In-Mold Labels Market Report Scope & Oveview:

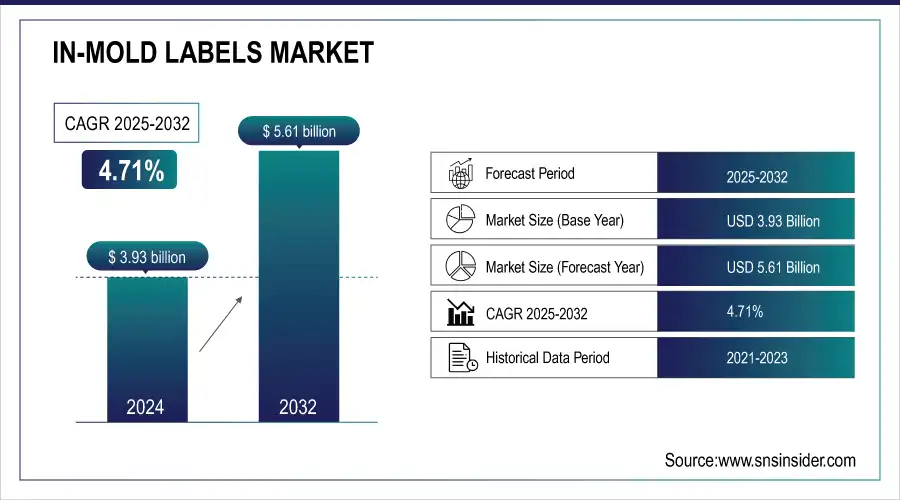

The In-Molds Labels Market was valued at USD 3.93 billion in 2024 and is expected to reach USD 5.61 billion by 2032, growing at a CAGR of 4.71% from 2025-2032.

Get More Information on In-Mold Labels Market - Request Sample Report

The In-Mold Labels (IML) market is experiencing steady growth due to its integration of labels with packaging during manufacturing, ensuring durability, premium aesthetics, and resistance to wear. Widely adopted in food and beverages for brand differentiation, IML is also gaining traction in cosmetics, pharmaceuticals, and household products. Its eco-friendly nature, reducing waste and supporting sustainability, further drives adoption. Technological advancements in materials, inks, and application techniques enhance design flexibility and quality. Despite benefits, high setup costs, specialized equipment, and intense competition present challenges.

Market Size and Forecast

-

Market Size in 2024: USD 3.93 Billion

-

Market Size by 2032: USD 5.61 Billion

-

CAGR: 4.71% from 2025 to 2032

-

Base Year: 2024

-

Forecast Period: 2025–2032

-

Historical Data: 2021–2023

In-Molds Labels Market Trends

-

Rising demand for durable, visually appealing, and cost-effective labeling solutions is driving the in-mold labels market.

-

Growing adoption in food, beverage, and household products packaging is boosting market expansion.

-

Integration with sustainable and recyclable packaging materials is aligning with eco-friendly initiatives.

-

Advancements in printing technologies are enabling high-quality graphics and customization.

-

Increasing automation in molding and labeling processes is improving efficiency and reducing production costs.

-

Expanding use in consumer goods and industrial applications is widening market scope.

-

Collaborations between packaging manufacturers, brand owners, and technology providers are fostering innovation.

In-Molds Labels Market Growth Drivers:

-

Rising Demand for Visually Appealing and Durable Packaging Across Food & Beverage Sector

The food and beverage sector drives the IML market significantly, with its demand for packaging that combines durability, moisture resistance, and superior aesthetics. In-Mold Labels allow high-quality graphics, vibrant designs, and clear branding, which boost consumer engagement and shelf differentiation. Their ability to integrate product information directly into packaging makes them a preferred solution. With rising consumer preference for packaged and branded goods, IML adoption continues to accelerate, making food and beverages the strongest driver of market expansion globally.

In-Molds Labels Market Restraints:

-

Complex Manufacturing Process Requiring Skilled Expertise Creates Operational Challenges

The IML process involves integrating labels within molds during container manufacturing, demanding high precision, advanced technical know-how, and specialized expertise. This complexity often leads to increased operational challenges, higher labor costs, and the need for extensive training. Any errors during production can result in significant losses, making consistency difficult for inexperienced players. These challenges restrict market penetration, particularly among small-scale manufacturers, thereby acting as a restraint on the growth potential of the In-Mold Labels market globally.

In-Molds Labels Market Opportunities:

-

Technological Innovations in Printing, Inks, and Materials Enhancing Label Performance

Ongoing technological innovations present lucrative opportunities for the IML market. Advancements in digital printing, UV-resistant inks, and specialty films allow labels to achieve better durability, vibrant aesthetics, and higher customization. Such innovations support sectors like cosmetics, pharmaceuticals, and premium beverages that demand high-end packaging. Additionally, the integration of smart features such as QR codes and interactive labels opens new avenues for consumer engagement, offering brands opportunities to differentiate themselves while expanding IML’s utility beyond conventional packaging applications.

-

Expanding Adoption of IML in Emerging Economies and New End-Use Sectors

Emerging markets present significant opportunities for IML adoption due to increasing industrialization, rising packaged food demand, and growing consumer preference for branded goods. Rapid urbanization and modern retail expansion in these regions drive the need for advanced packaging technologies. Beyond food and beverages, end-use industries such as personal care, household products, and pharmaceuticals are exploring IML for its durability and aesthetic appeal. This expansion creates vast opportunities for suppliers to penetrate untapped markets and diversify revenue streams.

In-Molds Labels Market Segment Analysis

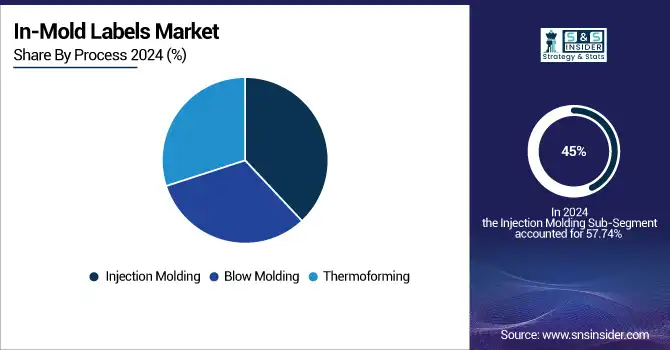

By Process, Injection molding dominates the In-Mold Labels market.

In 2024, Injection molding accounted for approximately 45% of the market due to its precision, versatility, and efficiency in producing complex, high-quality packaging designs. Widely used in food, beverage, and personal care industries, it ensures seamless label integration, durability, and resistance to wear. Its ability to handle large production volumes with consistent results makes it the most preferred process, driving its dominance in global IML applications.

By Material, Polypropylene dominates the In-Mold Labels market

In 2024, Polypropylene dominated the In-Mold Labels (IML) market with a share of approximately 38% due to its excellent durability, lightweight nature, and high resistance to moisture and chemicals. It provides superior print quality and adhesion, making it the preferred choice across food, beverage, and personal care packaging. Its recyclability and cost-effectiveness further boost adoption, aligning with the growing emphasis on sustainable packaging solutions while maintaining strong performance and visual appeal.

By Printing Method, Offset printing dominates the In-Mold Labels market

In 2024, Offset printing held a dominant share of around 42% owing to its ability to deliver high-quality, detailed, and vibrant graphics suitable for premium product packaging. This method supports large-scale production with consistent results, making it ideal for industries like food and beverages, where branding and aesthetics play a crucial role. Its cost efficiency for bulk runs and versatility across substrates further strengthen its market leadership.

By End Use, Food and beverages sector dominates the In-Mold Labels market.

In 2024, the food and beverages sector contributed around 50% of the market share, as brands increasingly adopt IML for superior packaging aesthetics, durability, and product differentiation. Dynamic graphics and enhanced shelf appeal make it highly effective in influencing consumer purchasing decisions. Its suitability for packaging that requires resistance to moisture and wear further strengthens its adoption, positioning food and beverages as the largest revenue-generating segment globally.

In-Molds Labels Market Regional Analysis

North America In-Molds Labels Market Insights

North America dominated the In-Mold Labels Market in 2024 due to high adoption of advanced packaging technologies, strong presence of leading label manufacturers, and extensive use across food & beverage, personal care, and pharmaceutical industries. The region benefits from well-established supply chains, robust R&D infrastructure, and increasing demand for sustainable and visually appealing packaging solutions, driving growth and reinforcing its leadership in the global IML market.

Get Customized Report as per your Business Requirement - Request For Customized Report

Asia Pacific In-Molds Labels Market Insights

The Asia-Pacific region is witnessing significant growth in the In-Mold Labels (IML) Market, driven by rapid industrialization, increasing consumer demand for packaged goods, and expanding food & beverage, personal care, and pharmaceutical sectors. Rising investments in advanced packaging technologies, growing manufacturing infrastructure, and increasing adoption of sustainable and aesthetically appealing labeling solutions are fueling market expansion, making Asia-Pacific a key region for IML manufacturers and suppliers.

Europe In-Molds Labels Market Insights

Europe holds a significant position in the In-Mold Labels (IML) Market, driven by advanced manufacturing capabilities, strong presence of key label manufacturers, and high demand from food & beverage, cosmetics, and pharmaceutical industries. The region emphasizes sustainable and eco-friendly packaging solutions, encouraging adoption of IML technology. Ongoing innovations in labeling materials, printing methods, and automation are further boosting market growth and enhancing product differentiation across Europe.

Middle East & Africa and Latin America In-Molds Labels Market Insights

The Middle East & Africa and Latin America In-Mold Labels (IML) Markets are expanding steadily, supported by growing packaged goods industries, urbanization, and rising consumer awareness. Limited local manufacturing has led to reliance on imports, while partnerships with global label suppliers are increasing accessibility. Investments in advanced packaging technologies, combined with demand from food & beverage, personal care, and pharmaceutical sectors, are driving market growth and creating opportunities in these regions.

In-Molds Labels Market Competitive Landscape:

Avery Dennison

Avery Dennison is a key player in the In-Molds Labels Market, offering innovative IML solutions with a focus on sustainability, recyclability, and traceability. The company integrates RFID technology into labels, enhancing product tracking, durability, and compliance with food safety standards. Avery Dennison continuously develops eco-friendly materials and PET-free inlays, supporting circular economy initiatives and reducing environmental impact while maintaining high-quality labeling performance across food, beverage, and consumer goods packaging applications.

Avery Dennison in In-Molds Labels Market focuses on innovation and sustainability, offering RFID-enabled IML products and eco-friendly solutions.

-

2025: Launched RFID-enabled IML portfolio AD Anchor U9, AD Line U9XE, and AD Spiral U9 IML designed for durability, traceability, and circularity.

-

2024: Western Michigan University certified AD Pure RFID inlays and tags for recyclability and repulpability, supporting sustainable labeling.

-

2023: Introduced AD Pure range, the first fully PET plastic-free RFID inlays and tags, reducing carbon footprint by 70–90%.

Key Players

Some of the In-Molds Labels Market Companies

-

CCL Industries Inc

-

Constantia Flexibles

-

Coveris Holdings SA

-

Mepco Label Systems

-

Avery Dennison Corporation

-

Century Label Inc

-

Allen Plastic

-

Cenveo Inc

-

Innovia Films Ltd

-

Huhtamaki Group

-

Multi-Color Corporation

-

Printpack Inc.

-

Sonoco Products Company

-

Bemis Company, Inc.

-

Winpak Ltd.

-

RPC Group Plc

-

Uflex Limited

-

LINPAC Packaging

-

WestRock Company

-

Berry Global, Inc.

| Report Attributes | Details |

| Market Size in 2024 | US$ 3.93 Bn |

| Market Size by 2032 | US$ 5.61 Bn |

| CAGR | CAGR of 4.71 % From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Material (Polyethylene, Polypropylene, Polystyrene, Polyethylene terephthalate, Paper, Barrier, Others) • By Printing Method (Flexographic, Gravure, Offset, Digital, Others) • By Process (Thermoforming, Blow Molding, Injection Molding) • By End Use (Food & Beverages, Pharmaceuticals, Personal Care & Cosmetics, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]). Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | CCL Industries Inc, Constantia Flexibles, Coveris Holdings SA, Mepco Label Systems, Avery Dennison Corporation, Century Label Inc, Allen Plastic, Cenveo Inc, Innovia Films Ltd, Huhtamaki Group, Multi-Color Corporation, Printpack Inc., Sonoco Products Company, Bemis Company, Inc., Winpak Ltd., RPC Group Plc, Uflex Limited, LINPAC Packaging, WestRock Company, Berry Global, Inc. |