Video Intercom Devices Market Key Insights:

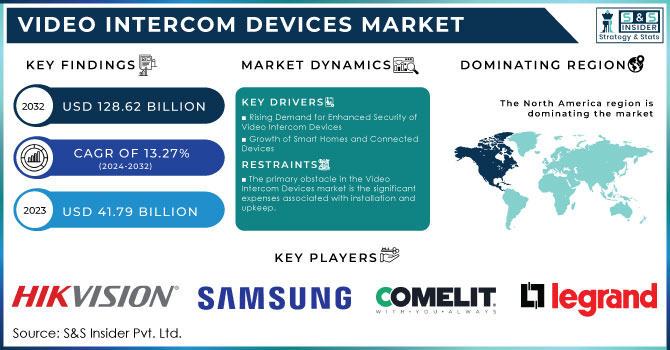

The Video Intercom Devices Market size was valued at USD 41.79 billion in 2023 and is expected to reach USD 128.62 billion by 2032, growing at a CAGR of 13.27% over the forecast period of 2024-2032.

To Get More Information on Video Intercom Devices Market - Request Sample Report

The Video Intercom Devices market is rapidly expanding due to the rising need for better security and the increasing use of smart technologies. In line with the growing popularity of smart homes and buildings, video intercom systems are commonly utilized for access control, enabling users to visually confirm the identity of visitors before permitting entry. This technology is becoming increasingly popular in residential and commercial settings.

The rising demand for these devices in the security and surveillance industry is anticipated to drive market growth during the forecast period. Video intercom systems are commonly set up as audiovisual communication devices at the access points of offices, communities, and structures.

These devices send a visitor's audio and visual data to the loudspeakers, phones, walkie-talkies, etc., that the user utilizes. Swift urban development in multiple economies is anticipated to generate profitable growth opportunities for market players. The rise in building automation is leading to greater use of Video Intercom Devices in both residential and commercial properties.

Additionally, the increasing appeal of smart homes is anticipated to generate profitable chances for the market. Furthermore, several government efforts aimed at creating smart cities are anticipated to propel market expansion even more. The emergence of sophisticated security audiovisual systems, which offer enhanced protection for residential buildings and offices, is also driving market expansion.

The market is being transformed by technological progress, with a significant demand for IP-based and wireless video intercom systems. Wireless intercoms are widely favored for their simple installation, whereas IP-based systems are chosen for their capability to connect with other smart gadgets and IoT networks. This pattern is causing analog systems to slowly decrease.

Market Dynamics

Drivers

- Rising Demand for Enhanced Security of Video Intercom Devices

As urbanization accelerates and the need for residential and commercial security increases, video intercom systems have become essential. Security concerns, particularly in urban areas with rising crime rates, are propelling the adoption of video surveillance systems. In 2023, over 60% of U.S. homeowners were reported to use video doorbell systems as part of their home security setups.

These systems, which often include video intercom capabilities, allow homeowners and businesses to verify visitors visually, reducing the risk of break-ins and unauthorized access. Additionally, government investments in urban infrastructure and smart city initiatives are further driving demand for integrated security systems, which include video intercoms.

- Growth of Smart Homes and Connected Devices

The proliferation of smart home technologies is a significant driver for the video intercom market. Consumers are increasingly adopting smart home solutions that integrate various devices for convenience and security. A study indicates that 45% of households in the U.S. had at least one smart device in 2023, with smart doorbells and video intercoms being among the most popular. Furthermore, video intercoms are being seamlessly integrated with other smart home devices, such as smart locks, lighting, and security cameras, enhancing their value proposition. Recent developments, such as Hikvision's announcement of a new 2-wire HD intercom solution tailored for apartments, are further propelling this growth. This system integrates advanced features like high-definition video and intuitive controls, catering to the increasing demand for smarter, more connected living environments.

Restraint

- The primary obstacle in the Video Intercom Devices market is the significant expenses associated with installation and upkeep.

A significant limitation of the Video Intercom Devices market is the expensive installation and maintenance expenses. Video intercom systems, especially sophisticated IP-based models, need significant upfront investment for top-notch hardware, network configuration, and incorporation with current infrastructure. This expense may hinder small businesses, residential users, and institutions with constrained budgets. Furthermore, ongoing maintenance costs are increased by wireless or IP-based systems that may need frequent software updates, security patches, and troubleshooting. Cost limitations can impede the adoption of services, especially in regions with limited budgets, which are more common in developing areas.

Segment Analysis

By Device type

The largest share of revenue in 2023 was from the door entry systems segment, making up 46% and projected to grow at a rapid CAGR of 11% in the forecast period. These systems provide improved audio and visual performance, along with diverse features like keyless entry, audiovisual capabilities, and adaptable connectivity to IP networks. Handheld devices are anticipated to experience substantial growth in the forecast period due to their widespread usage in various establishments such as hotels, restaurants, service centers, and retail stores. They facilitate simple and effective communication between hotel rooms and the main office. Additionally, they include digital audio and noise-canceling microphones to prevent frequency overlap, which is anticipated to generate growth prospects for the sector.

During the forecast period, the video baby monitors segment is anticipated to experience a notable compound annual growth rate of 14% because they offer parents a feeling of safety and security, along with being convenient and portable. Video baby monitors address the changing needs of parents today with features such as two-way audio, night vision, and temperature monitoring. The market's growth has also been fueled by a rise in awareness, affordability, and compatibility with other smart home products. As the difficulties of parenting grow, video baby monitors provide a helpful solution by enabling parents to juggle tasks while still monitoring their children closely.

By Access Control

In 2023, the password segment took the lead in terms of revenue share at approximately 34%, because of its advantages including strong security, ease of use, and convenient access. Accessing a password requires encrypting data that can only be decrypted with the authorized fingerprint or keyword password.

It is projected that the wireless access segment will experience a rapid CAGR of 12% during the forecast period. Integrated with a virtual private cloud network, wireless access control servers block unauthorized requests from entering the internal network. These servers are extensively utilized in surveillance, home automation, smart buildings, and safety & security industries. The wireless audiovisual intercom system with access control enables two-way communication with the visitor. These devices provide a range of advantages, like saving visitors' images and strong Wi-Fi connectivity.

By System

The wireless segment is projected to grow at the highest Compound Annual Growth Rate (CAGR) of 16% throughout the predicted timeframe. Wireless devices provide users with secure access control at an affordable price. Their characteristics consist of audiovisual surveillance with motion detection, integration with smart locks, storage of audiovisual data without extra charges in the cloud and entry without keys through a touchscreen keypad that is built-in. Wireless video intercom systems provide the ability to expand the system, operate easily, and have adaptable layouts.

By Technology

In 2023, the IP-based segment dominated with a 58% revenue share and is projected to grow at a rapid CAGR in the forecast period due to their widespread use and technological advancements. These devices provide a range of advantages, including simple setup, minimal upfront costs, and affordable infrastructure expenses. IP cameras, NVRs, and VoIP phones are examples of Video Intercom Devices that operate over the Internet. These systems drive the growth of the segment by delivering high video quality to any number of receiving devices.

Analog devices are not appropriate for two-way communication. The growth of the segment is hindered by disruptions in visual and data network signals.

The analog segment is projected to grow at a substantial CAGR in the future because of its dependable nature, ease of use, integration features, and cost efficiency. Analog video intercoms are able to handle power outages and network problems, while digital systems may experience failure.

By End-use

In 2023, the residential segment dominated with a 44% share of the total revenue. The items are commonly utilized in homes to prevent trespassers. The device includes IP video intercom terminals and monitor stations that are combined with CCTV and access control systems. This equipment has been tailor-made for individual homes, gated communities, and apartment complexes to provide optimal security and safety.

The automotive industry is projected to grow at a rapid pace with a CAGR of 15% during the forecast period. Video intercom systems are commonly utilized in the automotive sector, enabling individuals to easily communicate with door stations. These systems come equipped with different features, such as an integrated IP camera, a compatible IP touchscreen, audiovisual communication systems, and a separate speaker and microphone. A rise in the use of audiovisual features in car production is anticipated to boost the sector in the coming years.

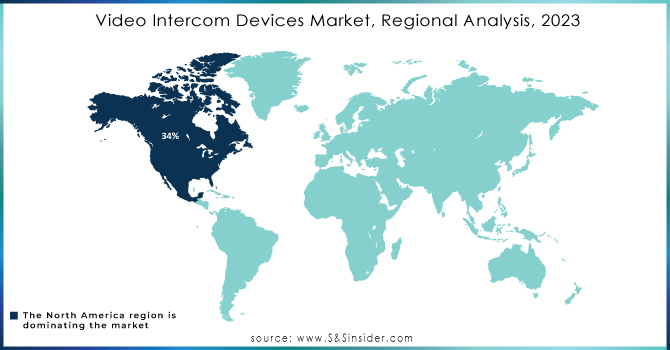

Regional Analysis

In 2023, North America dominated the market with approximately 34% share, mostly due to strong usage in the U.S. and Canada. The increasing need for home security systems, with more than 60% of American homes using video doorbells or video intercom systems, shows the area's dedication to safety and smart home technology. Moreover, there is a growing trend in North America's business and government industries to invest in combined security technologies, which is driving growth even more.

The video intercom market in the Asia Pacific region is the fastest-growing market in 2023. The increase is motivated by urban expansion, smart city projects, and growing spending power in nations such as China, India, and Japan. With the adoption of cutting-edge technology in residential and commercial settings, the popularity of Video Intercom Devices is projected to increase. Additionally, the rise in popularity of smart home technologies in Asia, combined with the cost-effectiveness of video intercom systems, establishes the region as a significant contributor to the market's expansion in the future. With the introduction of more advanced, cost-effective, and all-encompassing video intercom systems by businesses, the Asia Pacific area is poised to secure a larger portion of the worldwide market.

Do You Need any Customization Research on Video Intercom Devices Market - Inquire Now

Key Market Players

-

Hikvision(DS-KH6320-WTE1, DS-KIS603)

-

Samsung Electronics (Samsung Smart Video Doorphone, Samsung DRC-4K)

-

Comelit Group SpA (Visto,Simplebus)

-

Legrand (Bticino Classe 100, Bticino 2-Wire Video Door Entry System)

-

Aiphone (JOS-1VW, JOS-1AW)

-

2N (2N Indoor Touch, 2N IP Verso)

-

TCS (Telecommunication Systems) (HomeTec, TCS Voice and Video Entry Systems)

-

Bosch Security Systems (Divar IP, Video Entry System)

-

Siedle & Sohne OHG (Siedle Steel, Siedle Smart Gateway)

-

Panasonic(VL-SVN511, VL-SW250BX)

-

VTECH Communications (IS7100, IS8151)

-

Geesa (C300 Video Intercom, C200 Video Intercom)

-

Fermax (WayVision, CityMax)

-

ABB (ABB-Welcome Video Intercom, ABB-Welcome Touchscreen)

-

ZKTeco(ZKTeco Video Door Phone, ZKTeco IP Video Intercom)

-

Vivi (Vivi Video Doorphone, Vivi Entry System)

-

DoorBird (D101, D1101V)

-

ButterflyMX (ButterflyMX Video Intercom, ButterflyMX Mobile App)

-

Vanderbilt (ACTenterprise, ACTpro Video Intercom)

-

Valcom (V-1071 Video Intercom, V-1070 Video Entry System

Recent Developments

-

In November 2023, Samsung Electronics launched a new series of Video Intercom Devices, featuring 4K resolution cameras and facial recognition powered by AI technology. These systems are created to seamlessly integrate with Samsung's smart home ecosystem, giving users improved security and convenience. The release highlighted Samsung's commitment to improving home security technologies and addressing the changing requirements of contemporary homeowners with dependable and smart access control solutions.

-

In July 2023, Fermax Electronica S.A.U. launched a range of IP-based video intercom systems specifically created for tall residential buildings. These systems provide high-definition video quality and connect with smart home platforms, providing residents with improved security and convenience. The release is in line with Fermax's dedication to innovation in solutions for urban living, meeting the increasing need for advanced access control and communication technologies in cities.

-

In June 2023, 2N made history by being the first company to incorporate adaptive Face Zooming into its video intercom system. Adaptive Face Zooming enhances security by simplifying the process of identifying visitors for business owners and users in their premises.

-

In January 2023, Dahua Technologies Co., Ltd. announced the release of the EACH series, a hybrid video intercom system for villas. The latest EACH series revolutionizes flexibility and ease of use, convenience, and high-definition video in the 2-Wire video intercom system.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 41.79 Bn |

| Market Size by 2032 | US$ 128.62 Bn |

| CAGR | CAGR of 13.27% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Device Type (Door entry systems, Handheld devices, Video baby monitors) • By Access Control (Fingerprint readers, Password access, Proximity cards, Wireless access) • By System (Wired, Wireless) • By Technology (Analog, IP-based) • By End-use (Automotive, Commercial, Government, Residential, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | Hikvision, Samsung Electronics, Comelit Group SpA, Legrand, Aiphone, 2N, TCS (Telecommunication Systems), Bosch Security Systems, Siedle & Sohne OHG, Panasonic, VTECH Communications, Geesa, Fermax, ABB, ZKTeco, Vivi, DoorBird, ButterflyMX, Vanderbilt, Valcom |

| Key Drivers | • Rising Demand for Enhanced Security of Video Intercom Devices • Growth of Smart Homes and Connected Devices |

| Market Restraints | • The primary obstacle in the Video Intercom Devices market is the significant expenses associated with installation and upkeep. |