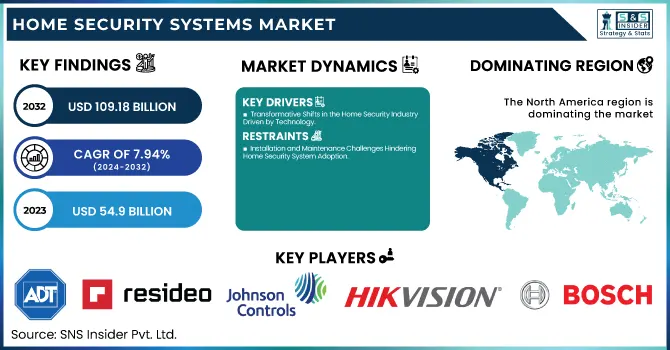

Home Security Systems Market Size Analysis:

The Home Security Systems Market was valued at USD 54.9 billion in 2023 and is projected to reach USD 109.18 billion by 2032, growing at a CAGR of 7.94% from 2024 to 2032. Key drivers of this growth include increasing concerns over personal safety and property protection, the growing adoption of smart home technology, and advancements in AI-powered security solutions. Additionally, the rise in disposable income, coupled with rising crime rates in certain regions, is further propelling demand for advanced security systems.

To Get more information on Home Security Systems Market - Request Free Sample Report

In the US, the Home Security Systems market was valued at USD 17.17 billion in 2023 and is expected to reach USD 31.57 billion by 2032, growing at a CAGR of 7.00%. The market is also supported by government initiatives promoting home safety and advancements in cloud-based security systems that offer remote monitoring and integration with other smart home devices. The evolving trend toward DIY installations and customized security solutions are expected to further enhance market growth, particularly as consumers seek more flexible and scalable home security options.

Home Security Systems Market Dynamics:

Drivers:

-

Transformative Shifts in the Home Security Industry Driven by Technology

The home security industry is undergoing a transformative shift, fueled by technological innovations and growing consumer awareness of safety needs. The integration of AI and IoT technologies has enhanced traditional security systems, enabling features like smart sensors that detect heat, motion, and sound, and provide real-time alerts. AI-powered video surveillance, facial recognition, and motion detection are improving threat detection accuracy while reducing false alarms. With home burglaries occurring every 26 seconds in the U.S., these advancements are crucial for effective protection. Additionally, integrated systems now offer multi-hazard detection, including fire, carbon monoxide, and water damage. Homes with sprinkler systems, for example, have seen a 90% reduction in fire-related deaths. Consumer demand for smart home technology, seen in 41% of German households, is propelling innovation, as security providers develop systems that seamlessly integrate with smart ecosystems, ensuring easy control and robust data protection through mobile apps.

Restraints:

-

Installation and Maintenance Challenges Hindering Home Security System Adoption

While some security systems are designed for easy DIY installation, many advanced solutions require professional installation, which can be costly and time-consuming. Additionally, ongoing maintenance, such as software updates, hardware repairs, and system troubleshooting, often necessitates expert involvement, further increasing long-term costs. This requirement can be a deterrent for consumers who seek hassle-free, cost-effective solutions. Moreover, individuals lacking technical expertise may struggle with setting up or maintaining these systems, leading to potential frustrations and reduced system efficiency. Consequently, these factors may limit the adoption of home security systems among consumers who prioritize simplicity and affordability in their purchases.

Opportunities:

-

AI and IoT advancements are revolutionizing home security by enabling smarter, more adaptive, and automated protection systems.

Advancements in artificial intelligence (AI) and Internet of Things (IoT) technologies are transforming the home security landscape by making systems more intelligent, adaptive, and efficient. AI-powered systems enable features like real-time threat detection, facial recognition, and predictive analytics, which can anticipate potential security breaches before they happen. IoT integration allows various devices, such as cameras, sensors, and alarms, to seamlessly communicate and work together, creating a highly responsive and automated security network. This interconnectedness enhances user experience by providing remote monitoring, timely alerts, and the ability to control the system from anywhere. The combination of AI and IoT technologies not only improves security measures but also enables more personalized and dynamic protection for homes, making them smarter and safer than ever before.

Challenges:

-

False alarms from sensors and cameras reduce system reliability, causing consumer frustration and diminishing trust in home security technologies.

False alarms caused by motion detectors, cameras, or other sensors are a significant challenge in the home security systems market. These alarms not only lead to unnecessary responses from authorities but also cause consumer frustration, diminishing trust in the system’s reliability. When false alarms occur frequently, users may become desensitized or disengage from using the system altogether. Additionally, the cost of handling false alarms and the associated impact on system effectiveness can undermine the overall value proposition of security solutions. Ensuring accurate detection and minimizing false positives is critical to maintaining user confidence and enhancing system reliability in the long term.

Home Security Systems Market Segment Analysis:

By Component

In 2023, the hardware segment of the home security systems market accounted for the largest share of revenue, approximately 45%, reflecting the growing demand for essential physical security devices. This includes components like surveillance cameras, motion sensors, door/window alarms, and control panels, which form the backbone of traditional home security systems. As homeowners seek more robust protection, the demand for high-quality hardware has surged, particularly for video surveillance and smart sensors that integrate with other home automation devices. The continuous advancements in camera technology, including features like high-definition video, night vision, and AI-powered facial recognition, have further fueled this market segment’s growth. Moreover, increasing consumer focus on safeguarding property and family has accelerated the adoption of reliable hardware solutions in home security systems.

The software segment is the fastest-growing in the home security systems market from 2024 to 2032, Software solutions allow for the implementation of advanced features such as remote monitoring, real-time alerts, and AI-driven analytics, providing users with more control and accessibility to personalized security systems. Software, which is increasingly crucial for managing sophisticated, interconnected security solutions as more consumers seek seamless integration with other smart home devices, is becoming critical.

By Type of System

In 2023, the Video Surveillance System segment dominated the home security systems, contributing approximately 50% of the total revenue. This dominance is driven by the growing demand for advanced surveillance cameras that provide high-definition video, night vision, motion detection, and real-time alerts. As security concerns rise, consumers increasingly prioritize video surveillance systems for their ability to monitor properties effectively and deter criminal activity. The integration of Artificial Intelligence (AI) and machine learning in video surveillance systems has further enhanced their capabilities, enabling features like facial recognition, activity tracking, and automated alert systems. The widespread adoption of smart homes and increasing integration with other security technologies are additional factors fueling the segment’s growth, positioning video surveillance as a critical component in modern security solutions.

The Access Control System segment is expected to be the fastest-growing in the home security systems from 2024 to 2032, driven by increasing demand for enhanced security and convenience. As smart homes become more widespread and the demand for safe, automated entry systems grows, access control solutions like biometric scanners, smart locks, and keyless entry systems are becoming more common. These systems provide enhanced security through the prevention of access to unauthorized parties and a more tailored approach to control, allowing for remote management through mobile apps. Also, the growth of this segment is supported by the transition towards the contactless technology along with the Internet of Things and Artificial Intelligence. With the increase of security challenges, particularly in residential and commercial buildings, access control systems are becoming a crucial element of modern security solutions.

By Distribution Channel

In 2023, the Offline segment dominated the home security systems market, contributing around 58% of the total revenue. This preference is largely due to traditional, non-digital physical security solutions that most people still trust the most and do not consider inconvenient at all. This makes offline systems, like wired alarm systems and manual control panels, very simple to install and operate, and therefore quite popular in regions where internet connectivity is either unavailable or inconsistent. The only reason for retaining offline systems, since online/cloud-based solutions in most cases outperform simply due to their speed, is to reduce costs, have a clear-cut solution, and avoid queries over security with no reliance of internet connectivity. This fact only continues to create a favorable environment for offline security solutions to maintain their high market share.

The Online segment is expected to be the fastest-growing in the home security systems market from 2024 to 2032. This growth is fueled by the increasing adoption of cloud-based solutions, which offer users the ability to remotely monitor and control their security systems via mobile apps and web platforms. The convenience of accessing real-time alerts, video surveillance footage, and system management from anywhere is a major driving force behind the shift towards online security solutions. Additionally, the integration of Internet of Things (IoT) devices and artificial intelligence (AI) is enhancing the capabilities of online systems, providing more intelligent, adaptive, and responsive security solutions. As consumers increasingly prioritize convenience, flexibility, and advanced features, the online segment continues to experience rapid growth and adoption.

Home Security Systems Market Regional Analysis:

In 2023, North America held the largest share of the home security systems market, accounting for approximately 44% of the total revenue. This dominance is driven by the region’s high demand for advanced security solutions, particularly in the United States and Canada, where concerns over property safety, technological adoption, and disposable income are high. North American consumers are increasingly investing in sophisticated home security systems, including video surveillance, smart locks, and AI-powered solutions, to safeguard their homes. Additionally, the region benefits from a robust infrastructure, widespread access to the internet, and the growing trend of smart home integration, all of which contribute to the continued growth and expansion of the home security market. The presence of leading security solution providers further bolsters North America's market leadership.

The Asia-Pacific region is the fastest-growing market for home security systems from 2024 to 2032. Rapid urbanization, rising disposable incomes, and an increasing security consciousness among consumers have propelled this growth in China, India and Japan. There is a need for advanced security systems such as video surveillance, smart lock, and alarm systems as the region sees the rise of smart homes and IoT technology. Government efforts to improve public safety and growing demand for mobile applications for remote tracking are some factors fuelling the growth of the market. Due to its significant tech-savvy population and increasing infrastructure, the Asia-Pacific region is set to maintain its leadership in the growth of the market.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players:

Some of the Major Players in Home Security Systems Market along with their Product:

-

ADT (US) (Security systems, video surveillance, smart home devices)

-

Resideo Technologies, Inc. (US) (Home security systems, thermostats, water leak detectors)

-

Johnson Controls (Ireland) (Smart security solutions, fire detection systems, building management systems)

-

Hangzhou Hikvision Digital Technology (China) (Video surveillance cameras, security systems, video recorders)

-

ASSA ABLOY (Sweden) (Smart locks, access control systems, door hardware)

-

SECOM (Japan) (Home security systems, fire protection, video surveillance)

-

Robert Bosch (Germany) (Home security systems, video surveillance, smart home devices)

-

Allegion (Ireland) (Access control, security locks, home safety solutions)

-

Snap One, LLC (US) (Smart home security, surveillance cameras, home automation systems)

-

ABB (Switzerland) (Home automation, smart security solutions, building control systems)

-

Control4 Corporation (US) (Smart home automation, security systems, lighting control, climate control)

-

Honeywell International Inc. (US) (Home security systems, thermostats, smoke detectors, video surveillance)

-

Tyco International Ltd. (Ireland) (Fire protection systems, security systems, video surveillance, access control)

-

Secom (Japan) (Home security systems, fire protection, video surveillance, security monitoring services)

List of key environmental component suppliers for the home security systems market:

-

Honeywell International Inc.

-

Bosch Sensortec

-

Sensirion AG

-

Amphenol Corporation

-

STMicroelectronics

-

Vishay Intertechnology

-

Teledyne Technologies

-

PST Sensors

Recent Development:

-

19 Aug 2024, Resideo has introduced its latest BRK smoke alarms featuring Precision Detection technology, designed to reduce nuisance alarms and provide earlier warnings of fire. These alarms meet new Underwriters Laboratories standards, improving safety by better detecting fires in modern homes.

-

29 Jan 2024, Johnson Controls India has launched its locally manufactured Ilustra Standard Gen3 security cameras, with over 75% of the components sourced locally. This initiative supports India’s "Make-in-India" push and aims to cater to the growing demand for surveillance products in domestic markets, including home security and smart city projects.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 54.9 Billion |

| Market Size by 2032 | USD 109.18 Billion |

| CAGR | CAGR of 7.94 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Hardware, Software, Services) • By Type of System(Video Surveillance System, Alarm System, Access Control System, Fire Protection System) • By Distribution Channel(Online, Offline) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | ADT (US), Resideo Technologies (US), Johnson Controls (Ireland), Hangzhou Hikvision (China), ASSA ABLOY (Sweden), SECOM (Japan), Robert Bosch (Germany), Allegion (Ireland), Snap One (US), ABB (Switzerland), Control4 Corporation (US), Honeywell International (US), and Tyco International (Ireland). |