Bleeding Disorders Treatment Market Size & Overview:

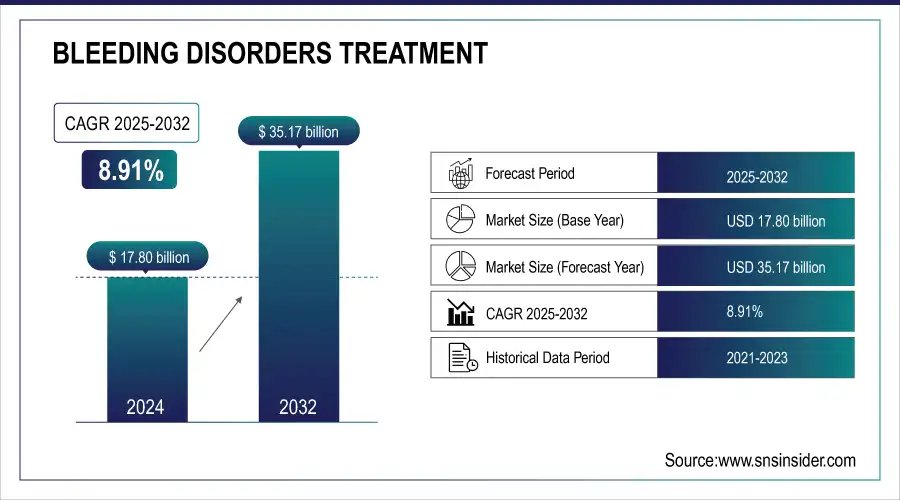

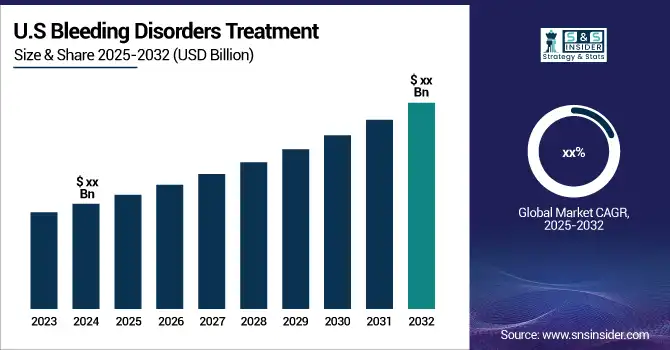

The Bleeding Disorders Treatment Market Size was USD 17.80 Bn in 2024 and is projected to reach USD 35.17 Bn by 2032, growing at 8.91% CAGR.

The Bleeding Disorders Treatment Market is growing enormously because of the increasing incidence of bleeding disorders such as hemophilia, Von Willebrand disease (vWD), and other rare clotting disorders. Hemophilia, primarily Hemophilia A and B, is the most common, with an estimated incidence of about 1 in 5,000 male births worldwide. This has driven the demand for advanced therapies to improve the quality of life of patients and decrease the risks associated with bleeding events.

To get more information on Bleeding Disorders Treatment Market - Request Free Sample Report

In the past few years, gene therapy and recombinant proteins have changed the landscape of treatment. For example, CSL announced the three-year results from the HOPE-B study for etranacogene dezaparvovec-drlb, a gene therapy for Hemophilia B that has confirmed long-term safety and efficacy post one-time infusion in December 2023. Similarly, Takeda's ADAMTS13, recombinant-krhn was approved by the U.S. FDA in November 2023 approved it as the treatment for congenital thrombotic thrombocytopenic purpura or cTTP. That's a milestone in treating rare blood disorders.

Additionally, Novo Nordisk has been in the lead with Mim8, a potential once-weekly or monthly prophylactic treatment for hemophilia A, while concizumab (another treatment from Novo Nordisk) has been recommended by the EMA for approval as a once-daily subcutaneous prophylactic treatment for hemophilia A or B with inhibitors, which could change the management of these conditions.

The surge in biopharmaceutical innovations, including recombinant coagulation factors, gene therapies, and enzyme replacement therapies supports the growth in this market. Moreover, new clinical trials and research regarding new therapies for common and rare bleeding disorders are also projected to drive growth in this market over the next years.

Key Bleeding Disorders Treatment Market Trends:

-

High prevalence of Hemophilia A, Hemophilia B, and Von Willebrand Disease increasing the need for specialized treatment.

-

Rising patient population creating significant demand for advanced and convenient therapies.

-

Recent approvals of innovative gene therapies like etranacogene dezaparvovec-drlb transforming treatment approaches.

-

Clinical evidence, such as the HOPE-B study, confirming long-term efficacy and safety of new therapies.

-

Adoption of recombinant factor concentrates improving treatment effectiveness and patient quality of life.

Bleeding Disorders Treatment Market Growth Drivers:

-

The increase in the world prevalence of bleeding disorders, especially hemophilia, represents a principal driver of the bleeding disorders treatment market.

Hemophilia A accounts for about 80% of all cases of hemophilia. It afflicts 1 in every 5,000 males born worldwide, and Hemophilia B affects 1 in every 25,000 males. The patients have led to a greatly increased number of patients needing specialized treatment. Moreover, diseases such as Von Willebrand Disease (vWD), which is the most common hereditary bleeding disorder, have a prevalence of about 1 in 1,000 individuals around the world thereby further increasing the markets' potential. With growing patient numbers, there is a significant demand for better and easier treatments to address these lifetime conditions.

-

Advances in gene therapy and recombinant therapies are increasingly driving the growth of this market in bleeding disorders.

Recent approvals, such as etranacogene dezaparvovec-drlb for Hemophilia B, with long-term efficacy from a single infusion, are revolutionizing treatment choices. For instance, the HOPE-B study, which in December 2023 confirmed the durability and safety of this gene therapy, exemplifies the potential for gene therapy to replace regular infusions and reduce bleeding episodes in hemophilia patients. Similarly, recombinant factor concentrates have enabled more effective treatment of bleeding disorders, helping prevent spontaneous bleeding and improve the quality of life for patients. Such innovations are expected to result in long-term growth in the market.

Market players driving the growth of the Bleeding Disorders Treatment Market through gene therapy and recombinant therapies:

| Company | Key Therapy | Focus Area | Recent Developments |

|---|---|---|---|

|

CSL Behring |

Etranacogene dezaparvovec-drlb (Gene Therapy for Hemophilia B) |

Gene therapy for Hemophilia B |

The HOPE-B study (December 2023) confirmed long-term durability and safety with a one-time infusion. |

|

Takeda |

ADAMTS13, recombinant-krhn (Recombinant Enzyme Replacement Therapy) |

Treatment for Congenital Thrombotic Thrombocytopenic Purpura (cTTP) |

FDA approval in November 2023 for the first recombinant enzyme replacement therapy for cTTP. |

|

Novo Nordisk |

Mim8 (Recombinant Therapy for Hemophilia A) |

Prophylactic treatment for Hemophilia A |

Positive phase 3 results for once-weekly and once-monthly dosing (June 2024). |

|

|

Concizumab (Recombinant Therapy for Hemophilia A or B with inhibitors) |

Prophylactic treatment for Hemophilia A and B with inhibitors |

EMA recommendation for approval (October 2024), a once-daily subcutaneous therapy for patients with inhibitors. |

Bleeding Disorders Treatment Market Restraints:

-

Limited Patient Population Hindering Market Growth of Bleeding Disorders Treatment

One of the biggest challenges facing the treatment market for bleeding disorders is the low number of patients for certain rare conditions, such as congenital thrombotic thrombocytopenic purpura (cTTP) and specific subtypes of Von Willebrand Disease (vWD). Such conditions are very rare; cTTP, for example, affects only 1 in a million. The low number of patients puts a cap on the demand for specialized therapies, hence diminishing the incentive for companies to invest heavily in research and development. This results in slow treatment adoption and market growth.

Bleeding Disorders Treatment Market Segment Analysis:

By Type

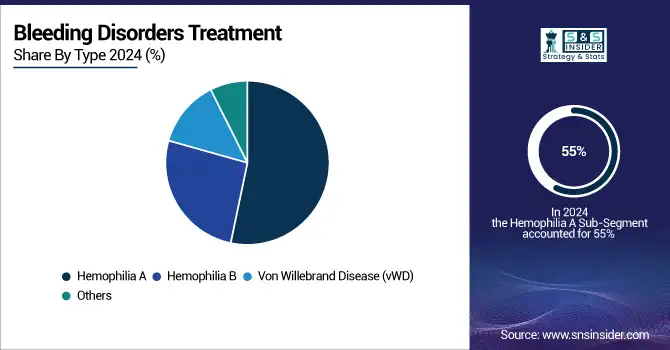

Hemophilia A segment dominated the bleeding disorders market with a market share of 55% in 2023. This is because Hemophilia A accounts for the majority at 80% of hemophilia cases globally. With an estimated figure of 1 in 5,000 male births affected, it drives a significant portion of the demand for treatments for bleeding disorders. Still ongoing are the advancements within recombinant therapies, including gene therapies specifically targeted toward Hemophilia A.

Von Willebrand Disease is the fastest-growing segment in this market with the highest CAGR during the forecast period. vWD is the most common inherited bleeding disorder, affecting about 1 in 1,000 people worldwide. Its growth is driven by increased diagnosis rates and better treatment options, especially for those with severe vWD. The growing awareness, improved diagnostic tools, and the introduction of new treatments tailored to vWD are expected to fuel this segment's growth over the forecast period.

By Drug Class

The Recombinant Coagulation Factor Concentrates segment dominated the market with a market share of 40% in 2023. This is because the high efficacy rate, better safety profiles, and ability to avoid bleeding events have made them standard treatments in Hemophilia A and B cases. These products have essentially replaced plasma-derived therapy as a treatment choice primarily because recombinant drugs are less likely to spread blood-borne pathogens; they can offer long-term benefits through fewer injections and are significantly pure.

The desmopressin segment is the fastest growing in the bleeding disorder treatment market, mainly for its increasing use in mild Hemophilia A and Von Willebrand Disease (vWD). Desmopressin is favored because of its affordability, ease of administration, and effectiveness in promoting blood clotting in patients with these milder forms of bleeding disorders. As awareness spreads, its use is being extended, especially in settings where more expensive therapies cannot be accessed.

By End-User

The hospital segment dominated the market with a market share of 50% in 2023. This is generally because the condition is much more complex, and most need hospital-based treatment. All advanced medical structures and specialty care providers are to be found within hospitals in managing treatments for conditions like Hemophilia and vWD through gene therapies, recombinant factor concentrates, and even newer treatments available. In addition, advanced treatment is usually expensive, which makes it more readily available in hospitals where all services are provided.

Bleeding Disorders Treatment Market Regional Analysis:

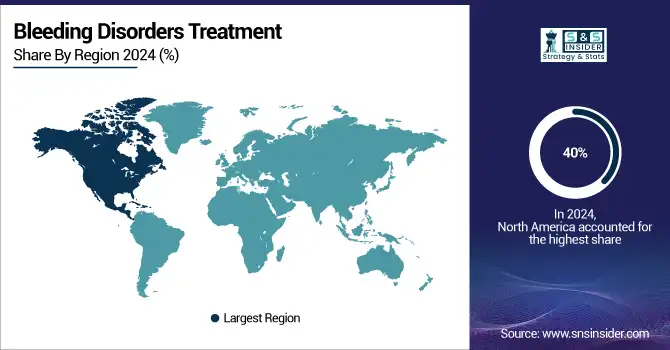

North America Bleeding Disorders Treatment Market Insights

North America dominated the bleeding disorders treatment market with a 40% market share, largely driven by the high prevalence of hemophilia and other bleeding disorders, advanced healthcare infrastructure, and a high adoption rate for treatment. The United States in particular is one of the largest markets because of a large patient population suffering from bleeding disorders. Several top pharmaceutical companies in the United States are involved in research and development, producing next-generation treatments like gene therapies and recombinant factor concentrates. The region also boasts a strong healthcare system, insurance, and easy access to specialized medical centers with comprehensive care for bleeding disorder patients. The approval processes for new treatments by the FDA in North America are much faster than those in other regions. Further, ongoing research and development work in the United States and Canada continue to advance the science behind treatment innovation, especially concerning recombinant therapies and gene therapies.

Get Customized Report as per Your Business Requirement - Enquiry Now

Asia Pacific Bleeding Disorders Treatment Market Insights

Asia Pacific is the fastest-growing region in the bleeding disorders treatment market during the forecast period. The region is seeing tremendous growth due to awareness and improvement in healthcare infrastructure as well as rising diagnostic capabilities. In countries like China and India, where immense underserved populations are suffering from bleeding disorders, the market is expanding as better options are becoming available. With improving economic conditions, more patients in these regions are gaining access to advanced therapies such as recombinant coagulation factor concentrates and desmopressin. Also, increasing healthcare expenditures and the attempts to enhance the diagnosis of bleeding disorders are fuelling market growth. Continued rapid adoption of newer therapies, such as gene therapies, should be expected with modernization in countries' healthcare systems and public health initiatives that increase awareness of rare bleeding disorders.

Europe Bleeding Disorders Treatment Market Insights

Europe represents a mature market for bleeding disorders treatment, driven by strong healthcare infrastructure, widespread access to advanced therapies, and supportive reimbursement policies. Rising prevalence of hemophilia and von Willebrand disease, coupled with ongoing clinical research and government initiatives, are fostering market expansion across countries such as Germany, France, and the U.K.

Latin America (LATAM) and Middle East & Africa (MEA) Bleeding Disorders Treatment Market Insights

LATAM and MEA markets are gradually expanding, supported by increasing diagnosis rates, improving healthcare facilities, and growing availability of recombinant therapies. Government programs to enhance rare disease awareness, along with international partnerships for affordable treatment access, are fueling demand. Brazil, Mexico, Saudi Arabia, and South Africa are key contributors to regional market growth.

Bleeding Disorders Treatment Market Key Players:

-

Biogen Inc. (Eloctate, Alprolix)

-

CSL Behring (Humate-P, Idelvion)

-

Pfizer Inc. (BeneFIX, Xyntha)

-

Novo Nordisk A/S (Novoeight, Refixia)

-

Grifols S.A. (Alphanate, Fanhdi)

-

Bayer AG (Kogenate, Jivi)

-

Octapharma AG (Wilate, Nuwiq)

-

Sanofi (Altuviiio, Obizur)

-

Roche (Hemlibra, ACE910)

-

Takeda Pharmaceutical (Advate, Feiba)

-

Ferring Pharmaceuticals (Desmopressin, Stimate Nasal Spray)

-

Baxter International (Obizur, Rixubis)

-

Amgen Inc. (Investigational therapies)

-

Alnylam Pharmaceuticals (RNAi-based treatments)

-

Bristol-Myers Squibb (Clinical-stage therapies)

-

Janssen Pharmaceuticals (Coagulopathy treatments)

-

Zydus Lifesciences (Plasma-derived factor concentrates, Generic antifibrinolytics)

-

Sun Pharmaceuticals (Tranexamic acid, Desmopressin)

-

AbbVie Inc. (Clotting factor stabilizers, Anticoagulant reversal agents)

-

Bausch & Lomb (Hemostatic products, Specialty bleeding management solutions)

Key suppliers

-

Lonza Group AG Suppliers

-

Thermo Fisher Scientific Inc. Suppliers

-

Merck KGaA (MilliporeSigma) Suppliers

-

Cytiva Suppliers

-

Bio-Rad Laboratories, Inc. Suppliers

-

Sartorius AG Suppliers

-

Charles River Laboratories International, Inc. Suppliers

-

WuXi Biologics Suppliers

-

Octapharma AG Suppliers

-

Catalent, Inc. Suppliers

Competitive Landscape for Bleeding Disorders Treatment Market:

Novo Nordisk A/S is a global leader in bleeding disorders treatment, offering innovative therapies such as Novoeight and Refixia for hemophilia management. The company focuses on developing advanced recombinant factor products and long-acting treatments, enhancing patient outcomes. Strong R&D investments and global presence solidify its position in the market.

-

June 2024: Novo Nordisk revealed positive outcomes from the phase 3 FRONTIER2 trial, which involved 254 participants aged 12 and older with hemophilia A, both with and without inhibitors. The trial assessed Mim8, an investigational therapy, under once-weekly and once-monthly prophylactic treatment regimens aimed at reducing prolonged and spontaneous bleeding episodes.

Takeda Pharmaceutical Company is a key player in the bleeding disorders treatment market, providing leading therapies such as Advate and Feiba. With a strong commitment to innovation, Takeda develops advanced plasma-derived and recombinant factor products. Its global reach and focus on rare disease care reinforce its leadership in hemophilia management.

-

November 2023: Takeda achieved a milestone with the U.S. FDA approval of ADAMTS13, recombinant-krhn. This marks the first-ever recombinant ADAMTS13 enzyme replacement therapy designed to treat congenital thrombotic thrombocytopenic purpura (cTTP), providing a groundbreaking therapeutic option for patients with this rare blood disorder.

| Report Attributes | Details |

| Market Size in 2024 | USD 17.80 Billion |

| Market Size by 2032 | USD 35.17 Billion |

| CAGR | CAGR of 8.91% From 2024 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Hemophilia A, Hemophilia B, Von Willebrand Disease (vWD), Others) • By Drug Class (Plasma Derived Coagulation Factor Concentrates, Recombinant Coagulation Factor Concentrate, Desmopressin, Antifibrinolytics, Fibrin Sealants, Other Bleeding Disorders Treatment) • By End-Users (Hospitals, Clinics, Research Institutes, Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Biogen Inc., CSL Behring, Pfizer Inc., Novo Nordisk A/S, Grifols S.A., Bayer AG, Octapharma AG, Sanofi, Roche, Takeda Pharmaceutical, Ferring Pharmaceuticals, Baxter International, Amgen Inc., Alnylam Pharmaceuticals, Bristol-Myers Squibb, Janssen Pharmaceuticals, Zydus Lifesciences, Sun Pharmaceuticals, AbbVie Inc., Bausch & Lomb. |