensors, KEYENCE Machine Vision Systems)

-

Cisco Systems, Inc. (Cisco Optical Sensors, Cisco Machine Vision Systems)

-

Amphenol Corporation (Amphenol Optical Sensors, Amphenol Fiber Optic Components)

-

TE Connectivity (TE Connectivity Optical Sensors, TE Connectivity Fiber Optic Components)

-

Hamamatsu Photonics (Hamamatsu Photodiodes, Hamamatsu Photomultiplier Tubes)

-

Broadcom (Broadcom Optical Sensors, Broadcom Fiber Optic Components)

-

Leuze Electronics Pvt. Ltd. (Leuze Optical Sensors, Leuze Machine Vision Systems)

Recent Trends

-

In September 2024: New sensor solutions brought in by Leuze promise to specifically enhance the efficiency of the battery production and assembly processes for electric vehicles. Their precise sensors make contributions to quality control, precision in positioning, and automation in manufacturing processes, and support the demanding growth that electric mobility needs.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 23.01 Billion |

| Market Size by 2032 | USD 59.11 Billion |

| CAGR | CAGR of 11.1 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Extrinsic Sensor, Intrinsic Sensor) • By Sensor Type (Fiber Optic Sensor, Photoelectric Sensor, Optical Temperature Sensors, Biomedical Sensors, Displacement & Position Sensors, Point Sensors, Others) • By Application Type (Pressure & Strain Sensing, Temperature Sensing, Geological Survey, Biometric, Others) • By End-use (Healthcare, Consumer Electronics, Energy & Utility, Aerospace & Defense, Automotive & Transportation, Manufacturing, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | ams-OSRAM AG, Semiconductor Components Industries, LLC, TOSHIBA CORPORATION, Texas Instruments Incorporated, Renesas Electronics Corporation, ROHM CO., LTD, STMicroelectronics, Rockwell Automation, SICK AG, Vishay Intertechnology, Inc, Honeywell International Inc., ifm electronic gmbh, KEYENCE CORPORATION, Cisco Systems, Inc., Amphenol Corporation, TE Connectivity, Hamamatsu Photonics, Texas Instruments, Broadcom, Leuze Electronics Pvt. Ltd. |

| Key Drivers | • Surging Demand for Optical Sensors in the Era of Industry 4.0 and Automation • Driving Innovation: The Expanding Role of Optical Sensors in Consumer Electronics and Automotive Safety |

| Restraints | • High Manufacturing Costs: A Barrier to Widespread Adoption of Optical Sensors Among SMEs |