Hospital EMR Systems Market Report Scoper & Overview:

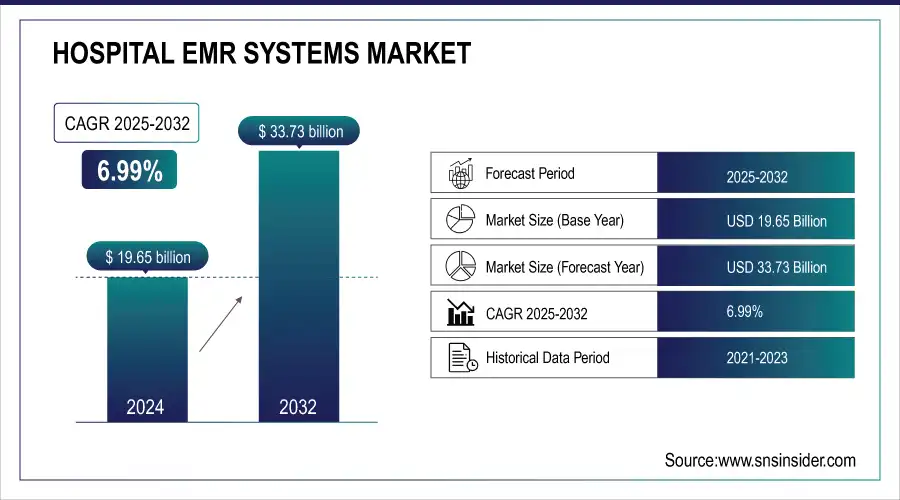

The Hospital EMR Systems Market size was USD 19.65 Billion in 2024 and is expected to reach USD 33.73 Billion by 2032 and grow at a CAGR of 6.99% over the forecast period of 2025-2032. This report provides key insights and trends shaping the hospital EMR systems market. It covers adoption rates, emphasizing the increasing implementation of EMR solutions in hospitals across developed and emerging markets. User demographics highlight hospitals as the primary adopters, with physicians and nurses being the major users. A feature analysis explores the rising demand for clinical decision support, interoperability, and AI-driven analytics.

Get more information on Hospital EMR Systems Market - Request Sample Report

Cost analysis examines the pricing differences between on-premise and cloud-based electronic medical records (EMRs) systems, with cloud adoption lowering overall costs. Integration capabilities focus on hospitals achieving seamless system integration while still facing interoperability challenges. Regulatory compliance is analyzed across regions, showcasing adherence to HIPAA, GDPR, and national EMR standards. Lastly, market growth projections indicate strong expansion, driven by AI, blockchain, and voice-recognition innovations in EMR systems.

Market Size and Forecast:

-

Market Size in 2024 USD 19.65 Billion

-

Market Size by 2032 USD 33.73 Billion

-

CAGR of 6.99% From 2025 to 2032

-

Base Year 2024

-

Forecast Period 2025-2032

-

Historical Data 2021-2023

Hospital EMR Systems Market Trends:

-

Government-backed initiatives and financial incentives are accelerating EMR adoption globally, including programs like HITECH in the US and GDPR-driven frameworks in Europe.

-

National digitization policies in emerging economies, such as India and China, are driving rapid EMR deployment in public hospitals.

-

AI-powered EMR systems are enhancing predictive insights, automated clinical decision support, and real-time patient monitoring for improved care and efficiency.

-

Cloud-based EMR solutions are enabling scalable, cost-effective, and remotely accessible healthcare data management.

-

Interoperability, data sharing, and regulatory compliance are being strengthened through cloud adoption and standardized EMR frameworks.

Hospital EMR Systems Market Growth Drivers:

-

Government assistance in the implementation of EMR solutions which drives the market growth.

The initial level of government support for the adoption of Electronic Medical Records (EMR) systems within hospitals, is an important driver of the implementation of the EMR system through financial incentives, regulatory frameworks, and a national program to digitize healthcare, specifically, programs such as HITECH act in the US have promoted EMR adoption by incentivizing EMR adoption where reimbursement or financial penalties are levied on healthcare providers if the system implemented is not certified. Likewise, in Europe, government-backed programs in the spirit of the GDPR provide for standardized data protection and interoperability among healthcare providers. The growth of EMR in emerging economies such as India and China is driven by national policies promoting the digitization of healthcare with government funding and mandates leading to rapid deployment of EMR in public hospitals. Moreover, cloud-based EMRs and interoperability standards promoted by policies, aid in the cheap implementation of EMRs and facilitate the sharing of information between two different healthcare institutions all of which complement the market growth.

Hospital EMR Systems Market Restraints:

-

High implementation and maintenance costs which may hamper the market growth.

High implementation and maintenance costs remain one of the major restraints in the hospital EMR systems market and it is one of the significant challenges for small and mid-sized hospitals. Implementing an EMR system needs significant expenditure on software, hardware, human capital, and periodic system upgrades making them financially unsustainable for healthcare providers with constrained budgets. Moreover, data security and privacy issues are still a hot topic, as hospitals need to comply with strict regulations like HIPAA (USA) and GDPR (Europe), which implies that data must be protected, and storage environments provided with high-level encrypted data. Difficulties with interoperability likewise restrict the growth of the marketplace, as leveraging EMR systems with the installed hospital and third-party software will surface technical challenges and disturbances in operations. In addition, the barriers posed by cumbersome workflows and EMR usability drive physicians toward avoiding EMR adoption, leaving behind a slow shift away from paper to digital records. Together, these act as deterrents to the smooth adoption of the EMR solution in hospitals.

Hospital EMR Systems Market Opportunities:

-

Advancement of AI-driven analytics and cloud-based EMR solutions create the opportunity.

AI-powered analytics and cloud-based EMR solutions can add value to the Hospital EMR Systems Market by optimizing processes, decreasing costs while improving patient care, quality of the patient or child care, and overall, being resourceful. AI can help hospitals to transform their experience powered by predictive insights, automated clinical decision support (CDS), and real-time patient monitoring for better diagnosis, treatment planning, and operational efficiency. The two primary benefits of having AI-based EMRs are bringing forth the patterns of disease and creating more output of voices and data documentation for less doctor workload and lesser medical misadventure. On the other hand, cloud-based EMR solutions are transforming the face of healthcare data management by providing solutions that can be scaled up, accessed remotely, and are more cost-effective than traditional on-premise solutions. Cloud adoption reduces enormous infrastructural spending for hospitals while paving the way to interoperability and data sharing across healthcare networks. In addition, cloud systems provide better data security, backup, and disaster recovery capabilities to ensure adherence to regulations such as HIPAA and GDPR.

Hospital EMR Systems Market Segment Analysis:

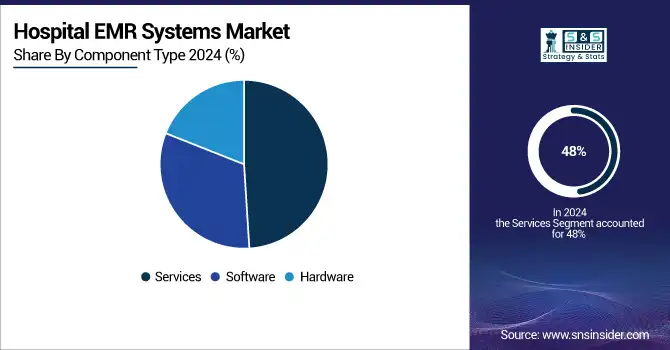

By Component Type

Services held the largest market share 48% in 2024. It is owing to a significant role in the implementation, maintenance, training, and support of the system itself. Along with the EMR, customized solutions are required by hospitals, for which consulting, integration, and deployment services, are imperative for the seamless adoption of EMR systems. Moreover, demand for managed services is also driven by ongoing software upgrades, cybersecurity management, and regulatory compliance monitoring. Absence of in-house IT expertise many healthcare providers do not have the IT expertise in-house, leading them to increasingly rely on third-party service providers for migrating data, hosting the cloud, and providing interoperability support. With hospital workflows being more complex and multi-specialty needed, this also drives workflow optimization and technical assistance.

By Type

General EMR solutions dominate the EMR market share owing to their applicability across various healthcare specialist areas, economical prices, and ease of integration to current hospital work setups. General EMR solutions apply to a range of hospital departments like internal medicine, emergency care, cardiology, and general surgery, which makes them the Go-To for both large and mid-sized hospitals; while specialized EMR systems are meant for niche medical specialties. These systems provide scalability and flexibility in designing workflows, organizing patient information, and associating with laboratory, pharmacy, and billing systems, allowing for smooth operations of a hospital. Moreover, government support like EMR adoption incentives and mandates, for instance, the HITECH Act in the United States and national-level healthcare digitization programs in Europe and Asia-Pacific, has also spurred the demand for general EMR solutions that are more comprehensive, interoperable, and can meet regulatory requirements.

By End User

The market for Hospital EMR Systems was dominated by small and medium-sized hospitals owing to the extensive adoption of cost-effective, cloud-based EMR solutions by these hospitals complemented by government incentives and regulatory mandates. With the foundation of many of the global hospitals that comprise the healthcare institutions of the world, these have shifted away from paper records to digital/unified systems that not only provide better care for the patient (and consequently the world), but also make the workflow more efficient and effective while adhering to healthcare-related regulations such as HIPAA, GDPR, and EMR in national places. Low-cost, scalable, and easy-to-implement EMR solutions have further stimulated adoption as smaller and mid-sized hospitals tend to have limited IT resources and prefer deployment of lower maintenance cloud-based models vs costly on-site systems.

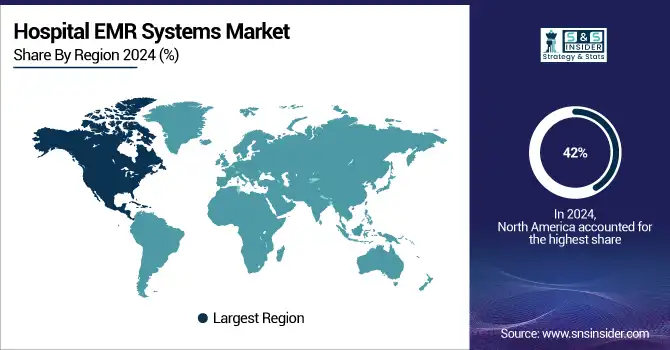

Hospital EMR Systems Market Regional Analysis:

North America Hospital EMR Systems Market Insights

North America held the largest market share, around 42% in 2024. It is owing to the favorable government reforms, increased expenditure on healthcare IT, and a wider adoption of advanced digital healthcare solutions. The healthcare infrastructural setups in the U.S. and Canada have been highly established with strong regulations like (HITECH) Health Information Technology for Economic and Clinical Health Act and Health Insurance Portability and Accountability Act (HIPAA) to enforce hospitals with EMR systems. Government programs, such as the Medicare and Medicaid EHR Incentive Programs, have also hastened the migration from paper to an integrated digital record as well. Market growth has been further fueled by the presence of dominant EMR providers, such as Epic Systems, Cerner (Oracle Health), and Allscripts, as they continue to innovate and develop AI-driven analytics, cloud-based solutions, and interoperability features. Additionally, they have also seen rapid improvements in interoperable systems in healthcare — one that would make hospitals, clinics, and third-party applications able to perform data exchange between each other.

Need any customization research on Hospital EMR Systems Market - Enquiry Now

Asia Pacific Hospital EMR Systems Market Insights

Asia Pacific held a significant share market share in 2023. This is owing to the rising adoption of healthcare digitization, government initiatives, and investments in hospital IT infrastructure. Various nations such as China, India, Japan, and Australia are presently executing field-based healthcare structures that mandate EMR reception to streamline patient data and streamline public hospitals. Healthcare IT reforms are also being supported through investments by governments across the region such as China Health China 2030 Plan and India Ayushman Bharat Digital Mission to promote interoperability and electronic health records (EHR) across hospitals. Moreover, the increasing number of hospitals, high patient throughput, and the increased need for cloud-based EMR solutions are also spurring market growth. Local EMR vendors and international players are entering the region to provide cost-effective, scalable, and AI-based EMR systems for small and mid-sized hospitals.

Europe Hospital EMR Systems Market Insights

The European Hospital EMR market is growing steadily due to government initiatives promoting digital healthcare, strict data protection regulations like GDPR, and investments in interoperability standards. Hospitals are increasingly adopting cloud-based and AI-powered EMR solutions to enhance patient care, streamline workflows, and reduce operational costs, driving the overall adoption across both public and private healthcare institutions.

Latin America (LATAM) and Middle East & Africa (MEA) Hospital EMR Systems Market Insights

The Hospital EMR market in LATAM and MEA is expanding as governments push digital healthcare initiatives and fund EMR adoption in public hospitals. Growing awareness of cloud-based solutions, AI-driven analytics, and the need for efficient patient data management are driving market growth, enabling better healthcare delivery and operational efficiency despite infrastructure and budgetary challenges.

Hospital EMR Systems Market Key Players:

-

Allscripts Healthcare Solutions, Inc. (Sunrise EHR, Paragon EHR)

-

Cerner Corporation (Cerner Millennium, PowerChart)

-

athenahealth, Inc. (Athena Clinicals, athenaOne)

-

Epic Systems Corporation (EpicCare, MyChart)

-

GE Healthcare (Centricity EMR, GE Health Cloud)

-

eClinicalWorks (eClinicalWorks EHR, Healow)

-

CPSI (Evident Thrive, TruBridge)

-

MEDITECH (Expanse, Magic EMR)

-

NextGen Healthcare (NextGen Enterprise, NextGen Office)

-

MEDHOST (Enterprise EHR, YourCare Suite)

-

Oracle Health (Oracle Health EHR, Oracle Cerner HealtheIntent)

-

Infor Healthcare (Cloverleaf Integration Suite, Infor CloudSuite Healthcare)

-

Philips Healthcare (Tasy EMR, IntelliSpace EMR)

-

Greenway Health (Intergy EHR, Prime Suite)

-

Practice Fusion (Practice Fusion EMR, Patient Fusion)

-

AdvancedMD (AdvancedEHR, AdvancedPM)

-

DrChrono (DrChrono EHR, Apollo+)

-

CompuGroup Medical (CGM APRIMA, CGM eMDs)

-

RamSoft (PowerServer RIS/PACS, OmegaAI)

-

CareCloud, Inc. (CareCloud Charts, CareCloud Central)

Competitive Landscape for Hospital EMR Systems Market:

Suki is a leading provider of AI-powered voice-enabled solutions for hospital EMR systems, designed to reduce clinician documentation time and improve workflow efficiency. Its platform leverages natural language processing to capture and organize patient data accurately, enhancing clinical decision-making. By integrating seamlessly with existing EMRs, Suki helps healthcare providers optimize operational efficiency, reduce physician burnout, and improve overall patient care in hospital settings.

-

In October 2024, Suki the healthcare startup Suki secured $70 million in funding to enhance the development of AI-powered assistants designed to reduce administrative workloads for healthcare providers.

AdventHealth is a prominent healthcare system implementing advanced EMR solutions to enhance patient care and operational efficiency. Leveraging integrated digital platforms, including AI-driven analytics, the organization streamlines clinical workflows, improves data management, and supports informed decision-making. By adopting hospital EMR systems, AdventHealth focuses on optimizing patient outcomes, ensuring regulatory compliance, and enabling seamless interoperability across its network of hospitals and care facilities.

-

In February 2024, AdventHealth finalized a $660 million upgrade to Epic's electronic health record system across 37 hospitals, enhancing interoperability and improving patient care.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 19.65 Billion |

| Market Size by 2032 | USD 33.73 Billion |

| CAGR | CAGR of 6.99% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component type (Software, Services, Hardware) • By Delivery Mode (On-premise, Cloud-based) • By Type (Specialty EMR Solutions, General EMR Solutions) • By Hospital Size (Small and Medium-sized Hospitals, Large Hospitals) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Allscripts Healthcare Solutions, Inc., Cerner Corporation, athenahealth, Inc., Epic Systems Corporation, GE Healthcare, eClinicalWorks, CPSI, MEDITECH, NextGen Healthcare, MEDHOST, Oracle Health, Infor Healthcare, Philips Healthcare, Greenway Health, Practice Fusion, AdvancedMD, DrChrono, CompuGroup Medical, RamSoft, CareCloud, Inc. |