Fiber Optic Gyroscope Market Size & Trends:

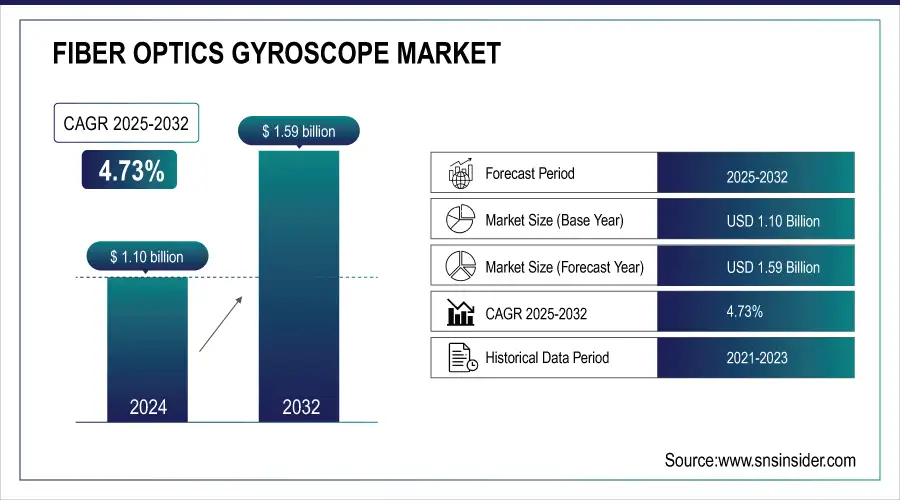

The Fiber Optic Gyroscope Market was valued at USD 1.10 billion in 2024 and is expected to reach USD 1.59 billion by 2032, growing at a CAGR of 4.73% from 2025-2032. This is attributed to the rising demand for high-precision navigation systems in aerospace, defense, robotics, and autonomous vehicles. The emerging trends are Ai-based predictive maintenance are improving system reliability by identifying potential malfunctions before they occur, thereby minimizing costs associated with outages and operational halts. Emerging MEMS gyroscope technologies, quantum sensors, and ring laser gyroscopes are showing potential as low-cost alternatives to fiber optic systems, creating the threat of technological substitution.

Fiber Optic Gyroscope Market Size and Forecast

-

Market Size in 2024: USD 1.10 Billion

-

Market Size by 2032: USD 1.59 Billion

-

CAGR: 4.73% from 2025 to 2032

-

Base Year: 2024

-

Forecast Period: 2025–2032

-

Historical Data: 2021–2023

To Get more information on Fiber Optic Gyroscope Market - Request Free Sample Report

Fiber Optic Gyroscope Market Trends

-

Growing demand for precise navigation and stabilization systems in aerospace, defense, and autonomous vehicles is fueling the Fiber Optic Gyroscope (FOG) market.

-

Increasing adoption of FOGs in inertial navigation systems (INS) for drones, aircraft, ships, and missiles enhances accuracy in GPS-denied environments.

-

Rising deployment in industrial robotics and surveying equipment supports automation and motion control precision.

-

Advancements in optical fiber technology and interferometric sensing are improving sensitivity and reducing drift errors.

-

Expansion of autonomous vehicles and unmanned aerial systems (UAS) is driving miniaturization and low-power FOG designs.

-

FOGs are gaining preference over ring laser gyroscopes (RLG) due to their high reliability, low maintenance, and longer operational life.

-

Increasing R&D investment and defense modernization programs are expected to sustain steady market growth.

Fiber Optic Gyroscope Market Growth Drivers:

-

Fiber Optic Gyroscopes Enable Precise Navigation in GPS-Denied Environments.

Fiber Optic Gyroscopes (FOGs) are also increasingly being used across sectors such as aerospace, defense, and autonomous vehicles, due to the growing requirement for precision-based navigation systems. The FOGs, which are quite useful in GPS-denied environments such as deep-sea, space and electronic warfare environments, can accurately position and track the motion without depending on the external signals. They are crucial for system stability for missiles, UAVS, submarines and space vehicles under extreme conditions. By contrast, FOG's immunity to EMI (EMI) is beneficial for military operations, while they are used in autonomous drones, self-driving cars, and marine vehicles for real-time stabilization.

Fiber Optic Gyroscope Market Restraints:

-

Temperature fluctuations, vibrations, and mechanical stress affect Fiber Optic Gyroscope performance, requiring advanced stabilization measures.

Fiber Optic Gyroscopes (FOGs) offer excellent precision but are vulnerable to environmental conditions like temperature changes, vibrations, and mechanical stress, which will reduce their accuracy. Thermal expansion changes the optical path leading to signal drift and degrading stability. Noise is generated from vibrations from aircraft, submarines, or autonomous vehicles, calling for sophisticated damping mechanisms. In DSCs, mechanical stress can cause shifts in the alignment of the fiber coils, which, especially in cases of harsh military or industrial environments, may negatively affect the performance. At extreme conditions, however, other forces can have an unwanted influence, so manufacturers utilize temperature compensated designs, vibration isolation systems, and ruggedized housings for reliable navigation and motion sensing.

Fiber Optic Gyroscope Market Opportunities:

-

Fiber Optic Gyroscopes enable precise navigation and stabilization in autonomous vehicles.

The growing adoption of self-driving cars, drones, and autonomous robots is fueling demand for high-precision navigation and stabilization systems, making Fiber Optic Gyroscopes (FOGs) essential. Unlike GPS, which can be unreliable in urban canyons, tunnels, or electronic warfare zones, FOGs provide uninterrupted, real-time motion tracking by detecting angular velocity with extreme accuracy. This capability is critical for autonomous vehicles, ensuring precise lane-keeping, obstacle avoidance, and smooth maneuvering even in GPS-denied environments. In drones, FOGs enhance stability during flight and landing, making them invaluable for applications like surveillance, logistics, and disaster response. As the autonomous mobility sector expands, advancements in AI-driven sensor fusion and miniaturization will further integrate FOGs into next-generation smart transportation systems.

Fiber Optic Gyroscope Market Challenges:

-

Environmental factors like temperature changes, vibrations, and mechanical stress affect Fiber Optic Gyroscope accuracy, requiring advanced compensation mechanisms.

Fiber-optic gyroscopes (FOGs) are precision navigation instruments that are heavily impacted by external effects including temperature changes, vibrational, and mechanical stresses. Temperature variations can trigger thermal expansion or contraction inside the fiber coils and introduce phase shifts in light signals, resulting in drift and decreased precision. To mitigate this, manufacturers employ thermal compensation like advanced coatings, insulation materials, and real-time calibration algorithms. Vibration, particularly within aerospace, autonomous vehicles, military equipment, etc, add noise that affects signal integrity. To counter this kind of degradation, shock absorbers, vibration damping mechanisms, and sturdy housing materials are employed. Any mechanical stress on focus (bend or strain on the fiber optical cables) changes the path of propagation of light resulting in signal loss. More reliable encapsulation techniques, reinforced, layer construction combined with AI error correction algorithms are adding to longevity.

Fiber Optic Gyroscope Market Key Segments:

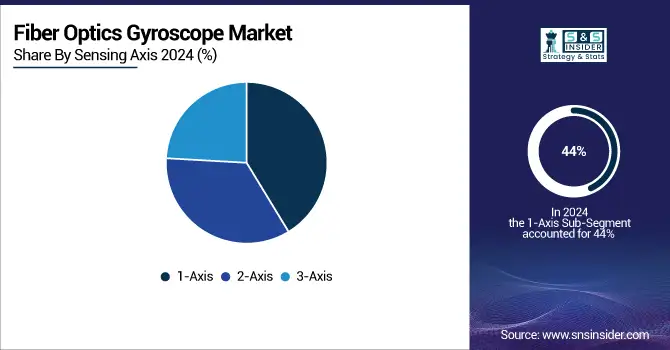

By Sensing Axis, 1-Axis dominates the Fiber Optic Gyroscope Market. 3-Axis is expected to grow fastest.

The 1-Axis segment held the largest revenue share of around 44% in the Fiber Optic Gyroscope Market in 2024, due to its extensive applications in the aerospace and defense industry and industrial automation. It is cost-effective, consumes less power, and is compact, making it an ideal choice for missile guidance, UAV stabilization, and robotics applications. The increasing need for accurate angular motion detection in navigation systems and inertial measurement units (IMUs) also adds fuel to demand With the high performance of various motion sensing solutions across all industries.

The 3-Axis segment is the fastest-growing in the Fiber Optic Gyroscope Market over the forecast period 2025-2032, owing to their higher precision and ability to sense motion in multiple directions. 3-axis FOGs are capable of measuring the rotation in three-dimensional space, making them perfect for applications such as autonomous vehicles, aerospace, and advanced robotics, while having significantly improved stability and accuracy compared to single and dual-axis FOGs. Market growth driven by increasing utilization in advanced inertial navigation systems (INS), UAVs, and space applications.

By Device Sensing Axis, Inertial Measurement Units (IMUs) dominate the Fiber Optic Gyroscope Market. Gyrocompass is expected to grow fastest.

The Inertial Measurement Units (IMUs) segment dominated the Fiber Optic Gyroscope Market with the largest revenue share of approximately 45% in 2024, owing to the importance of high-precision navigation and motion sensing applications. Gyroscopes alone will not be able to provide the essential motion parameters that are required in aerospace, defense, automotive, and industrial automation, therefore IMUs combine fiber optic gyros and accelerometers to provide accurate angular velocity and acceleration data.

The Gyrocompass segment is the fastest-growing in the Fiber Optic Gyroscope Market over the forecast period 2025-2032, driven by its high demand in maritime navigation, submarines, and defense applications. Unlike traditional magnetic compasses, fiber optic gyrocompasses provide accurate, drift-free heading information without reliance on external signals, making them ideal for GPS-denied environments. The increasing use of autonomous ships, naval vessels, and underwater exploration systems is fueling market expansion.

By Vertical, Aerospace & Defense dominates the Fiber Optic Gyroscope Market. Automotive is expected to grow fastest

The Aerospace & Defense segment dominated the Fiber Optic Gyroscope Market in 2024 accounting for approximately 36% of total revenue, driven by its critical role in high-precision navigation, missile guidance, and surveillance systems. Fiber optic gyroscopes (FOGs) offer exceptional accuracy, durability, and resistance to electromagnetic interference, making them essential for fighter jets, UAVs, submarines, and space exploration vehicles.

The Automotive segment is the fastest-growing in the Fiber Optic Gyroscope Market over the forecast period 2025-2032, o the rising demand for autonomous vehicles, ADAS, and vehicle stability control technologies. As a result, fiber optic gyroscope (FOGs) offer high-precision motion sensing, real-time navigation, and improved stability, as well as being key components in automated driving cars, electronic vehicles (EV), and intelligent transportation systems.

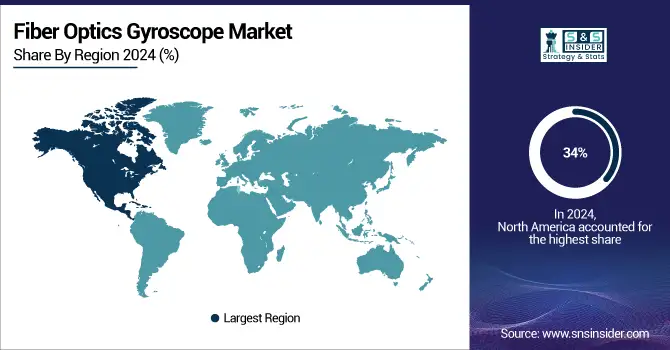

Fiber Optic Gyroscope Market Regional Analysis

North America Fiber Optic Gyroscope Market Insights

The North America region dominated the Fiber Optic Gyroscope Market in 2024, capturing approximately 34% of total revenue, driven by high defense spending, advanced aerospace technology, and rapid adoption of autonomous systems. The presence of leading defense contractors, space exploration agencies, and automotive innovators fuels the demand for high-precision navigation and guidance systems. The region's strong investment in military modernization, UAVs, and AI-driven autonomous vehicles further accelerates market growth. Additionally, government initiatives, technological advancements, and increasing integration of fiber optic gyroscopes in space exploration and robotics solidify North America's position as a market leader.

Get Customized Report as per Your Business Requirement - Enquiry Now

Asia Pacific Fiber Optic Gyroscope Market Insights

The Asia-Pacific region is the fastest-growing in Fiber Optic Gyroscopes Market over the forecast period 2025-2032, in Fiber Optic Gyroscopes Market. The country is investing heavily in military modernization, UAV, smart transportation systems and space exploration related programs, which is increasing the demand for high-precision gyroscopes. This in turn boosts the market growth for automated manufacturing, robotics and intelligent vehicle technologies. FOG in the Asia-Pacific region is further driven by government initiatives that foster aerospace innovation, encourage 5G infrastructure, and support smart mobility solutions.

Europe Fiber Optic Gyroscope Market Insights

Europe holds a significant position in the Fiber Optic Gyroscope Market due to advanced aerospace, defense, and industrial automation sectors. The region’s strong focus on navigation accuracy, autonomous systems, and robotics integration drives steady demand. Government investments in defense modernization and expanding UAV applications further support growth, while ongoing research in precision sensing technologies enhances innovation and competitiveness across major European economies.

Middle East & Africa and Latin America Fiber Optic Gyroscope Market Insights

Middle East & Africa and Latin America hold emerging growth potential in the Fiber Optic Gyroscope Market, driven by increasing adoption of navigation and stabilization technologies in defense, oil & gas, and infrastructure sectors. Expanding investments in UAVs, autonomous systems, and offshore exploration enhance market demand. Additionally, government initiatives promoting technological modernization and industrial automation are expected to further strengthen regional market expansion over the forecast period.

Fiber Optic Gyroscope Market Competitive Landscape:

Honeywell International Inc.

Honeywell International Inc. is a global leader in aerospace, automation, and advanced sensing technologies. The company leverages its expertise in precision navigation, industrial automation, and defense-grade systems to deliver high-performance solutions. Honeywell’s focus on integrating advanced inertial technologies, such as fiber-optic gyros (FOG) and MEMS, strengthens its position in next-generation navigation and stabilization markets for both aerospace and industrial sectors.

-

2024: Announced the acquisition of Civitanavi Systems—specialist in high-performance FOG technology—expanding Honeywell’s navigation and sensors portfolio for aerospace, industrial, and defense markets.

-

2023: In collaboration with Civitanavi Systems, launched the HG2800 family of inertial measurement units (IMUs) incorporating FOG technology for high-bandwidth, low-noise aircraft pointing, stabilization, and navigation applications.

Safran S.A.

Safran S.A. is a leading international technology group specializing in aerospace propulsion, defense, and equipment manufacturing. The company delivers high-precision inertial navigation systems used in both military and civilian platforms. Safran’s continued innovation in fiber-optic gyro (FOG) technology underlines its commitment to improving reliability, reducing life-cycle costs, and scaling production to meet increasing global demand for navigation systems.

-

2024: Detailed its FOG & FMU Series (fiber-optic gyro IMUs) designed for industrial, civil, and military use, showcasing high reliability, low life-cycle cost, and production capacity of over 4,000 FOG units annually.

Silicon Sensing Systems Ltd.

Silicon Sensing Systems Ltd. specializes in developing and manufacturing micro-electromechanical system (MEMS)-based gyroscopes, accelerometers, and inertial sensors. The company is at the forefront of precision sensing technologies that rival traditional FOG systems in accuracy, compactness, and reliability. Silicon Sensing’s continuous innovation aims to expand MEMS applications in aerospace, defense, and autonomous vehicle industries, providing lighter and more efficient alternatives to conventional gyro systems.

-

2025: Signed a cooperation agreement with Kongsberg Discovery AS to develop next-generation MEMS-based gyro technology expected to challenge traditional fiber-optic gyro systems.

-

2025: Produced its 30 millionth inertial sensor, marking a milestone that underscores the company’s success in competing with heavier FOG-based systems in precision and reliability.

Tamagawa Seiki Co., Ltd.

Tamagawa Seiki Co., Ltd. is a Japanese manufacturer known for its advanced motion control and inertial sensing systems. The company has a strong heritage in precision gyros, servos, and encoders, supporting applications in aerospace, robotics, and industrial automation. Tamagawa’s ongoing evolution toward hybrid FOG/MEMS technologies reflects its strategy to offer high-accuracy, robust solutions adaptable to diverse operating environments, including mobility and industrial settings.

-

2022: Added an IP65 waterproof variant to its lineup of fiber-optic gyros (i-FOG) for mobility and industrial applications, broadening use beyond aerospace.

-

2021: Published updates to its “FOG & MEMS combined IMU” product catalogue, highlighting efforts to transition from classic fiber-optic gyros to hybrid FOG/MEMS solutions.

Fiber Optic Gyroscope Companies are:

-

Honeywell International Inc.

-

EMCORE Corporation

-

KVH Industries, Inc.

-

Colibrys (Safran Colibrys SA)

-

Fizoptika Corporation

-

iXblue SAS

-

Optolink LLC

-

NEDAERO Components

-

Advanced Navigation

-

Tamagawa Seiki Co., Ltd.

-

Fiber Optic Gyro, LLC

-

BEI Precision Systems & Space Company

-

Fizoptika Malta Limited

-

Silicon Sensing Systems Ltd.

-

Systron Donner Inertial

-

InnaLabs Ltd.

-

Rockwell Collins, Inc.

-

L3Harris Technologies, Inc.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 1.10 Billion |

| Market Size by 2032 | USD 1.59 Billion |

| CAGR | CAGR of 4.73% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Sensing Axis (1-Axis, 2-Axis, 3-Axis) • By Device Type (Gyrocompass, Inertial Navigation Systems, Inertial Measurement Units) • By Vertical(Aerospace & Defense, Automotive, Robotics, Mining, Healthcare, Transportation & Logistics) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles |

Honeywell International Inc., Northrop Grumman Corporation, EMCORE Corporation, KVH Industries, Inc., Safran S.A., Colibrys (Safran Colibrys SA), Fizoptika Corporation, iXblue SAS, Optolink LLC, NEDAERO Components, Advanced Navigation, Tamagawa Seiki Co., Ltd., Fiber Optic Gyro, LLC, BEI Precision Systems & Space Company, Fizoptika Malta Limited, Silicon Sensing Systems Ltd., Systron Donner Inertial, InnaLabs Ltd., Rockwell Collins, Inc., L3Harris Technologies, Inc. |