Human Immunodeficiency Virus Therapeutics Market Report Scope & Overview:

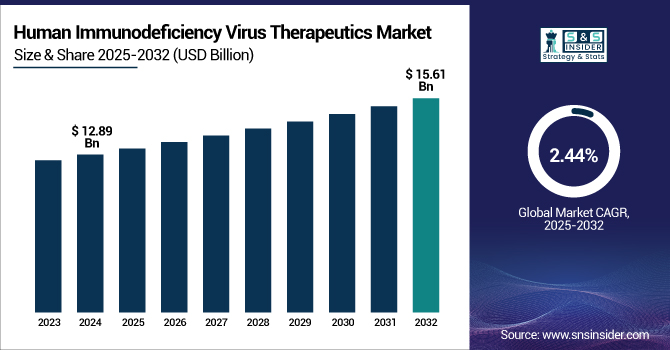

The Human Immunodeficiency Virus Therapeutics Market size was valued at USD 12.89 billion in 2024 and is expected to reach USD 15.61 billion by 2032, growing at a CAGR of 2.44% over the forecast period of 2025-2032.

To Get more information on Human Immunodeficiency Virus Therapeutics Market - Request Free Sample Report

Global human immunodeficiency virus therapeutics market growth is driven by the rising HIV prevalence, combined with technological developments in medication discovery and increased access to treatment across both developed and resource-limited regions.

For instance, UNAIDS estimates that 1.3 million new infections were recorded globally in 2023, a 39% drop from 2010. Nearly 39.9 million people were living with HIV globally in 2023.

Particularly in low- and middle-income nations, government initiatives and international programs, including the U.S. President's Emergency Plan for AIDS Relief (PEPFAR) and the Global Fund to Fight AIDS, Tuberculosis, and Malaria, have been crucial in increasing access to antiretroviral therapy (ART). The Center for Disease Control and Prevention (CDC) estimates that 1.2 million people live with HIV, which is approximately 0.3% of the total population in the U.S. With a substantial compound annual growth rate (CAGR) of 2.16%, the U.S. human immunodeficiency virus therapeutics market size has shown a consistent rise from USD 4.89 billion in 2023 to USD 5.79 billion by 2032. These numbers highlight the ongoing need for creative ideas and continuous public health campaigns to stop the epidemic and improve patient outcomes.

HIV treatments range in antiretroviral medications used to lower the risk of transmission, boost the immune system, and stop viral replication. Long-acting injectables, fixed-dose combos, and single-tablet regimens, all of which enhance patient adherence and quality of life, are reshaping the market. HIV.gov reports that 53% people living with HIV globally in 2023 were women and girls, underscoring the need for gender-sensitive methods in therapy and prevention. As seen by the 75.3% of the U.S. citizens with HIV receiving treatment and 65.9% attaining viral suppression in 2021, international organizations and national governments have begun awareness programs and extension of ART coverage.

Market Dynamics:

Drivers:

-

Growing Global HIV Prevalence and Increased Access to Antiretroviral Treatment Drive the Market Growth

A main driver pushing the human immunodeficiency virus therapeutics market growth is the ongoing rise in HIV infection rates globally, particularly among younger populations and high-risk categories. New infections still originate from unprotected sexual activities, needle sharing, and little knowledge of transmission, which fuels a continuous demand for innovative treatment approaches.

For instance, the according to a report from the World Health Organisation (WHO), 39.9 million individuals globally, by the end of 2023, were living with HIV; of these, 1.4 million were children aged 0–14 years old and 38.6 million were adults with 15+ years old. 630,000 persons perished from HIV-related causes globally.

HIV treatment has been transformed by ongoing innovation in antiretroviral therapy, which has produced fixed-dose combos, long-acting injectables, and next-generation integrators.

Particularly in underdeveloped areas, governments and non-governmental groups have responded with increased testing, public health campaigns, and more general access to antiretroviral medication. Through antiretroviral treatment (ART), government programs as PEPFAR and the Global Fund have increased treatment availability, therefore helping approximately 20.6 million individuals globally. In high-burden nations, these initiatives, together with rising awareness campaigns and diagnostic developments, have lowered mother-to-child transmission rates by 58% since 2010. Simplified regimens, including fixed-dose combinations have helped to increase adherence and 76% of patients will have viral suppression in 2023.

Restraints:

-

Unequal Access Limit Market Penetration in Low-Resource Settings and High Cost of Antiretroviral Medications Impede Market Expansion

Particularly in low- and middle-income nations, the large expense linked with antiretroviral medications remains a major obstacle for the human immunodeficiency virus therapeutics market expansion. Several areas still suffer from issues related to affordability, poor healthcare infrastructure, and restricted insurance coverage, even with projects to increase access globally. Often delaying the availability of reasonably priced generic alternatives, patent rights, and exclusivity on branded HIV drugs help to prolong high pricing and limit access for underprivileged groups.

Patented antiretrovirals remain expensive even with generic medication manufacturing and annual treatment costs in high-income nations go over USD 24,000 per patient. PEPFAR's USD 736 million procurement budget in 2024 was disrupted in low- and middle-income countries, therefore compromising supply for 370,000 healthcare professionals depending on sponsored programmes. Drug patent exclusivity delayed generic alternatives until 2027, leaving 6.7 million people in the Asia Pacific region dependent on limited options.

Combined with inadequate government financing and logistical challenges, socioeconomic inequalities aggravate these problems and lead to health disparities whereby many people are deprived of life-saving HIV treatments. Achieving world treatment targets and optimizing market potential depending on removing these structural and financial obstacles.

Segmentation Analysis:

By Drug Type

Branded drug segment driven by constant innovation, robust clinical trial support and the adoption of sophisticated medicines, and branded medications kept a commanding presence in the human immunodeficiency virus therapeutics market in 2024. Leading pharmaceutical businesses, such as Gilead Sciences and ViiV Healthcare have introduced very successful branded medications, including Biktarvy and Cabenuva, which offer increased efficacy, less side effects, and simple dose schedules.

For instance, Gilead's Phase 1 trial, published on March 11, 2025, found that a single 5,000 mg intramuscular Lenacapavir injection kept effective HIV-preventive medication levels for more than 12 months. Most participants wanted the treatment over daily oral PrEP, and it was well-tolerated with just moderate adverse effects. Plans call for more Phase 3 research by 2025.

Several sophisticated branded drugs, including Sunlenca (lenacapavir), a biennial injectable for patients with multidrug-resistant HIV, have been approved by the U.S. Food and Drug Administration (FDA), therefore confirming the leadership in this field. Strong safety profiles, availability of fixed-dose combos, and introduction of long-acting formulations addressing adherence issues and lowering stigma help to support the inclination for branded medications.

Over the projected period, the generic pharmaceuticals segment is expected to expand at the fastest compound annual growth rate (CAGR). This acceleration is fueled by the expiration of patents on major branded antiretrovirals, enabling generic manufacturers to enter the market with a cost-effective alternative. Particularly in resource-constrained environments, governments and international agencies are aggressively pushing the use of generics to lower treatment costs and increase access. For instance, in August 2023, Dr. Reddy's Laboratories and Hetero partnered with Gilead Sciences to produce and market lenacapavir in 120 low- and lower-middle-income countries, further increasing access to creative HIV treatment for highly treatment-experienced patients.

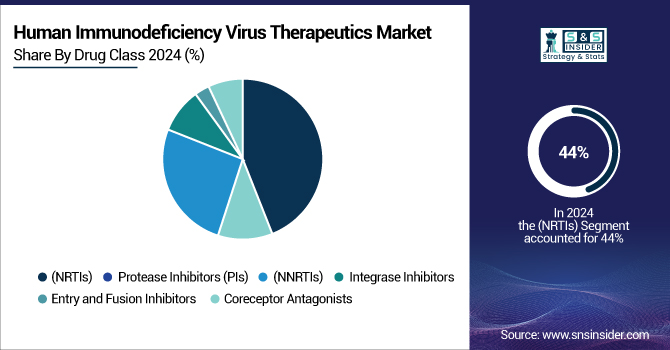

By Drug Class

Nucleoside-analog reverse transcriptase inhibitors (NRTIs) dominated and held 44% of the human immunodeficiency virus therapeutics market share in 2024. The segment’s growth is driven by its proven effectiveness, safety, and fitness with other medication classes, mostly ART regimens center on NRTIs. Forming the foundation of both first-line and salvage therapy programs, they are extensively advised in national and international treatment guidelines. The constant development of NRTIs with better pharmacokinetic characteristics and lowered adverse effects has strengthened their market dominance.

Also, the norm of treatment now is fixed-dose combos, such as Biktarvy (bictegravir/emtricitabine/tenofovir alafenamide), further enhancing patient convenience and outcomes. Particularly in high-income nations, where modern treatments are easily accessible, these developments have led to increased therapy acceptance.

The non-nucleoside reverse transcriptase inhibitors (NNRTIs) segment is expected to grow with the fastest CAGR throughout the forecast period due to the continuous research, release of new drugs with enhanced resistance profiles, and the extension of long-acting injectable regimens. Patients who acquire resistance or intolerance to other medication classes should include NNRTIs, since they provide an alternative mechanism of action.

For instance, the market's move toward creative delivery techniques that improve patient quality of life is ViiV Healthcare's Cabenuva, the first long-acting injectable regimen combining the NNRTI rilpivirine with the integrase.

As an alternative for both first- and second-line therapy, international recommendations increasingly point to NNRTI-based regimens, further extending their use. The WHO and other organizations are also trying to increase access to long-acting NNRTIs in low- and middle-income nations, where daily oral medication could be difficult because of logistical barriers or stigma.

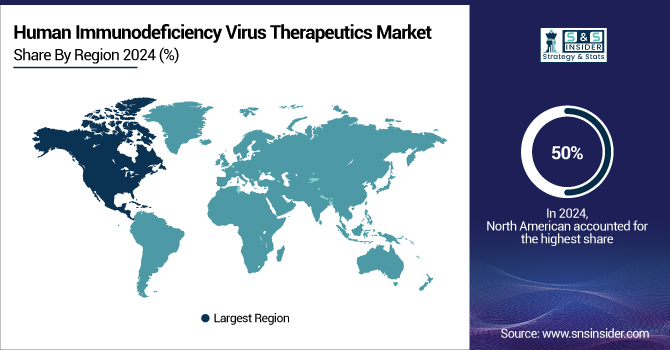

Regional Analysis:

The North American region held the dominant global human immunodeficiency virus therapeutics market share of 50% in 2024. Advanced healthcare infrastructure, thorough public health campaigns, and the presence of major pharmaceutical corporations pushing innovation and fast acceptance of novel medications help to explain this supremacy. Widespread ART coverage under Medicaid and Medicare, and the "Ending the HIV Epidemic" effort by the U.S. government, have greatly raised diagnostic rates, treatment acceptance, and viral suppression among those living with HIV.

For instance, around 1.2 million Americans live with HIV, and 13% of them are unaware of their status and need testing. With a rate of 11.3 per 100,000 people, 31,800 new HIV infections occurred, 87% of which affected men.

Reflecting the success of national policies in enhancing outcomes and lowering transmission. Gilead Sciences leads the U.S. market with over 60% share, mostly relying on its blockbuster medicine Biktarvy to keep its leadership and maintains significant R&D investments to support this position.

The Asia Pacific is expected to be the fastest-growing region in the human immunodeficiency virus therapeutics market. Driven by increased prevalence, government initiatives, and the increasing availability of reasonably priced generic medications, Asia Pacific aiming to reach the UN's 95-95-95 targets, nations, such as India and China have started extensive national campaigns including India's NACO and China's Healthy China 2030, further increasing ART access and promoting early diagnosis. Producing affordable generics, which are essential for increasing treatment in high-burden environments, the pharmaceutical sector of the region is also significantly helping to provide cost-effective solutions. Especially in underprivileged areas, collaborations with organizations, such as the Global Fund and PEPFAR have improved access to diagnoses and treatment. These elements help Asia Pacific to be a main driver of the global HIV therapy market expansion in the coming years.

Supported by increasing HIV prevalence, robust pharmaceutical presence, and key alliances to enhance medicine supply, Europe was the second-largest human immunodeficiency virus therapeutics market in 2024. Access to sophisticated technologies has been enhanced by projects such the distribution cooperation for Trogarzo (Theratechnologies Europe Limited and Loxxess, July 2020).

The LAMEA (Latin America, Middle East, and Africa) region continues to face challenges related to healthcare infrastructure and access, but is seeing development due to the increased funding from international organizations and the release of generic ARTs. Lenacapavir, a biennial injectable, has potential for increasing access in low- and middle-income nations, especially in Africa and Latin America, where the HIV burden remains high, according to the United Nations announced in January 2025.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

The key human immunodeficiency virus therapeutics companies are AbbVie Inc., Cipla, Boehringer Ingelheim International GmbH, Dr. Reddy's Laboratories, Bristol-Myers Squibb Company, Genentech, Inc., Gilead Sciences, Inc., Merck & Co., Inc., ViiV Healthcare, Aurobindo Pharma, and Johnson & Johnson.

Recent Developments

-

The World Health Organisation (WHO) invited manufacturers to indicate interest in prequalification of the dual prevention pill (DPP), a coformulated generic combining HIV PrEP and contraception, in November 2024. Viatris intends to submit for WHO PQ by the end of 2024.

-

Aiming to make sophisticated HIV treatment more widely available, Gilead announced in October 2024 royalty-free, voluntary licensing arrangements with six generic manufacturers to offer lenacapavir in 120 high-incidence, resource-limited countries.

-

AbbVie started a Phase I trial for ABBV-1882 in June 2023 combining anti-PD1 with anti-α4β7 antibodies. Targeting PD1 and α4β7 integrin channels, the treatment seeks to fight HIV.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 12.89 Billion |

| Market Size by 2032 | USD 15.61 Billion |

| CAGR | CAGR of 2.44% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Drug Type (Branded Drugs, Generic Drugs) • By Drug Class (Nucleoside-Analog Reverse Transcriptase Inhibitors (NRTIs), Protease Inhibitors (PIs), Non-Nucleoside Reverse Transcriptase Inhibitors (NNRTIs), Integrase Inhibitors, Entry and Fusion Inhibitors, Coreceptor Antagonists) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | AbbVie Inc., Cipla, Boehringer Ingelheim International GmbH, Dr. Reddy's Laboratories, Bristol-Myers Squibb Company, Genentech, Inc., Gilead Sciences, Inc., Merck & Co., Inc., ViiV Healthcare, Aurobindo Pharma, Johnson & Johnson |