Image Recognition Market Size & Overview:

Get more information on Image Recognition Market - Request Sample Report

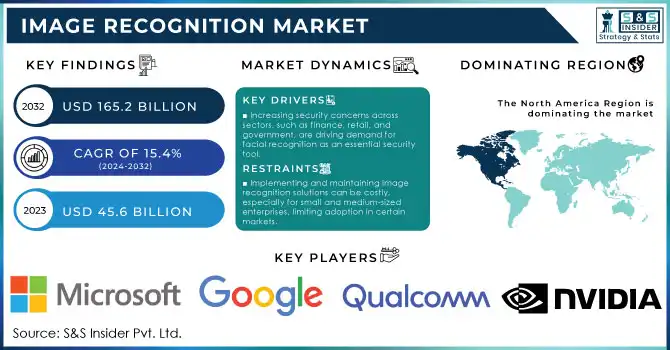

Image Recognition Market Size was valued at USD 45.6 Billion in 2023 and is expected to reach USD 165.2 Billion by 2032, growing at a CAGR of 15.4% over the forecast period 2024-2032.

The Image Recognition market has been rapidly expanding, driven by multiple government-backed initiatives and statistics that underscore the potential of this technology in various sectors. Governments worldwide are increasingly incorporating image recognition into public safety, healthcare, and defense, fueled by the surge in demand for AI-enhanced security solutions. As per the U.S. Department of Commerce's most recent government data, investments in AI and machine learning (ML) technologies climbed 15% year over year in 2023. Besides this, the European Commission started its own AI for Society scheme to invest around €1 billion in AI research and development with a specific focus on image recognition technology. Market growth is not only reinforced by these factors, but also AI-driven image Recognition solution development adoption across traffic management systems, public health surveillance, and law enforcement. According to a report released by the Ministry of Electronics and Information Technology in India, AI has played a significant role in reinforcing urban safety systems as image recognition is expected to grow at a significant CAGR over the next five years. The global focus on automated image-based identification has, indeed, now triggered an initiative in other governments, including China and Japan, announcing an additive policy to promote the implementation of AI-based systems into public infrastructure. These initiatives have increased the need for Image Recognition technologies, which is now an important part of the digital transformation roadmap of most governments from different sectors.

Growing demand for high-bandwidth data services & advanced machine learning are some of the major factors driving the growth of the image recognition technology market in media & entertainment, retail, IT & telecom, BFSI, and the power & utility sectors among others. Image recognition is being used by these industries for object, scene, and activity identification, detecting other content in images and videos, such as a person’s face, a trademark, a logo, or a specific place. This technology enables the blending between offline materials with things like AR and promotional videos in digital experiences by simply taking pictures of the marketing campaign with your smartphone. Image recognition is the task of identifying an object or a feature in the image, and it is an essential step in computer vision. This technology helps in collecting and analyzing the data in real-time, converting complex visual data into measurable and actionable insights. It's commonly used for object detection, activity recognition, image reconstruction, and video tracking. The increasing deployment of image databases is an opportunity for the analysis of big data and product brands.

Image Recognition Market analysis

Drivers

-

Significant improvements in AI and deep learning are enhancing image recognition software’s accuracy and reliability, allowing more sectors to adopt the technology for advanced applications.

-

Increasing security concerns across sectors, such as finance, retail, and government, are driving demand for facial recognition as an essential security tool.

-

Image recognition is being increasingly integrated into automation platforms for document processing and operational efficiency, reducing manual tasks and improving data accuracy.

Integration of image recognition technology with automation and workflow systems is one of the major factors driving the growth of the image recognition market. This driver is especially pronounced in industries/verticals such as healthcare, finance, and retail, where automation and operational efficiency are vital. For example, in healthcare, image recognition is employed to automate the interpretation of medical images like X-rays and MRIs. For instance, AI image recognition tools for medical imaging can improve the speed and accuracy an NHS (National Health Service) radiologist can use to detect diseases such as Cancer in the UK. The use of artificial intelligence and predictive analysis not only accelerates diagnosis but also improves the accuracy of results and lessens human error thereby improving the quality of patient treatment.

Retail companies, such as Zalando and ASOS, use image recognition for visual search capabilities for e-commerce. Those allow shoppers to upload product photos and find similar products from the retailer's inventory. That has a positive impact on customer experience and raises conversion rates. Additionally, automation in document processing is growing across industries. Image recognition systems are integrated into business workflows to extract and categorize data from scanned invoices, receipts, and forms. This helps an organization to get rid of manual errors, improves data accuracy, and better operational efficiency. These integrations showcase the increasing dependency on image recognition as a means of enhancing productivity, minimizing errors, and making a positive user experience across different industries.

Restraints

-

Widespread adoption, especially of facial recognition, faces hurdles due to privacy issues, with growing consumer concerns about the unauthorized use of personal data.

-

Implementing and maintaining image recognition solutions can be costly, especially for small and medium-sized enterprises, limiting adoption in certain markets.

Privacy and Data Security Concerns are one of the major factors that restrain the growth of the image recognition market. With image recognition technologies, especially facial recognition, now in the public domain, they raise considerable issues concerning the capture, storage, and use of personal data. Consumers are concerned about images being taken and analyzed separately, potentially breaching their privacy. Such technologies are also under increased scrutiny from governments across the globe, which are facing regulatory challenges regarding deploying them in sensitive areas, such as law enforcement and public surveillance. For instance, the European Union has some of the most stringent data protection laws (GDPR) while parts of the U.S. have begun counterbalancing the rise in the use of facial recognition with proposed legislation that will affect its adoption. Finally, security risks such as data breaches or abuse of biometric data reduce consumer trust, which will hinder market development in greater scope. Such worries can dampen the pace of image recognition especially in sensitive fields.

Image Recognition Market Segment analysis

By Technique

The facial recognition segment dominated the market with the highest revenue share of 23% in 2023 in the image recognition market. The high growth rate of this segment is attributed to government support and the increasing adoption of facial recognition in surveillance & security applications. For instance, the U.S. Department of Homeland Security has mandated facial recognition in major airports, aiming to enhance border security by reducing reliance on traditional ID verification methods. As a result, facial recognition technologies have been heavily invested in, estimated to grow 25% annually in just the airport security stream of this force crowd control industry (a US Government Accountability Office report). Likewise, the Chinese government has incorporated facial recognition into its Skynet with the description of "AI Intelligent Identification Technology", which is applied to public security in urban areas. With governments prioritizing the use of facial recognition for security and identification purposes, the market has witnessed consistent revenue growth in this segment.

By Deployment

The cloud segment accounted for the highest revenue share of 72% in 2023. The evident inclination towards cloud-based image recognition solutions denotes the advantage of flexibility, scalability, and cost-efficiency the solution possesses as compared to the on-premise solutions. Both governments and enterprises are practically moving their AI and ML workloads to the cloud infrastructures. To cite an example, the "Cloud First" policy of the UK Government was announced in 2023 and requires government departments to leverage cloud-based solutions to increase the accessibility to data and create more agile operations. This transition is a major factor in fuelling the uptake of cloud-based image recognition solutions as transmission and storage of high-res images can be done without the need for an extensive infrastructure in place enabling real-time analysis. Additionally, government departments across the globe using cloud platforms for image recognition applications in healthcare, transportation, and other industries will further boost this deployment segment.

By Application

In 2023, the marketing and advertising application segment accounted for the largest market share at 28%, mainly driven by the growing necessity for personalized and targeted advertising solutions. The U.S. Federal Trade Commission (FTC) states that personalized advertisements including image recognition saw a 40% increase in consumer engagement through 2023. As this engagement continues to grow, so does the need for brands to integrate image recognition into their marketing strategies to be able to base ads on the consumption of behavior that consumers prefer. Thus, the European Commission also emphasizes the necessity of ethical AI concerning digital advertising and creates instructions, which stimulate the utilization of AI tools with transparency-driven mechanisms. The regulatory backing has led to the rapid growth of the marketing and advertising industry, where brands are using image recognition to boost ad performance and drive higher returns on investment.

By Vertical

The image recognition market was dominated by the retail and e-commerce verticals, while the segment accounted for a 20% share of the market during the year 2023. The increasing digital commerce and adoption of AI-based solutions for enhanced customer experience are fueling growth in this segment. Data shared by U.S. Department of Commerce states that the growth of image recognition across retail saw a 30% year-on-year increase in 2023 as remote version management aided in both quick service and improved customer experience. Furthermore, the Japan Ministry of Economy, Trade, and Industry stated that online shopping based on visual search technologies increased by 22% as shoppers could look for products by uploading images. As governments encourage e-commerce development and digital transformation of retail, adoption of image recognition technology in retail is expected to grow amidst this trend.

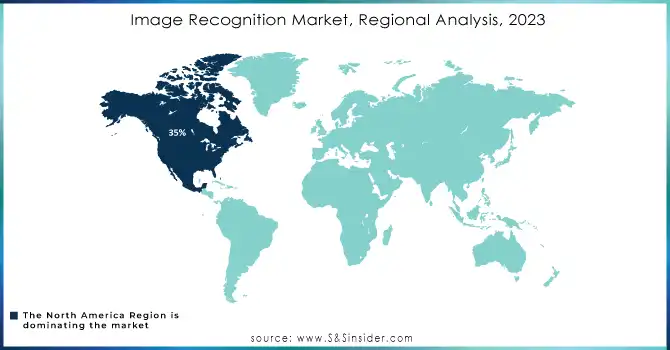

Regional Dominance and Growth

North America dominated the global image recognition market in 2023 with a 35% market share. This dominance happened not without reason as AI and machine learning systems find extensive applications in various sectors, from retail and health to public safety. The U.S. government has continued to invest in AI-based technologies, which also has significantly fuelled the growth of the market, for example, via the National Artificial Intelligence Initiative Act. The regulatory-friendly environment for integrating AI solutions, and embracing frameworks on how to apply AI ethically, has also facilitated the implementation of use of image recognition systems. These elements have established their dominance in the market in North America with a highly well-versed research and development (R&D) in AI and imaging recognition technology.

Asia-Pacific will register the highest growth in the next few years because its governments have laid out plans to promote the adoption of AI in different sectors. China experienced a 28% boost in AI investments this year, with much of that money flowing into improvements in image recognition technologies, according to China’s Ministry of Industry and Information Technology (MIIT). Most of these investments drive smart city infrastructures, retail experiences, and e-commerce platforms. Additionally, the uncovering of innovation and digital transformation because of government-supported projects such as, "Made in China 2025" has set Asia-Pacific for high development in the image recognition market. The region is likely to hold the highest CAGR [compound annual growth rate] in the market in the foreseeable future, as governments stand by their intent to facilitate AI development.

Need any customization research on Image Recognition Market - Enquiry Now

Key Players

Service Providers / Manufacturers:

-

Google (Google Lens, TensorFlow)

-

Microsoft (Azure Computer Vision, Custom Vision)

-

AWS (Amazon Rekognition, AWS SageMaker)

-

Qualcomm (Snapdragon Vision, AI Engine)

-

NVIDIA (NVIDIA Deep Learning AI, Jetson)

-

Huawei (Huawei HiAI, HiLens)

-

Toshiba (AI Solutions, Image Recognition Solutions)

-

NEC Corporation (NeoFace, Intelligent Imaging Solutions)

-

Hitachi (Hitachi AI Technology, Video Analytics)

-

Oracle (Oracle Cloud Infrastructure, Oracle AI)

Users of Services/Products

-

Klarna

-

Snapchat

-

Uber

-

BMW

-

Adidas

-

Sephora

-

Walmart

-

L'Oréal

-

Ikea

-

CVS Health

Recent Developments in the Image Recognition Market

-

In August 2023, the European Union Introduced a New AI Regulatory Framework which includes guidelines on the ethical use of image recognition technologies in the public and private sectors, with a specific emphasis on privacy and data protection.

-

ImageChat, rolled out by Chooch in April 2023, serves as a business-grade toolkit to prompt complex computer vision models with just a few descriptive text prompts. ImageChat, trained on 11 billion parameters and 400 million images, can identify more than 40 million visual features. It allows you to create descriptions and keywords for the images and videos, offers interactive insights, and is useful in an application like object detection and detailed analysis by integrating AI Vision and large language models for better accuracy.

-

Paravision announces 6th generation facial recognition suite, the most accurate according to NIST FRVT 1: N and NIST FRVT 1: 1 in August 2023 Thanks to cloud support, this new generation also marks a new standard for facial recognition technology that is reliable and accurate.

| Report Attributes | Details |

| Market Size in 2023 | USD 45.6 Billion |

| Market Size by 2032 | USD 165.2 Billion |

| CAGR | CAGR of 15.4% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Deployment (On-Premise, Cloud) • By Component (Hardware, Software, Service, Training, Support, and Maintenance) • By Application (Scanning and Imaging, Security and Surveillance, Image Search, Augmented Reality, Marketing, and Advertising) • By End Use (BFSI, Media and Entertainment, Retail and E-commerce, IT and Telecom, Government, Healthcare, Transportation and Automobile, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles |

Google, Microsoft, AWS, Qualcomm, NVIDIA, Huawei, Toshiba, NEC Corporation, Hitachi, Oracle |

| Key Drivers | •Significant improvements in AI and deep learning are enhancing image recognition software’s accuracy and reliability, allowing more sectors to adopt the technology for advanced applications •Increasing security concerns across sectors, such as finance, retail, and government, are driving demand for facial recognition as an essential security tool. •Image recognition is being increasingly integrated into automation platforms for document processing and operational efficiency, reducing manual tasks and improving data accuracy |

| Market Opportunities | •Widespread adoption, especially of facial recognition, faces hurdles due to privacy issues, with growing consumer concerns about the unauthorized use of personal data •Implementing and maintaining image recognition solutions can be costly, especially for small and medium-sized enterprises, limiting adoption in certain markets. |