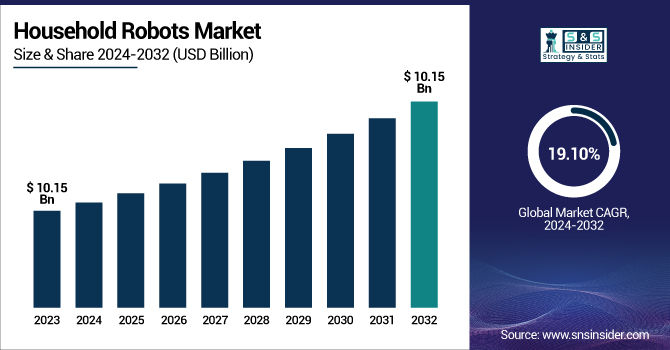

Household Robots Market Size & Growth Analysis:

The Household Robots Market Size was valued at USD 10.15 Billion in 2023 and is expected to reach USD 48.85 Billion by 2032 and grow at a CAGR of 19.10% over the forecast period 2024-2032.

To Get more information on Household Robots Market - Request Free Sample Report

Usage intensity is increasing in the household robots market, with consumers relying more on automation for routine activities. Robot Operating Systems (ROS), especially a combination of open-source and proprietary platforms, are increasing flexibility and innovation by leveraging functionality. These days, household robots are using a range of sensors, including infrared, LIDAR, ultrasonic, and more, to prepare a comprehensive plan for precise navigation and obstacle avoidance. Moreover, AI integration is progressing steadily, enabling robots to learn their environments, identify objects, and interact more intelligently in smart home ecosystems. Household robots in the U.S. picked up heat in 2024 with devices such as the iRobot Roomba Combo 10 Max. The rise of artificial intelligence, machine learning, and voice assistant integration, increased adoption.

The U.S. Household Robots Market is estimated to be USD 7.11 Billion in 2023 and is projected to grow at a CAGR of 8.29%. Fueling growth of household robots market in USA is the increasing demand of convenience, growing penetration of smart home devices and development of artificial intelligence and sensor technologies. This is because customers are looking for quick solutions to their chores, such as cleaning and even lawn maintenance, while elderly folks create a demand for assistive and companion robots.

Household Robots Market Dynamics

Key Drivers:

-

Household Robots Gain Momentum Amid Smart Tech Integration Urban Lifestyles and Post-Pandemic Hygiene Focus

The household robots market is experiencing strong expansion, driven by increasing consumer interest in automation and the improvement of daily chores. The rapid rise in the use of domestic robots, such as vacuum cleaners, lawnmowers, and pool cleaners, is due to increasing urbanization and hectic lifestyles. Robots have benefitted from great strides in efficiency due to advances in AI, machine learning, and IoT that enable integration into smart homes and sophistication with autonomous navigation. Moreover, the cleanness and hygiene fad after the pandemic has driven the robotic cleaning demand. Growing disposable incomes and decreasing robot product costs are also boosting market penetration across emerging economies.

Restrain:

-

Household Robots Face Challenges in Functionality Performance and Smart Home Integration Across Diverse Environments

One of the major limitations of the household robots market is the relatively low functionality and reliability of some robotics solutions. Current models are often task-specific and inconsistent in performance across complex and unstructured environments. It is likely that, for example, robotic vacuum cleaners will not work very well in homes with cluttered rooms or multiple floor types. Furthermore, the absence of universal communication standards between smart home devices and robots makes integration difficult, which might impede their capabilities in fully automated smart homes.

Opportunity:

-

Emerging Opportunities Drive Household Robot Demand in Elderly Care Education Entertainment and Developing Global Markets

With the rise in the global aging population, elderly & handicapped assistance robots providing mobility, companionship & daily activities support are huge market opportunities. Additionally, there is a rising demand for AI-based entertainment and educational robots for kids which creates new opportunities in the entertainment & leisure segment. With the expansion of online retail, combined with strong marketing and discounts, market players are gaining strong wings to expand their audience reach. The future is with voice assistant-compatible modular multifunction robots that are more attractive to tech-savvy consumers. Future growth is also anticipated to come from developing markets such as India, Brazil, and Southeast Asia.

Challenges:

-

Household Robots Market Faces Data Privacy Technical Complexity and Limited Support Challenges Hindering User Confidence

Data privacy and security concerns, particularly with AI-enabled and internet-connected robots, are another big hurdle. The use of microphones, cameras, and other types of sensors in these devices to gather and process sensitive user data may cause suspicion among consumers due to the high risk of a data breach or unauthorized access. In addition, technical complexity and user adaptability remain challenges most users feel tedious about setting up, programming, and maintaining a home robot. Finally, still, there remains a limited presence of skilled support and after-sales service offered in some regions, impacting customer satisfaction and building confidence in robotic solutions. To ensure prolonged adoption and confidence in the market, manufacturers have a mountain to climb in terms of user-friendliness, scaling of service networks, and privacy concerns.

Household Robots Industry Segmentation Analysis

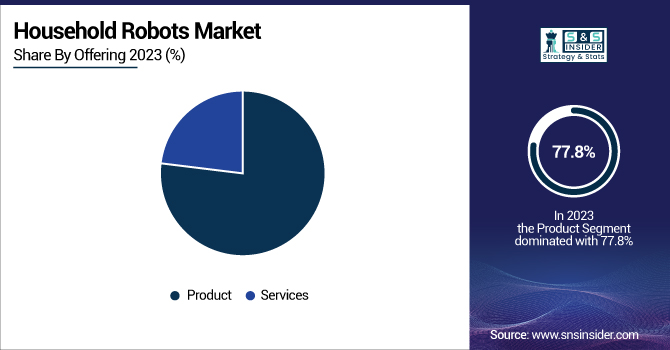

By Offering

In 2023, the market was dominated by the product segment with the largest share of 77.8%, followed by service robots, attributed mainly to the large share of robotic vacuum cleaners, lawnmowers, and pool cleaners. This is because products that work well, are becoming more affordable, and the technology for autonomous navigation and actual smart homes is improving (slowly but surely), so consumers still love these. These devices have become common, especially in urban households, as they automate many of the tedious chores people do at home.

The services segment is expected to grow at the fastest CAGR during the forecast period of 2024 to 2032. Factors such as the increasing demand for installation, maintenance, software updates, and customization services are contributing to this growth. As household robots are becoming more complex, and are more and more incorporated into AI and IoT platforms, customers want a professional to make sure these robots operate well. The move from a one-time purchase to subscription-based service models and other remote diagnostics is also starting to take off creating added revenue avenues not only for manufacturers but also for third-party providers to be leveraged as the smart home ecosystem continues to evolve.

By Type

The household robots market size was dominated by the domestic segment by 73.7 % in 2023, as a large number of people have implemented these robots for several activities, such as vacuuming, floor cleaning, lawn Mowing, and window cleaning. As the need for convenience and hygiene increased more and more awareness increased even more about smart home appliances, now it is evident that domestic robots will become an indispensable part of modern households. This makes them especially popular in urban locations as they automate mundane chores and cut back on manual labor and time.

The entertainment and leisure segment is expected to experience the fastest CAGR during the forecast period of 2024-2032. This growth is driven by a growing interest in companion robots and robot toys as well as educational robots for children. These robots are growing their interactivity level with every increment in AI and voice interaction capabilities. Furthermore, increasing awareness among consumers toward personalized digital experiences and emotional support systems is creating new growth opportunities within this segment.

By Distribution Channel

The online channel held the largest market share at 67.9% in 2023 owing to the rise of e-commerce platforms that offer more household robots at more competitive prices while allowing consumers to compare features and reviews easily. Delivery speed, unique online promotions, and return-friendly policies have led consumers to prefer purchasing robotic products online. Developed regions have also witnessed extremely high growth in online sales, boosted further by the emergence of digital marketplaces and direct-to-consumer brand strategies.

From 2024 to 2032, the offline channel is anticipated to have the highest CAGR. This growth will be enhanced by the role of in-store spaces, where shoppers can see, touch, test, and learn about robots before making a purchase. Moreover, an offline retail option deals with one-on-one assistance and guided help availability post the sale, which is especially key for first-time buyers. An increase in consumer trust towards robotic solutions will increase the desire for a physical retail experience coupled with the need for local service support, providing a propellant force to the offline channel expansion.

By Application

The household robots market was initially dominated by vacuuming, which accounted for a 47.4% share in 2023 and is projected to grow at the fastest CAGR throughout the forecast period (from 2024 to 2032). Robotic vacuum cleaners are popular owing to their effectiveness, time-saving nature, and convenience in cleaning, which is expected to boost their dominance in the market. And urban consumers are increasingly turning to these devices to keep things tidy with little effort. The incorporation of technology like smart navigation, app-controlled features, assisted by voice, auto dirt disposal systems, and more have improved the user experience and thus benefited the overall market. Moreover, the growing emphasis on cleanliness, particularly after the pandemic, has propelled the advent of automated cleaning solutions. The vacuuming robots are anticipated to continue the strong momentum throughout the forecast period due to continuous innovation and upcoming competitive price points.

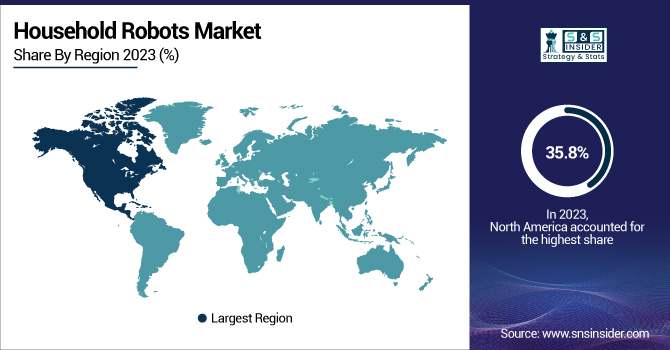

Household Robots Market Regional Overview

North America had a significant share in the household robots market accounting for 35.8% in 2023, mainly because of the high smart home technologies adoption, high disposable income, and a tech-savvy consumer base. The region is well-connected with strong infrastructure, high Internet penetration, and a matured e-commerce ecosystem for quick robotic product distribution. Market leadership led by companies, such as iRobot (Roomba) based in the U.S. market due to simplified innovative solutions for robotic vacuuming. Moreover, the boosting awareness for hygiene and introduction for the elderly population requiring assistive technologies alongside the ever-swelling demand for convenience in-home management further propel the advancement of the market within the region.

Between 2024 and 2032, Asia Pacific will expand at the fastest CAGR fueled by rising urbanization, increasing middle-class income, and continued advancements in technology. Leading the charge are countries like China, Japan, and South Korea and homegrown giants like Xiaomi, Ecovacs, and Panasonic with heavy investments in AI-powered, economical robotic engineering. The growth of companion and elderly-care robots in Japan is spurred by the country's frail older population while increasing adoption of smart and time-saving appliances in China and India is fueling China and India's commercial robot demand. A huge population base and improving access to digital platforms in the regions are anticipated to drive this rapid growth evolution.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players Listed in Household Robots Market are:

-

iRobot (Roomba)

-

Samsung Electronics (Jet Bot AI+)

-

LG Electronics (CordZero ThinQ Robot)

-

Ecovacs Robotics (DEEBOT T20 Omni)

-

Roborock (S8 Pro Ultra)

-

Neato Robotics (Botvac D10)

-

SharkNinja (Shark AI Ultra Robot)

-

Xiaomi (Mi Robot Vacuum-Mop 2 Ultra)

-

Panasonic (RULO MC-RSC10)

-

Dyson (360 Vis Nav)

-

Eufy by Anker (RoboVac X8 Hybrid)

-

Bissell (SpinWave Robot)

-

Proscenic (M8 Pro)

-

Miele (Scout RX3 Home Vision HD)

-

ILIFE (A11 Robot Vacuum)

Recent Trends

-

In March 2025, iRobot launched eight new Roomba models featuring LiDAR mapping for faster, more accurate navigation. The lineup includes advanced features like auto-empty docks, mop pad cleaning, and Matter smart home support.

-

In January 2024, ECOVACS unveiled its revolutionary DEEBOT X2 COMBO, combining a robot and stick vacuum with Matter support. The brand also introduced the WINBOT W2 OMNI and GOAT GX-600, expanding its whole-home and outdoor robotics lineup.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 10.15 Billion |

| Market Size by 2032 | USD 48.85 Billion |

| CAGR | CAGR of 19.10% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Offering (Products, Services) • By Type (Domestic, Entertainment and Leisure) • By Distribution Channel (Online Channel, Offline Channel) • By Application (Vacuuming, Lawn Mowing, Pool Cleaning, Companionship, Elderly Assistance and Handicap Assistance, Robot Toys and Hobby Systems, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | iRobot, Samsung Electronics, LG Electronics, Ecovacs Robotics, Roborock, Neato Robotics, SharkNinja, Xiaomi, Panasonic, Dyson, Eufy by Anker, Bissell, Proscenic, Miele, ILIFE. |