Spectator Sports Market Report Scope & Overview:

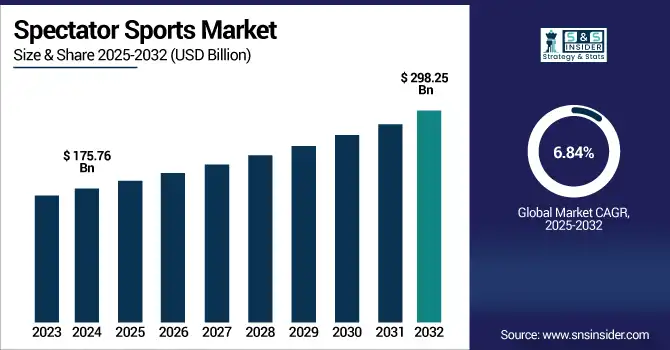

The Spectator Sports Market Size was valued at USD 175.76 billion in 2024 and is expected to reach USD 298.25 billion by 2032, growing at a CAGR of 6.84% over the forecast period of 2025-2032.

To Get more information on Spectator Sports Market- Request Free Sample Report

The market organizes and promotes live sports events for public viewing, generating money directly through ticket sales and indirectly from broadcasting rights, sponsorships, and merchandising. That expanding universe features professional clubs, leagues, and event holders in football, basketball, baseball, cricket, and other sports. New technology is going to upend the way sports media is experienced, particularly around digital streaming services and fan engagement. A growing investment in infrastructure and increasing globalization of the major leagues have also lent momentum to the spike. Amidst increasing consumer demand for live entertainment experiences, the spectator sports market continues to transform based on both deep-rooted tradition and a craving for the most cutting-edge experiences that fans globally have come to expect.

According to research, in the 2024 season, NBA spectator involvement boomed, while social and digital viewership mirrored a wider market increase. The top of that list was led by LeBron James at 3.23 billion views and also included Stephen Curry, 2.56 billion, and Luka Dončić, 1.82 billion on NBA platforms, showing the star power that continued to draw viewers. Highlight the increasing significance of digital reach to revenue streams, such as broadcast rights, sponsorship, and online merchandise, validating the strategic

The U.S. Spectator Sports Market size was USD 34.99 billion in 2024 and is expected to reach USD 53.14 billion by 2032, growing at a CAGR of 5.36% over the forecast period of 2025–2032. The market is boosted by the big-time professional leagues, NFL, NBA, MLB, NHL, where the number of fans is huge and spending billions in media rights, sponsorships, and merchandise, among others. Dominance of the U.S. is driven by urbane sports infrastructure, native digital engagement, and long-standing technology investments that deliver unprecedented revenue creation and the largest global influence spectator sports ecosystem.

Market Dynamics:

Key Drivers:

-

Expansion of Digital Streaming Platforms Accelerated Market Reach and Fan Engagement

In the spectator sports market growth is due to the digital streaming platforms. With a growing number of leagues and franchises either selling their services or partnering with other OTT services, the fans are becoming more connected than ever to live games from wherever and whenever. In this era of availability, it brought a broader viewership, and then in turn, higher media rights fees and sponsor rights coming in. Greater use of digital advertising, virtual experiences, and personalized sponsorships has increased monetization, which in turn increases league and team wealth, buoying the market even more.

For instance, the NBA’s mid-2024 streaming deal with major platforms increased its digital-only subscription base by over 30%, significantly enhancing revenue diversification and improving global fan reach.

Restraints:

-

Escalating Stadium Operational Costs Straining League Profitability and Ticket Pricing Impedes Market Growth

The rising costs of operations at stadiums have been a major obstacle in the spectator sports market analysis, resulting in reduced profit margins and ticket prices in several leagues. Utilities, payroll costs, security, and technology upgrades, including the installation of contactless entry systems in all the theatres, are driving up overhead. So, teams have jacked up ticket prices and concession prices to make up for these shortfalls, which has resulted in declining attendance for mid-level games and fan grumbling for anyone price-conscious. Elevated revenue per head has solid short-term financials, but the long-term implication could be disillusioned fans and a damaged brand. As a result, this cost-based pressure threatens the development of the fan base and could limit investment in player development, stadium improvement, or digital innovation unless substantial operational efficiencies are achieved.

Opportunities:

-

Rising Fan Interest in Hybrid In-Venue and Virtual Live Events, Enhanced Market Diversity

The rising fan interest in hybrid in-venue and virtual live sports events, as audiences seek flexible ways to experience live games, leagues have introduced combined ticket packages that include both stadium attendance and virtual perks, such as behind-the-scenes footage, VR replays, and interactive Q&A sessions. This convergence of physical and digital fan experiences has expanded market reach, drawing in tech-savvy younger demographics and remote fans alike. Due to hybrid offerings, increase engagement and justify premium pricing while generating valuable fan behavior data. As a result, revenue streams diversify beyond traditional ticket and broadcast models, allowing leagues to tap into sponsorships tailored to digital platforms and personalized merchandise offers. This evolution not only strengthens existing revenue channels but also establishes resilience against disruptions, such as pandemic-related capacity constraints.

Challenges:

-

Regulatory Pressure over Sports Betting Monetization Complicating Sponsorship and Revenue Structures

Regulatory pressure surrounding sports betting monetization has become a key challenge for the market, complicating sponsorship strategies and revenue models. As more states legalized sports betting, leagues partner with betting operators to integrate odds into broadcasts and in-stadium experiences.

However, evolving regulations, such as ad restrictions on live streaming and limits on in-arena betting signage, have introduced compliance costs and sponsorship uncertainties. The effect, while betting partnerships offer a powerful new revenue source, regulatory shifts necessitate constant adaptation in contractual deals, advertising content, and fan messaging. In turn, this creates risk for sponsors who may face branding restrictions or reputational backlash, affecting their willingness to invest. Ultimately, this challenge requires leagues to balance monetization opportunities with ethical standards and regulatory adherence to maintain fan trust and sustainable growth.

Segmentation Analysis:

By Revenue Stream

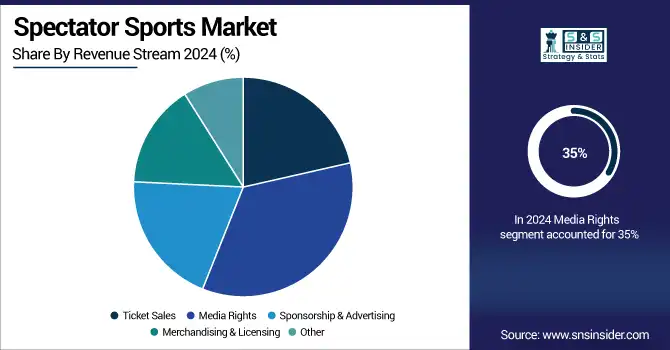

The Media Rights category accounted for 35% revenue share in 2024, due to Major Network and Streaming Deals to Drive Growth, as effective monetization of fan engagement becomes increasingly essential for the industry. In 2024, High-priced TV deals, the NBA's 11-year, USD 76 billion pact with ESPN/ABC, NBCUniversal, and Amazon, paved the way for multi-platform distribution. The response was to broaden the digital product, grow the audience, and exploit commercial opportunities to the limit, with media rights at the core of the financial landscape.

Sponsorship and Advertising segment is expected to surge at a 10.46% CAGR, during the forecast period 2025-2032. Enabled by Innovative Ad-Tier Launches. Owing to the rising demand for brand visibility and interactive advertising. In July 2025, ESPN’s extended partnership with the Big East Conference introduced expanded sponsor integrations across 300+ ESPN+ events. As a result, enhanced exposure and real-time fan engagement are driving increased sponsor investment, boosting monetization, and positioning this segment as a key contributor to market expansion.

By Sport Type

Football/Soccer Segment accounted spectator sports market share of 28% in 2024 supported by Global Broadcast Investment, as the world’s most followed sport. Major investments, such as Sony’s UEFA rights deal and DAZN’s FIFA Club World Cup coverage, have elevated the sport’s presence in the U.S. spectator landscape. Due to these global broadcasting efforts, fan engagement surged, leading to increased ticket sales, merchandise consumption, and brand sponsorships, making football a dominant force in driving industry revenue.

Cricket Segment is growing at 14.20% CAGR, boosted by broadcast debuts and growing interest among diverse fan bases and international media attention. A major development includes Sony Sports acquiring broadcast rights for Major League Cricket in the U.S. in July 2024. As a result, the sport is capturing new audiences, enhancing media coverage, and attracting fresh sponsorships, supporting the evolution of a more globally diversified market.

Regional Analysis:

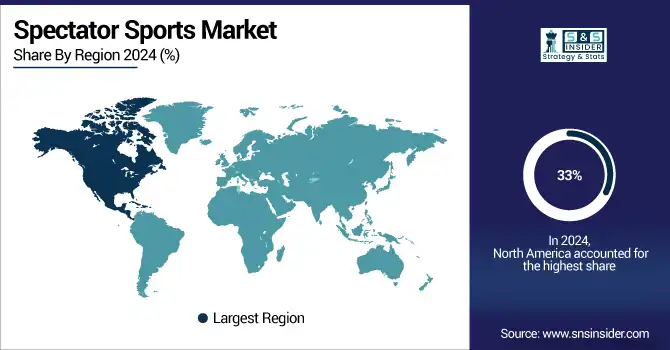

The North America region is the leading market in terms of market share, with approximately 33% in 2024, owing to the presence of mature professional sports leagues, advanced television broadcast coverage, and high expenditure on sports entertainment. The U.S. is the North American leader owing to its wide sports media system, robust franchise values, and corporate sponsorship depth. The country plays host to some of the highest-grossing sports events, with global audiences and advertisers lining up. Through these digital and technological fan engagement initiatives, immersive in-venue experiences including AR/VR and the widespread development of stadium upgrades across the country, the U.S. is further revolutionizing the live sports experience.

In 2024, Asia Pacific is the fastest-growing region in the spectator sports market with a CAGR of around 9.65% during the estimated period of 2025-2032, driven by the increasing disposable income, rising digital penetration, and the emergence of the most popular sporting formats globally. A growing youth population in the region connected with live-streaming platforms is contributing to increased market participation. The most rapidly growing country is India, and it is evident by the strong support toward cricket, especially the Indian Premier League (IPL). India is fast emerging as a prominent spectator sports economy, supported by strategic investments in stadium infrastructure, media partnerships, and digital fan experiences.

Europe was a significant regional contributor to the Spectator Sports Market in 2024. Deep-rooted sports culture, particularly in football (soccer), and high investments in club infrastructure drive strong market performance. Germany remains the dominant country in Europe, backed by its Bundesliga league, renowned for its fan engagement, modern stadiums, and solid governance. The country’s efficient organization of events and its leadership in sustainability and affordability for fans, which make it a standout market. Germany’s commitment to enhancing digital sports experiences and international broadcast appeal further strengthens Europe’s overall market influence.

In 2024, the Middle East & Africa and Latin America regions are emerging markets in the Spectator Sports industry, showing moderate yet promising growth. In MEA, countries such as Saudi Arabia and the UAE are heavily investing in sports infrastructure and global events, including football, motorsports, and esports, aiming to become international sports hubs. Government-led sports tourism initiatives and media deals are driving regional development. In Latin America, Brazil leads the market, driven by football’s cultural significance and a growing focus on commercialization. Rising sponsorship deals, improved stadium facilities, and digital media growth are supporting long-term market expansion across the region.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players:

The spectator sports market companies are the Walt Disney Company, Comcast Corp, Liberty Media Corp, DAZN Group Ltd, Madison Square Garden Sports Corp, Manchester United PLC, Real Madrid CF, FC Barcelona, Yankees Global Enterprises, Dallas Cowboys Football Club Ltd, and others.

Recent Developments:

-

May 2025 – At Disney’s 2025 Upfront event, NFL stars Patrick Mahomes and Saquon Barkley headlined, spotlighting Disney’s expanding involvement in live sports content across broadcast and streaming platforms under CEO Bob Iger.

-

March 2025 – Comcast's NBCUniversal introduced a new USD70 Sports & News TV streaming package, featuring access to NFL, NBA, Premier League soccer, WWE, and more, targeting consumers seeking live sports without traditional cable plans.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 175.76 Billion |

| Market Size by 2032 | USD 298.25 Billion |

| CAGR | CAGR of 6.84% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Revenue Stream (Ticket Sales, Media Rights, Sponsorship & Advertising, Merchandising & Licensing, Other) • By Sport Type (Football/Soccer, Basketball, Baseball, Cricket, Motorsports, Tennis, Golf, Other) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Taiwan, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Walt Disney Company, Comcast Corp, Liberty Media Corp, DAZN Group Ltd, Madison Square Garden Sports Corp, Manchester United PLC, Real Madrid CF, FC Barcelona, Yankees Global Enterprises, Dallas Cowboys Football Club Ltd, and Others. |