High Performance Message Infrastructure Market Report Scope & Overview:

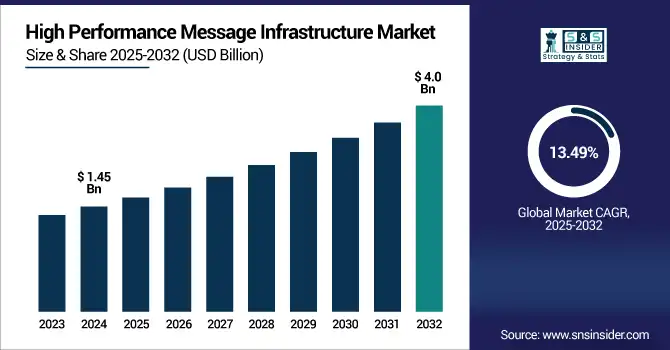

The high performance message infrastructure market size was valued at USD 1.45 billion in 2024 and is expected to reach USD 4.0 billion by 2032, growing at a CAGR of 13.49% during 2025-2032.

To Get more information on High Performance Message Infrastructure Market - Request Free Sample Report

The high performance message infrastructure market is witnessing significant growth due to rising demand for real-time communication, ultra-low latency, and high-throughput messaging solutions across industries like BFSI, telecommunications, and defense. These infrastructures enable seamless data exchange between distributed systems, which is vital for applications such as algorithmic trading, IoT, and edge computing. Key growth drivers include the rapid expansion of big data and analytics, increasing adoption of cloud-based architectures, and the need for scalable and secure messaging platforms. High Performance Message Infrastructure Market analysis highlights strong momentum fueled by digital transformation and the proliferation of connected devices. The future outlook remains positive as businesses prioritize efficient, high-speed data transmission. Emerging High Performance Message Infrastructure Market trends include AI-enabled message processing, integration with microservices architecture, and enhanced cybersecurity for message integrity.

The U.S. High Performance Message Infrastructure Market was valued at approximately USD 0.5 billion in 2024 and is projected to reach around USD 1.3 billion by 2032, growing at a CAGR of 13.21%. Growth is driven by the rising need for real-time data transmission in financial services, defense, and telecom sectors. Increased cloud adoption, AI-based messaging, and low-latency demands from algorithmic trading platforms further boost market expansion.

Market Dynamics:

Drivers:

-

Growing reliance on real-time analytics and ultra-low latency applications is driving increased adoption of high performance message infrastructure.

High-performance message infrastructures are critical for sectors like finance, telecom, and defense, where real-time decisions rely on rapid data exchange. In algorithmic trading, for instance, milliseconds can determine profit or loss, making ultra-low latency essential. As organizations scale their digital ecosystems, they require messaging solutions that ensure seamless, high-speed communication between distributed applications and systems. The growth of IoT, edge computing, and connected devices has further amplified the need for real-time messaging. These infrastructures not only improve operational efficiency but also enable instant insights from large data streams. This accelerating demand is a key driver for the market’s expansion globally, especially in technologically advanced economies.

For Instance, In 2024, over 82% of trading firms in the U.S. reported using ultra-low latency messaging for high-frequency trading systems, up from 76% in 2022.

Restraints:

-

The significant upfront investment and complex integration requirements are limiting adoption among cost-sensitive and mid-sized enterprises.

Deploying high performance message infrastructure involves substantial capital investment in hardware, software, and skilled personnel. These solutions must be integrated seamlessly with existing IT systems, which often involves customization, leading to higher upfront and operational costs. For small and medium-sized enterprises (SMEs), the expense of adopting such advanced messaging frameworks can be prohibitive. Moreover, ongoing maintenance, updates, and performance optimization add to long-term financial commitments. These cost barriers may limit adoption in price-sensitive markets and delay digital transformation in less mature regions. As a result, the high cost of deployment remains a significant restraint in broader market penetration, especially outside large enterprises and government sectors.

For Instance, In 2024, 63% of mid-sized enterprises cited high deployment and infrastructure costs as the primary barrier to adopting high-performance messaging solutions.

Opportunities:

-

Rising adoption of cloud-native architectures and AI-driven messaging workflows is creating new growth avenues for infrastructure vendors.

The growing adoption of AI-driven analytics, hybrid and multi-cloud environments, and microservices-based applications opens new opportunities for high performance message infrastructure vendors. These infrastructures are increasingly being designed to support dynamic workloads and scalable messaging across diverse platforms and environments. Cloud-native messaging solutions enable global scalability and resilience, while AI integration enhances intelligent routing, anomaly detection, and adaptive performance tuning. Additionally, microservices depend heavily on efficient, low-latency communication between distributed containers, creating ongoing demand for high-speed messaging backbones. Vendors that offer flexible, interoperable, and API-based infrastructures are well-positioned to capitalize on these technological trends, presenting a vast opportunity for long-term market growth and innovation.

In 2024, 80% of new enterprise applications were deployed in containers or Kubernetes environments, requiring message infrastructure compatible with microservices.

Challenges:

-

Managing secure, high-speed messaging across diverse platforms and legacy systems poses ongoing technical and compliance challenges.

One of the biggest challenges in the high performance message infrastructure market is ensuring interoperability across different platforms, networks, and protocols while maintaining security and performance. As enterprises deploy multi-vendor environments and hybrid infrastructures, maintaining consistent message delivery, order, and latency becomes technically complex. Moreover, safeguarding sensitive data in transit requires robust encryption, authentication, and compliance with evolving cybersecurity regulations. Integrating messaging infrastructures with legacy systems further adds layers of complexity. These technical hurdles demand skilled IT teams and advanced monitoring tools. Consequently, managing performance, security, and compatibility at scale continues to be a major challenge for both vendors and users, affecting adoption timelines and operational efficiency.

Segmentation Analysis:

By Component:

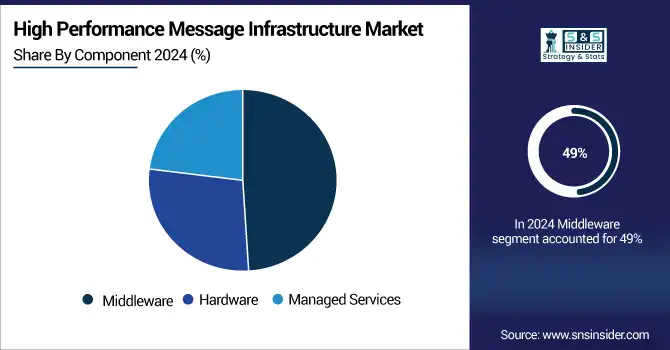

The Middleware segment dominated the market and accounted for 49% of high performance message infrastructure market share in 2024, driven by the critical role it plays in enabling real-time data flow between distributed systems. Its widespread adoption in financial services, telecom, and defense sectors supports seamless messaging, orchestration, and protocol translation, making it a core component in modern, latency-sensitive enterprise architectures.

In March 2025, Modern middleware platforms are incorporating AI-driven behavior-based access controls, real-time security patching, and automated compliance scanning to dynamically respond to evolving threats and ensure regulatory adherence

The Managed Services segment is expected to register the fastest CAGR through 2032, fueled by increasing demand for outsourcing complex infrastructure management. Enterprises are opting for cost-effective, scalable solutions that ensure 24/7 performance monitoring, system updates, and security. This shift enables businesses to focus on core operations while leveraging expert management of high-performance messaging platforms.

By Industry:

The BFSI segment dominated the high performance message infrastructure market in 2024 and accounted for a significant revenue share, due to its critical need for real-time transaction processing, ultra-low latency communication, and regulatory compliance. High-frequency trading, fraud detection, and instant settlement systems require robust messaging frameworks, pushing financial institutions to invest heavily in scalable, high-speed infrastructure to support their digital transformation strategies.

The Telecommunication segment is expected to register the fastest CAGR through 2032, driven by the rollout of 5G networks, edge computing, and increased demand for real-time service orchestration. Telecom operators are adopting high-performance messaging to manage massive device communication, ensure ultra-reliable low-latency transmissions, and enable AI-powered network automation and service delivery.

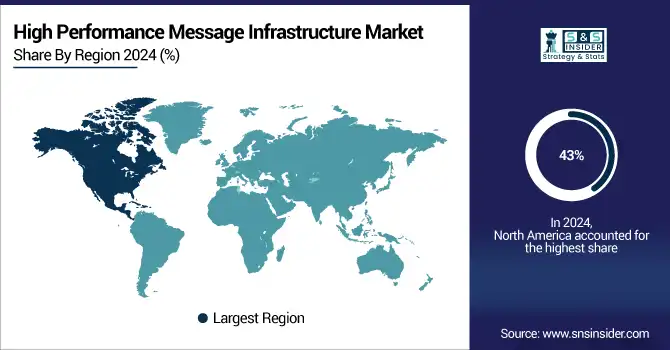

Regional Analysis:

North America dominated the high performance message infrastructure market in 2024 and accounted for 43% of revenue share, driven by advanced IT infrastructure, high adoption of algorithmic trading platforms, and strong presence of financial, defense, and telecom sectors. The region’s early embrace of low-latency systems, cloud-native architectures, and AI-enabled middleware continues to boost enterprise investment in real-time messaging and distributed data solutions.

Asia-Pacific is projected to register the fastest CAGR through 2032 during the forecast period, fueled by rapid digital transformation, booming fintech ecosystems, and increasing deployment of IoT and edge computing across manufacturing and telecom. Government-led smart city initiatives and rising cloud adoption among enterprises are further accelerating demand for scalable, low-latency messaging infrastructures across countries like China, India, and South Korea.

Europe’s high performance message infrastructure market growth is driven by increasing adoption of cloud-native platforms, regulatory compliance in financial messaging, and rising demand for low-latency solutions in automotive and manufacturing. The region is expected to witness steady expansion as enterprises modernize infrastructure and embrace AI-integrated messaging technologies.

A 2024 CNCF survey revealed 89 % of European organizations use or evaluate cloud-native technologies, with 80 % running Kubernetes in production

Germany dominated the European high performance message infrastructure market in 2024 due to its strong industrial base, advanced manufacturing sector, and robust financial services infrastructure. High investments in Industry 4.0 and real-time automation systems have positioned Germany as a key adopter of low-latency messaging solutions.

For Instance, In 2024, 46.5 % of German businesses had embraced cloud technologies, with another 11.1 % planning integration, reflecting strong modernization

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players:

The major high performance message infrastructure market companies are IBM Corporation, Microsoft Corporation, Amazon Web Services (AWS), Google LLC, Red Hat (IBM Subsidiary), Solace Corporation, TIBCO Software Inc., Confluent, Inc., VMware, Inc., Huawei Technologies Co., Ltd. and others

Recent Developments:

-

In September 2024, IBM Released IBM MQ 9.4 LTS, enhancing zHyperLink support for faster active log writes, 64-bit channel initiators, and improved streaming queue performance.

-

In March 2025, IBM Announced support for AMD Instinct MI300X accelerators in IBM watsonx AI and Red Hat OpenShift AI platforms to boost generative AI and AI-enhanced messaging workloads

| Report Attributes | Details |

| Market Size in 2024 | US$ 1.4 Billion |

| Market Size by 2032 | US$ 4.0 Billion |

| CAGR | CAGR of 13.5% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Hardware, Middleware, Managed Services) • By Industry (Energy, BFSI, Government, Manufacturing, Retail, Transport and Logistics, Telecommunication, Other Industries) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | IBM Corporation, Microsoft Corporation, Amazon Web Services (AWS), Google LLC, Red Hat (IBM Subsidiary), Solace Corporation, TIBCO Software Inc., Confluent, Inc., VMware, Inc., Huawei Technologies Co., Ltd. and others in the report |