HD Map for Autonomous Vehicles Market Report Scope & Overview:

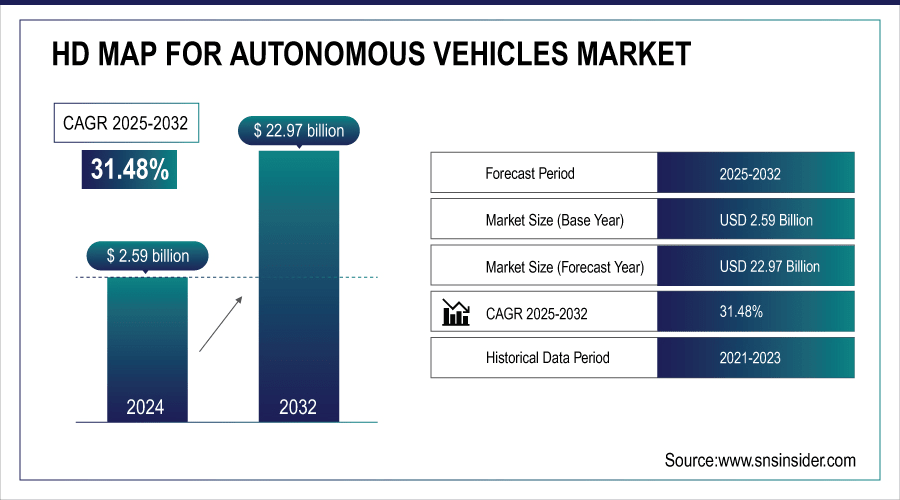

HD Map for Autonomous Vehicles Market was valued at USD 2.59 billion in 2024 and is expected to reach USD 22.97 billion by 2032, growing at a CAGR of 31.48% from 2025-2032.

The HD Map for Autonomous Vehicles Market is rapidly growing due to increasing adoption of advanced driver-assistance systems (ADAS), the push for fully autonomous vehicles, and rising demand for precise, real-time mapping. Enhanced navigation accuracy, improved safety, and regulatory support for autonomous driving technologies are driving investments, fueling market expansion, and accelerating the adoption of high-definition mapping solutions globally.

A project by the Pennsylvania Department of Transportation demonstrated that HD maps, combined with work zone-specific reflectivity and connectivity tools like Cellular Vehicle-to-Everything (C-V2X), significantly improved object detection and Automated Driving Systems (ADS) recognition of work zone boundaries, enhancing safety and traffic flow.

The California Department of Transportation (Caltrans) highlights the role of HD maps in enabling predictive and vehicle environment data, improving automated driving performance.

To Get More Information On HD Map for Autonomous Vehicles Market - Request Free Sample Report

Key HD Map for Autonomous Vehicles Market Trends

-

Rising adoption of autonomous and semi-autonomous vehicles is driving demand for high-definition (HD) maps.

-

Real-time localization and navigation needs are boosting investment in precise mapping technologies.

-

Integration with AI, LiDAR, and sensor fusion is enhancing map accuracy and dynamic updates.

-

Increasing vehicle-to-everything (V2X) communication is improving route planning and safety.

-

Expansion of autonomous mobility services and smart city initiatives is fueling market growth.

-

Cloud-based map updates and multi-layered map architectures are enabling scalable, real-time solutions.

-

Collaborations between automotive OEMs, tech companies, and mapping providers are accelerating HD map adoption.

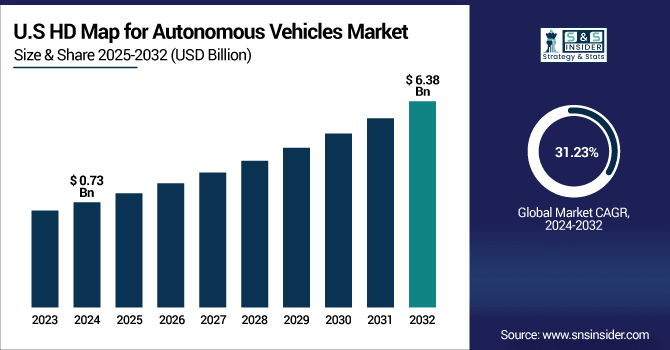

U.S. HD Map for Autonomous Vehicles Market was valued at USD 0.73 billion in 2024 and is expected to reach USD 6.38 billion by 2032, growing at a CAGR of 31.23% from 2025-2032.

The U.S. HD Map for Autonomous Vehicles Market growth is driven by rising autonomous vehicle deployment, advanced driver-assistance system adoption, and increasing investment in smart transportation infrastructure. Demand for precise, real-time mapping and regulatory support further accelerate market expansion and technological integration.

HD Map for Autonomous Vehicles Market Growth Drivers:

-

Increasing demand for precise real-time navigation and localization to improve autonomous vehicle safety and reliability in diverse driving conditions

Growing demand for precise real-time navigation fuels the adoption of HD maps in autonomous vehicles. Standard maps are insufficient for lane-level decision-making, but HD maps provide centimeter-level accuracy, essential for safe vehicle maneuvering in urban and highway environments. With rising concerns about passenger safety and collision prevention, automakers and technology providers are increasingly integrating HD mapping solutions. These maps support predictive modeling, object detection, and adaptive routing, improving decision-making in complex traffic environments. The shift toward fully automated driving systems significantly boosts the relevance of HD mapping in ensuring both safety and navigation efficiency.

-

The Ohio Rural Automated Driving Systems (ADS) Project demonstrated that AVs equipped with HD maps operated safely without any incidents on the three designated public road routes. This underscores the critical role of HD maps in ensuring the safe operation of AVs in real-world conditions.

-

The Federal Geographic Data Committee (FGDC) highlights that HD maps support strategic goals such as safety, economic strength, equity, climate change, sustainability, and transformation. These maps enable precise vehicle positioning and coordination, enhancing safety and efficiency on the road.

HD Map for Autonomous Vehicles Market Restraints:

-

High cost of creating, updating, and maintaining detailed HD maps limiting scalability and adoption for autonomous vehicle manufacturers

The creation and maintenance of HD maps demand significant investment in sensors, data processing, and cloud infrastructure. Continuous updates are essential to capture dynamic changes such as road construction, weather conditions, or updated traffic rules. This makes the process costly and resource-intensive, posing challenges for large-scale deployment across diverse geographies. Smaller automotive manufacturers or mobility providers often face budget constraints in adopting these solutions. The financial burden associated with building and sustaining HD maps can hinder widespread adoption, particularly in developing regions where infrastructure and funding for advanced mapping technologies remain limited.

-

Creating and updating HD maps can cost up to $1,000 per kilometer, requiring frequent updates to reflect road changes, construction, and traffic conditions, posing high costs for widespread autonomous vehicle adoption.

HD Map for Autonomous Vehicles Market Opportunities:

-

Rising government initiatives for smart transportation infrastructure supporting adoption of HD maps in autonomous and connected mobility ecosystems

Governments are increasingly investing in intelligent transportation systems, smart roads, and vehicle-to-infrastructure (V2I) technologies. These initiatives create strong opportunities for HD map adoption in autonomous vehicles. Policies supporting road digitization, advanced traffic management, and sustainable mobility encourage collaboration between public authorities and private sector providers. By promoting safety, reducing congestion, and improving urban mobility, governments play a central role in accelerating HD mapping deployment. Subsidies, regulatory frameworks, and public-private partnerships further support innovation. As autonomous vehicle trials expand across major cities worldwide, demand for robust HD mapping solutions aligned with government-backed smart mobility programs will increase rapidly.

HD Map for Autonomous Vehicles Market Segment Highlights

-

By Usage Type, Personal Mobility dominated with ~55% share in 2024; Commercial Mobility fastest growing (CAGR 32.62%).

-

By Vehicle Type, Passenger Car dominated with ~64% share in 2024; Commercial Vehicles fastest growing (CAGR 32.75%).

-

By Service Type, Mapping dominated with ~35% share in 2024; Updates and Maintenance fastest growing (CAGR 33.71%).

-

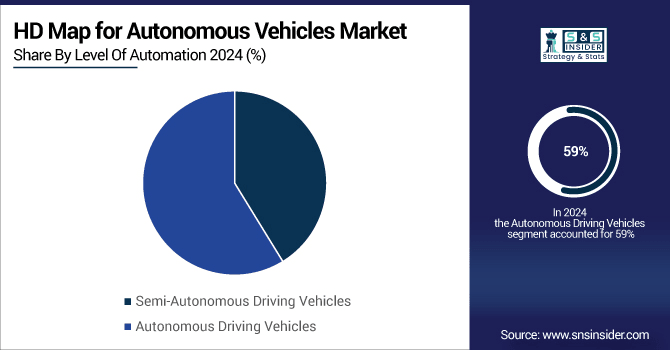

By Level of Automation, Autonomous Driving Vehicles dominated with ~59% share in 2024; Autonomous Driving Vehicles fastest growing (CAGR 32.56%).

HD Map for Autonomous Vehicles Market Segment Analysis

-

By Level of Automation, Autonomous Driving Vehicles led and are projected to grow fastest

Autonomous driving vehicles segment led the HD map for autonomous vehicles market in 2024 and is also expected to witness the fastest growth during 2025–2032. Its dominance stems from increasing deployment of self-driving technologies, growing demand for precise lane-level navigation, and enhanced safety requirements. Strong investments by automakers, technology developers, and governments in smart mobility infrastructure further accelerate growth. Expanding applications across passenger mobility, logistics, and ride-hailing strengthen reliance on HD maps, ensuring this segment remains both the largest and the fastest growing.

-

By Usage Type, Personal Mobility dominated while Commercial Mobility is expected to grow fastest

Personal mobility segment accounted for the largest share in 2024 due to rising adoption of autonomous ride-hailing, shared mobility platforms, and consumer demand for convenience-driven navigation. Increasing urbanization, supportive infrastructure, and the need for real-time, precise lane-level mapping further strengthened the segment’s dominance in the HD map for autonomous vehicles market.

Commercial mobility segment is expected to expand rapidly during the forecast period 2025–2032 as logistics, delivery services, and fleet operators increasingly adopt autonomous vehicles to enhance operational efficiency. The need for accurate HD mapping in freight optimization, route planning, and cost reduction will drive growth, supported by e-commerce expansion and smart logistics infrastructure investments.

-

By Vehicle Type, Passenger Cars led while Commercial Vehicles are projected to expand fastest

Passenger car segment dominated in 2024, driven by the growing integration of advanced driver-assistance systems (ADAS) and autonomous features in personal vehicles. Increasing consumer demand for safer, more efficient travel experiences and government-backed initiatives promoting smart mobility enhanced passenger vehicle reliance on HD maps, reinforcing this segment’s strong market leadership.

Commercial vehicles segment is projected to grow fastest during 2025–2032, supported by rising adoption of autonomous trucks, buses, and delivery fleets. The demand for high-precision navigation in long-haul freight, last-mile logistics, and urban delivery solutions will accelerate reliance on HD maps, making commercial vehicles the fastest-growing segment in autonomous mobility ecosystems.

-

By Service Type, Mapping dominated while Updates and Maintenance are expected to grow fastest

Mapping segment led in 2024 due to its foundational role in enabling autonomous driving, offering precise road geometry, lane markings, and infrastructure details. Automakers and technology providers prioritize high-quality mapping to ensure vehicle safety, predictive modeling, and seamless navigation, solidifying mapping as the largest revenue contributor in the HD map market.

Updates and maintenance segment is expected to see the fastest growth during 2025–2032 as autonomous vehicles require continuous real-time map adjustments for changing traffic, construction, and weather conditions. Crowdsourced data, 5G connectivity, and AI-driven updates will fuel demand, making constant maintenance crucial for safe, accurate, and scalable autonomous driving operations globally.

HD Map for Autonomous Vehicles Market Regional Highlights

-

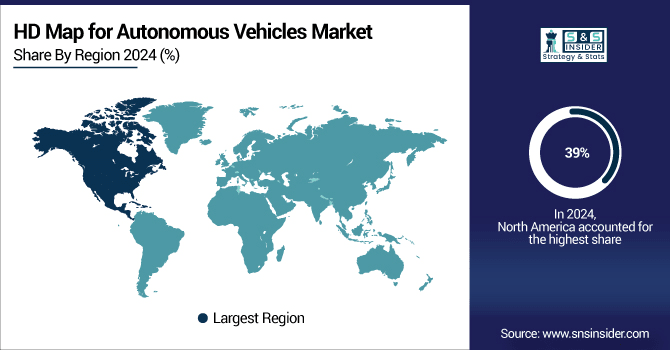

By Region, North America dominated with ~39% share in 2024; Asia Pacific fastest growing (CAGR 33.81%).

HD Map for Autonomous Vehicles Market Regional Analysis

North America HD Map for Autonomous Vehicles Market Insights

North America dominated the HD map for autonomous vehicles market in 2024 due to strong presence of leading automakers, technology providers, and mapping companies. Early adoption of autonomous driving technologies, advanced infrastructure, and favorable regulatory support have driven growth. High investments in R&D, robust 5G networks, and widespread testing programs further reinforced the region’s leading market position.

Get Customized Report as Per Your Business Requirement - Enquiry Now

Asia Pacific HD Map for Autonomous Vehicles Market Insights

Asia Pacific is anticipated to witness the fastest growth during 2025–2032, driven by rapid urbanization, rising vehicle adoption, and government-backed smart mobility initiatives. Strong investments in autonomous driving, expansion of 5G networks, and growing e-commerce logistics demand are fueling adoption of HD maps. Increasing collaborations between global technology firms and regional automakers further accelerate market growth.

Europe HD Map for Autonomous Vehicles Market Insights

Europe holds a significant position in the HD map for autonomous vehicles market, supported by stringent safety regulations, strong automotive manufacturing presence, and rapid adoption of advanced driver-assistance systems. Government initiatives promoting sustainable and smart mobility, coupled with investments in intelligent transportation infrastructure, strengthen market growth. Collaboration between automakers, technology firms, and mapping providers further enhances Europe’s role in autonomous driving development.

Middle East & Africa and Latin America HD Map for Autonomous Vehicles Market Insights

Middle East & Africa and Latin America are emerging markets for HD maps in autonomous vehicles, driven by gradual adoption of smart city projects, growing urbanization, and investments in digital infrastructure. Although adoption remains limited compared to developed regions, rising interest in connected mobility, government initiatives, and collaborations with global technology providers are expected to support future market expansion.

HD Map for Autonomous Vehicles Market Competitive Landscape:

TomTom

TomTom, a leading player in the HD Map for Autonomous Vehicles Market, provides high-precision mapping and real-time navigation solutions essential for autonomous driving. Leveraging advanced sensor data, AI, and cloud-based platforms, TomTom enhances vehicle localization, safety, and route optimization. The company’s continuous investment in autonomous vehicle partnerships and map updates strengthens its market position, enabling automakers and mobility providers to deploy reliable, scalable, and accurate HD mapping solutions globally.

-

In 2024, TomTom Collaborates with Mitsubishi Electric to combine its ADAS HD-Map with Mitsubishi’s High-Definition Locator, delivering a high-precision, integrated mapping solution for next-generation autonomous vehicles.

Waymo

Waymo, a pioneer in autonomous driving, plays a key role in the HD Map for Autonomous Vehicles Market by developing highly detailed, real-time maps for self-driving vehicles. Utilizing advanced LiDAR, AI, and sensor technologies, Waymo ensures precise vehicle localization and safe navigation. Its extensive autonomous fleet and continuous map updates support reliable route planning and traffic management, solidifying its leadership in delivering scalable, accurate, and innovative HD mapping solutions for global autonomous mobility.

-

In 2025, Waymo Began mapping Tokyo’s city streets through manually driven Waymo vehicles, creating 3D maps to support simulation and adaptation of its autonomous technology for the Japanese urban environment.

HERE Technologies

HERE Technologies, a major player in the HD Map for Autonomous Vehicles Market, offers high-definition maps and location-based services critical for autonomous driving. Utilizing AI, LiDAR, and real-time data, HERE enhances vehicle localization, navigation accuracy, and safety. Strategic partnerships with automakers and technology providers, along with continuous map updates and cloud-based platforms, strengthen its market presence, enabling scalable, precise, and reliable HD mapping solutions for autonomous mobility worldwide.

-

In 2025, HERE Technologies, Extended partnership with BMW, integrating standard and HD map data into new models to deliver lane-level positioning, ADAS enhancements, and safer automated driving capabilities globally.

Key Players

Some of the HD Map for Autonomous Vehicles Market Companies

-

Waymo

-

TomTom

-

NVIDIA

-

HERE Technologies

-

Baidu

-

NavInfo

-

Civil Maps

-

Dynamic Map Platform

-

Zenrin

-

Mapbox

-

Momenta

-

Esri

-

CE Info Systems (MapmyIndia)

-

RMSI

-

The Sanborn Map Company

-

Voxelmaps

-

Wipro

-

SK Telecom

-

Hyundai MnSoft

-

Autonavi

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 2.59 Billion |

| Market Size by 2032 | USD 22.97 Billion |

| CAGR | CAGR of 31.48% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Service Type (Mapping, Localization, Updates and Maintenance, Advertisement) • By Level of Automation (Semi-Autonomous Driving Vehicles, Autonomous Driving Vehicles) • By Usage Type (Personal Mobility, Commercial Mobility) • By Vehicle Type (Passenger Car, Commercial Vehicles) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Waymo, TomTom, NVIDIA, HERE Technologies, Baidu, NavInfo, Civil Maps, Dynamic Map Platform, Zenrin, Mapbox, Momenta, Esri, CE Info Systems (MapmyIndia), RMSI, The Sanborn Map Company, Voxelmaps, Wipro, SK Telecom, Hyundai MnSoft, Autonavi |