Automation as a Service Market Report Scope & Overview:

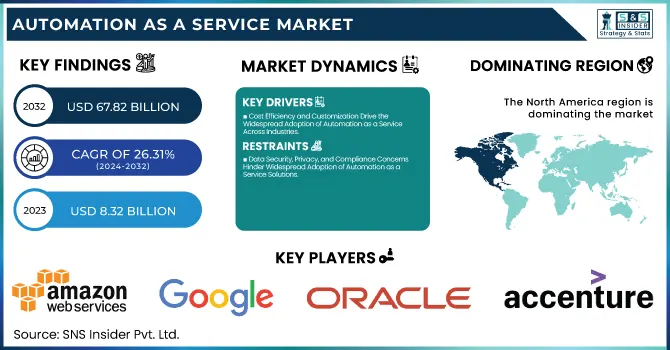

The Automation as a Service Market was valued at USD 8.32 billion in 2023 and is expected to reach USD 67.82 billion by 2032, growing at a CAGR of 26.31% from 2024-2032. This report covers adoption rates of emerging technologies, indicating significant user demographics in 2023. It delves into the integration of Automation as a Service with other technologies to create innovative business processes across industries. The cost-savings impact of adopting automation solutions is also covered, where it has been identified that businesses leverage these services to maintain operational efficiency and reduced overheads. Automation is going to have a very large growth prospect as it will become an integral part of the business strategy.

To Get more information on Automation as a Service Market - Request Free Sample Report

Automation as a Service Market Dynamics

Drivers

-

Cost Efficiency and Customization Drive the Widespread Adoption of Automation as a Service Across Industries

The increasing need for cost-effective solutions is driving businesses to adopt Automation as a Service, as it minimizes the need for hefty upfront investments in automation infrastructure and software. This affordability opens up opportunities for businesses of all sizes, enabling them to integrate automation without facing financial strain. In addition, the ability to customize automation solutions according to specific business processes makes this service highly adaptable across various industries. It can scale and tailor solutions to the unique demands of businesses, thereby ensuring a more personalized and efficient approach. This makes Automation as a Service an attractive choice for businesses seeking innovation while controlling costs and enhancing operational performance.

Restraints

-

Data Security, Privacy, and Compliance Concerns Hinder Widespread Adoption of Automation as a Service Solutions

As businesses migrate critical operations to cloud-based platforms, data security, privacy, and regulatory compliance become significant issues. The threat of cyber threats to sensitive business and customer information is a top concern, particularly for industries such as healthcare, finance, and government, where regulatory requirements are strict. Fear of data breaches, unauthorized access, or failure to comply with data protection laws can be an inhibiting factor for companies embracing Automation as a Service solutions in full. In addition, high standards of security maintained by the service providers as well as adhering to the local and international regulations would further complicate the adoption process. These may pose a risk that may hamper the market growth as organizations evaluate the possibilities of outsourcing their business operations through cloud-based automation.

Opportunities

-

AI and Machine Learning Integration Drives Innovation and Growth in the Automation as a Service Market

The integration of AI and machine learning technologies into the service of automation provides tremendous promise for businesses: automating increasing complexity in various tasks and also optimizing decision making. With these AI and ML technologies, a company can strive to achieve maximum accuracy, expedite data processing, and yield solutions that answer its needs accordingly. This makes the technology innovative for industries who wish to increase innovation, create a smooth pathway for operations and improve productivity as well. In addition, with more accessible and scalable automation solutions for SMEs, the efficiency and competitiveness of these small and medium-sized enterprises will increase. The increased demand for specific automation solutions as well as support for remote work environments further widens the market growth, which Automation as a Service is key to enabling business transformation.

Challenges

-

Integrating Automation Solutions with Legacy Systems Creates Significant Challenges for Successful Adoption of Automation as a Service

A significant challenge to businesses adopting Automation as a Service is the integration of automation solutions with existing legacy systems. Many organizations still rely on older infrastructure that may not be compatible with modern, cloud-based automation technologies. The complexity of integration often requires substantial time, technical expertise, and resources to ensure seamless operation between the new and old systems. This may result in delay, surprise cost, and even failure in implementation. Moreover, legacy systems might not be flexible enough to smoothly integrate into new systems, further complicating the transition. Businesses may, therefore, face challenges in adopting automation solutions that could enhance efficiency without disrupting day-to-day operations or existing workflows.

Automation as a Service Market Segment Analysis

By Component

The Solution segment dominated the Automation as a Service Market with the highest revenue share of about 64% in 2023 due to the increasing demand for comprehensive, end-to-end automation solutions that streamline business processes. These solutions offer scalability, efficiency, and customization, driving widespread adoption. The Services segment is expected to grow at the fastest CAGR of about 27.48% from 2024-2032, driven by the growing need for ongoing support, maintenance, and consulting services to ensure smooth implementation and optimization of automation solutions.

By Organization Size

The Large Enterprises segment dominated the Automation as a Service Market with the highest revenue share of about 60% in 2023 due to their significant resources, scale, and greater demand for complex, integrated automation solutions across diverse functions. The Small and Medium-sized Enterprises (SMEs) segment is expected to grow at the fastest CAGR of about 27.63% from 2024-2032, driven by the increasing affordability and scalability of automation solutions, which make them more accessible for SMEs to improve efficiency and compete with larger businesses.

By End User

The BFSI segment dominated the Automation as a Service Market with the highest revenue share of about 31% in 2023 due to the sector's need for enhanced efficiency, compliance, and customer service through automated solutions. The IT and Telecom segment is expected to grow at the fastest CAGR of about 28.75% from 2024-2032, driven by the increasing adoption of automation for network management, customer support, and operational optimization in these rapidly evolving industries.

By Deployment Model

The Public Cloud segment dominated the Automation as a Service Market with the highest revenue share of about 57% in 2023 due to its cost-effectiveness, scalability, and ease of access, allowing businesses to quickly deploy automation solutions without heavy infrastructure investments. The Hybrid Cloud segment is expected to grow at the fastest CAGR of about 28.32% from 2024-2032, driven by organizations seeking the flexibility to combine the benefits of both public and private cloud environments for better control, security, and compliance while maintaining scalability.

By Type

The Rule-based Automation segment dominated the Automation as a Service Market with the highest revenue share of about 60% in 2023 due to its simplicity, ease of implementation, and effectiveness in automating repetitive, well-defined tasks across various industries. The Knowledge-based Automation segment is expected to grow at the fastest CAGR of about 28.11% from 2024-2032, driven by the increasing adoption of AI, machine learning, and cognitive technologies that enable more complex, data-driven automation for decision-making and problem-solving in dynamic business environments.

Regional Analysis

North America held the highest revenue share of about 41% in 2023, led by its superior technological infrastructure and high adoption of cloud-based automation solutions. Well-established industries and a strong focus on digital transformation across sectors like BFSI, healthcare, and manufacturing have driven substantial demand for automation solutions in the region. Major service providers and robust investments in AI and machine learning also made North America a leader in the market.

Asia Pacific is expected to grow at the fastest CAGR of about 28.48% from 2024-2032 due to the growing acceptance among businesses in emerging economies toward automation for the purpose of efficiency and innovation. Growing urbanization, a rapidly growing middle class, and increasing adoption of cloud technologies are driving this growth. Furthermore, the region's emphasis on smart manufacturing along with the push from governments towards digitalization has made Asia Pacific an emerging hotbed for the future of Automation as a Service.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

-

Amazon Web Services (AWS) (AWS Lambda, Amazon S3)

-

Google LLC (Google Cloud AI, Google Cloud Automation)

-

SAP SE (SAP Intelligent RPA, SAP Business Technology Platform)

-

Oracle Corporation (Oracle Autonomous Database, Oracle Cloud Infrastructure)

-

Accenture (Accenture myConcerto, Accenture Intelligent Automation)

-

AutomationEdge (AutomationEdge IT Automation, AutomationEdge Cloud Management)

-

WorkFusion (WorkFusion Intelligent Automation Cloud, WorkFusion RPA)

-

Cognizant Technology Solutions (Cognizant Intelligent Automation, Cognizant RPA)

-

ServiceNow (ServiceNow Automation Engine, ServiceNow Flow Designer)

-

Digital Workforce (Digital Workforce RPA, Digital Workforce Automation Suite)

-

Automation Anywhere Inc. (Automation 360, Bot Insight)

-

Blue Prism Limited (Blue Prism Cloud, Blue Prism RPA)

-

HCL Technologies Limited (HCL RPA, HCL Automation Hub)

-

Hewlett Packard Enterprise Development LP (HPE Ezmeral, HPE OneView)

-

International Business Machines Corporation (IBM Robotic Process Automation, IBM Cloud Pak for Automation)

-

Kofax Inc. (Kofax RPA, Kofax Intelligent Automation)

-

Microsoft Corporation (Power Automate, Azure Logic Apps)

-

NICE (NICE RPA, NICE Workforce Management)

-

Pegasystems Inc. (Pega Platform, Pega Robotic Automation)

-

UiPath (UiPath Studio, UiPath Orchestrator)

Recent Developments:

-

In December 2024, AWS launched the Security Incident Response service to automate triage and remediation of security events detected by Amazon GuardDuty, aiming to reduce response times for cyber threats and minimize alert fatigue for security teams.

-

In February 2024, UiPath and Google Cloud expanded their partnership, making UiPath’s AI-powered automation platform available on the Google Cloud Marketplace. This collaboration integrates with Google Vertex AI, enabling businesses to enhance automation with generative AI capabilities, machine learning models, and cloud-based workflows.

-

In October 2024, Oracle introduced new AI-powered service workflows within Oracle Fusion Cloud Service, designed to enhance the customer service lifecycle. These tools automate service request handling, improve response times, and boost overall customer satisfaction by using generative AI for task summarization and issue resolution.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 8.32 Billion |

| Market Size by 2032 | USD 67.82 Billion |

| CAGR | CAGR of 26.31% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Solution, Services) • By Type (Rule-based Automation, Knowledge-based Automation) • By Deployment Model (Public Cloud, Private Cloud, Hybrid Cloud) • By Organization Size (Small and Medium-sized Enterprises (SMEs), Large Enterprises) • By End User (BFSI, Telecom and IT, Retail and Consumer Goods, Healthcare and Life Sciences, Manufacturing, Other End-user Industries) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Amazon Web Services (AWS), Google LLC, SAP SE, Oracle Corporation, Accenture, AutomationEdge, WorkFusion, Cognizant Technology Solutions, ServiceNow, Digital Workforce, Automation Anywhere Inc., Blue Prism Limited, HCL Technologies Limited, Hewlett Packard Enterprise Development LP, International Business Machines Corporation (IBM), Kofax Inc., Microsoft Corporation, NICE, Pegasystems Inc., UiPath |