Behavioral Rehabilitation Market Size Analysis:

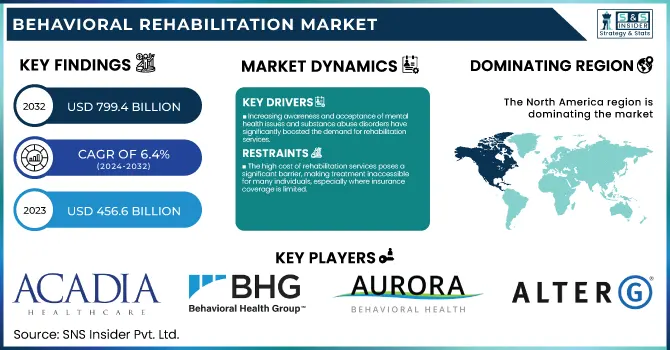

The Behavioral Rehabilitation Market Size was valued at USD 456.6 Billion in 2023 and is expected to reach USD 799.4 Billion by 2032, growing at a CAGR of 6.4% over the forecast period 2024-2032.

The Behavioral Rehabilitation Market report covers key data related to the behavioral rehabilitation industry, such as incidence and prevalence of behavioral disorders, including substance use disorders, anxiety, and PTSD. It examines treatment usage and prescription data regionally, highlighting the growth in demand for psychiatric drugs and non-drug therapies like CBT and teletherapy. It also details the proliferation of rehabilitation facilities and the expansion of bed capacity, noting the increase in both inpatient and outpatient centers.

To Get more information on Behavioral Rehabilitation Market - Request Free Sample Report

It also provides an analysis of drug volume trends in the production and use of psychiatric medications. Healthcare spending breakdowns by government, insurers, and out-of-pocket payments are explored, alongside technological adoption in behavioral rehabilitation, focusing on telemedicine, AI-driven mental health tools, and digital therapy platforms shaping the industry’s future. The behavioral rehabilitation market is expected to increase due to greater awareness of mental health issues and substance abuse disorder.

Behavioral Rehabilitation Market Dynamics

Drivers:

-

Increasing awareness and acceptance of mental health issues and substance abuse disorders have significantly boosted the demand for rehabilitation services.

The growing recognition and understanding of mental health issues and substance use disorders have greatly boosted the demand for behavioural rehabilitation services. Recent data supports this trend, showing an increased awareness and readiness to get help. The Economic Survey 2024 of India states that 10.6% of adults experience mental disorders, while the prevalence rate in urban metro areas is higher at 13.5%. This is concerning as the treatment gap for these disorders varies from 70% to 92%, depending on the disorder in question. A difference so large that it shows an urgent need for better behavioral rehab care. Stress at work has become a major factor in mental health issues. Among those with workplace stress, 90% would appreciate better work-life balance policies, according to a 2024 survey. Additionally, 77% find therapy expensive, and 74% do not seek therapy due to lack of insurance coverage for mental health services. These findings highlight the necessity for affordable and accessible mental health care options.

For example, over half of LGBTQ+ youth in the United States reported experiencing discrimination based on their sexual orientation or gender identity. High costs and fear of not being taken seriously stand in the way of accessing mental health care. Such systemic issues highlight the necessity for easy-to-use and supportive mental health services for all. Another stimulant further drawing attention to behavioral rehab is the spike in cannabis addiction. Online communities, such as Reddit’s r/leaves, have sprung up as support networks, signaling a hunger for accessible recovery resources. This trend highlights the need for the integration of technology into mental health support systems.

Restraints:

-

The high cost of rehabilitation services poses a significant barrier, making treatment inaccessible for many individuals, especially where insurance coverage is limited.

The high costs of behavioral rehabilitation services still represent a major obstacle to accessing necessary care. Although the general public has taken a step back to learn about mental health, many people find such services financially prohibitive. This economic obstacle is exacerbated by limited insurance coverage, particularly for outpatient and long-term rehabilitation programs, leading to substantial out-of-pocket expenses for patients. As a result, a large part of the population does not have access to behavioral health interventions and end up untreated, placing an even greater strain on public health systems. Addressing this issue requires policy reforms to enhance insurance coverage and funding, aiming to make behavioral rehabilitation services more accessible and affordable for all individuals in need.

Opportunities:

-

The integration of technology in treatment delivery, such as telehealth and digital therapy platforms, is setting the stage for remote access to rehabilitation programs, enabling healthcare providers to reach individuals who may not have the means to attend in-person sessions.

Technology Integration in Behavioral Rehabilitation Technology integration in behavioral rehabilitation is a path with strong potential to improve the accessibility and efficacy of our mental health services. It is evident from recent data that behavioral health care has transitioned toward telehealth. Before the pandemic, less than 1% of behavioral health visits were conducted via telehealth; by the second quarter of 2022, this figure had risen to 32.8%, marking a 45-fold increase. This increase shows that consumers are becoming more comfortable with and prefer remote care; nearly 4 in 10 consumers prefer telemedicine over in-person visits for mental health services.

Innovative digital therapy platforms are emerging to meet this demand. For example, Neurofit, a New York City-based startup, has created an app that merges neuroscience and artificial intelligence for users to tackle chronic stress. By providing mental health support in a bio-data driven, personalized way, the app uses personal biometric data to offer personalized guidance. For example, virtual hospitals such as the Seha Virtual Hospital in Saudi Arabia provide physical treatments into digital networks, including psychiatric care, breaking borders of geographical limitations and reducing healthcare costs. In addition, previous research has shown that app-based interventions can be effective. A new study from UT Health San Antonio reported that opioid use was reduced by 35% and treatment retention was improved by 19% among individuals who received the WEconnect Health app in addition to medication. These developments underscore the potential of technology to transform behavioral rehabilitation by making it more accessible, personalized, and effective.

Challenges:

-

The behavioral rehabilitation market faces significant hurdles due to a chronic shortage of qualified mental health professionals, such as psychiatrists, psychologists, and counselors.

The behavioral rehabilitation industry is currently undergoing a critical shortage of mental health care workers, a factor which will ultimately stifle access to quality care for those requiring behavioral health care and diminishes the overall efficacy of the rehabilitation services provided. More recently in Australia, several analyses have shown that the country only has about 70% of the required mental health workforce to adequately meet patients’ needs. Projections indicate that by 2030, this shortfall could escalate, with an estimated 40% of required staff positions remaining unfilled. The shortfall is especially pronounced in psychiatry, where the existing workforce is sprinkled out with only around 2,800 psychiatrists to what is estimated to be a need of around 5,000 to properly serve the population. That shortage is not unique to Australia or even the United States; estimates indicate a projected shortage of 250,510 full-time equivalent mental health professionals by 2025, including psychiatrists, psychologists, counselors, and social worker positions. Multiple factors attributing to this workforce crisis include lack of financial incentives, inadequate pathways for education and training, and persistently poor working conditions, which impede new workers from entering the field and contribute to excessive turnover in the workforce. This widespread availability shortage highlights the critical demand for proactive measures to recruit, train, and sustain mental health professionals so that behavioral rehabilitation services can be developed to serve the increasing needs of the population.

Behavioral Rehabilitation Market Segmentation Analysis

By Disorder

The anxiety disorders segment held the highest market share of 33% in 2023. This dominance is mainly due to the high prevalence of anxiety disorders globally and the rise in acknowledgment and diagnosis rates. In 2019, about 301 million people worldwide, including 58 million children and adolescents, had anxiety disorders, according to the World Health Organization. According to the National Institute of Mental Health, about 19.1% of adults in the United States had an anxiety disorder in the last year. They hold a significant market share, also because there are many effective treatments available and an increasing willingness to seek help for such conditions. The Centers for Disease Control and Prevention (CDC) found that the percentage of adults with symptoms of an anxiety disorder increased from 8.1% in 2019 to 36.4% in 2020. This sudden rise in cases has created a need for anxiety management behavioral rehabilitation services to be implemented.

In addition, government efforts to enhance mental health care services have fueled the segment's growth. One such initiative is the U.S. Department of Health and Human Services' Certified Community Behavioral Health Clinic (CCBHC) model that has increased access to a full scope of mental health and substance use disorder services, including anxiety disorders.

By Healthcare Settings

In 2023, the outpatient segment held the largest revenue share at 73%. This large market share can be explained by multiple elements, such as economic, convenience, and the transition to models of care based in the community. The challenge lies in that for those who are only facing less severe behavioral health issues, outpatient services are allowing individuals to maintain their days and responsibilities. Government statistics and measures sustain the predominance of outpatient services. The Substance Abuse and Mental Health Services Administration's National Mental Health Services Survey (N-MHSS) reported that in 2020, there were 12,472 mental health treatment facilities in the United States, with 77% of those providing outpatient services. This availability of outpatient services helps give them a large market share. The Affordable Care Act’s focus on delivering behavioral health through primary care settings has helped the outpatient sector grow. According to the Health Resources and Services Administration (HRSA), in 2019, 89% of HRSA-funded health centers offered mental health services (primarily via outpatient treatment), serving more than 2.7 million patients. The trend towards outpatient care is also reflected in Medicare data. According to the Medicare Payment Advisory Commission (MedPAC), outpatient mental health services were 50% of Medicare spending for mental health treatment in 2018, versus only 14% for inpatient care. The Department of Health and Human Services found that the usage of telehealth under Medicare increased by 63 times during the pandemic, and many of these services were related to behavioral health.

Behavioral Rehabilitation Market Regional Insights

In 2023, North America held the largest revenue share of Behavioral Rehabilitation Market was approximately 42% of the global market. This is mainly due to the region's established healthcare infrastructure, high awareness of mental health issues, and substantial governmental funding for behavioral health programs. As per SAMHSA, the U.S. mental health and substance abuse treatment market accounted for USD 301 billion in 2020, highlighting the large size of the behavioral rehabilitation space in the region.

Asia Pacific is witnessing the highest growth during the forecast period, with a significant CAGR over the forecast period. This surge in growth can be attributed to heightened awareness around mental health issues, growing disposable incomes, and government initiatives to enhance mental health care. The demand for psychological rehabilitation services has grown in Japan, with the Ministry of Health, Labour and Welfare reporting that the number of patients receiving mental health treatment increased from 3.9 million in 2014 to 4.2 million in 2020. The National Health Commission of China has reported that there has been a significant increase in the awareness of mental health and in help-seeking behavior. In 2019, there were more than 35 thousand mental health practitioners in China, up 30% from 2015, which was part of the effort by the Government to expand mental health services.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players in the Behavioral Rehabilitation Market

-

Behavioral Health Group (BHG)

-

Aurora Behavioral Health System

-

AAC Holdings Inc.

-

Haven Behavioral Healthcare Inc.

-

Magellan Health Inc.

-

Niznik Behavioral Health

-

Springstone Inc.

-

Universal Health Services Inc.

-

Tridiuum Inc.

-

Ginger

-

Lyra Health Inc.

-

Encompass Health

-

Amedisys

-

Kindred Healthcare

-

Wellpath Recovery Solutions

-

Strolll

-

Ekso Bionics

-

AlterG

Recent Developments in the Behavioral Rehabilitation Market:

-

In June 2023, the U.S. Department of Health and Human Services announced a funding opportunity of $15 million to expand access to medication-assisted treatment for opioid use disorder (OUD) in rural communities to address the ongoing opioid crisis.

-

In January 2025, the Canadian government launched a national mental health strategy, committing CAD 5 billion over five years to enhance access to mental health and addiction care in every province, including through expanded telehealth for behavioral rehabilitation.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 456.6 Billion |

| Market Size by 2032 | USD 799.4 Billion |

| CAGR | CAGR of 6.4% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Disorder (Anxiety Disorders, Personality Disorders, Mood Disorders, Substance Abuse Disorders, Attention Deficit Disorders) • By Healthcare Settings (Inpatient, Residential, Outpatient) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Acadia Healthcare, Behavioral Health Group (BHG), Aurora Behavioral Health System, Promises Behavioral Health, AAC Holdings Inc., Haven Behavioral Healthcare Inc., Magellan Health Inc., Niznik Behavioral Health, Springstone Inc., Universal Health Services Inc., Tridiuum Inc., Ginger, Lyra Health Inc., Encompass Health, Amedisys, Kindred Healthcare, Wellpath Recovery Solutions, Strolll, Ekso Bionics, AlterG. |