Drone Flight Simulators Market Report Scope & Overview:

To get more information on Drone Flight Simulators Market - Request Free Sample Report

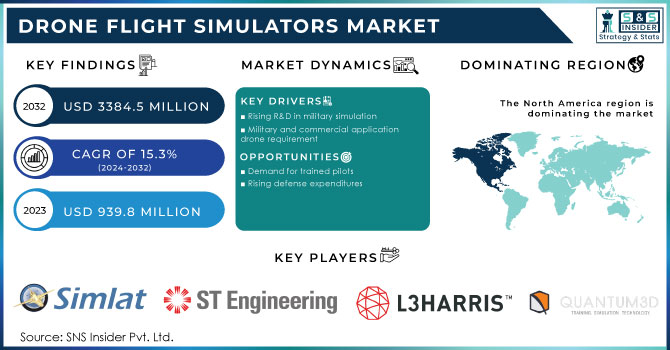

The Drone Flight Simulators Market Size was valued at USD 939.8 million in 2023 and is expected to reach USD 3384.5 million by 2032, growing at a CAGR of 15.3% over the forecast period 2024-2032.

Drone simulations are designed to create a simulation of real-world system operation or process associated with drone flight training. It is a program that allows drone pilots to train on a computer without the risk and cost of damaging the real model. Technological advances in the drone charging system and the growing power of drone technology will require more advanced simulation programs. Significant investments have been made in the development of artificial intelligence, which could lead to rapid market growth during forecasting. However, an important obstacle to the growth of the drone simulator market is the complexity of the cost of producing and maintaining drone simulator systems. More recently, drones have been widely used in the aviation, construction, mining, oil and gas, communications and transportation sectors. The use of drones is driven by its advantages over its regular counterparts for manual testing. With the rapid development of technology, drones can detect boundary erosion and deformity of the wind turbine blade and can detect lightning turbine blade light receptors, towers, and nacelles. Also, drones can detect leaks, rust, and other problems in oil and gas pipelines.

MARKET DYNAMICS

KEY DRIVERS

-

Rising R&D in military simulation

-

Military and commercial application drone requirement

OPPORTUNITIES

-

Demand for trained pilots

-

Rising defense expenditures

CHALLENGES

IMPACT OF COVID-19

The outbreak of COVID-19 severely disrupted a series of supply and production of electronic devices, including the hardware component of a drone device. The outbreak of global violence, followed by the closure situation, has led industry experts to speculate that the industry will face at least a quarter of the lag in the supply chain. The outbreak of COVID-19 has led governments to impose a number of restrictions on industrial, commercial, and social activities worldwide in order to control the spread of disease. Therefore, drone manufacturers and Drone MRO service providers have seen significant losses during this epidemic. The production volume of the drone manufacturer is significantly reduced, thus preventing the adoption rate of various simulation solutions. This disruption is expected to cause an earthquake by the end of 2021. The equipment and aerospace and defense industries are likely to grow rapidly soon after governments around the world gradually introduce various security measures to revive the economy. Plant and manufacturing industries are expected to grow from 2022, which could have a positive impact on the demand for drone equipment, including hardware parts for drone equipment.

Governments around the world are cutting back on military spending as a result of declining financial resources due to the COVID-19 outbreak. International military services reduce the cost of training and reduce their military base. As a result, the military's attention has shifted to finding less expensive and effective remedies for its needs. Real-time training is time-consuming and expensive. Also, it requires a large amount of immature resources, such as fuel and explosives, and contains a high level of risk. As a result, military departments are increasingly turning to virtual training and simulation-based games that make use of technologies like big data, AI, and cloud computing. Military simulation and virtual training are becoming increasingly popular among the military around the world because they are based on trade-offs (COTS), and help reduce training costs. Characters are made with a small amount of development. Conditions are essential for soldiers to be more proactive in modeling-based training technologies.

Drone simulation is currently being used to train future soldiers and represents real-time status using real digital settings. Therefore, the increase in cost in simulation software drives the growth of the drone simulator market. The drone simulator industry has been divided into two segments based on device type: augmented reality and virtual reality. During the projection period, the augmented reality segment is expected to develop at the fastest CAGR. This expected high increase is owing to the increasing adoption of augmented reality drone simulators in military applications, which provide pilots with a more realistic training experience by utilizing the actual world environment.

KEY MARKET SEGMENTATION

By Vomponent

-

hardware

-

software

By Technology

-

virtual reality

By Simulator Type

-

fixed system

-

portable system

By Drone Type

-

fixed wing

-

rotary wing

REGIONAL ANALYSIS

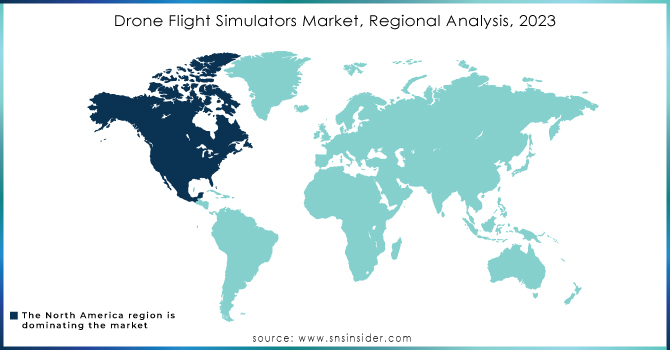

Because of the high adoption rate of drone simulators in the United States and Canada, North America was the largest regional market. Due to the increasing use of drone simulators for gaming applications, the European market is likely to be the second-largest throughout the projection period. Because of favourable government policies that encourage innovation and develop infrastructure capacities, North America has the highest rate of adoption of sophisticated technology. As a result, any factor impacting the performance of the region's industries impedes its economic progress. Due to the COVID-19 outbreak, the United States is currently the world's worst-affected country, prompting governments to put a number of restrictions on industrial, commercial, and public activities in order to stem the spread of infection. As a result, during the epidemic, drone manufacturers and drone MRO service providers have suffered huge losses. The manufacturing volume of drone manufacturers has substantially fallen, stifling the adoption rate of various simulation solutions. The governments of the United States and Canada, on the other hand, have maintained their defence spending levels.

Need any customization research on Drone Flight Simulators Market - Enquiry Now

REGIONAL COVERAGE:

-

North America

-

USA

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

The Netherlands

-

Rest of Europe

-

-

Asia-Pacific

-

Japan

-

south Korea

-

China

-

India

-

Australia

-

Rest of Asia-Pacific

-

-

The Middle East & Africa

-

Israel

-

UAE

-

South Africa

-

Rest of Middle East & Africa

-

-

Latin America

-

Brazil

-

Argentina

-

Rest of Latin America

-

KEY PLAYERS

The Major Players are Simlat UAS Simulation, Singapore Technologies Electronics Ltd., L3Harris Technologies, Inc., General Atomics, BLUEHALO, Quantum3D,Israel Aerospace Industries Ltd., Leonardo S.p.A., HAVELSAN A.S., CAE Inc, and Other Players.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 939.8 Million |

| Market Size by 2032 | US$ 3384.5 Million |

| CAGR | CAGR of 15.3% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By component (hardware, Software • By technology (augmented reality, virtual reality) • By simulator type (fixed system, portable system) • By drone type (fixed wing, rotary wing) |

| Regional Analysis/Coverage | North America (USA, Canada, Mexico), Europe (Germany, UK, France, Italy, Spain, Netherlands, Rest of Europe), Asia-Pacific (Japan, South Korea, China, India, Australia, Rest of Asia-Pacific), The Middle East & Africa (Israel, UAE, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | SIMLAT UAS SIMULATION, SINGAPORE TECHNOLOGIES ELECTRONICS LIMITED, L3Harris Technologies, Inc., General Atomics, BLUEHALO, Quantum3D,Israel Aerospace Industries Ltd., Leonardo S.p.A., HAVELSAN A.S., CAE Inc, and Other Players. |

| DRIVERS | • Rising R&D in military simulation • Military and commercial application drone requirement |

| OPPORTUNITIES | • Demand for trained pilots • Rising defense expenditures |