High Power LED Market Size & Growth Trends:

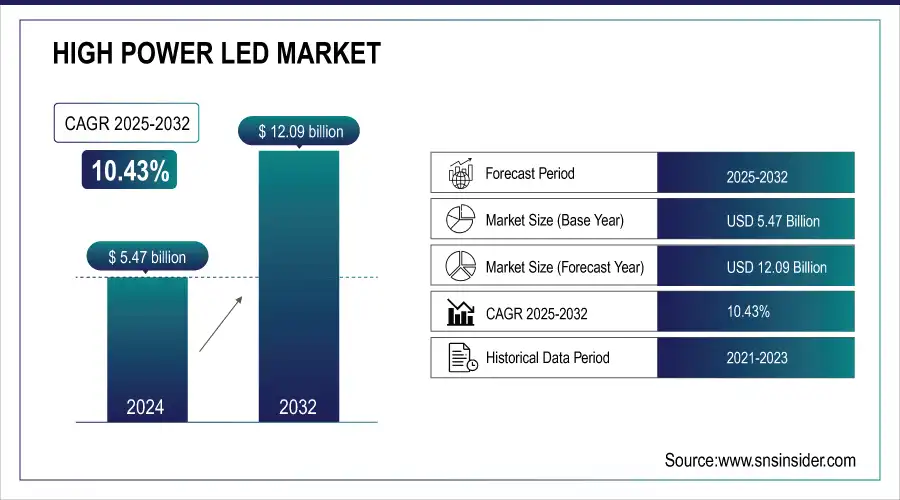

The High Power LED Market was valued at USD 5.47 billion in 2024 and is expected to reach USD 12.09 billion by 2032, growing at a CAGR of 10.43% from 2025-2032.

Technological advancements are rapidly changing the high-power LED market with key trends focused on enhancing efficiency as well as power density. Technological advances in LED materials and packaging have boosted lighting performance while fab capacity utilization is being fine-tuned to accommodate growing demand. Now that energy efficiency is becoming the priority, manufacturers are coming up with LEDs that can produce more light with less energy input.

To Get more information on High Power LED Market - Request Free Sample Report

High-power LEDs, meanwhile, are also progressing in terms of power density, enabling smaller, longer-lasting, and more luminous lighting for a range of applications. Over 1200 companies are actively engaged within the U.S. high-power LED market, and high-power LED technology will remain one of the hottest technology trends in 2024. It accounts for one of the most significant volumes of LED installations, with street lighting and other outdoor applications taking up over 45% of the commercial lighting sector. In automotive, almost 70% of manufacturers are integrating high-power LEDs for headlamps, while the presence of LEDs in the consumer electronics market continues to grow where over 350 million units were shipped in Q1 alone.

Market Size and Forecast

-

Market Size in 2024: USD 5.47 Billion

-

Market Size by 2032: USD 12.09 Billion

-

CAGR: 10.43% from 2025 to 2032

-

Base Year: 2024

-

Forecast Period: 2025–2032

-

Historical Data: 2021–2023

High Power LED Market Trends

-

Rising demand for energy-efficient and long-lasting lighting solutions is driving the high-power LED market.

-

Increasing adoption in automotive, street lighting, industrial, and commercial applications is boosting growth.

-

Advancements in LED chip design, thermal management, and optics are enhancing performance and reliability.

-

Focus on smart lighting systems and IoT integration is shaping market trends.

-

Expansion of renewable energy and sustainable building initiatives is fueling adoption.

-

Government regulations promoting energy conservation and reduced carbon emissions are supporting market growth.

-

Collaborations between LED manufacturers, electronics companies, and lighting solution providers are accelerating innovation and deployment.

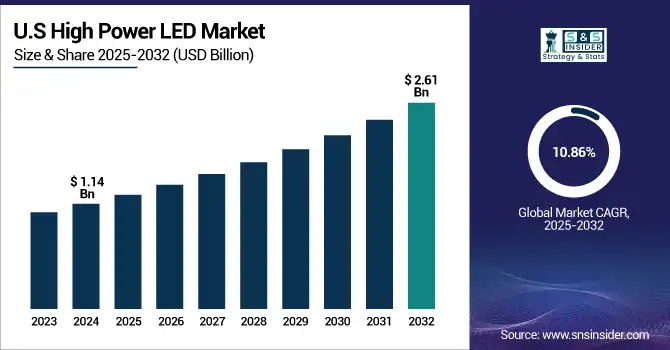

U.S. High Power LED Market was valued at USD 1.14 billion in 2024 and is expected to reach USD 2.61 billion by 2032, growing at a CAGR of 10.86% from 2025-2032. The U.S. high-power LED market is expanding with energy-efficient, low-power, high-performance lighting capabilities. Growing demand in commercial, automotive, and residential segments and next-gen technologies in LED power density and luminous efficacy will make adoption high across numerous applications increasing sustainability and economic advantages.

High Power LED Market Growth Drivers:

-

Rising Demand for Energy-Efficient Lighting Solutions Drives Growth in High Power LED Market

Several factors are fuelling the demand for the high-power LED market. This is mainly due to the increasing demand for energy-efficient lighting solutions in residential, commercial, and industrial sectors. Unlike traditional lighting alternatives, Power LEDs exhibit better performance, low power consumption, and longer life spans; thus, they are ideal choices for price-sensitive consumers and enterprises. Enhanced LED technology referring to heat dissipation, quality of light, and color rendering also contributes to this trend. Demand for LEDs in street lighting, urban spaces, and transportation systems is also being driven by smart cities and digital technologies in the infrastructure as well as government mandates for energy-efficient systems.

High Power LED Market Restraints:

-

Challenges in Heat Dissipation and Lack of Standardization Hinder Growth of High Power LED Market

A big one is the heat dissipation problem, Although High Power LEDs have very good technical specifications, all lead to the generation of a lot of heat, thereby poor thermal conduction can ultimately compromise the performance and longevity of the High Power LED. This also requires complex heat sink designs and some efficient cooling design, both of which make products more difficult to develop. The second concern is the absence of an industrial standard in the LED technology which leads to variations in performance, quality, and compatibility of LEDs. This can produce issues for the end-user and delay the mass adoption of some uses.

High Power LED Market Opportunities:

-

Emerging Markets and Advancements in Automotive and Specialty Applications Drive High Power LED Growth

The High Power LED market has plenty of opportunities especially in the emerging regions including Asia Pacific and Latin America owing to the high population and urbanization coupled with increased industrialization in the region leading to a high demand for infrastructure. The LED market has a massive growth opportunity within the automotive industry for new applications & use cases such as automotive lighting & display systems integrated into vehicles. In addition, advances in specialty applications which include flash illumination for mobile gadgets, scientific lighting, and horticultural lighting open up new possibilities for the market. As the world should go for sustainability, this trend of the use of eco-friendly and durable solutions is embedded, and the market continues to have a favorable outlook.

High Power LED Market Challenges:

-

Technical Limitations and Competition from Alternative Technologies Challenge Growth of High Power LED Market

Technical limitations like reduced efficiency over time and susceptibility to voltage fluctuations make maintenance of constant output difficult. Integration is more complicated for manufacturers because High Power LEDs are also more expensive and require custom drivers in addition to custom circuit designs. At one end of the scale too, performance issues like light degradation from long-term operation, and the effects of environmental factors such as humidity and dust can affect long-term reliability. In addition to this, the presence of alternative lighting technologies including OLEDs and laser-based lighting solutions inhibit the growth of High Power LEDs in certain verticals. Sustained industry growth will require addressing these technical and market challenges.

High Power LED Market Segment Analysis

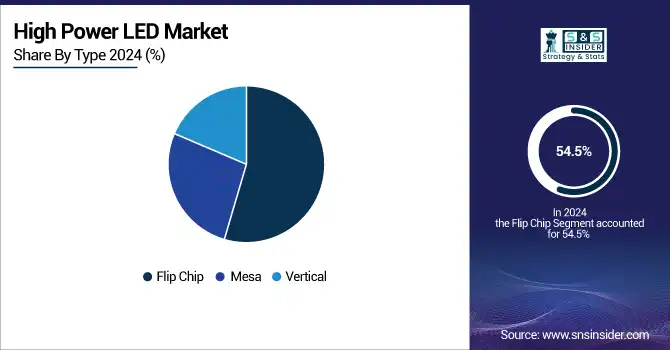

By Type, Flip Chip Technology held the largest high-power LED market share in 2024, while Vertical LEDs are expected to grow fastest from 2024 to 2032.

The largest high-power LED market share in 2024 was held by Flip Chip Technology, which accounted for 54.5% of the total market share. Due to its superior thermal management and current spreading as well as its higher efficiency compared to conventional LED packages, this dominance was seen. The ruler-free Flip Chip LEDs do not require wire bonding, decreasing the resistance and thus the performance of the LED, making them the go-to technology for automotive lighting, general lighting, as well as display backlighting. In addition to that, they can also manage a much higher power density with minimal performance degradation due to the market-leading design.

The fastest car during 2025 – 2032 is expected for Vertical. This growth is driven by improved light extraction efficiency, high current-carrying capacity, and high-intensity lighting applications. Vertical LED is projected to gain significant traction in the market and will drive rapid growth for the market owing to the growing demand for compact, high-performance, and robust LED solutions especially in automotive, medical, and outdoor lighting.

By Application, General Lighting dominated the market in 2024, while Automotive applications are projected to register the highest CAGR from 2025 to 2032.

General Lighting represented 37.8% of the total high-power LED market in 2023. This dominance is attributed to the increasing demand for energy-efficient lighting solutions for residential, commercial, and industrial applications. Stringent Energy Regulations are being mandated by governments in a majority of countries, thereby driving prospects for LED-based Lighting which results in lower power usage. Furthermore, along with the integration of high-power LEDs with IoT-based controls, smart lighting systems have gained rapid acceptance in street lighting, offices, and industrial facilities. The combination of their longevity, a higher light output, and less maintenance have helped them implement greater penetration of the marketplace.

The automotive applications segment is anticipated to show the most rapid CAGR from 2025 to 2032. A major factor driving this growth includes the growing adoption of LED headlights, taillights, interior fixtures, and display panels in contemporary vehicles. As electric vehicles (EVs) and autonomous driving technologies become more mainstream, automakers are incorporating even more advanced LED solutions to bolster energy efficiency, visibility, and aesthetics, fuelling strong growth in the market.

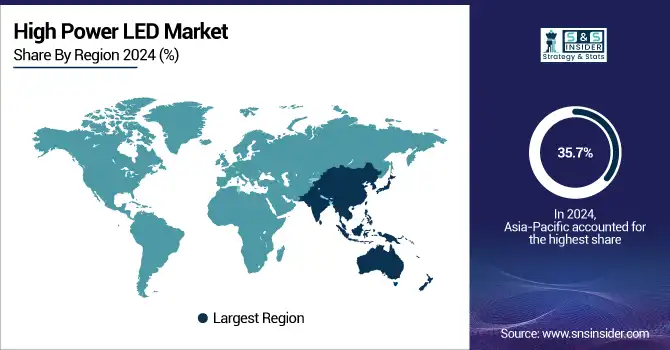

High Power LED Market Regional Analysis

Asia Pacific High Power LED Market Insights

Asia Pacific was the leading High Power LED market with a 35.7% market share in 2024. Such leadership was due to the fast-paced industrialization, urbanization, and the dominating presence of LED manufacturers in countries like China, Japan, South Korea, and Taiwan. The LED giants Nichia Corporation, Seoul Semiconductor, and Everlight Electronics are all located in China which is significant for the supply chains around the world. Such initiatives to boost sustainability along with the growing demand for energy-efficient lighting solutions, automotive LEDs, and backlighting applications in the region are driving the regional AR and VR market growth. The deployment of LED street lighting has been markedly improved through various programs such as the “Ten Cities, Ten Thousand Lights” program in China. In addition, the growing market in India and Southeast Asia is also driving the demand for high-power LEDs in display panels and mobile terminals.

Get Customized Report as per Your Business Requirement - Enquiry Now

North America High Power LED Market Insights

Because of the rising adoption of automotive LED lighting, smart lighting systems, and advanced display technologies the fastest CAGR from 2024 to 2032 is anticipated to be in North America. The increasing adoption of high-power LEDs is driven by the rise of electric vehicles (EVs) and autonomous driving features for using high-power LEDs as headlights, heads-up displays (HUD), and interior lighting. Major North American and regional LED companies (like Cree LED (U.S.), Lumileds, and Osram) have effectively been the trendsetters in innovation. The rising penetration of smart home and IoT-based lighting systems across the U.S. and Canada, for instance, also provides tremendous growth potential. The proliferation of innovative Philips Hue and top-quality LIFX smart LED lighting systems in household and commercial areas serves as an illustration of the technological shift emerging toward high-efficiency LED solutions across the region.

Europe High Power LED Market Insights

Europe holds a significant position in the High Power LED market, driven by increasing adoption of energy-efficient lighting solutions across commercial, industrial, and residential sectors. Stringent government regulations promoting sustainability, coupled with rising investments in smart city infrastructure, are accelerating demand. Key countries such as Germany, France, and the UK lead in LED deployment. Growth is further supported by technological advancements in high-power LEDs, expanding applications in automotive, horticulture, and general lighting, enhancing market potential.

Middle East & Africa and Latin America High Power LED Market Insights

The High Power LED market in the Middle East & Africa and Latin America is witnessing steady growth, driven by urbanization, infrastructure development, and rising energy efficiency awareness. Governments are promoting sustainable lighting through initiatives and incentives. Key sectors include commercial, industrial, and outdoor lighting. Adoption of smart lighting solutions and increasing investments in renewable energy projects are further fueling market expansion, while cost reductions and technological advancements enhance regional accessibility and application diversity.

High Power LED Market Competitive Landscape:

Nichia Corporation

Nichia Corporation, founded in 1956 and headquartered in Anan, Japan, is a global leader in LED and phosphor technology. The company specializes in high-performance lighting solutions, automotive LEDs, and optical components, emphasizing energy efficiency, durability, and innovation. Nichia’s products enable sustainable and advanced lighting applications for residential, commercial, and industrial use, while driving continuous improvements in brightness, color quality, and efficiency to support next-generation illumination and display technologies worldwide.

-

September 2024: Nichia launched the NFSWL11A-D6, a chip-scale LED designed for soft, uniform lighting with strong horizontal distribution, enabling thinner, more efficient lighting fixtures.

Key Players Listed in the High Power LED Market are:

-

Lumileds Holding B.V.

-

Nichia Corporation

-

ams-OSRAM

-

Samsung Electronics Co. Ltd.

-

LG Innotek Co. Ltd.

-

Seoul Semiconductor Co. Ltd.

-

Epistar Corporation

-

Broadcom Inc.

-

Koninklijke Philips N.V.

-

WOLFSPEED

-

Edison Opto Corporation

-

Optogan

-

Tech-LED (Marubeni America Corporation)

-

Bridgelux

-

Plessey Semiconductors

-

Refond Optoelectronics

-

Citizen Electronics

-

Vorlane

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 5.47 Billion |

| Market Size by 2032 | USD 12.09 Million |

| CAGR | CAGR of 10.43% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Flip Chip, Mesa, Vertical) • By Application (General Lighting, Automotive, Flash Lighting, Backlighting, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Lumileds Holding B.V., Nichia Corporation, ams-OSRAM, Cree Inc., Samsung Electronics Co. Ltd., LG Innotek Co. Ltd., Everlight Electronics Co. Ltd., Seoul Semiconductor Co. Ltd., Epistar Corporation, Broadcom Inc., Koninklijke Philips N.V., WOLFSPEED, Edison Opto Corporation, Optogan, Tech-LED (Marubeni America Corporation). |