Cloud TV Market Report Scope & Overview:

To Get More Information on Cloud TV Market - Request Sample Report

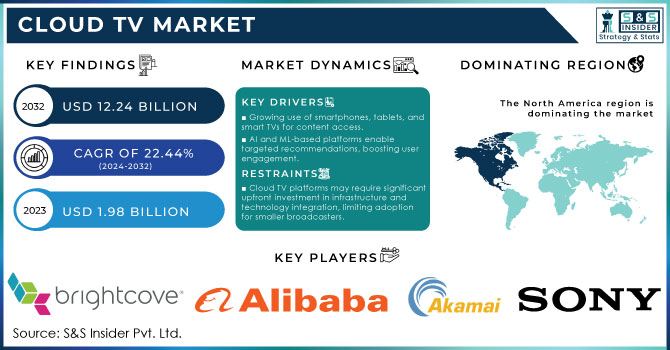

Cloud TV Market was valued at USD 1.98 billion in 2023 and is expected to reach USD 12.24 Billion by 2032, growing at a CAGR of 22.44% from 2024-2032.

The Cloud TV Market is expanding rapidly as demand for on-demand streaming and OTT content grows. With cloud infrastructure, Cloud TV enables content providers to efficiently manage and deliver video services, meeting the rising need for scalable, flexible, and cost-effective broadcasting solutions. Traditional broadcasters, telecom operators, and media companies swiftly adopt cloud-based strategies to fulfil consumer expectations for seamless, multi-device streaming experiences. Projections indicate that global OTT video subscribers will surpass 1.7 billion by 2025, up from around 1.1 billion in 2021, highlighting a significant shift towards cloud-based TV solutions capable of managing high data volumes and ensuring reliable streaming. Several factors drive this market's growth. The expansion of high-speed internet, especially with the advent of 5G, significantly supports high-definition video streaming with minimal interruptions. Industry forecasts suggest that 5G-enabled OTT streaming will soon represent a large portion of mobile video usage, fueling Cloud TV’s expansion. Personalized content delivery is also crucial; Cloud TV platforms using AI and machine learning analyze viewer preferences, allowing content providers to tailor recommendations and enhance user engagement. Platforms like Netflix and Amazon Prime Video, for example, leverage cloud-based recommendation systems to offer personalized content to millions, increasing viewer satisfaction and retention.

The trend of multi-device streaming and the adoption of smart TVs also bolster Cloud TV growth. By 2024, approximately 80% of U.S. households are expected to own at least one connected TV device, with consumers increasingly seeking flexible content access. Cloud TV enables broadcasters to reach audiences across various devices, including smartphones, tablets, and connected TVs, broadening viewership. Furthermore, hybrid work models and more home-based activities have driven up demand for home entertainment, further accelerating Cloud TV adoption.

Another key growth driver is the need for cost-effective content delivery solutions. Cloud TV platforms reduce operational costs by removing the need for extensive hardware setups, which is especially beneficial for smaller broadcasters. For instance, Comcast’s Xfinity Stream and AT&T TV use cloud-based systems to deliver on-demand content without traditional cable installations. This shift toward cloud infrastructure is set to revolutionize broadcasting as more providers adopt scalable, flexible solutions that improve user experiences while minimizing operational costs.

Market Dynamics

Drivers

-

Growing use of smartphones, tablets, and smart TVs for content access.

-

AI and ML-based platforms enable targeted recommendations, boosting user engagement.

-

Increased consumer preference for on-demand and OTT streaming content.

The increasing demand for on-demand and over-the-top (OTT) streaming content is driving significant growth in the Cloud TV Market. As audience preferences evolve, viewers are seeking more flexible, personalized content that can be accessed at any time and on any device, moving away from the limitations of traditional broadcast schedules. This shift has accelerated the adoption of Cloud TV technology, enabling providers to offer scalable, cost-effective solutions that meet the needs of modern viewers. On-demand content is particularly popular with younger audiences who are familiar with digital devices and streaming platforms. This demographic values the ability to pause, rewind, and access content across multiple devices such as smartphones, tablets, smart TVs, and laptops. Cloud TV allows service providers to meet these expectations by ensuring seamless cross-device compatibility, enhancing user satisfaction and expanding their reach.

OTT platforms like Netflix, Amazon Prime Video, and Disney+ have leveraged cloud technology to store and deliver vast libraries of on-demand content. This strategy is particularly beneficial as the global OTT subscriber base continues to grow, with projections indicating over 1.7 billion users by 2025. Cloud infrastructure enables these platforms to efficiently manage large data volumes and ensure high-quality, uninterrupted streaming, meeting the increasing demands of consumers. Cloud TV goes beyond traditional broadcasting by offering advanced features. AI and machine learning-powered platforms analyze viewer preferences to deliver personalized recommendations, boosting engagement and loyalty—critical advantages in the competitive streaming market. Moreover, cloud-based platforms help broadcasters’ lower operational costs by reducing the need for physical infrastructure, making it easier for smaller players to enter the market.

As OTT demand continues to rise, broadcasters and telecom operators are increasingly adopting Cloud TV, moving away from traditional linear TV models to more flexible, on-demand offerings to stay relevant in the digital-first landscape.

|

Consumer Preference |

Cloud TV Solution |

Benefits |

|---|---|---|

|

Personalized content |

AI-driven recommendation engines |

Boosts engagement and satisfaction |

|

Cost-effective access |

Reduced need for physical infrastructure |

Affordable for diverse providers |

|

High-quality streaming experience |

Scalability and adaptability of cloud solutions |

Ensures consistent viewing |

Restraints

-

Cloud TV platforms may require significant upfront investment in infrastructure and technology integration, limiting adoption for smaller broadcasters.

-

As content is stored and transmitted via cloud infrastructure, concerns over data privacy and security can deter some users and service providers.

-

Despite the rise of OTT, traditional cable and satellite TV services still dominate in some regions, slowing the shift to cloud-based TV models.

Although Cloud TV is growing globally, the strong foothold of traditional cable and satellite TV in certain regions remains a notable obstacle to its full adoption. The longstanding appeal of conventional TV services influences the pace at which both consumers and providers shift towards cloud-based models.

A key factor is the well-established infrastructure of cable and satellite TV, built over decades. In many areas, these services deliver reliable, diverse channel packages with both live and on-demand content. Consumers often prefer the familiarity of traditional subscription bundles, which may also offer exclusive access to live sports, news, and other programming not always available on OTT platforms.

In regions with limited or inconsistent internet connectivity, traditional TV still holds a distinct advantage. Cloud TV depends on high-speed, stable internet for an uninterrupted, quality streaming experience, a challenge in rural or underserved areas. Here, cable and satellite options are often perceived as more reliable. Additionally, traditional TV’s bundled pricing structure remains attractive to consumers who may be reluctant to pay for multiple OTT subscriptions. These packages typically offer various services at competitive rates, including premium channels and DVR options, appealing to cost-conscious viewers.

Moreover, older audiences, who may be less comfortable with digital technology, tend to find traditional TV easier to navigate than internet-based streaming platforms. This demographic prefers the simplicity of cable and satellite services, leading to slower Cloud TV adoption within certain age groups. In conclusion, while Cloud TV is expanding worldwide, the deeply rooted presence of traditional TV in some regions still presents a significant barrier, impacting the pace at which cloud-based models can replace legacy broadcasting.

Segment Analysis

By Deployment

The public cloud segment dominated the market and represented significant revenue share in 2023. Leading vendors, including Amazon Web Services (AWS), Microsoft Azure, and Google Cloud Platform offer television providers and streaming services high-end software and services to process, store, and distribute media. The segment is experiencing an increase in its growth, owing to its capability of scaling, global exposure, superior security, and advanced analytics that enhance better content delivering and viewer interaction, between regions.

The private cloud segment register the highest CAGR during the forecast period, driven by increased control and security over their content delivery infrastructures. IBM Cloud and Oracle Cloud Infrastructure provide dedicated private cloud solutions that are tailored for media processing, storage, and streaming. The driven evolution of this segment is due to the growing needs of data security and regulatory compliance, customizable configurations, and high-performance components to deliver reliable and seamless media experiences for audiences around the world.

By Platform

In 2023, mobile devices led the market, capturing the largest revenue share due to the widespread use of smartphones and tablets as the primary means for content consumption. Streaming services like Hulu and Disney+ optimize their platforms for mobile screens, ensuring smooth streaming experiences through cloud infrastructure. This segment’s growth is fueled by increasing mobile internet access, a rising demand for on-the-go entertainment, and innovations in mobile technology that support high-quality streaming, interactive content, and personalized recommendations.

Smart TVs are projected to experience the fastest CAGR From 2024 to 2032, driven by the incorporation of internet connectivity and advanced features in modern television sets. Major brands such as Samsung Smart TV, LG WebOS, and Roku utilize cloud technology to offer immersive viewing experiences with easy access to streaming services like Netflix and Amazon Prime Video. This segment's growth is propelled by consumer demand for seamless content access on larger screens, enhanced user interfaces, and integration with smart home ecosystems, fostering continued innovation in the market.

By Enterprise Size

In 2023, large enterprises dominated the market and represented significant revenue share, leveraging scalable cloud infrastructure to offer comprehensive media solutions. Providers like IBM Cloud Video and Google Cloud Platform cater to large broadcasters and media conglomerates, offering robust streaming, content management, and analytics tools. This segment's expansion is driven by the need for centralized, secure platforms that enable global content distribution, personalized viewer experiences, and efficient monetization strategies across diverse markets.

Small and medium-sized enterprises (SMEs) are expected to experience the highest CAGR From 2024 to 2032. This growth is supported by scalable, cost-effective cloud solutions. Providers such as Vimeo OTT and Wistia offer tailored platforms that allow SMEs to easily launch and manage streaming services with minimal upfront investment. The segment's expansion is fueled by the increasing digital content consumption among SMEs, along with user-friendly tools for content creation, distribution, and monetization, driving market reach and viewer engagement.

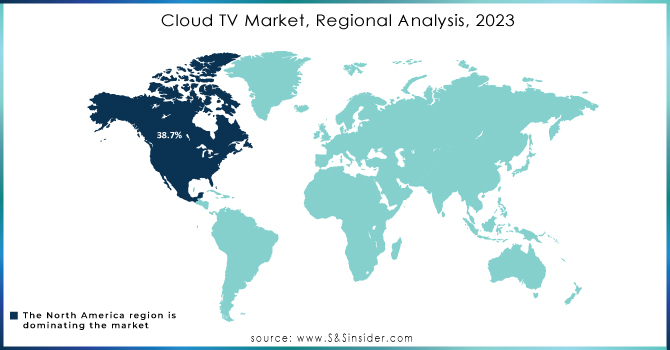

Regional Analysis

In 2023, North America held the largest share of the cloud TV market with 38.7% of revenue, driven by a growing demand for scalable, secure, and innovative media delivery solutions. Leading companies like Bright cove and Akamai Technologies are leveraging advanced streaming technologies to enable broadcasters and content providers to deliver seamless, high-quality video across various devices while focusing on enhancing viewer experiences and optimizing monetization strategies.

Asia Pacific also captured a significant share of the market in 2023, fueled by rapid digital transformation and expanding internet connectivity. Major players such as Alibaba Group, Sony, and Zee Entertainment are utilizing cloud platforms to meet diverse content demands, improve user engagement with personalized experiences, and capitalize on the rising trend of online video consumption.

The Japanese cloud TV market is expected to experience strong growth from 2024 to 2032. Platforms like Netflix, Amazon Prime Video, and local providers such as Hulu Japan and dTV are at the forefront, using cloud technologies to offer a broad content range, including anime, dramas, and international films, with a focus on high-quality streaming and user-friendly interfaces. This expansion is driven by technological innovations, a robust media consumption culture, and growing subscriptions for both on-demand and live-streaming services.

Do You Need any Customization Research on Cloud TV Market - Enquire Now

Key Players

The major key players along with their products are

-

Brightcove – Brightcove Video Cloud

-

Akamai Technologies – Akamai Adaptive Media Delivery

-

Alibaba Group – Alibaba Cloud Video Streaming

-

Sony – PlayStation Vue

-

Zee Entertainment – ZEE5

-

Netflix – Netflix Streaming Service

-

Amazon – Amazon Prime Video

-

Google – YouTube TV

-

Apple – Apple TV+

-

Roku – Roku Streaming Platform

-

Vimeo – Vimeo OTT

-

Microsoft – Azure Media Services

-

Hulu – Hulu with Live TV

-

Disney – Disney+

-

Samsung Electronics – Samsung Smart TV

-

LG Electronics – LG WebOS

-

Comcast – Xfinity Stream

-

ViacomCBS – Paramount+

-

WarnerMedia – HBO Max

-

Sling TV – Sling TV Streaming Service

Recent developments

March 2024 – ActiveVideo launched a new interactive TV streaming solution aimed at enhancing user engagement through advanced cloud delivery models. This product is designed to deliver high-quality video content without buffering, supported by 5G and improved internet infrastructure

February 2024 – Synamedia introduced a new Cloud TV platform that integrates AI and machine learning to provide personalized content recommendations. This update focuses on improving user experience and content monetization strategies

| Report Attributes | Details |

| Market Size in 2023 | USD 1.98 billion |

| Market Size by 2032 | USD 12.24 Billion |

| CAGR | CAGR of 22.44 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Service (Software as a Service, Infrastructure as a Service, Platform as a Service) • By Deployment Type (Public Cloud, Private Cloud, Hybrid Cloud) • By Organization Size (Large Enterprise, Small and Medium Size Enterprise) • By Application (Consumer Television, Media & Entertainment, Telecommunication, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles |

Brightcove, Akamai Technologies, Alibaba Group, Sony, Zee Entertainment, Netflix, Amazon, Google, Apple |

| Key Drivers |

•Growing use of smartphones, tablets, and smart TVs for content access. |

| Market Restraints |

•Cloud TV platforms may require significant upfront investment in infrastructure and technology integration, limiting adoption for smaller broadcasters. |