Hemophilia Market Size & Overview:

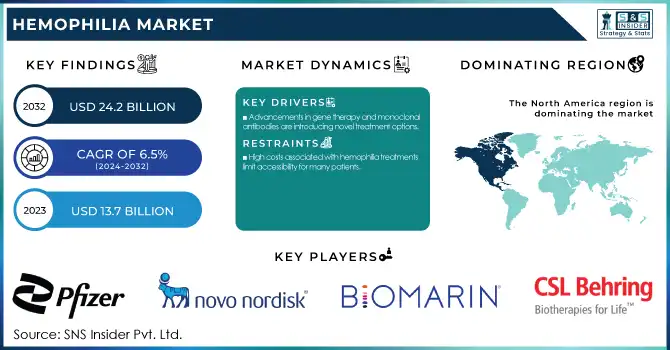

The Hemophilia Market Size was valued at USD 13.7 Billion in 2023 and is expected to reach USD 24.2 Billion by 2032, growing at a CAGR of 6.5% over the forecast period 2024-2032.

Get More Information on Hemophilia Market - Request Sample Report

The Hemophilia Market report offers key statistics and emerging trends that shaping the industry. It addresses incidence and prevalence figures, identifying diagnosed and undiagnosed patients throughout the world. The report reviews treatment adoption patterns with emphasis on the prescription behaviour of clotting factor therapies, gene therapy, and novel non-factor therapies. It also reviews drug volume forecasts, monitoring manufacturing and demand changes. Additionally, the report discusses therapeutic innovations, such as gene therapy breakthroughs, and evaluates the regulatory and reimbursement environment by region, providing insights on pricing, accessibility, and market dynamics. The hemophilia market is facing immense growth fueled by growing awareness, enhanced diagnostic methods, and advancements in treatment modalities.

Hemophilia Market Dynamics:

Drivers

-

Advancements in gene therapy and monoclonal antibodies are introducing novel treatment options.

Advancements in gene therapy and monoclonal antibodies are significantly transforming hemophilia treatment, offering promising alternatives to traditional therapies. Recent developments have demonstrated substantial efficacy in reducing bleeding episodes and improving patient outcomes. Pfizer's hemophilia A gene therapy had an impressive annual bleeding rate in a key Phase III study. In an analysis of 75 patients, 84% sustained Factor VIII levels greater than 5% at 15 months after infusion, demonstrating durable efficacy.

In the same vein, CSL's HEMGENIX, Europe's first approved hemophilia B gene therapy showed a 64% reduction in annual bleeding rates. Cure of hemophilia following treatment enabled 96% of patients to stop routine Factor IX prophylaxis, underscoring the potential of this therapy to reduce treatment frequency. A landmark study from the Centre for Stem Cell Research at Christian Medical College, Vellore, India, treated five severe hemophilia A patients with gene transfer, and under a total follow-up of 81 months, there were zero bleeding events in any subject, demonstrating the efficacy of the therapy. Novo Nordisk's Alhemo, approved by the U.S. FDA in December 2024, provides another treatment alternative to patients with hemophilia aged 12 years and older with inhibitors to standard factor replacement therapies. Administered via subcutaneous injection, Alhemo is expected to be available by February 2025.

Restraints:

-

High costs associated with hemophilia treatments limit accessibility for many patients.

The high cost of hemophilia treatments significantly limits patient accessibility. For example, Roche's Hemlibra, a treatment for hemophilia, now costs about USD 600,000 annually after an 8% increase. Novel therapies will strain payers More recently, CSL Behring's gene therapy for hemophilia B, Hemgenix, has been just been listed at USD 3.5 million per dose, thus becoming the world's most expensive drug so far. That characteristic, along with considerable research, development, manufacturing, and regulatory compliance costs, is cited for these high costs of biologic drug development. As a result, these high-priced life-saving therapies are unattainable for significant proportions of patients, particularly in areas where the healthcare infrastructures are less developed. Even in developed countries, incomplete insurance coverage and variable access to financial assistance schemes increase the financial burden for patients. Not only does this economic barrier limit access to essential therapies but also causes disparities in health among hemophilia patients around the world.

Opportunities:

-

Emerging gene therapy approaches offer potential long-term solutions for hemophilia management.

Gene therapy is emerging as a transformative opportunity in hemophilia treatment, offering the potential for long-term solutions. The recent advances that have shown to markedly reduce bleeding and infrequent requirement for repeat infusions. Pfizer's gene therapy for hemophilia A significantly lessened annual bleeding compared to standard Factor VIII replacement therapy in a pivotal Phase III clinical trial. Importantly, 84% of participants had Factor VIII levels above 5% at 15 months post-infusion, indicating sustained therapeutic benefits. The same has been found for hemophilia B, where bleeds were reduced by 71% with a single infusion of the gene therapy fidanacogene elaparvovec (Beqvez, Pfizer) compared to conventional Factor IX prophylaxis. It achieved an annualized infusions reduction of 92.3% and also reduced Factor IX consumption by 92.4%, which suggests that the therapy has the potential to be life changing for patients. In India, a groundbreaking study by the Centre for Stem Cell Research at Christian Medical College, Vellore, successfully conducted the country's first in-human gene therapy for hemophilia A. With the innovative approach, five patients were treated, and there were no bleeding events observed among them for a total follow-up of 81 months, showing the efficacy and durability of the therapy.

Challenges:

-

Limited access to healthcare facilities in certain regions hinders effective hemophilia management.

Restricted access to healthcare centers considerably inhibits effective hemophilia management, particularly in nations such as India. Despite an estimated 80,000 to 100,000 severe hemophilia cases nationwide, only about 21,000 are registered, indicating that nearly 80% remain undiagnosed due to lack of awareness and diagnostic facilities. Treatment accessibility is also a concern. Currently, only 4% of Indian children with hemophilia are being given prophylactic treatment, compared to 80-90% are treated in developed nations. Such unevenness results in recurrent bleeding incidents and chronic deterioration of joints among untreated patients. The shortages of clotting factor concentrates contribute to the difficulties. Such difficulty leads to aggravated disability and reduced quality of life among hemophilia patients in communities with poor medical infrastructure.

Hemophilia Market Segmentation Insights:

By Type

In 2023, Hemophilia A accounted for the largest share at 73%. There are several reasons for this dominance, hemophilia A is more frequent than the other hemophilia types. Hemophilia A is three to four times as common as hemophilia B, according to the Centers for Disease Control and Prevention, and the larger share of Hemophilia A in the market can also be attributed to a higher number of treatment options and continued research that is focused on this type. The CDC estimates that among all males with hemophilia, slightly more than 4 in 10 have the severe form, which requires more intensive and frequent treatment. In addition, the major shares of Hemophilia A can be attributed to the fact that patients with severe forms tend to utilize more costly therapies which employ advanced technology. The market is further boosted due to growing approval of new treatments specifically for Hemophilia A by the FDA, which has provided more options available for patients.

Government initiatives have significantly contributed to the excellence of the Hemophilia A market segment. Data and algorithms to determine the future trajectory of hemophilia care development Hemophilia A, with its underdeveloped therapies, should benefit from time by focusing on strengthening surveillance and data and research capabilities of healthcare systems to rapidly respond to the treatment market.

By Treatment

The prophylaxis segment held the majority share of 47% in 2023. The large market share is due to increased focus on preventive care and the demonstrated success of prophylactic treatment in reducing bleeding episodes and improving the quality of life of hemophilia patients. According to the CDC, prophylaxis is now considered the standard of care for individuals with severe hemophilia, particularly in developed countries. The dominance of the prophylaxis segment is supported by clinical evidence and government recommendations. The CDC and other health organizations recommend prophylactic treatment, particularly in children, to avoid damage to the joints and other complications related to repeated bleeding. The results have been proven to drastically minimize the number of hemorrhagic occurrences as well as the hospitalization rates of hemophiliacs.

Furthermore, government initiatives to improve access to prophylactic treatment have contributed to its market dominance. National hemophilia programs, which are now being established in many countries, have a strong emphasis on prophylaxis for pediatric patients in particular. Combined with growing awareness in healthcare providers and patients regarding the advantages of prophylaxis, these programs have fueled the growth of this segment.

By Therapy

In 2023, factor replacement therapy segment captured the largest market share of 60%. The major share can be attributed to the established effectiveness of factor replacement therapy and its long-established use in the management of the disorder. In the case of hemophilia, factor replacement therapy involves infusing the missing clotting factor into the patient’s bloodstream to treat or prevent bleeding episodes. The dominance of factor replacement therapy is supported by extensive clinical data and recommendations from health authorities. The CDC and other organizations recognize factor replacement as the primary treatment for hemophilia, particularly for severe cases. Overwhelming clinical evidence and guidance from health authorities support the use of factor replacement therapy as the standard of care. According to CDC data, among all males with hemophilia, just over 4 in 10 have the severe form of the disorder, necessitating regular factor replacement therapy.

The continuous improvements in factor replacement products. Improved treatment efficacy with recombinant factors and their extended half-life counterparts have revolutionised the treatment of patients with bleeding disorders and facilitated a shift from intravenous injections to subcutaneous infusions, helping to improve patient adherence and quality of life. These advancements have kept factor replacement therapy at the forefront of hemophilia treatment, despite the emergence of newer therapies.

By Distribution Channel

The specialty pharmacies segment held a 62% market share of the hemophilia market in 2023. The treatment of hemophilia is highly specialized, and the management of patients with hemophilia is complex, contributing to this large market share. Role of specialty pharmacies in dispensing hemophilia medications, patient education, and support services needed for disease management Government data and health practice make it clear that specialty pharmacies dominate care for people with hemophilia. The CDC states that the majority of hemophilia patients in the United States receive treatment through a system of federally funded hemophilia treatment centers (HTCs) These centers typically collaborate with specialty pharmacies, ensuring that patients have access to needed medicines and supplies.

Another significant factor leading to the rise of specialty pharmacies in hemophilia care is due to different companies and governments creating policies and regulations that require strict adherence to treatment protocols. State Medicaid programs and other government healthcare initiative have acknowledged the advantages of using specialty pharmacy services and have linked their increasing use in the distribution of hemophilia medications.

Hemophilia Market Regional Analysis:

In 2023, North America region dominated and held the largest market share 45%. There are several factors contributing to this dominance, such as an advanced healthcare infrastructure, high levels of awareness, and considerable research and development spending. As per the CDC, approximately 33,000 males are living with hemophilia in the United States alone, which shows that a large patient population is present who is driving the market growth. Government initiatives in both regions have played crucial roles in shaping the market. In North America, the CDC's efforts in surveillance and research have led to better understanding and management of hemophilia.

The Asia-Pacific region is projected to grow at the highest CAGR over the forecast period. The rapid growth is mainly driven by the enhancing healthcare infrastructure, increasing diagnosis rate, and rising awareness of hemophilia in countries such as China and India. According to the World Federation of Hemophilia, these nations have experienced a notable surge in identified cases of hemophilia in recent years, indicating a growing market for hemophilia treatments. Government initiatives in the Asia-Pacific region focused on enhancing access to hemophilia care in rural parts of the region are also supporting the growth of the market. Such as the inclusion of hemophilia in India's National Health Mission priority disease list resulting in increased funding and awareness campaigns.

Need any customization research on Hemophilia Market - Enquiry Now

Key Players in Hemophilia Market

Key Service Providers/Manufacturers

-

Pfizer Inc. (Hympavzi, Beqvez)

-

Novo Nordisk A/S (Alhemo, NovoEight)

-

BioMarin Pharmaceutical Inc. (Roctavian)

-

CSL Behring (Hemlibra, Idelvion)

-

Swedish Orphan Biovitrum AB (Sobi) (Elocta, Alprolix)

-

Sanofi S.A. (Efanesoctocog alfa, Alprolix)

-

Roche Holding AG (Hemlibra)

-

Takeda Pharmaceutical Company Limited (Advate, Adynovate)

-

Octapharma AG (Nuwiq, Wilate)

-

Grifols S.A. (Alphanate, Alphanine SD)

Users

-

Mayo Clinic

-

Cleveland Clinic

-

Great Ormond Street Hospital

-

St. Jude Children's Research Hospital

-

Royal Free Hospital

-

Apollo Hospitals

-

Fortis Healthcare

-

AIIMS (All India Institute of Medical Sciences)

-

National Hemophilia Center,

-

Haemophilia Treatment Centre, Alfred Hospital

Recent Developments:

-

In August 2023, the Food and Drug Administration (FDA) approved Hemgenix, the initial gene therapy for hemophilia B, a transformative treatment option from CSL Behring that can potentially cure patients with hemophilia B in a single administration and also represents an exciting evolution in hemophilia care.

-

In February 2024, Novo Nordisk released positive clinical trial data for concizumab, which is a subcutaneous treatment indicated for both hemophilia A and B, from a phase 3 trial showing that the dose for concizumab prevents bleeding episodes and offering potential convenience versus infusion treatment for patients.

| Report Attributes | Details |

|---|---|

|

Market Size in 2023 |

USD 13.7 Billion |

|

Market Size by 2032 |

USD 24.2 Billion |

|

CAGR |

CAGR of 6.5% From 2024 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2032 |

|

Historical Data |

2020-2022 |

|

Report Scope & Coverage |

Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

|

Key Segments |

• By Type (Hemophilia A, Hemophilia B, Others) |

|

Regional Analysis/Coverage |

North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

|

Company Profiles |

Pfizer Inc., Novo Nordisk A/S, BioMarin Pharmaceutical Inc., CSL Behring, Swedish Orphan Biovitrum AB (Sobi), Sanofi S.A., Roche Holding AG, Takeda Pharmaceutical Company Limited, Octapharma AG, Grifols S.A. |