High Temperature Cables Market Size Analysis:

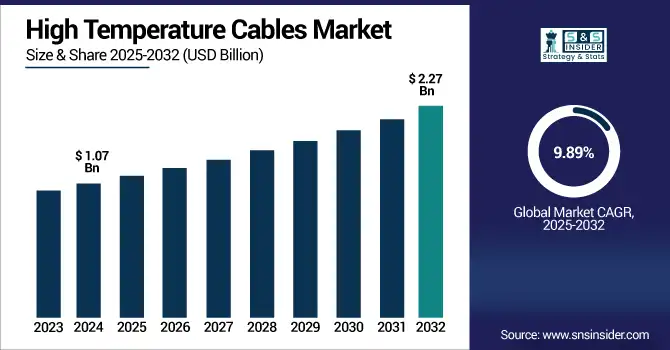

The High Temperature Cables Market Size was valued at USD 1.07 billion in 2024 and is expected to reach USD 2.27 billion by 2032 and grow at a CAGR of 9.89% over the forecast period 2025-2032. Global Market Insights provides detailed analysis on segmentation, trends, dynamics, competitive landscape and opportunities available in the market. Expanded due to the increasing demand from power generation, automotive, aerospace, and industrial industries. Cable performance is being improved by technology advances in insulation and conductor materials, and growing investments in heat-resistant infrastructure. High Temperature Cables Market analysis reveals evolving applications across harsh environments. Such factors render high-temperature cables indispensable for reliable operation under extreme environmental conditions in modern global electrical and energy-intensive technology frameworks.

To Get more information on High-Temperature-Cables-Market - Request Free Sample Report

For instance, over 65% of industrial automation systems now rely on heat-resistant cables for mission-critical control and power delivery.

The U.S. High Temperature Cables Market size was USD 0.20 billion in 2024 and is expected to reach USD 0.41 billion by 2032, growing at a CAGR of 9.61% over the forecast period of 2025–2032.

U.S. market is well positioned and robust growth is attributed to increase in renewable energy installations, infrastructure upgrades, and growth in aerospace and defense sectors. A rise in need for heat-resistant wiring in harsh industrial environments also supports adoption. In addition, strong R&D investments in advanced materials and insulation technologies are improving the performance and reliability of the cables. All these factors are cumulatively contributing to the continuous usage of the high temperature cable in multiple high demand high performance applications across the country.

For instance, over 85% of high-temperature cables used in U.S. aerospace and defense sectors meet MIL-DTL-25038 or UL 5128 standards.

High Temperature Cables Market Dynamics:

Key Drivers:

-

Rapid Industrialization and Electrification of Automotive and Aerospace Manufacturing

The rapid growth of the automotive and aerospace industries is further accelerating the demand for high-temperature cable and therefore the high-temperature cable market. They are used in electric vehicle (EV) battery packs, aircraft engines, and control systems and have an important role that requires their ability to withstand heat while maintaining electrical integrity. High-performance, thermal capable cables are essential for both EVs and compact next-gen aircraft. In addition, manufacturing is becoming increasingly automated and integrated with AI for fast decision-making, which in turn makes the need for continuous power reliability crystal clear, creating strong demand for premium high-temperature wiring solutions in such industries.

For instance, new-generation aerospace cables are being engineered with lightweight high-temp materials—reducing up to 20% cable weight for fuel efficiency.

Restraints:

-

High Cost of Advanced Materials and Complex Manufacturing Processes

Production costs jump considerably with nickel-alloys, silver-plated copper, and high-grade insulation materials. Just as other high-quality cables, these cables are individually manufactured and extensively tested, resulting in higher price point as compared to traditional cables. This price sensitivity is more pronounced among SMEs with more limited capital budgets. Change in prices of raw materials, particularly copper and specialty polymers, also brings uncertainty in the markets. High Temperature Cables Market trends highlight rising concerns over material cost volatility. We said that the significant initial investment required might act as a deterrent to adoption, especially in price-sensitive sectors and in the developing regions, where budgets are strained.

Opportunities:

-

Rising Demand for Heat-Resistant Cables in Electric Vehicle Infrastructure and Battery Systems

The mainstreaming of electric vehicles is driving up demand for high-temperature cables used in BMS, charging infrastructure, and powertrains. These parts function under situations of high load and temperature and need uncompromising thermal performance. EV charging stations, especially fast chargers, also need to ensure thermally stable connections. This has developed a huge prospect for cable players to supply their customized solution in line with this developing interface specification. High Temperature Cables Market growth is accelerating through EV sector innovation. The shift to more affordable mid-market EV models combined with government incentives to encourage adoption and infrastructure rollout is propelling demand and expanding this segment as a growth opportunity for future cable development and innovation.

For instance, heat-related wear is responsible for over 40% of failures in high-power EV charging stations, highlighting the need for thermally optimized cabling.

Challenges:

-

Technological Limitations in Achieving Both Flexibility and Thermal Resistance Simultaneously

The key technical challenge for this market is the tradeoff between thermal tolerance and mechanical flexibility. There are materials with better heat resistance such as ceramic fiber and mica, but these do not allow flex and can crack when repeatedly bent. However, more pliable materials may not be able to handle the highest temperature thresholds. This approach ties the flexibility of cables into a complicated, yet static assembly that is unable to work in-the-loop for the dynamic or mobile applications such as in robotics and aerospace systems. Tackling this challenge needs advanced R&D on composite materials, which can be costly and lengthy.

High Temperature Cables Market Segmentation Analysis:

By Type

In the year 2024, fiberglass led the market with a 25.7% share due to its affordability and high thermal resistance in addition to the availability of fiberglass. This is widely used in industrial equipment, power plants, and automotive wiring in applications that require durable and high-temperature insulation. Thermal Wire and Cable, LLC excels in providing durable, fiberglass-based solutions optimized for its end-use in acclaimed high-heat environments, which makes it ideal for bred industrial usage and long-living presence, further sustaining its share in the high-temperature cables space.

Mica-based cables are expected to have the highest CAGR of 11.83% from 2024–2032 due to their outstanding flame resistance and dielectric strength. They are, however, beginning to see use in critical applications such as nuclear power plants, and in aerospace and defense systems. One of the primary suppliers of mica insulated cables, RSCC Wire & Cable, supplies high quality wiring under fire and high heat conditions, driving the mica insulated cables market growth in safety-critical and challenging environments.

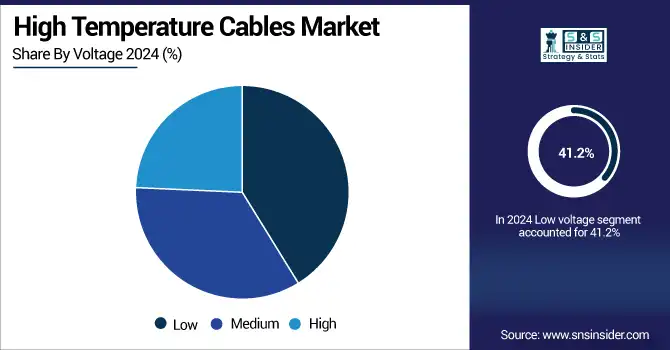

By Voltage

Low voltage cables held a significant market share in terms of revenue, accounting for 41.2% in 2024, owing to their wide-scale usage in consumer electronics, household appliances, and automotive systems. Lucid's market sovereignty can largely be attributed to their cheaper price point, relative ease of installation, and capability of meeting the thermal requirements of low-load circuits. General Cable (member of Prysmian Group) has been offering a robust variety of low-voltage high-temperature cables for several sectors that enhance their adoption in end-user and industrial-grade applications quickly.

High voltage cables are anticipated to witness the highest growth at a market growth rate of 10.51% from 2024 to 2032 owing to their high accessibility whenever there is a need for power transmission in juiced up power supply and booming heavy industrial applications during the projected period. This resistance to high voltage and thermal stress makes them essential for infrastructure such as wind farms and utility-scale grids. Nexans S.A., a global leader in the cable industry's development and supply of advanced energy cable solutions, has sustained its investment in high-voltage high-temperature cable innovation as an enduring effort to improve energy safety and efficiency in the world's most demanding energy environments, particularly for renewable and smart grid projects.

By Conductor Material

In 2024, Copper accounted for the largest share of 38.6% as a conductor material. Copper is the most popular conductor due to its excellent thermal conductivity, strength, and electrical performance. Well-suited for most high temperature applications due to its long history of reliability and compatibility with numerous insulation types. Various industrial and infrastructural applications of copper enable companies such Southwire Company, LLC to be prominent players in the business of producing copper-based thermal cables, or cables designed to meet electrical requirements with copper’s long-lasting durability and conductivity across market segments.

Nickel-Alloy is expected to witness the highest growth rate of 11.34% from 2024–2032 attributable to excellent resistance to extreme heat and corrosion. Aerospace engines, refiners, and high-performance industrial settings are all ideal locations for these cables. Okonite Company specializes in high-grade nickel-alloy conductor cables for hot, aggressive environments. They are a leader for non-corrosive cables for critical infrastructure and defense-related applications.

By Application

In 2024, Energy segment dominated the High Temperature Cables market share on account of increasing adoption of high-temperature cables in thermal power plant and renewable energy systems & electrical substations, contributing to 24.5% share of the market. Critical in the operation of turbines, generators and transmission systems for high heat loads. Through capability in providing custom cable solutions to energy sector clients to ensure performance and safety at extreme temperatures, TPC Wire & Cable Corp further strengthens energy as a key application segment.

Aerospace & defense applications are expected to grow with the highest CAGR of 11.99% from 2024–2032 due to increasing defense budgets and space exploration efforts. Cables operating under high temperatures are important in aerospace engines, military jets and satellites. TE Connectivity - a leader supplier for high-performance cable assemblies specifically for thermal extremes for aerospace/military use designed for the rising demand for this segment in the defense and commercial aviation market.

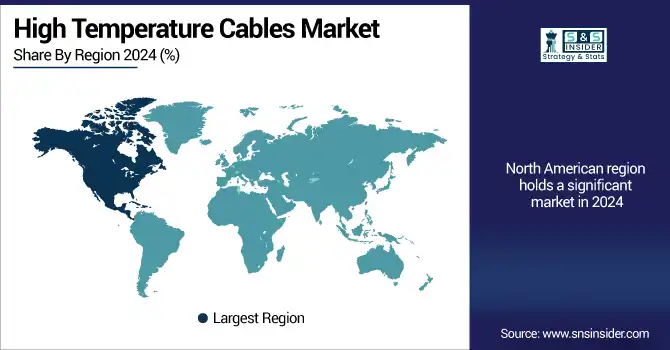

High Temperature Cables Market Regional Outlook:

North America benefits from high industrial automation, an increasing aerospace and defense sector, and an ever-increasing energy infrastructure upgrade process. The region is characterized with competitive R&D capabilities, stringent safety regulations and adoption of renewable energy technologies. The U.S. has a significant market share due to the increasing need for heat and durable cables for mission-critical uses in industrial and harsh environments.

-

The U.S. dominates the North American high temperature cables industry due to its advanced aerospace and defense sectors, extensive industrial infrastructure, and strong investments in power grid modernization, renewable energy projects, and high-performance electrical systems requiring heat-resistant cabling.

Asia Pacific was driven by rapid industrialization and energy demand along with burgeoning manufacturing in China, India, and Japan which captured the largest revenue share of 30.6% in 2024. Due to investments in renewable energy, electric vehicles, smart grids, and industrial automation, the region is anticipated to grow at the highest CAGR of 10.69% during the period of 2024 to 2032, as local production and technology advances.

-

China leads the Asia Pacific market owing to its massive manufacturing base, rapid urbanization, and large-scale investments in renewable energy, EV infrastructure, and industrial automation—driving significant demand for high-performance, heat-resistant cables across critical infrastructure and export-oriented industries.

In Europe, the high temperature cables market is significantly driven by the demand from automotive, aerospace and energy sectors due to stringent safety standard regulations and environmental considerations. Germany, France and the UK are ahead in terms of preparedness for building more advanced cabling solutions of the EVs, industrial automation, and renewable energy systems. Moreover, the market in the region is also being driven by technological innovation and sustainability initiatives.

-

Germany dominates the European high temperature cables market due to its strong industrial base, advanced automotive manufacturing, and leadership in renewable energy. Its strict safety standards and focus on technological innovation drive high demand for durable, heat-resistant cable solutions.

Middle East & Africa is dominated by Saudi Arabia, owing to the huge oil, gas, and power infrastructure in the country. Brazil is the largest market in Latin America, benefiting greatly from the trends of industrialization, increasing renewable energy generation projects and rising automotive production—creating increased demand for protective, heat-resistant cabling solutions within both regions.

Get Customized Report as per Your Business Requirement - Enquiry Now

High Temperature Cables Companies are:

Major Key Players in High Temperature Cables Market are Nexans S.A., Prysmian Group, Leoni AG, TE Connectivity Ltd., Belden Inc., Sumitomo Electric Industries, Ltd., Southwire Company, LLC, TPC Wire & Cable Corp., Okonite Company, RSCC Wire & Cable, Thermo Electric Company, Inc, Cable USA, Axon’ Cable, General Cable, Eland Cables, HELUKABEL GmbH, Lapp Group, Bhuwal Cables Ltd., Anixter International Inc. and Thermal Wire and Cable, LLC and others.

Recent Developments:

-

In June 2025, Nexans showcased high-temperature superconducting (HTS) cables at the CIRED conference, highlighting their potential to revolutionize energy grids—such as Chicago’s REG project and Paris’s SuperRail rail system.

-

In February 2025, TE Connectivity announced its planned acquisition of Richards Manufacturing for around USD 2.3 billion to enhance its underground/overhead electrical and gas distribution offerings—areas tied closely to high-performance, heat-resistant cable systems.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 1.07 Billion |

| Market Size by 2032 | USD 2.27 Billion |

| CAGR | CAGR of 9.89% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Fluoroplastic, Silicone rubber, Fiberglass, Ceramic fiber, Mica-based and Others) • By Voltage (Low, Medium and High) • By Conductor Material (Copper, Aluminum, Nickel-Alloy, Silver-Plated Copper and Tinned Copper) • By Application (Energy, Electric Appliances, Industrial Machinery, Aerospace & Defense, Automotive and Others. |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia,Taiwan, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Nexans S.A., Prysmian Group, Leoni AG, TE Connectivity Ltd., Belden Inc., Sumitomo Electric Industries, Ltd., Southwire Company, LLC, TPC Wire & Cable Corp., Okonite Company, RSCC Wire & Cable, Thermo Electric Company, Inc. , Cable USA , Axon’ Cable , General Cable, Eland Cables, HELUKABEL GmbH, Lapp Group, Bhuwal Cables Ltd., Anixter International Inc. and Thermal Wire and Cable, LLC. |