Legionella Testing Market Overview

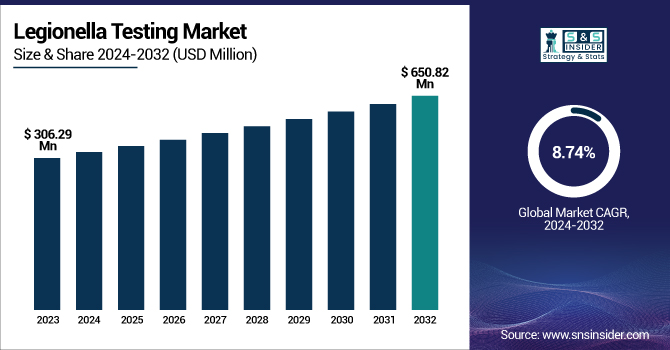

The Legionella Testing Market reached USD 306.29 million in 2023 and is projected to grow to USD 650.82 million by 2032, expanding at a CAGR of 8.74%.

To Get more information on Legionella Testing Market - Request Free Sample Report

This report provides a comprehensive analysis of the legionella testing market, highlighting key trends such as the rising incidence of Legionnaires’ disease and the increasing adoption of rapid diagnostic methods like PCR testing. It examines the regulatory landscape, detailing compliance rates and enforcement measures across regions. The report also explores testing volume growth, end-user adoption trends, and advancements in testing technologies.

Additionally, it covers water contamination statistics, investment in R&D, and pricing trends in the market. A detailed assessment of testing method adoption rates, along with industry-specific demand from healthcare, hospitality, and industrial sectors, is included. The study also presents a cost analysis of various testing methods and their regional variations. Overall, this report delivers critical insights into market dynamics, innovation, and regulatory impact shaping the legionella testing industry.

United States Legionella Market Size

The Legionella Market size in the U.S. was USD 95.4 million in 2023 and is expected to reach USD 180.1 million by 2032, growing at a CAGR of 7.31% over the forecast period of 2024-2032. The U.S. held the largest market share in the North American naphtha market, accounting for 76% market share in 2023 due to its extensive refining capacity, strong petrochemical industry, and high demand for gasoline blending. The country has one of the largest refinery infrastructures globally, enabling the production of large volumes of naphtha to support its industrial and energy sectors. The presence of major petrochemical hubs along the Gulf Coast, where naphtha is a key feedstock for ethylene and propylene production, has further strengthened its dominance.

The U.S. benefits from an abundant supply of shale oil and natural gas liquids, which enhances its refining efficiency and cost competitiveness. Rising exports of naphtha to Asia and Europe, along with increasing domestic demand from the automotive and packaging industries, have further solidified the U.S. position as the market leader in North America.

Legionella Testing Market Dynamics

Drivers

-

Stringent water safety regulations and rising legionnaires’ disease cases drive the legionella testing market growth.

The growing number of Legionnaires’ disease cases worldwide has led to stricter water safety regulations, significantly driving demand for Legionella testing. Regulatory bodies, such as the U.S. Environmental Protection Agency (EPA), the Centers for Disease Control and Prevention (CDC), and the European Centre for Disease Prevention and Control (ECDC), have enforced stringent guidelines for monitoring Legionella contamination in water systems. These regulations mandate frequent testing in high-risk environments like hospitals, hotels, and industrial cooling towers. Additionally, rising public awareness about the health risks associated with Legionella-contaminated water has further fueled market growth. As a result, industries are increasingly adopting rapid diagnostic methods, including PCR and antigen-based tests, to ensure compliance with safety standards. This heightened regulatory scrutiny, coupled with advancements in Legionella detection technologies, continues to propel market expansion.

Restrain

-

High costs of advanced legionella testing methods limit market adoption in cost-sensitive regions.

Despite the growing demand for Legionella testing, the high costs associated with advanced diagnostic techniques remain a significant restraint. PCR-based and next-generation sequencing (NGS) methods, while highly accurate and efficient, require expensive laboratory equipment, skilled personnel, and specialized reagents, making them financially challenging for small-scale water testing facilities and low-income regions. Traditional culture-based methods, although more affordable, have longer turnaround times, delaying critical responses to Legionella outbreaks. Moreover, regulatory compliance costs add financial burdens to industries required to conduct regular Legionella testing. Small and medium-sized businesses, particularly in developing countries, often struggle to meet these requirements due to budget constraints. As a result, the adoption of cost-effective testing solutions remains a key challenge, limiting the broader expansion of the Legionella testing market in cost-sensitive regions.

Opportunity

-

The rising adoption of automated and AI-powered water testing solutions creates growth opportunities for the legionella testing market.

The increasing integration of automation and artificial intelligence (AI) in water testing presents a significant growth opportunity for the Legionella testing market. Advanced automated testing solutions, including AI-powered real-time water monitoring systems, can detect Legionella contamination with high accuracy and minimal human intervention. These innovations enable faster, more efficient testing, reducing delays associated with traditional laboratory-based methods. Furthermore, the growing adoption of Internet of Things (IoT)-enabled water quality monitoring systems in industrial and commercial settings has enhanced proactive Legionella detection. Governments and private enterprises are investing in smart water management technologies to ensure compliance with stringent safety regulations. As AI-driven diagnostic tools become more affordable and accessible, the market is expected to witness increased adoption, particularly in industries such as healthcare, hospitality, and municipal water treatment.

Challenge

-

Challenges in standardizing global legionella testing regulations across different regions and industries.

One of the major challenges in the Legionella testing market is the lack of standardized global regulations across various regions and industries. While developed nations such as the U.S., Canada, and European countries have stringent guidelines for Legionella monitoring, many emerging economies still lack well-defined regulatory frameworks. This inconsistency leads to varying testing frequencies, methodologies, and compliance requirements across different sectors. Additionally, some industries, such as healthcare and hospitality, are subject to stricter monitoring compared to others, creating disparities in testing adoption. The absence of universally accepted standards complicates the implementation of effective Legionella control measures, as businesses operating in multiple regions must navigate different regulatory landscapes. Addressing this challenge requires coordinated efforts from international health organizations, regulatory bodies, and industry stakeholders to establish uniform guidelines for Legionella testing worldwide.

Legionella Testing Market Segmentation Analysis

By Type

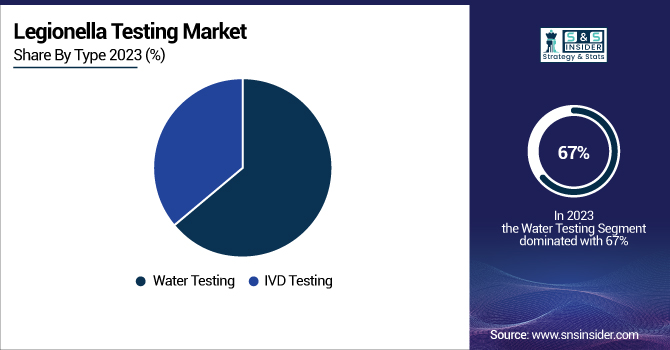

Water Testing held the largest market share, around 67%, in 2023. It is due to legionella bacteria that can be found in water systems like cooling towers, plumbing networks, hot water tanks, and industrial water supplies. regular testing is a requirement for compliance with strict safety standards. To keep Legionella out of buildings like hospitals, hotels, and many commercial buildings, regulators including the EPA, CDC, and WHO, require regular water testing in these environments. Moreover, the growing demand for rapid and automated water testing solutions, including PCR (Polymerase chain reaction) based tests and antigen detection tests, is anticipated to fuel the market growth over the forecast period. The continuous increase in public awareness of waterborne diseases, along with the growing availability of real-time water-monitoring technologies, has lent yet more support to the established dominance of water testing, establishing it as the most common Legionella detection method.

By End-Use

Microbial Culture held the largest market share in the legionella testing market around 39% in 2023. It is due to its status as the gold standard for Legionella detection, widely recognized by regulatory agencies such as the CDC, EPA, and WHO. This method is highly reliable for identifying viable and infectious Legionella bacteria, making it essential for regulatory compliance in water safety programs. Despite the emergence of rapid diagnostic techniques like PCR and DFA stain, microbial culture remains the preferred choice due to its ability to differentiate live bacteria from dead cells, ensuring accurate risk assessment. Additionally, its widespread adoption in hospitals, water treatment facilities, and industrial sites reinforces its market dominance. While the method has a longer turnaround time, its cost-effectiveness and regulatory acceptance contribute to its continued leadership in the Legionella testing market.

Legionella Testing Market Regional Insights

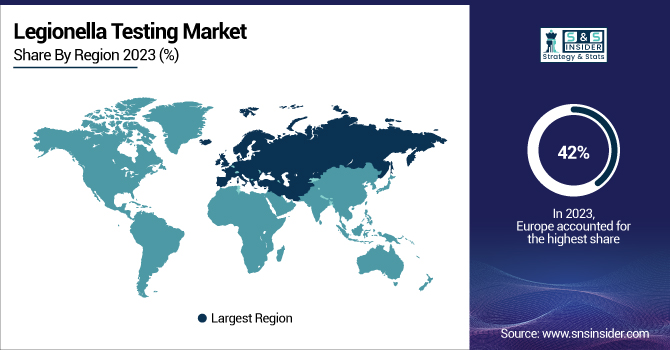

Europe held the largest market share at around 42% in 2023. This is owing to stringent regulations set for water safety, high level of awareness regarding legionella-related risks, and well-established healthcare infrastructure. Legionella testing is required in industries like healthcare, hospitality and water treatment facilities by regulatory bodies like the European Centre for Disease Prevention and Control (ECDC) and the Health and Safety Executive (HSE) in the U.K. There have also been more cases of Legionnaires’ disease in Europe and therefore buildings are being tested more regularly in both the public and private sector. Innovation is another area where the region excels, with PCR-based rapid diagnostics and mechanization and auto water monitoring techniques. In addition to this, the commercialization of waterborne disease prevention along with stringent compliance requirements has propelled the demand for Legionella testing in the region, which has established Europe as a leading market across the globe.

Asia Pacific held the significant market share. This is due to the strengthening of water quality guidelines for controlling Legionella outbreaks in China, Japan, India, and Australia, which has led to stringent regulations in the healthcare, hospitality, and manufacturing industries. This wide range of applications from land to water and the exponential growth of cooling towers, water treatment facilities, and public water systems have created a significant demand for routine testing. Moreover, there is also growing utilization of these advanced testing technologies like PCR-based detection, automated water testing solutions, etc. In addition, its wide market share can also be attributed to its huge population, rapidly developing healthcare infrastructure, and foreign investments in water safety projects.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players in the Legionella Testing Market

-

Aquacert Ltd (Legionella Water Testing Kits, Lab Analysis Services)

-

Quidel Corporation (Lyra Direct Legionella Assay, Sofia FIA System)

-

Merck KGaA (Legiolert Test, Singlepath Legionella)

-

Thermo Fisher Scientific Inc. (SureTect PCR System, Remel Legionella Latex Test)

-

bioMérieux (VIDAS Legionella, GENE-UP Legionella)

-

Eurofins Scientific (Legionella Culture Testing, qPCR Legionella Testing)

-

Abbott (Alere Legionella, BinaxNOW Legionella Urinary Antigen Card)

-

Bio-Rad Laboratories, Inc. (iQ-Check Legionella Kit, RAPID Legionella Medium)

-

BD (BD MAX System, Legionella DFA Test)

-

IDEXX Corporation (Legiolert, Colilert-18)

-

Pall Corporation (Legionella Detection Filtration Kits, Ultrafiltration Systems)

-

NEOGEN Corporation (Legionella qPCR Detection Kit, LuminUltra Test Kit)

-

Hygiena (EnSURE Touch, Innovate System)

-

LuminUltra (GeneCount Legionella Testing, LuminUltra qPCR Kits)

-

Water Treatment Products Ltd. (Legionella Rapid Test Kit, Potable Water Testing Kit)

-

ALS Limited (Legionella Culture Testing, PCR Legionella Analysis)

-

MP Biomedicals (Legionella DFA Kit, Legionella PCR Assay)

-

Camlab (Legionella Field Testing Kit, Water Test Strips)

-

Pro-Lab Diagnostics (Legionella Latex Test Kit, Microgen Legionella ID Panel)

-

Veolia Water Technologies (Legionella Risk Assessment, On-Site Legionella Testing Services)

Recent Development in the Legionella Testing Market

-

In 2024, Eurofins Scientific, in collaboration with industry partners, led Eurofins IPROMA in developing advanced biosensors designed for detecting Legionella pneumophila in water systems, improving rapid detection and prevention strategies.

-

In 2023, LuminUltra introduced BugCount Guardian, an advanced version of their 2nd Generation ATP testing, providing fast and reliable microbial monitoring solutions for water systems.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 306.29 Million |

| Market Size by 2032 | USD650.82 Million |

| CAGR | CAGR of8.74 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Water Testing, IVD Testing) • By End-Use (Microbial Culture, Direct Fluorescent Antibody (DFA) Stain, PCR, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Aquacert Ltd, Quidel Corporation, Merck KGaA, Thermo Fisher Scientific Inc., bioMérieux, Eurofins Scientific, Abbott, Bio-Rad Laboratories, Inc., BD, IDEXX Corporation, Pall Corporation, NEOGEN Corporation, Hygiena, LuminUltra, Water Treatment Products Ltd., ALS Limited, MP Biomedicals, Camlab, Pro-Lab Diagnostics, Veolia Water Technologies |