Switch Mode Power Supply Market Size & Trends:

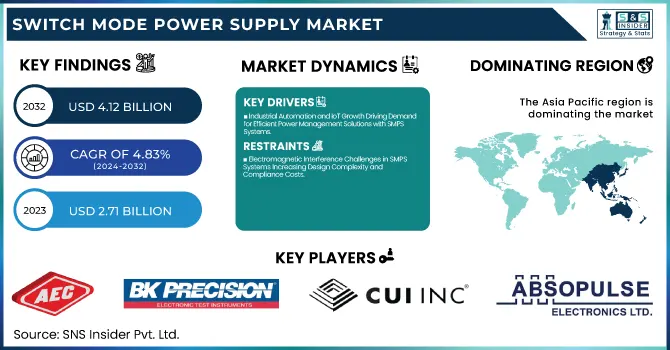

The Switch Mode Power Supply Market Size was valued at USD 2.71 billion in 2023 and is expected to reach USD 4.12 billion by 2032, growing at a CAGR of 4.83% from 2024-2032.

To Get more information on Switch Mode Power Supply Market - Request Free Sample Report

The Switch Mode Power Supply market has seen significant growth in recent years, largely due to the rising demand for energy-efficient solutions across multiple sectors. As industries like consumer electronics, industrial automation, and telecommunications expand, the need for more reliable and compact power management systems has intensified. This growing demand is fueled by the clear advantages of SMPS, including reduced energy consumption, smaller form factors, and enhanced performance over traditional power supplies. Infineon's StrongIRFET 2 30 V technology, which offers up to a 40% improvement in RDS and up to a 60% reduction in QG compared to the previous generation, is a prime example of technological advancements that enhance power efficiency in applications like industrial SMPS. With this momentum, SMPS is becoming integral to a wide range of applications, from personal gadgets to large-scale industrial systems.

This widespread adoption is further amplified by the surge in electric vehicle production and the increasing focus on renewable energy, which demand highly efficient and compact power systems. In 2023, the International Renewable Energy Agency reported a 473 gigawatt increase in global renewable electricity capacity, with solar energy expanding by 32.4% to 1.42 terawatts, highlighting the growing need for efficient power solutions in this sector. In particular, SMPS is playing a critical role in electric vehicle charging infrastructure, as well as in solar power and battery management systems, where space and energy efficiency are paramount. Additionally, the rapid expansion of the Internet of Things and smart home technology has contributed to the heightened demand for efficient power solutions, positioning SMPS as an essential component in these evolving ecosystems.

Looking toward the future, the SMPS market holds immense potential, driven by innovations in materials and technologies. The adoption of next-generation semiconductors, such as gallium nitride, is set to further enhance power supply performance and efficiency. In 2024, Infineon Technologies unveiled the world’s first 300 mm GaN power wafer, marking a significant advancement in semiconductor technology. Additionally, the integration of artificial intelligence and machine learning for predictive maintenance and system optimization is expected to unlock new opportunities in power supply management. As industries continue to prioritize energy efficiency and sustainability, the SMPS market is poised for sustained growth across various high-tech sectors.

Switch Mode Power Supply (SMPS) Market Dynamics

Drivers

-

Industrial Automation and IoT Growth Driving Demand for Efficient Power Management Solutions with SMPS Systems

The rapid growth of industrial automation and IoT applications is increasing the need for reliable, efficient power management systems. These technologies require continuous, stable power to operate complex sensors, devices, and machinery, making efficient power conversion essential. SMPS systems play a critical role in meeting the power demands of these advanced systems, offering high efficiency, compactness, and the ability to manage varying loads in real-time. As industrial automation becomes more prevalent across sectors such as manufacturing, logistics, and energy, and IoT devices continue to proliferate, the need for robust, scalable power supplies has surged. SMPS is uniquely suited to address these requirements, ensuring that power is delivered effectively while minimizing energy waste and reducing system heat. The ongoing expansion of these technologies will continue to drive the need for advanced power solutions like SMPS.

-

Rising Demand for Compact and Efficient Power Supplies in Portable Consumer Electronics Driving Growth in SMPS Market

The growing use of portable consumer electronics such as smartphones, laptops, tablets, and wearables is driving the need for compact, efficient, and reliable power supplies. As these devices become more integrated into daily life, their power requirements have evolved, demanding smaller form factors without compromising performance. SMPS systems are ideally suited for this purpose due to their high efficiency, compact design, and ability to handle diverse power needs. With portable electronics becoming more power-hungry and requiring faster charging, SMPS offers superior benefits, including energy savings and faster response times. Additionally, the shift toward more energy-efficient solutions aligns with global sustainability efforts, making SMPS a preferred choice for manufacturers. This growing demand for reliable power supplies in consumer electronics continues to fuel the expansion of the SMPS market.

Restraints

-

Electromagnetic Interference Challenges in SMPS Systems Increasing Design Complexity and Compliance Costs

SMPS systems, while offering high efficiency and compactness, can generate electromagnetic interference, which affects the performance of nearby electronic devices. This interference arises due to the high-speed switching operations that occur within the system, potentially causing disruptions in the operation of sensitive components in surrounding equipment. To mitigate these issues, additional filtering components or shielding are required, adding complexity and cost to the design and manufacturing process. The need to comply with regulatory standards related to EMI further increases the investment required to implement SMPS solutions. In regions with stringent EMI regulations, manufacturers may face additional hurdles in product development and market entry, limiting the widespread adoption of SMPS systems. As a result, the challenges associated with EMI can slow down the growth of the SMPS market, particularly in industries sensitive to electromagnetic interference.

-

Design Complexity and Maintenance Challenges in SMPS Systems Leading to Higher Manufacturing and Operational Costs

The intricate design of SMPS systems, which includes advanced components like high-frequency switching circuits, inductor coils, and capacitors, makes manufacturing more complex compared to traditional power supplies. This complexity requires specialized knowledge and expertise in design and production, contributing to higher costs. Additionally, the repair and maintenance of SMPS systems are more demanding, as pinpointing faults in the compact, high-tech components can be time-consuming and expensive. These factors can also lead to longer downtime when repairs are necessary, impacting operational efficiency. Furthermore, businesses may need to invest in skilled technicians or external service providers for maintenance, further increasing operational costs. As a result, the overall expenses related to the production, repair, and upkeep of SMPS systems can be a significant challenge, particularly for businesses with tight budgets or in cost-sensitive industries.

Switch Mode Power Supply Market Segment Analysis

By Type

In 2023, the AC to DC segment dominated the Switch Mode Power Supply market with the highest revenue share of approximately 48%. This dominance can be attributed to the widespread adoption of AC to DC power conversion in a variety of industries, including consumer electronics, telecommunications, and industrial automation. The versatility of AC to DC SMPS in providing stable, efficient power for applications such as laptops, smartphones, and industrial equipment has fueled its consistent demand. As global energy efficiency standards tighten, the need for reliable and energy-efficient AC to DC solutions continues to drive this segment's growth.

The DC to DC segment is expected to grow at the fastest compound annual growth rate of about 6.33% from 2024 to 2032. The rapid expansion of renewable energy systems, electric vehicles, and IoT applications is propelling this growth, as these technologies often require efficient power conversion between different DC voltage levels. Additionally, DC to DC SMPS offers improved efficiency in power management, making it essential for applications where energy savings and compact solutions are critical. As the demand for energy-efficient, flexible power solutions intensifies, the DC to DC segment is poised for significant market expansion.

By Application

In 2023, the Consumer Electronics segment held the largest revenue share of approximately 42% in the Switch Mode Power Supply market. This dominance is driven by the increasing demand for portable devices such as smartphones, laptops, tablets, and wearable technology, all of which require efficient, compact power supplies. As consumer electronics continue to evolve with advanced features and energy-efficient designs, the need for reliable and high-performance SMPS systems has surged, solidifying the segment’s leading position in the market.

The Industrial segment is projected to grow at the fastest compound annual growth rate of about 6.17% from 2024 to 2032. The rapid adoption of industrial automation, IoT applications, and smart manufacturing technologies is fueling this growth. As industries seek more energy-efficient and reliable power management solutions to support complex machinery and devices, the demand for SMPS systems in industrial applications is expected to rise, contributing to the segment's accelerated expansion.

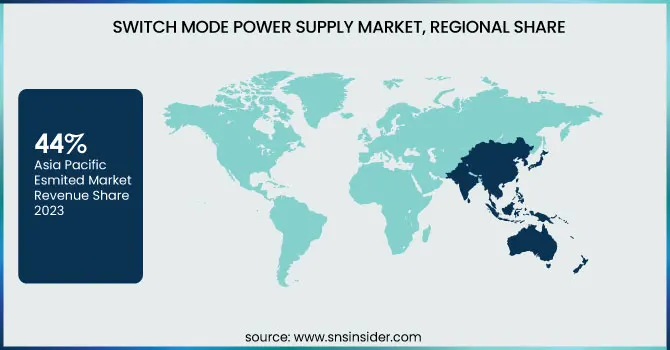

SMPS Market Regional Outlook

In 2023, the Asia Pacific region dominated the Switch Mode Power Supply market with the highest revenue share of approximately 44%. This dominance is largely attributed to the region's robust manufacturing sector, especially in countries like China, Japan, and South Korea, where there is a high demand for SMPS in electronics, automotive, and industrial applications. Additionally, the growing adoption of consumer electronics and the rapid expansion of renewable energy infrastructure in the region have further fueled market growth, positioning Asia Pacific as a key player in the global SMPS market.

North America is projected to experience the fastest compound annual growth rate of about 6.38% from 2024 to 2032. This growth is driven by the region's increasing focus on energy efficiency, smart grid technologies, and the rise of electric vehicles, all of which require advanced power supply solutions. As industries and consumers prioritize sustainable and reliable power management systems, the demand for SMPS in North America is set to expand rapidly, positioning the region as a key contributor to the market's future growth.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

-

Allis Electric Co. Ltd. (Switching Power Supplies, DC-DC Converters)

-

B&K Precision Corporation (Programmable Power Supplies, AC Power Sources)

-

CUI, Inc. (AC-DC Power Supplies, DC-DC Converters)

-

Absopulse Electronics Ltd. (Industrial Power Supplies, DC-DC Converters)

-

BENNING Elektrotechnik und Elektronik GmbH & Co. KG (Power Supplies, Battery Chargers)

-

Block Transformatoren-Elektronik GmbH (Switching Power Supplies, Isolation Transformers)

-

American Portwell Technology Inc. (Embedded Power Supplies, ATX Power Supplies)

-

Artesyn Embedded Power (AC-DC Power Supplies, DC-DC Converters)

-

Apx Technologies Inc. (DC-DC Converters, Power Modules)

-

Bicker Elektronik GmbH (DC-DC Converters, Power Modules)

-

Acopian Technical Company (Modular Power Supplies, Custom Power Supplies)

-

ADVANCED Motion Controls (Motion Control Power Supplies, Servo Power Supplies)

-

Applied Motion Products, Inc. (AC-DC Power Supplies, DC-DC Power Converters)

-

Coilcraft, Inc. (Inductors, Power Inductors)

-

Datatronics (Power Inductors, Transformers)

-

Infineon Technologies AG (Power Modules, AC-DC Power Supplies)

-

Munich Electrification GmbH (Power Converters, Power Modules)

-

Premier Magnetics, Inc. (Inductors, Transformers)

-

Pulse Electronics (Magnetic Components, Power Inductors)

-

Signal Transformer - A Bel Group (Transformers, Custom Transformers)

-

Sumida Corporation (Inductors, Transformers)

-

Tamura Corporation (Transformers, Power Supplies)

-

TDK Electronics AG (Power Modules, DC-DC Converters)

-

Triad Magnetics (Transformers, Power Supplies)

-

Wall Industries, Inc. (AC-DC Power Supplies, DC-DC Converters)

-

XP Power Limited (AC-DC Power Supplies, Medical Power Supplies)

-

Flextronics International Ltd (AC-DC Power Supplies, Custom Power Solutions)

-

AcBel Polytech Inc. (AC-DC Power Supplies, DC-DC Converters)

-

LITE-ON Technology Corporation (AC-DC Power Supplies, LED Power Supplies)

-

Delta Electronics (AC-DC Power Supplies, DC-DC Converters)

Recent Developments:

-

September 20, 2024: Infineon expanded its OptiMOS 6 MOSFET portfolio with the introduction of 135 V and 150 V product families. These devices are designed to enhance efficiency in drives and SMPS applications, offering up to 50% reduction in on-state resistance and improved switching performance.

-

December 2024: TDK introduced RoHS-compliant aluminum electrolytic capacitors suitable for consumer electronics applications. These capacitors are designed for high reliability and compact size, making them ideal for use in SMPS, frequency converters, UPS, medical equipment, and solar inverters.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 2.71 Billion |

| Market Size by 2032 | USD 4.12 Billion |

| CAGR | CAGR of 4.83% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (AC to DC, DC to DC, DC to AC, AC to AC) • By Application (Communications, Industrial, Consumer Electronics, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Allis Electric Co. Ltd., B&K Precision Corporation, CUI, Inc., Absopulse Electronics Ltd., BENNING Elektrotechnik und Elektronik GmbH & Co. KG, Block Transformatoren-Elektronik GmbH, American Portwell Technology Inc., Artesyn Embedded Power, Apx Technologies Inc., Bicker Elektronik GmbH, Acopian Technical Company, ADVANCED Motion Controls, Applied Motion Products, Inc., Coilcraft, Inc., Datatronics, Infineon Technologies AG, Munich Electrification GmbH, Premier Magnetics, Inc., Pulse Electronics, Signal Transformer - A Bel Group, Sumida Corporation, Tamura Corporation, TDK Electronics AG, Triad Magnetics, Wall Industries, Inc., XP Power Limited, Flextronics International Ltd, AcBel Polytech Inc., LITE-ON Technology Corporation, Delta Electronics. |

| Key Drivers | • Industrial Automation and IoT Growth Driving Demand for Efficient Power Management Solutions with SMPS Systems. • Rising Demand for Compact and Efficient Power Supplies in Portable Consumer Electronics Driving Growth in SMPS Market. |

| RESTRAINTS | • Electromagnetic Interference Challenges in SMPS Systems Increasing Design Complexity and Compliance Costs. • Design Complexity and Maintenance Challenges in SMPS Systems Leading to Higher Manufacturing and Operational Costs. |