Flight Inspection Market Report Scope & Overview:

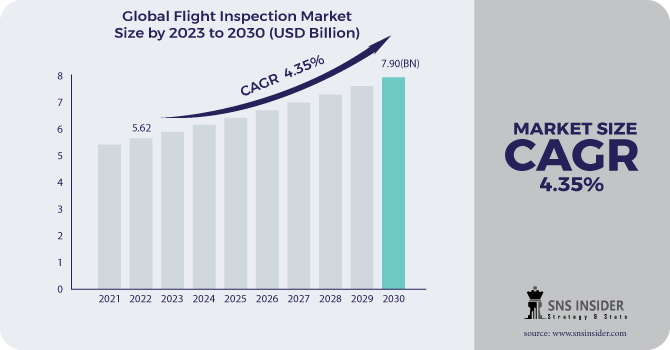

The Flight Inspection Market Size was valued at USD 5.62 billion in 2022 and is expected to reach USD 7.90 billion by 2030 with a growing CAGR of 4.35% over the forecast period 2023-2030.

The flight inspection market is expanding rapidly as the aircraft fleet expands. Flight inspection is the process of evaluating avionic systems such as navigational aids on a regular basis to verify their safety and accuracy. Flight inspections assess the functionality of an aircraft's communication, navigation, and surveillance equipment. Furthermore, flight inspection examines all flight processes such as routes, approach, departure, and validation of electronic signals provided from the ground navigation system to ensure the reliability and sufficiency of in-flight navigational support in the absence of any obstructions. Flight inspection is distinct from flight testing, which assesses the aerodynamic design and physical structure of the aircraft.

To get more information on Flight Inspection Market - Request Free Sample Report

MARKET DYNAMICS

KEY DRIVERS

-

Increasing Air Passenger Traffic Leads to the Construction of New Airports

-

They improve flying operations by removing barriers and increasing productivity.

RESTRAINTS

-

Technical difficulties encountered during flying inspection

-

Observance of stringent aviation regulations

OPPORTUNITIES

-

Rising Demand for Flight Inspection Systems from Emerging Markets

-

Existing airports are being updated, and some governments have announced plans to invest in the industry in order to enhance airport infrastructure and aviation services.

CHALLENGES

-

The rising amount of constraints imposed on transportation and market services

-

Flight Inspection's Technical Difficulties

IMPACT OF COVID-19

Travel prohibitions enforced by countries all around the world to slow the spread of COVID-19 have had an impact on the aviation inspection industry, as flight inspection services rely significantly on commercial airlines for revenue.

Due to disruptions in the supply chain and transportation services, demand for aviation inspection equipment and services has also decreased.

Airlines will postpone the purchase of new aircraft because travel bans enforced by governments around the world because to the COVID-19 pandemic have effectively shut down all revenue sources for airlines.

Airlines are suffering significant financial losses as a result of flight cancellations and reduced air traffic caused by travel restrictions enforced by authorities in the aftermath of the COVID-19 outbreak.

The flight inspection market has been divided into three sections: solution, end user, and geography. The system sector is expected to develop at the fastest CAGR among solutions throughout the forecast period. It is also predicted to lead the flight inspection market over the forecast period. Fixed systems, mobile systems, and ground-based systems are sub segments of the system segment. The growing number of new airport development plans, as well as rising investment by emerging nations on airport infrastructure, are driving the expansion of the flight inspection industry.

The flight inspection market has been divided into commercial and defence airports based on end user. The defence airports category is expected to lead the market throughout the forecast period due to the increasing number of tactical forward airbases and defence airports as military infrastructure investment increases. Governments have been building new airports to suit the increased demand for air passenger traffic and aircraft fleet. Furthermore, the Indian government intends to invest 1.83 billion USD on airport infrastructure and aviation services development in the country by 2028. This type of investment in greenfield airport developments is predicted to strengthen the worldwide flight inspection market.

The fixed system segment led the APAC flight inspection market in terms of system. The fixed system for flight inspection operation is utilized for routine flight inspections. The aircraft is navigated by a fixed system for safe takeoff and landing operations on the runway. Furthermore, rising demand for autonomous and stable flight inspection systems in aircraft is driving the expansion of fixed inspection systems to better monitor and regulate operations.

Flight inspection service providers demand a high fee for routine, commissioning, and customized flight inspection services. This occasionally puts airport authorities under pressure to minimize expenditures in other areas of investment that are equally vital. However, due to the importance of flight inspection activities, postponement is not an option. As a result, the service providers' lower flight inspection costs would encourage airport authorities to perform the flight inspection work without jeopardizing other airport expenses. The increased cost of carrying out flight inspection activities is critical for flight inspection service providers to build a customer base in the approaching years, thereby fueling the APAC flight inspection market expansion.

KEY MARKET SEGMENTATION

By Services Type

-

Commissioning

-

Routine

-

Special Inspection

BySystem Type

-

Fixed

-

Mobile

-

Ground-based

BySolution

-

System

-

Services

ByEnd User

-

Commercial Airports

-

Defense Airports

.png)

Need any customization research on Flight Inspection Market - Enquiry Now

REGIONAL ANALYSIS:

Because of the existence of important corporations such as Textron Inc and Airfield Inc, North America dominates the flight inspection market. In recent years, the expanding aircraft passenger traffic in the region, as well as the construction and renovation of Brazilian and Mexican airports, has been fueling the flight inspection market growth. Europe, on the other hand, has seen recent growth due to the presence of key industry participants such as Aerodata AG and Saab AB.

REGIONAL COVERAGE:

-

North America

-

USA

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

The Netherlands

-

Rest of Europe

-

-

Asia-Pacific

-

Japan

-

south Korea

-

China

-

India

-

Australia

-

Rest of Asia-Pacific

-

-

The Middle East & Africa

-

Israel

-

UAE

-

South Africa

-

Rest of Middle East & Africa

-

-

Latin America

-

Brazil

-

Argentina

-

Rest of Latin America

-

KEY PLAYERS

The Major Players are Textron Inc., Aerodata AG, NXT LLC, Cobham Flight Inspection Limited, Airfield Technology Inc., Safran S.A., Radiola Airspace, Saab Automobile AB, Norwegian Special Mission AG, Bombardier Inc, and other players

Airfield Technology Inc-Company Financial Analysis

| Report Attributes | Details |

|---|---|

| Market Size in 2022 | US$ 5.62 Billion |

| Market Size by 2030 |

US$ 7.90 Billion |

| CAGR | CAGR of 4.35% From 2023 to 2030 |

| Base Year | 2022 |

| Forecast Period | 2023-2030 |

| Historical Data | 2020-2021 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Services Type (Commissioning, Routine, Special Inspection) • By System Type (Fixed, Mobile, Ground-based) • By Solution (System, & Services) • By End User (Commercial Airports, Defense Airports) |

| Regional Analysis/Coverage | North America (USA, Canada, Mexico), Europe (Germany, UK, France, Italy, Spain, Netherlands, Rest of Europe), Asia-Pacific (Japan, South Korea, China, India, Australia, Rest of Asia-Pacific), The Middle East & Africa (Israel, UAE, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Textron Inc., Aerodata AG, NXT LLC, Cobham Flight Inspection Limited, Airfield Technology Inc., Safran S.A., Radiola Airspace, Saab Automobile AB, Norwegian Special Mission AG, Bombardier Inc. |

| Key Drivers | • Increasing Air Passenger Traffic Leads to the Construction of New Airports • They improve flying operations by removing barriers and increasing productivity. |

| Restraints | • Technical difficulties encountered during flying inspection • Observance of stringent aviation regulations |