Gene Therapy Market Report Scope & Overview:

Get more information on Gene Therapy Market - Request Free Sample Report

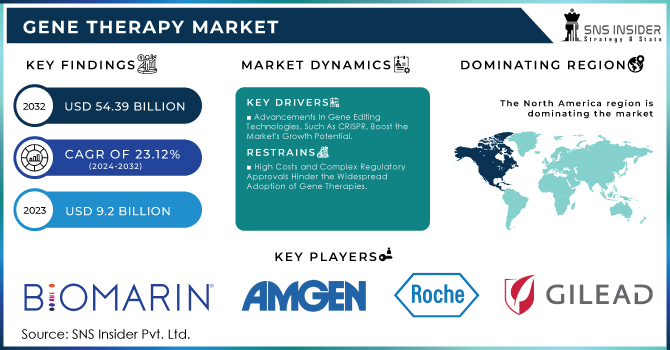

The Gene Therapy Market Size was valued at USD 9.2 Billion in 2023, and is expected to reach USD 54.39 Billion by 2032, and grow at a CAGR of 23.12%.

The gene therapy market has been rapidly growing in recent years due to significant advancements in biotechnology, genomics, and gene-editing technologies. Several gene therapies have received regulatory approval for specific genetic disorders, such as certain types of inherited blindness, spinal muscular atrophy, and rare immune deficiencies. The market potential for gene therapy is substantial, as it holds the promise of treating a wide range of genetic diseases that were previously considered incurable. However, it is essential to note that gene therapy is a complex and challenging field with various technical, regulatory, and ethical considerations. One of the major advantages of gene therapy products is that they are subject to rigorous regulatory approval before they can be marketed. They work at the genetic level, and their therapeutic effects are relatively more effective and longer-lasting than those of other traditional medicines. Due to this advantage, the number of approvals for gene therapy products is expected to increase. The US FDA has already approved over 10 products from 2021 to 2023, and there are a high number of products in the final stages of the clinical pipeline that will gain final approval and start marketing in the forecast period. Therefore, this is a major factor contributing to the growth of the market over the forecast period. Furthermore, the number of research and development activities for cell and gene therapy is increasing.

This is particularly the case because cell and gene therapy can mainly address problems associated with a specific group of incurable diseases. Therefore, it provides an opportunity for pharmaceutical and biotechnology companies to develop and market new types of cell and gene therapies. In addition to this, cell and gene therapies are the result of targeted therapy, which is one of the reasons they are widely adopted. Due to this reason, gene and cell therapies have been a source of treatment after reduction. However, repetition remains a threat, reducing the quality of patient treatment for long-term recovery.

MARKET DYNAMICS:

Key Drivers:

-

The Increasing Prevalence of Genetic Disorders and Chronic Diseases Drives the Demand for Gene Therapy Solutions.

-

Advancements In Gene Editing Technologies, Such As CRISPR, Boost the Market's Growth Potential.

Restraints:

-

High Costs and Complex Regulatory Approvals Hinder the Widespread Adoption of Gene Therapies.

-

Limited Clinical Success Rates and Safety Concerns Pose Challenges to Market Expansion.

Opportunity:

-

Growing Investment In R&D For Novel Gene Therapies.

-

Expanding Applications in Oncology and Rare Diseases.

KEY MARKET SEGMENTATION:

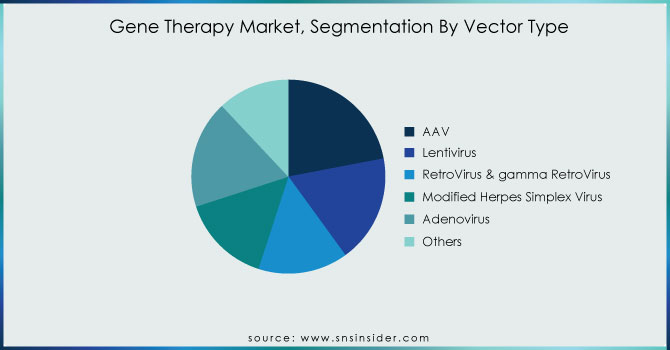

By Vector Type

The share of the AAV market segment was 22% in 2023. Several biopharmaceutical manufacturing firms have offered their viral vector platform for the manufacture of AAV gene therapy products. For example, a strategic research agreement to engineer novel adeno-associated virus AAV capsids that can deliver transformative gene therapy drugs that can address the root genetic issues that underlie various neuromuscular and central nervous system CNS disorders. The United States Department of Commerce’s National Institute of Standards and Technology NIST, the National Institute for Innovation in Manufacturing Biopharmaceuticals NIIMBL, and the United States Pharmacopeia announced a collaboration on AAV in July 2021. The trio will evaluate current analytical approaches and formulate procedures for AAV. As part of the agreement, multiple labs will perform an interlaboratory analysis of these vital quality characteristics, and the outcomes will be compared and analyzed. The exciting new gene therapy technologies will be boosted thanks to this collaborative effort, which will transform people’s lives.

Get Customized Report as per your Business Requirement - Request For Customized Report

By Indication

The spinal muscular atrophy segment dominated the market in 2023 by 21% of the market share. However, this disease is not frequent; it is one of the most common fatal inherited disorders of infancy. With the advent of Zolgensma AVXS-101, it has been evaluated that it is also effective in treating SMA, and constitutes a phenotypic transformation of the disorder. With this technology, the FDA gave its full approval to Novartis’ Zolgensma set to treat the primary cause of SMA. Zolgensma is also the only gene therapy product in this market. From recent findings, it can be inferred that the approval of Zolgensma types shows how the industry is increasingly utilizing therapies for severe inherited illnesses. Over the projection period, the Beta-Thalassemia Major/SCD segment is expected to register the fastest CAGR. SCD and β-thalassemia therapies are based on the transplantation of gene-modified hematopoietic stem cells. Clinical and preclinical trials show that this therapy is effective and safer.

However, its effectiveness is still compromised by other factors such as suboptimal gene expression levels & gene transfer efficiency, scarce stem-cell dosage and quality, and toxicity of myeloablative regimens. Also, the product was granted Orphan Drug status by the U.S. FDA for the management of patients with sickle cell disease. In addition to this, Vertex Pharmaceuticals also partnered with CRISPR Therapeutics in April 2021 for the development, production, and commercialization of CTX001 in sickle beta thalassemia and cell disease. The advancements in this segment are anticipated to play an essential role in driving the market’s growth in this segment.

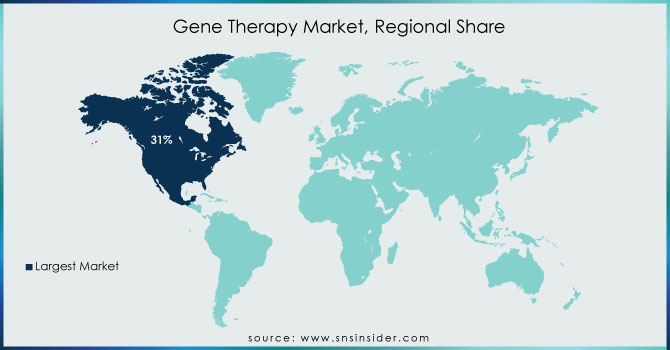

REGIONAL ANALYSIS:

In terms of revenue, North America dominated the market with a 31% revenue share in 2023. During the forecast period, the region is expected to become the largest routine manufacturer of gene therapy in terms of approvals and revenue generated. An increasing number of investments by large and small companies for R&D to develop the ideal therapy drug and approval of gene therapy across the U.S. are expected to drive the market growth. For example, in 2020 and 2021, the NIH investment in Gene Therapy in the United States was USD 403 million and USD 481 million in 2020 and 2021 respectively. Over the estimated period, increasing investment in gene therapy in the United States will raise the development of gene therapies in this region, thus driving the growth of the market.

KEY PLAYERS:

The key market players are BioMarin., Amgen Inc., F. Hoffmann-La Roche, Gilead Sciences, Inc., Merck & Co., Legend Biotech., Bristol-Myers Squibb Company, Sarepta Therapeutics, Inc., Novartis AG, uniQure N.V. and Other players.

RECENT DEVELOPMENTS

-

In June 2023, U.S. FDA approved Sarepta for ELEVIDYS gene therapy to treat DMD in children of age 4-5 years

-

In January 2023, Voyager Therapeutics and Neurocrine Biosciences entered into a strategic collaboration for the commercialization & development of Voyager’s GBA1 program and other next-generation gene therapies for neurological diseases

-

In January 2023, Spark Therapeutics and Neurochase established a strategic collaboration to develop Neurochase’s unique delivery technology for use with selected gene treatments for rare disorders in the CNS. In this agreement, Neurochase will contribute its extensive knowledge in direct drug delivery technology to Spark’s premier AAV platform.

-

In January 2022, 64x Bio raises USD 55M in funding to advance their gene therapy manufacturing platform. With this initiative, the company is expected to expand its VectorSelect platform.

|

Report Attributes |

Details |

|---|---|

|

Market Size in 2023 |

US$ 9.20 Billion |

|

Market Size by 2032 |

US$ 54.39 Billion |

|

CAGR |

CAGR of 23.12% From 2024 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2032 |

|

Historical Data |

2020-2022 |

|

Report Scope & Coverage |

Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

|

Key Segments |

•By Indication (Acute Lymphoblastic Leukemia (ALL), Inherited Retinal Disease, Large B-cell lymphoma, Melanoma (lesions), Beta-Thalassemia Major/SCD, Spinal Muscular Atrophy (SMA) & Others) |

|

Regional Analysis/Coverage |

North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

|

Company Profiles |

BioMarin., Amgen Inc., F. Hoffmann-La Roche, Gilead Sciences, Inc., Merck & Co., Legend Biotech., Bristol-Myers Squibb Company, Sarepta Therapeutics, Inc., Novartis AG, uniQure N.V. and Other players |

|

Key Drivers |

•The Increasing Prevalence of Genetic Disorders and Chronic Diseases Drives the Demand for Gene Therapy Solutions. |

|

RESTRAINTS |

•High Costs and Complex Regulatory Approvals Hinder the Widespread Adoption of Gene Therapies. |