DNA Synthesizer Market Size Analysis:

To Get More Information on DNA Synthesizer Market - Request Sample Report

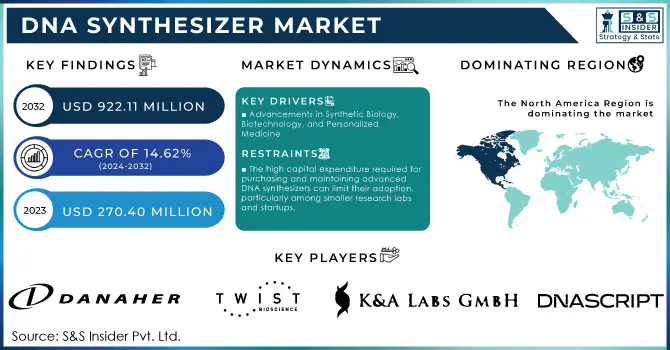

The DNA Synthesizer Market size valued at USD 270.40 million in 2023 and is expected to reach USD 922.11 million by 2032 with a CAGR of 14.62% during the forecast period of 2024-2032.

Recent advancements in DNA synthesizer technology are driving a transformative shift in genomic research, biotechnology, and drug development. Key factors propelling this evolution include technological breakthroughs in DNA synthesis cost reduction, increased speed, and the growing importance of synthetic biology, gene therapies, and personalized medicine. These developments are making DNA synthesizers an essential tool across multiple sectors.

One of the most significant advancements in the DNA synthesizer market has been the substantial reduction in DNA synthesis costs. Over the past decade, the cost of synthesizing DNA has dropped by over 90%, primarily due to innovations in high-throughput DNA synthesizers and enzyme-based synthesis technologies. A study published in Nature Reviews Molecular Cell Biology in 2022 emphasized that DNA synthesis costs are now at a point where it is possible to produce entire genomes in a relatively short time frame, thanks to improvements in the speed and accuracy of DNA synthesizers. This cost reduction has dramatically improved the scalability and precision of DNA production, enabling the efficient creation of longer and more complex genetic sequences. As a result, the demand for DNA synthesizers is surging in the fields of gene therapy and biopharmaceutical development, where researchers rely on precise DNA synthesis to develop therapeutic proteins and monoclonal antibodies.

In particular, synthetic biology has driven a surge in the adoption of DNA synthesizers. According to a 2023 study published in Heliyon, synthetic biology is facilitating breakthroughs in the development of biofuels, new drugs, and environmentally sustainable solutions. The ability to design and synthesize custom DNA sequences quickly is making these advancements possible. DNA synthesizers play a critical role in enabling the engineering of microorganisms for producing valuable compounds, such as biofuels and pharmaceuticals. Recent research has shown that DNA synthesis is essential for speeding up drug discovery, with some estimates suggesting that DNA synthesizers could shorten development timelines by as much as 50%, according to a study published by the Journal of Industrial Microbiology and Biotechnology in 2023.

The growing demand for personalized medicine is another key factor boosting the DNA synthesizer market. The integration of synthetic DNA into gene-editing technologies like CRISPR is making it possible to develop highly targeted therapies for genetic disorders, including sickle cell anemia and Duchenne muscular dystrophy. A recent report in Heliyon 2024 highlighted that CRISPR-based therapies are now entering clinical trials for these genetic diseases, marking a major milestone in gene therapy. Additionally, gene-based diagnostics are benefiting from advancements in DNA synthesis, with custom-designed sequences helping to detect pathogens and predict disease risk more accurately. As more personalized treatments emerge, the need for precise and cost-effective DNA synthesizers is expected to increase significantly.

The impact of synthetic DNA is further amplified by research funding and technological innovations. For example, initiatives like the NIH’s genome completeness projects in 2023 and the UKRI’s synthetic biology investments in 2024 are accelerating the development of DNA synthesizer technology. These initiatives support the growing demand for DNA synthesis tools that can enable advancements in biotechnology, molecular diagnostics, and therapeutic development.

Overall, the DNA synthesizer market is undergoing rapid growth due to technological advancements that are reducing costs, improving efficiency, and expanding the range of applications for synthetic DNA. As synthetic biology, gene therapies, and personalized medicine continue to advance, the demand for high-performance DNA synthesizers will continue to rise. With ongoing investments and innovations, the DNA synthesizer market is poised to play a pivotal role in shaping the future of biotechnology, genomic research, and healthcare.

DNA Synthesizer Market Dynamics

Drivers

-

Advancements in Synthetic Biology, Biotechnology, and Personalized Medicine

The DNA synthesizer market is primarily driven by several key factors, including advancements in synthetic biology, biotechnology, and the growing demand for personalized medicine. One of the most significant drivers is the rapid reduction in the cost of DNA synthesis, which has fallen by over 90% in the past decade. This decrease in cost has been driven by technological innovations in high-throughput DNA synthesis and the use of enzymatic methods, making DNA production faster, cheaper, and more accurate. These advancements have opened the door for applications across various industries, including drug discovery, genetic engineering, and biopharmaceuticals.

Moreover, the rise of synthetic biology is a crucial factor propelling the market. The ability to design and create custom DNA sequences enables researchers to develop novel therapeutics, biofuels, and environmentally sustainable solutions. DNA synthesizers are at the heart of this innovation, helping to rapidly generate large-scale, complex genetic sequences for research and commercial applications.

Another significant driver is the increasing demand for personalized medicine. As genetic therapies and gene-editing technologies, like CRISPR, evolve, there is a growing need for precise, tailored DNA synthesis for gene therapies, genetic testing, and diagnostic applications. The continuous development of CRISPR-based technologies and genomic editing tools is fueling the demand for high-quality, customizable DNA sequences, further accelerating growth in the DNA synthesizer market. These drivers are contributing to an expanding range of applications, positioning the market for substantial growth in the coming years.

Restraints

-

The high capital expenditure required for purchasing and maintaining advanced DNA synthesizers can limit their adoption, particularly among smaller research labs and startups.

-

The sophisticated technology and expertise required to operate and maintain DNA synthesizers can pose challenges, potentially hindering market growth and accessibility for less experienced users.

Key Segmentation

By Application

In 2023, Drug Discovery & Development held the largest share of the DNA synthesizer market, driven by the increasing demand for precision therapies and gene editing technologies. This segment accounted for approximately 40.0% of the total market share. DNA synthesizers are crucial in designing and synthesizing custom DNA sequences for drug development, particularly in areas like gene therapy, cancer treatment, and rare diseases. With the rising prevalence of chronic diseases and advancements in genomics, the need for DNA synthesis in drug discovery remains robust.

The Genetic Engineering segment is the fastest-growing application, expected to expand at a compound annual growth rate (CAGR) of 18% over the next few years. This growth is attributed to the rapid advancements in synthetic biology and the increasing use of CRISPR and other gene-editing technologies. Genetic engineering is integral to the development of novel bioproducts, biofuels, and therapeutics, creating significant demand for DNA synthesis tools capable of supporting complex genetic modifications and large-scale production.

By Type

Benchtop DNA Synthesizers dominated the market in 2023, holding around 55.0% of the market share. These compact and affordable devices are widely used by research labs, academic institutions, and small-scale biotech companies for their convenience and cost-effectiveness in synthesizing shorter DNA sequences. The increasing demand for DNA synthesis in genetic research and personalized medicine continues to drive the widespread use of benchtop synthesizers, especially in academic and research settings.

Large-scale DNA Synthesizers are the fastest-growing segment, projected to grow at a CAGR of 15%. The increasing demand for high-throughput DNA synthesis in commercial applications, including biopharmaceuticals, genetic engineering, and synthetic biology, is driving this growth. These systems are capable of synthesizing larger and more complex DNA sequences, making them essential for industries engaged in large-scale gene synthesis and drug development.

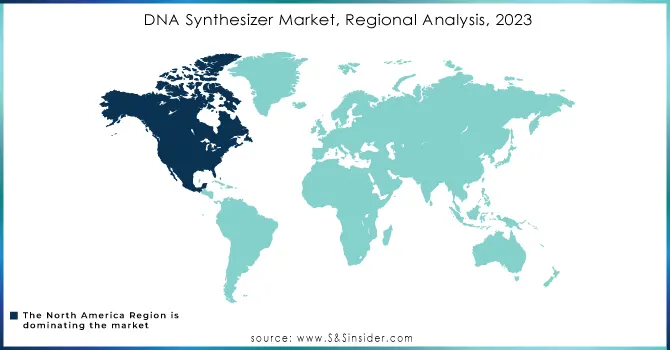

Regional Analysis

The DNA synthesizer market is experiencing varied growth across regions, with North America dominant in 2023, holding the largest market share. This dominance is driven by the region’s strong biotechnology and pharmaceutical sectors, advanced research institutions, and high investments in genetic research, personalized medicine, and drug discovery. The U.S., in particular, benefits from a well-established ecosystem for biopharmaceutical innovation and regulatory support for genomic research. The increasing adoption of CRISPR and other gene-editing technologies has further propelled the demand for DNA synthesizers in North America. The region’s market is expected to continue growing steadily due to ongoing investments in R&D and healthcare advancements.

Europe held a significant share of the market as well, driven by the thriving pharmaceutical and biotech industries in countries like Germany, the U.K., and Switzerland. The region benefits from strong academic research initiatives and regulatory frameworks that support genetic engineering and gene therapies. Europe’s steady growth is also aided by a well-established healthcare infrastructure and a rising demand for personalized medicine, making it a key player in the DNA synthesizer market.

The Asia-Pacific region is the fastest-growing market, projected to expand at a CAGR of over 15%. This growth is attributed to the rapid development of biotech industries, increasing healthcare investments, and expanding genetic research in countries like China, India, and Japan. The rising demand for personalized medicine, genetic testing, and affordable DNA synthesis technologies is a key driver in the region's market growth.

Do You Need any Customization Research on DNA Synthesizer Market - Enquire Now

Key Players

-

Danaher - Applied Biosystems DNA Synthesizers

-

Twist Bioscience - Twist Bioscience DNA Synthesis Platform

-

Kilobase - Kilobase DNA Synthesizer

-

LGC Limited - LGC Biosearch Technologies Custom DNA Synthesis

-

CSBio - CSBio DNA Synthesizers

-

K&A Labs GmbH - K&A DNA Synthesizers

-

DNA Script - DNA Script Synteza

-

OligoMaker ApS - OligoMaker DNA Synthesizers

-

PolyGen GmbH - PolyGen DNA Synthesizers

-

Biolytic Lab Performance Inc. - Biolytic DNA Synthesizers

Recent Developments

-

In November 2024, Twist Bioscience, a leading DNA synthesis platform developer, partnered with Absci, a de novo designer, in a new collaboration focused on AI-driven antibody development. This marks the latest of three recent partnerships that Twist has launched or advanced, aiming to enhance innovation in the biotechnology sector.

-

In November 2024, DNA Script appointed Marc Montserrat as CEO to spearhead long-term commercial growth for its pioneering enzymatic DNA synthesis platform. Founder Thomas Ybert transitions to the role of Chief Scientific Officer, reinforcing the company’s dedication to advancing scientific discovery and innovation.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 270.40 million |

| Market Size by 2032 | US$ 922.11 million |

| CAGR | CAGR of 14.62% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Application (Drug Discovery & Development, Genetic Engineering, Clinical Diagnostics) • By Type (Benchtop DNA Synthesizers, Large-scale DNA Synthesizers) • By End-use (Academic & Research Institutes, Pharmaceutical & Biotechnology Companies, Clinical Laboratories) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Danaher, Twist Bioscience, Kilobase, LGC Limited, CSBio, K&A Labs GmbH, DNA Script, OligoMaker ApS, PolyGen GmbH, Biolytic Lab Performance Inc. |

| Key Drivers | • Advancements in Synthetic Biology, Biotechnology, and Personalized Medicine |

| Restraints | • The high capital expenditure required for purchasing and maintaining advanced DNA synthesizers can limit their adoption, particularly among smaller research labs and startups. • The sophisticated technology and expertise required to operate and maintain DNA synthesizers can pose challenges, potentially hindering market growth and accessibility for less experienced users. |