Women’s Health Therapeutics Market Size & Trends:

To Get More Information on Women’s Health Therapeutics Market - Request Sample Report

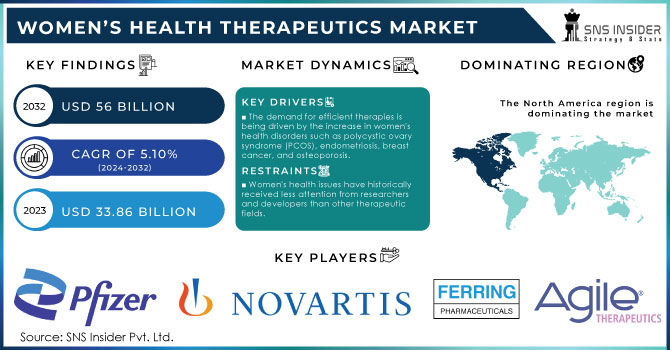

The Women’s Health Therapeutics Market Size was valued at USD 43.21 billion in 2023 and is expected to reach USD 61.6 billion by 2032 and grow at a CAGR of 4.05% over the forecast period of 2024-2032.

Growing awareness of women's health issues, increasing adoption of modern medical technology, and an aging population are critical factors driving the growth of the women's health therapeutics market. The prevalence of conditions such as menopause, PCOS, and breast cancer are also rising considerably and are set to increase demand for specialized treatments. The WHO states that around 10% of women around the world are diagnosed with PCOS. Breast cancer is the most common cancer diagnosed in women, affecting 2.3 million females annually. These numbers speak to the enormous potential for targeted therapeutics to combat such widespread health issues.

Modern advances in women's health therapeutics have emerged in the form of advanced contraceptive methods and targeted therapies for different conditions, endometriosis and PCOS among them. Examples include non-hormonal types, like the vaginal capsule OUI, which would act as a barrier within cervical mucus, and Phexxi, vaginal gel, which creates an acidic environment to hinder sperm motility. At present, this increase in demand is for safer, more effective drugs with fewer side effects factors that could impact the flow of people towards personalized medicine.

In addition to contraception, there is tremendous scope in developing solutions for unmet needs in reproductive health areas such as infertility and STIs. Governments across the world have invested more in women's health programs, and the U.S. National Institutes of Health continue to fund research in furthering solutions within this space. Lastly, customized reproductive health solutions, including user-friendly contraceptive technologies, will increase access and health outcomes on a global level.

TABLE 1: Emerging Trends in Women's Health Therapeutics

| Trend | Description |

|

Personalized Medicine |

Tailoring treatments based on individual patient profiles. |

|

Digital Health Integration |

Use of apps and telemedicine for women's health management. |

|

Non-Prescription Options |

Increase in availability of over-the-counter solutions. |

|

Increased Focus on Preventive Care |

Emphasis on early diagnosis and preventive strategies. |

|

Rising Interest in Natural Remedies |

Growth in demand for herbal and alternative therapies. |

TABLE 2: Major Players and Their Offerings

| Company | Key Products | Country of Origin |

|

Pfizer Inc. |

Premarin, Minastrin 24 Fe |

United States |

|

Bayer AG |

Yasmin, Mirena |

Germany |

|

AbbVie Inc. |

Orilissa |

United States |

|

Teva Pharmaceutical |

Various contraceptive options |

Israel |

|

F. Hoffmann-La Roche Ltd. |

Various hormonal therapies |

Switzerland |

Market Dynamics

Drivers

-

The Rise of Innovative Therapeutics Through Advocacy and Awareness

The awareness and advocacy for health issues related to women continue to be one of the vital demand drivers for advanced therapeutic solutions against menopause, reproductive disorders, and hormonal imbalances, among others. With awareness, women are demanding all types of information on health concerns that were previously not addressed and therefore this type of shift has led to increased advocacy towards women's health and this is a stimulant for the development of innovative therapeutic options.

Technological advancement in the healthcare sector has been the major force in its evolution, considering precision medicine and new formulations of drugs as a stepping stone toward more personalized treatment strategies. Targeted therapy, minimally invasive procedures, and all that improved management for women's health conditions with better outcomes and increased patient satisfaction. The integration of women's health into primary care by providers also progressively helps de-stigmatize the issues, motivating women to attend to them early.

Furthermore, support for government policies and funding to contribute toward research in women's health accelerates the speed of therapeutic discovery. As education and advocacy continue to increase, this will lead to an expansion in the therapeutics market in women's health due to joint endeavors from healthcare providers, organizations, and patients to have more efficient solutions in healthcare that cater to the specific health concerns of women. Such comprehensive attention towards women's health is changing the therapeutic face, as women's health issues attract the required attention and actions.

Restraints

-

Regulatory Challenges

The processes for the approval of women's health drugs by regulatory agencies are very complex and strict. This might lead to delays in the product launch by many months, which could prevent innovative therapies from being introduced in the market on time.

-

Gender-Based Research Disparities

Disparities in clinical research and access to healthcare still exist today, which would affect the development of cohesive women's health therapeutics and hence the application of any treatment over diverse populations.

Key Segmentation

By Application

In 2023, the market was led by contraceptives, which held the highest revenue share of 35.8%. The growth in the awareness of family planning and the availability of advanced contraceptive options are considered to be the primary drivers. Market growth is also supported by the approval and launch of innovative products such as the over-the-counter contraceptive pill Opill, the FDA approved the launch of which took place in 2023. Reimbursement policies from governments and private organizations for contraceptives will also be expected to support the global adoption process of the same.

The endometriosis and uterine fibroids segment is expected to grow at the compound annual growth rate (CAGR) of 7.6% during the forecast period. Growth in this segment is due to the rising prevalence of these conditions along with increasing awareness and higher diagnosis rates, further increasing the demand for targeted treatments. Technological advancements in new types of therapy, improved management of endometriosis, and uterine fibroids are the main drivers for the growth of this market. Newly introduced therapeutic products, like Orilissa for endometriosis, and the government's efforts to improve women's health are fast-paced actions for that segment.

By Age

The age group 50 years and above held the largest market revenue share in 2023. This is attributed to the growing prevalence of menopausal and postmenopausal conditions. Women at this stage experience a wide range of symptoms, such as osteoporosis, hormonal changes, and increased vulnerability to many chronic diseases. This demographic shift, combined with an increasing awareness of health problems in women, has lifted the demand for treatment. Furthermore, advances in hormone replacement therapies as well as personalized medicine provide better alternatives to elderly women in terms of treatment.

Market growth for young women, particularly those in their reproductive ages, is driven primarily by a greater awareness of issues related to reproductive health problems such as polycystic ovary syndrome (PCOS) and infertility. Better access to information and healthcare services empowers younger women to seek early diagnosis and treatments. Increased ingenuity in the methods of contraception and fertility treatment has also started addressing this demographic's needs. Greater emphasis on preventive care, coupled with governmental efforts emphasizing more effective education in women's health, helps create an enabling environment for therapeutic adoption across different segments of age.

By Drug

Prolia was the market leader in 2023 by drug, with the highest revenue share at 16.3%. The growth of the drug is influenced by its effectiveness in preventing and treating osteoporosis among postmenopausal women by inhibiting RANK ligand, a protein involved in bone resorption, which subsequently reduces bone loss and fractures. The biannual injection regimen also facilitates better patient compliance, and it is thus a first choice for doctors. Government policies and favorable schemes for reimbursement, particularly in North America, have enhanced its market, and the pace of Prolia's growth is similar.

Minastrin 24 Fe would increase significantly in the forecasting period. This drug works as an anti-conceptive besides being an antitreatment that may correct dysfunctional menstrual cycles. This product is a combination drug of ethinyl estradiol and norethindrone acetate; it is used for the regulation of menstrual cycles and to prevent pregnancy. Some growth factors include an increased understanding of reproductive health as well as the increasing demand for convenient methods of contraception. In addition, further growth in this market is the ready availability of Minastrin 24 Fe distribution channels, which the product could make available to women through retail pharmacies as well as online sources, ensuring dependable contraception.

By Distribution Channel

The hospital pharmacies were the major contributors to the market share by collecting the highest share of revenue with 47.7% in 2023, mainly due to the growing prevalence of women's health disorders, such as endometriosis, PCOS, and osteoporosis. There is a growing demand for specific medicines and treatments within these outlets to treat women's specific health disorders. The increasing demand for effective treatments, coupled with innovation in medical research, has increased the ability of hospital pharmacies to supply complete care. Additionally, the entrenched structures of hospitals together with accessibility to health professionals ensure that medicines are always readily available, thus bolstering this segment's growth.

More citizens will avail of online pharmacies at a compound annual growth rate (CAGR) of 4.6% during the forecast period as they want to enjoy the trend of digital healthcare and are finding convenience from online platforms. With the wide expansion of e-commerce platforms, women can easily access the entire range of health products or drugs from their homes. This access is particularly helpful in dealing with sensitive health issues, thus more women visit treatments without facing stigma. Moreover, telemedicine services integrated into the pharmacies improve the engagement of the patients towards follow-up care, which also increases the online sales in pharmacies in the market.

Regional Analysis

North America was the dominant region in 2023 with a 46.2% share. The reason behind this is the high consciousness about women's health issues, strong health expenditure of the region, and availability of advanced treatments. Furthermore, the significant adoption of products used for women's health together with the growth of conditions such as breast cancer boosts the market in this region. The US market, in particular, is very well positioned to witness tremendous growth due to the ever-increasing number of occurrences of osteoporosis, breast cancer, and menopause besides huge investments from major players such as Pfizer Inc. and Merck & Co., Inc.

On the other hand, the Asia Pacific women's health therapeutics is emerging to be a rapidly increasing market as online platforms are easy and fast-paced digital healthcare. E-commerce and telemedicine initiatives that grow in this region ensure better access to health products with rising awareness and investment in health.

Growing cases of PCOS and endometriosis are specifically helping the market in China, along with the government initiative to strengthen healthcare infrastructure. Improved awareness about women's health in countries like Germany, the UK, and France, along with strengthened healthcare infrastructure, drives the market strongly in Europe. The presence of market majors, which are focusing strategically on collaboration, promotes growth in this market. Overall, these regional dynamics reflect the holistic landscape of a country's women's health therapeutics based on awareness and availabilities of targeted and easily accessible treatments.

Do You Need any Customization Research on Women’s Health Therapeutics Market - Enquire Now

Key Drug Manufacturers in Women's Health Therapeutics

-

Pfizer, Inc.

-

Cipla Inc.

-

Orchid Pharma

-

Sun Pharmaceutical Industries Ltd.

-

Teva Pharmaceutical Industries Ltd.

-

F. Hoffmann-La Roche Ltd.

-

AbbVie Inc.

-

Axena Health

-

Novartis AG

-

GlaxoSmithKline plc

-

Merck & Co., Inc.

-

Eli Lilly and Company

-

AstraZeneca plc

-

Johnson & Johnson

-

Eisai Co., Ltd.

-

Otsuka Pharmaceutical Co., Ltd.

-

Shionogi & Co., Ltd.

-

Mitsubishi Tanabe Pharma Corporation

-

Daiichi Sankyo Company, Limited

-

Astellas Pharma Inc.

-

Sanofi

-

Bristol Myers Squibb Company

-

Allergan plc

Key Players in Women's Health Therapeutic Diagnostics

-

Roche Diagnostics

-

Siemens Healthineers

-

Hologic, Inc.

-

Qiagen N.V.

-

Becton, Dickinson and Company (BD)

-

F. Hoffmann-La Roche Ltd.

-

Thermo Fisher Scientific Inc.

-

Bio-Rad Laboratories, Inc.

-

Genomic Health, Inc.

-

Illumina, Inc.

-

Medtronic plc

-

Ortho Clinical Diagnostics

-

Abcam plc

-

Cytiva

Recent Developments

In June 2024, Orchid Pharma teamed up with Cipla to introduce Cefepime-Enmetazobactam, an innovative antibiotic combination approved for treating complicated urinary tract infections (cUTI), ventilator-associated pneumonia (VAP), and hospital-acquired pneumonia (HAP). This collaboration guarantees broad distribution of the treatment throughout India. By leveraging Orchid's expertise in drug development and Cipla's extensive distribution network, the partnership ensures that this critical medication reaches healthcare providers quickly and efficiently.

| Report Attributes | Details |

| Market Size in 2023 | US$ 43.21 Bn |

| Market Size by 2032 | US$ 61.6 Bn |

| CAGR | CAGR of 4.05% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Application (Hormonal Infertility, Contraceptives, Postmenopausal Osteoporosis, Endometriosis & Uterine Fibroids, Menopause, Polycystic Ovary Syndrome (PCOS)) • By Age (50 Years & Above, Others) • By Drug (ACTONEL, YAZ, Yasmin, Yasminelle, FORTEO, Minastrin 24 Fe, Mirena, NuvaRing, ORTHO TRI-CY LO, Premarin, Prolia, Reclast/Aclasta, XGEVA, Zometa, Others) • By Distribution Channel (Hospital Pharmacy, Retail Pharmacy, Online Pharmacy) |

| Regional Analysis/Coverage | North America (USA, Canada, Mexico), Europe (Germany, UK, France, Italy, Spain, Netherlands, Rest of Europe), Asia-Pacific (Japan, South Korea, China, India, Australia, Rest of Asia-Pacific), The Middle East & Africa (Israel, UAE, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Abbott Laboratories, AbbVie Inc., Abcam plc, Allergan plc Astellas Pharma Inc., AstraZeneca plc, Axena Health, Bayer AG, Becton, Dickinson and Company (BD) Bio-Rad Laboratories, Inc., Bristol Myers Squibb Company, Cipla Inc. Cytiva Daiichi Sankyo Company, Limited, Eisai Co., Ltd. Eli Lilly and Company, F. Hoffmann-La Roche Ltd., Genomic Health, Inc., GlaxoSmithKline plc, Hologic, Inc., Illumina, Inc., Johnson & Johnson, Medtronic plc, Merck & Co., Inc., Mitsubishi Tanabe Pharma Corporation, Novartis AG, Orchid Pharma, Ortho Clinical Diagnostics, Otsuka Pharmaceutical Co., Ltd., Pfizer, Inc., Qiagen N.V., Roche Diagnostics, Sanofi, Shionogi & Co., Ltd., Siemens Healthineers, Sun Pharmaceutical Industries Ltd., Teva Pharmaceutical Industries Ltd., Thermo Fisher Scientific Inc. & Others |

| Key Drivers | • The Rise of Innovative Therapeutics Through Advocacy and Awareness |

| Market Restraints | • Regulatory Challenges • Gender-Based Research Disparities |