Fiber Optic Cables for Military and Aerospace Market Report Scope & Overview:

The Fiber Optic Cables for Military and Aerospace Market size was USD 1.66 billion in 2023 and is expected to reach USD 2.61 billion by 2032, growing at a CAGR of 5.18% over the forecast period of 2024-2032.

Growing demand for internet services as the number of internet users increases, particularly in developing countries, has led to increased demand for high bandwidth connectivity and data transmission services, eventually increasing demand for fibre optics as it is essential for effectively transmitting data, voice messages, and images over long distances. Thus, one of the primary drivers projected to drive the Fiber Optics Market is the desire for high bandwidth communication. Aside from that, developments such as the emergence of 5G and the increasing demand for FTTx are likely to generate profitable prospects for the Fiber Optics Market.

To get more information on Fiber Optic Cables for Military and Aerospace Market - Request Free Sample Report

Fiber Optics is a technology that deals with the transfer of information from one place to another. The method used for information to be received and delivered by optical fibers. Optical fiber is a data transfer technology that uses simple moving pulses and long fiber, usually made of plastic or glass. Compared to traditional cables, Fiber Optic Cables offer several advantages. This includes greater bandwidth, faster speed, longer distances, and improved secure communication. Fiber optic cables are thinner and lighter in weight than copper wires.

The fiber optic cables have a light-bearing core that allows data to be transmitted. This enables fiber optic cables to transmit signals at a speed of only 31% of light speeds. Fiber optics is divided into single-mode fiber and Multi-mode fiber. Single mode fiber is used for long distance transmission, while multi mode fiber is used for short distances. Since fiber-optic cables are non-ferrous, they are not susceptible to electrical interference. Fiber Optics finds its use in the field of telecom lighting, military, fiber optic, among others.

MARKET DYNAMICS

KEY DRIVERS

-

Increasing application in new and upgraded aircraft

-

Demand for more electric aircraft and glass cockpit designs is increasing.

RESTRAINTS

-

Physical damage and transmission loss are possible.

OPPORTUNITIES

-

Photonics technology is being used in electronic warfare networks.

-

The need for optical add-drop multiplexer (OADM) networks is increasing.

CHALLENGES

-

Complex installation and maintenance needs

-

Observance of tight regulatory standards

THE IMPACT OF COVID-19

Amphenol fsi (US), Carlisle Interconnect Technologies (US), Radiall (Italy), Corning optical communications LLC (US), and TE Connectivity are among the leading companies in the military and aerospace fibre optic cable industry (US). These companies have expanded their operations to North America, Europe, Asia Pacific, the Middle East, Africa, and Latin America. COVID-19 has also had an impact on their businesses. According to industry insiders, COVID-19 will have an impact on the defence and aerospace sectors globally in 2020.

During the COVID-19 outbreak, military orders and supplies of fibre optic cables were complete. However, due to supply chain interruptions, a modest negative impact on the Fiber optic cables market for military and aerospace is projected, with a gradual recovery in the first quarter of 2022.

The market is divided into two categories: single-mode and multi-mode. The global market is likely to be dominated by the Multi-Mode category. Although single-mode fibre is easier to update and can help with "future proof" installations, multi-mode fibre is still the preferred fibre of choice for many applications. Multi-mode fibre optic cables feature greater core diameters, allowing several light routes and wavelengths to be communicated. They cost less to run, install, and maintain. Multimode optical fibre can easily accommodate the majority of lengths required for corporate and data centre networks while being less expensive than single-mode fibre. Multi-mode fibre optic connections provide excellent speed and bandwidth across small distances as well. As a result of these benefits, demand for multi-mode fibre optic cables is likely to increase in the future.

The market is divided into two sections: glass and plastic. The Global Fiber Optics Market was dominated by glass fibres. Glass optical fibres offer a better information transmission capability than plastic optical fibres. Making a glass fibre optic assembly is simpler, quicker, and less costly. Glass fibres can resist and adapt to higher temperatures. They are widely utilised in corrosive conditions and do not deteriorate. Thus, increased need for glass fibre for diverse applications, simplicity of availability, and high transmission capacity are some of the reasons likely to drive glass fibre demand in the approaching years.

KEY MARKET SEGMENTATION

By Platform

-

Civil

-

Military

-

Space

By Application

-

Avionics

-

Navigation

-

Weapon Systems

-

Communication Systems

By Type

-

Single-mode

-

Multi-mode

By Material

-

Glass

-

Plastic

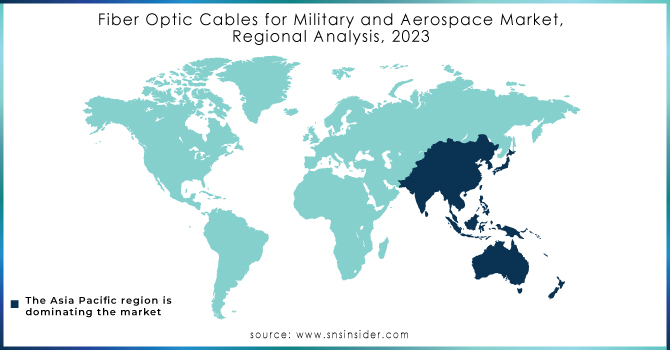

REGIONAL ANALYSIS

The Global Fiber Optics Market is divided into four regions: North America, Europe, Asia Pacific, and the Rest of the World. The Asia Pacific region is likely to have a significant proportion due to nations such as China and India, which have the most smartphone users globally. China, the world's most populated country, dominates the global telecom business. These nations are seeing an increase in the number of internet users, as well as a greater need for improved connectivity and data transfer, which will drive demand for Fiber Optics in the future years.

Need any customization research on Fiber Optic Cables for Military and Aerospace Market - Enquiry Now

REGIONAL COVERAGE:

-

North America

-

USA

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

The Netherlands

-

Rest of Europe

-

-

Asia-Pacific

-

Japan

-

south Korea

-

China

-

India

-

Australia

-

Rest of Asia-Pacific

-

-

The Middle East & Africa

-

Israel

-

UAE

-

South Africa

-

Rest of Middle East & Africa

-

-

Latin America

-

Brazil

-

Argentina

-

Rest of Latin America

-

KEY PLAYERS

The Major Players are Amphenol fsi, Carlisle Interconnect Technologies, Radiall, TE Connectivity, Corning Optical Communications LLC, Prysmian Group, Northrop Grumman Corporation, W.L. Gore & Associates, Inc.,Collins Aerospace., AFL., and other players

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 1.66 Billion |

| Market Size by 2032 | US$ 2.61 Billion |

| CAGR | CAGR of 5.3% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Platform (Civil, Military, Space) • By Application (Avionics, Navigation, Weapon Systems, Communication Systems) • By Type (Single-mode, Multi-mode) • By Material (Glass, Plastic) |

| Regional Analysis/Coverage | North America (USA, Canada, Mexico), Europe (Germany, UK, France, Italy, Spain, Netherlands, Rest of Europe), Asia-Pacific (Japan, South Korea, China, India, Australia, Rest of Asia-Pacific), The Middle East & Africa (Israel, UAE, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Amphenol fsi, Carlisle Interconnect Technologies, Radiall, TE Connectivity, Corning Optical Communications LLC, Prysmian Group, Northrop Grumman Corporation,W.L. Gore & Associates, Inc.,Collins Aerospace., AFL., and other players. |

| DRIVERS | • Increasing application in new and upgraded aircraft • Demand for more electric aircraft and glass cockpit designs is increasing. |

| RESTRAINTS | • Physical damage and transmission loss are possible. |