In-Flight Catering Services Market Report Scope And Overview:

Get More Information onIn-flight catering Services Market - Request Sample Report

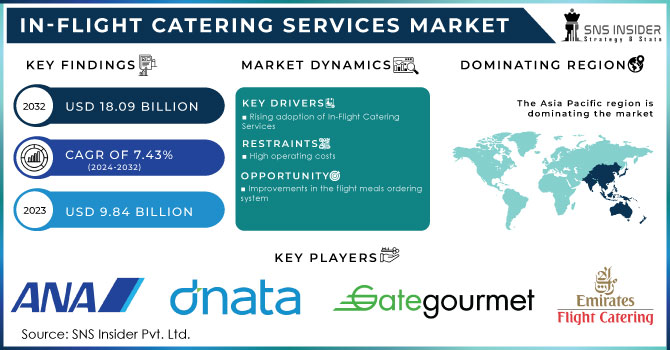

The In-flight catering Services Market size was valued at USD 9.84 Billion in 2023 and is expected to reach USD 18.09 Billion by 2032 and grow at a CAGR of 7.43% over the forecast period of 2024-2032.

From a business growth aspect, air transportation companies are focusing on improving the quality of in-flight catering services in order to attract more passengers. This aspect is likely to drive demand for various in-flight catering services, hence propelling the in-flight catering market's growth throughout the study period. According to the International Flight Transport Association (IATA), the global aviation industry's international and domestic flight traffic has expanded significantly in recent years, resulting in increasing operational earnings and overall net profits for carriers

Based on food type, the meal segment accounted for the largest revenue share of over 51.0% in 2022. Some of the primary causes driving growth are increased demand for catering services and ready-to-eat meals on long-distance nonstop flights. The biggest in-flight catering firms are taking steps to deliver meals to ethnically diverse passengers. Passengers' increasing demand for healthy and nutritious meals, as well as their willingness to pay a premium price for such meals, are likely to fuel growth over the next eight years.

The bakery and confectionery is another segment that is expected to expand at the highest CAGR of 8% from 2022 to 2030. One of the key elements propelling the market is an increase in passenger interest in nutritious juices, coffee, and tea on short-haul flights. Another aspect boosting segment expansion is a diverse selection of beverage alternatives for passengers, including juices and other forms of alcohol.

MARKET DYNAMICS

KEY DRIVERS

-

Rising adoption of In-Flight Catering Services

The expansion of the economy and of the rise in population is responsible for the increase in airline passengers and flights. Middle-class consumers are boosting the airline business. Low-cost airlines have also started to appear, offering catering services at reasonable rates on well-traveled routes. Tourism, business, and high-value manufacturing are some of the key activities that have a significant impact on the volume of traffic that an airport handles. Strongly commercially oriented cities, including corporate headquarters, see a rise in air travel demand.

RESTRAIN

-

High operating costs

There are many reasons why running in-flight catering services is expensive, as it has to maintain food safety standards. In order to safeguard passengers' health, in-flight catering businesses are required to follow strict food safety regulations. This entails spending money on specialist equipment and employee training. Meals from central kitchens must be transported to airports by in-flight catering companies. This can be expensive, particularly for airlines that run flights out of several locations.

OPPORTUNITY

-

Improvements in the flight meals ordering system

Passengers are increasingly seeking a more personalized and convenient onboard eating experience, and airlines are responding by investing in new technology and partnerships. Airlines are utilizing data analytics to develop personalized menus that reflect their guests' dietary restrictions and tastes. This contributes to less food waste and higher customer satisfaction. Passengers can now order and pay for meals and drinks on their smartphones or tablets before or during the journey. This allows individuals greater control over their eating experience while also shortening wait times. The drive toward digital transformation in the airline industry is fueling growth in the market for in-flight culinary services.

-

Increasing demand for specialized catering options

CHALLENGES

-

Environmental concerns

According to the International Civil Aviation Organisation (ICAO), the aviation industry accounts for around 2% of worldwide CO2 emissions. The manufacturing of food for in-flight catering, for example, necessitates a substantial amount of energy and resources. For example, 1 pound of beef requires approximately 1,800 liters of water. Food waste and other catering materials must be disposed of following a flight. This garbage has the potential to end up in landfills, where it produces methane, a greenhouse gas 25 times more potent than CO2.

IMPACT OF RUSSIAN-UKRAINE WAR

Russia and Ukraine are major wheat, sunflower oil, and other agricultural commodity exporters. The war has affected commodity production and export, lowering global supplies. Furthermore, Russia is a significant oil supplier, but as a result of sanctions imposed by various nations, global oil prices have risen. As a result, the food business has been impacted. The food industry is the most important sector of in-flight catering services. According to the International Air Transport Association (IATA), airline capacity has reduced by 20% since the start of the war. As a result, demand for in-flight culinary services has decreased. Europe had experienced a 20% decrease in growth in 2022.

IMPACT OF ONGOING RECESSION

The Food and Agriculture Organisation of the United Nations (FAO) estimates that the global food price index will rise by 12.6% in March 2023. During a recession, passenger spending on in-flight catering services such as meals, beverages, and other items is predicted to fall by 10%. This is because travellers are more inclined to cut back on discretionary spending like in-flight meals and drinks, opting for smaller meal amounts or fewer meal alternatives. Since the recession, Asia Pacific has experienced a 7.5% drop in growth. Because of its emphasis on tourist and business travel, Europe is projected to be the most affected region.

MARKET SEGMENTATION

by Flight Type

-

Full-service Carriers

-

Low-cost Carriers

-

Others

by Airline Seating Class

-

Economy Class

-

Business Class

-

First-class

by Flight Duration

-

Long Haul

-

Short Haul

by Food Type

-

Meals

-

Bakery & Confectionary

-

Beverages

-

Others

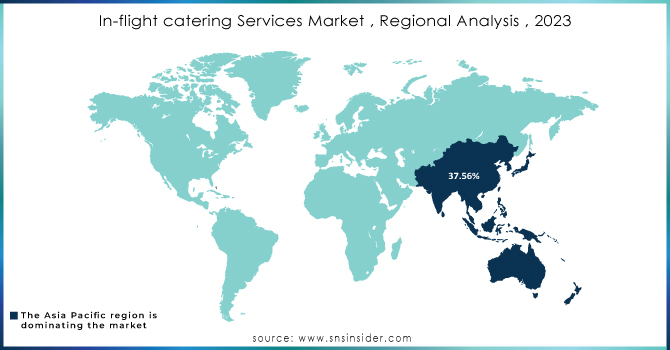

REGIONAL ANALYSIS

The Asia Pacific region accounted for the largest market revenue share of over 37.56% in 2023. Growth in foreign travel and tourism, growing urbanization, a rising level of living to supplement aspirational travel, and a comeback in discretionary spending are all factors contributing to regional growth. The region is expected to grow at the quickest rate, owing to significant increases in domestic as well as international flights and tourism in developing countries such as China, India, and Vietnam. Furthermore, the region's growing number of airline operators is likely to generate considerable growth potential for in-flight catering companies.

Europe is a significant market for growth at a CAGR of 7.6% in the forecast period. The increased propensity of travelers to spend money on buying healthy and ethical meals and airline partnerships with food professionals with practical knowledge are additional variables anticipated to offer considerable growth potential in the upcoming years.

The North American in-flight food services industry is anticipated to growing with the largest CAGR in forecast period. Increasing air passenger traffic, rising demand for premium in-flight food services, expanding low-cost carrier (LCC) operations, and rising disposable incomes are driving the expansion of the North American in-flight catering services market. With over 900 million passengers traveling yearly, the United States is one of the world's busiest air travel markets. Premium in-flight catering services, such as fresh meals, specialty drinks, and healthier selections, are rising in demand.

Need any customization research on In-flight catering Services Market - Enquiry Now

REGIONAL COVERAGE

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

KEY PLAYERS

Some major key players in the In-Flight Catering Services Market are ANA Catering Services Co. Ltd., Emirates Flight Catering, DO & CO., DNATA, Gate Group (Gate gourmet), Newrest International Group, Flying Food Group, LLC, LSG Lufthansa Service Holdings AG, SATS Ltd., Servair SA, and other key players.

RECENT DEVELOPMENTS

In February 2023, Cathay Pacific Catering Services worked with VTC to develop aviation talent in Hong Kong. This has aided the company's appeal among Hong Kong residents.

In October 2022, LSG Group was able to obtain or extend several airline catering contracts during the third quarter, including a three-year deal with Copa Airlines covering 22 stations, and further contracts with China Southern Airlines throughout Thailand and GOL in Brazil.

In August 2022, Dnata expanded its cooperation with GOL Airlines, an airline and travel service provider, in order to enhance the relationship and provide consumers with the greatest catering experience possible.

| Report Attributes | Details |

| Market Size in 2023 | US$ 9.84 Billion |

| Market Size by 2032 | US$ 18.09 Billion |

| CAGR | CAGR of 7.43 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Flight Type (Full-service Carriers, Low-cost Carriers, and Others) • By Airline seating Class (Economy Class, Business Class, and First-class) • By Flight Duration (Long Haul and Short Haul) • By Food Type (Meals, Bakery & Confectionary, Beverages, and Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | ANA Catering Services Co. Ltd., Emirates Flight Catering, DO & CO., DNATA, Gate Group (Gate gourmet), Newrest International Group, Flying Food Group, LLC, LSG Lufthansa Service Holdings AG, SATS Ltd., Servair SA |

| Key Drivers | • Rising adoption of In-Flight Catering Services |

| Market Opportunity | • Improvements in the flight meals ordering system • Increasing demand for specialized catering options |