Hypersonic Weapons Market Report Scope & Overview:

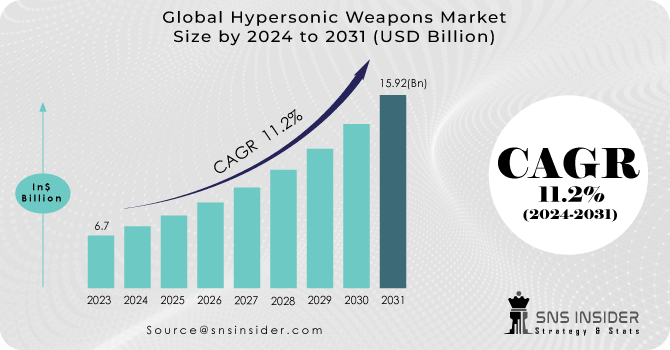

The Hypersonic Weapons Market size was valued at USD 6.7 Billion in 2023 & is estimated to reach USD 15.92 Billion by 2031 and increase at a compound annual growth rate (CAGR) of 11.2% between 2024 and 2031.

The market for hypersonic weapons was expanding rapidly as a result of increased spending in research, development, and deployment by numerous governments. The market was expected to be worth billions of dollars over the next decade, with a rapid growth rate. The United States and Russia were at the forefront of hypersonic weapon development, with China making major strides as well

To get more information on Hypersonic Weapons Market - Request Free Sample Report

Lockheed Martin, Raytheon Technologies, Northrop Grumman, Boeing, and numerous Russian defence corporations were all actively interested in hypersonic weapon research. Hypersonic Cruise Missiles are air-breathing missiles capable of velocities exceeding Mach 5. They offer precision strike capabilities. Hypersonic Glide Vehicles (HGVs) are non-propulsive vehicles that are launched into the atmosphere and glide to their target at hypersonic speeds. They're allowed to have conventional or nuclear warheads.

The United States had a significant market share, driven by its extensive research and development programs and the desire to maintain technological superiority. Russia had a history of hypersonic weapons development and was actively deploying them in its military. China was rapidly advancing in the field and posed a growing competitive threat. Geopolitical Tensions are Rising tensions between major powers, including the U.S., Russia, and China, which were driving investments in hypersonic weapons to bolster national security.

Military Modernization is the need to modernize defense capabilities and stay ahead of potential adversaries was a major driver. Technological Advancements Advances in materials, propulsion, and guidance systems were making hypersonic weapons more feasible. Some countries were looking to export hypersonic technology, creating opportunities for international partnerships and sales.

Technical Challenges Developing and maintaining hypersonic technology posed significant engineering and materials science challenges. Arms Race Concerns The rapid development of hypersonic weapons raised concerns about a new arms race and the potential for destabilization. Arms Control calls for arms control agreements and international regulations to prevent the proliferation of hypersonic weapons.

MARKET DYNAMICS

DRIVERS:

-

Many countries are investing heavily in modernizing their military capabilities, including the development and deployment of hypersonic weapons.

-

Technological Advancements are the driver of the Hypersonic Weapons Market.

Technological advances, such as improved materials, propulsion systems, and guidance systems, have made the development and deployment of hypersonic weapons more viable. These developments have lessened the entry barriers for countries seeking to create these systems.

RESTRAIN:

-

Developing and maintaining hypersonic technology is extremely challenging due to the extreme speeds and temperatures involved.

-

High Development Costs are the restraint of the Hypersonic Weapons Market.

Hypersonic weapon research, development, and testing can be excessively expensive. Many countries are constrained by fiscal constraints, which may limit their capacity to invest in these technologies.

OPPORTUNITY:

-

There is a substantial need for research and development in hypersonic technology.

-

Export Potential is an opportunity for the Hypersonic Weapons Market.

Nations with advanced hypersonic technology may explore opportunities for export to other countries. This can generate revenue and strengthen diplomatic ties. However, such exports are often subject to stringent regulatory controls and political considerations.

CHALLENGES:

-

The research, development, and testing of hypersonic weapons are expensive endeavors.

-

Technical Complexity is the challenge of the Hypersonic Weapons Market.

Developing hypersonic weapons involves overcoming immense technical challenges related to materials, propulsion, aerodynamics, and guidance systems. The extreme speeds and temperatures involved require innovative solutions that can be costly and time-consuming to develop.

IMPACT OF RUSSIA-UKRAINE WAR

Ukraine's air defences claim to have destroyed a significant number of Russian rockets fired into the country's populated centres. Russia has the capacity to create more Kinzhals relatively quickly. Even if more Russian missiles were intercepted than normal, an air war would not be decisive. In comparison, Russia causes significantly more devastation in Ukraine with the thousands of artillery shells it fires. And the ground conflict remains practically at a standstill. Many observers believe Russia's long-anticipated spring attack has already started, but it is having minimal impact due to its reduced troops and arsenals. Russia's hypersonic missiles are launched from aircraft in Ukraine. Ships and submarines can also launch hypersonic missiles. They are also capable of transporting nuclear warheads. The Kinzhal type has the ability to hit targets up to 2,000 km away. Other hypersonic missiles have a range of approximately 1,000 km.

Hypersonic missiles, such as the Kinzhal, are a relatively new type of weapon that combines high speed with manoeuvrability to avoid being shot down. They are not only difficult to detect, but they also make abrupt and unpredictable path adjustments as they approach a target. In this war, the Hypersonic Weapons Market gained profit up to 2-3%.

IMPACT OF ONGOING RECESSION

Because of a series of factors, such as the exceptionally quick recovery following the epidemic, energy markets started tightening in 2021. However, with Russia's invasion of Ukraine in 2022, the situation rapidly deteriorated into a full-fledged worldwide energy catastrophe. Natural gas prices reached all-time highs, and as a result, power prices rose in several areas. Oil prices have reached their highest point since 2020.

Higher energy prices have led to excruciatingly high inflation, pushed households into poverty, forced some firms to reduce output or even close down, and this has led to a slowdown in economic growth & some countries are already on the brink of recession. Europe, whose gas supply is particularly vulnerable due to its historic reliance on Russia, may face gas rationing this winter, while many emerging economies risk dramatically higher energy import expenditures and fuel shortages. To ensure adequate oil supply, the IEA and its members responded with the two greatest emergency oil stockpile releases in history. The IEA coordinated the release of about 183 million barrels of emergency oil from public inventories or committed stocks held by industry with two decisions in 2022. Some IEA member nations individually revealed additional public stocks, totalling more than 242 million barrels in 2022. In this recession, the Hypersonic Weapons Market is gaining less profit up to 1.2-1.5%.

KEY MARKET SEGMENTATION

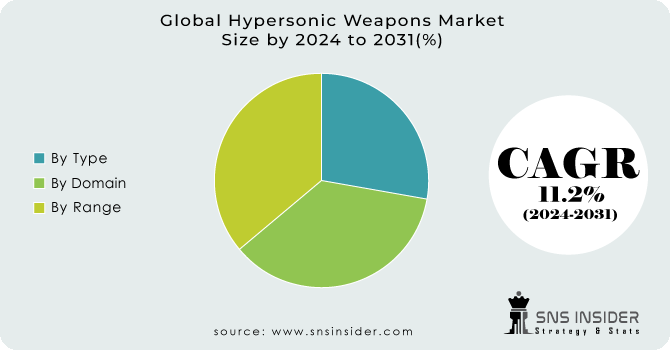

By Type

-

Hypersonic glide vehicles

-

Hypersonic missiles

By Domain

-

Naval

-

Land

-

Airborne

By Range

-

Long-range

-

Medium-range

-

Short-range

Need any customization research on Hypersonic Weapons Market - Enquiry Now

REGIONAL COVERAGE:

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

REGIONAL ANALYSIS

Europe: Europe remained the biggest source of money for supersonic and hypersonic weapons since numerous countries in the region made significant advancements in these weapon systems. In the region, Russia has been the main source of demand. The nation is making strides with the creation of numerous sophisticated missile systems. Russia declared in 2021 that a potential hypersonic missile had been successfully test-fired by its navy.

Asia Pacific: Several important variables have contributed to the tremendous expansion of hypersonic weaponry in the North American region. First, several powerful military nations, like Japan, China, Australia and India, are in the Asia-Pacific region. These nations have substantial military budgets, have been updating their military capabilities, and have made significant investments in fields like missile technology. Second, the market in this area is driven by quick technological developments and investments in hypersonic weapons technology. Major Asian Pacific countries have developed or invested in developing hypersonic weapons technology.

Key players

Some major key players in the Hypersonic Weapons Market are Northrop Grumman Corporation, Lockheed Martin Corporation, Raytheon Technologies Corporation, Thales Group, BAE Systems, Hanwha Group, Israel Aerospace Industries, Brahmos Aerospace Corporation, MBDA, L3harris Technologies Inc. and other players.

Northrop Grumman Corporation-Company Financial Analysis

RECENT DEVELOPMENT

In 2023: The US Air Force awarded Raytheon Technologies Corporation (US) a contract to develop hypersonic cruise missiles for the HACM Program (Hypersonic assault cruise missile). The contract had a 985-million-dollar value.

In 2021: Defense Advanced Research Projects Agency (DARPA) (US) granted a contract worth USD $4 million to Bae Systems (UK) to provide data links for hypersonic weapons. The purpose of the contract was to create prototypes of the data link systems that would control a future hypersonic Tactical Boost Glide (TBG) vehicle.

| Report Attributes | Details |

| Market Size in 2023 | US$ 6.7 Billion |

| Market Size by 2031 | US$ 15.92 Billion |

| CAGR | CAGR of 11.2% From 2024 to 2031 |

| Base Year | 2023 |

| Forecast Period | 2024-2031 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Hypersonic glide vehicles, Hypersonic missiles) • By Domain (Naval, Land, Airborne) • By Range (Long-range, Medium-range, Short-range) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | Northrop Grumman Corporation, Lockheed Martin Corporation, Raytheon Technologies Corporation, Thales Group, BAE Systems, Hanwha Group, Israel Aerospace Industries, Brahmos Aerospace Corporation, MBDA, L3harris Technologies Inc. |

| Key Drivers | • Many countries are investing heavily in modernizing their military capabilities, including the development and deployment of hypersonic weapons. • Technological Advancements are the driver of the Hypersonic Weapons Market. |

| Market Opportunity | • There is a substantial need for research and development in hypersonic technology. • Export Potential is an opportunity for the Hypersonic Weapons Market. |