Packaging Material Market scope & overview:

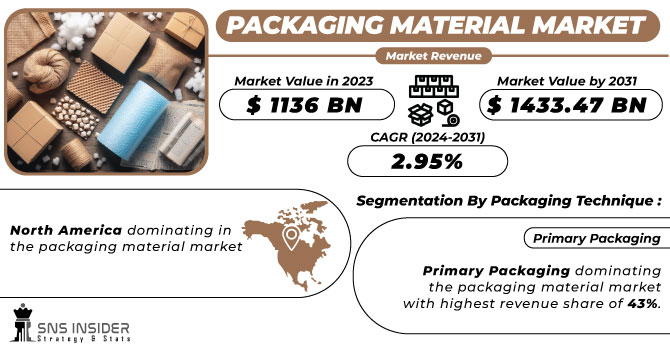

Packaging Material Market Size was valued at USD 1136 billion in 2023 and is expected to reach USD 1433.47 billion by 2031 and grow at a CAGR of 2.95% over the forecast period 2024-2031.

The packaging material market is a dynamic and rapidly growing industry that plays a vital role in protecting products throughout their journey from production to consumption. It encompasses a wide range of applications including food & beverage, pharmaceuticals, personal care, and industrial goods.

Get More Information on Packaging Material Market - Request Sample Report

Regulations and standards by governments and industry bodies significantly influence market growth. These regulations can promote sustainable practices e.g., recyclable/reusable materials, restrictions on single-use plastics like India's 2022 ban. While advancements like tamper-proof seals and custom printing which can boost brand recognition by 89% and purchase intent by 33% drive market growth, concerns regarding waste generation 353 million tonnes of plastic waste globally, with only 9% recycled according to the World Bank and the environmental impact of packaging materials pose challenges for widespread adoption of sustainable alternatives. Overall, the market is driven by the need to protect products, ensure food safety, and create brand differentiation, but must navigate the challenge of balancing these needs with environmental responsibility.

MARKET DYNAMICS:

KEY DRIVERS:

-

Growing Demand for Eco-Conscious Packaging.

Driven by growing environmental awareness among consumers and stricter regulations, the packaging material market is undergoing a transformation. The demand for sustainable and eco-friendly solutions like biodegradable plastics, recyclable materials, and minimized packaging waste is surging, shaping the future of the industry.

-

Consumers are increasingly concerned about food safety and traceability.

RESTRAINTS:

-

The rise of environmental awareness creates a complex challenge for the packaging material market.

Growing environmental concerns about plastic pollution, deforestation, and climate change are driving a surge in demand for sustainable alternatives. Consumers are increasingly rejecting single-use plastics and non-recyclable materials, forcing a transformation in the packaging industry. Companies that fail to adapt to eco-friendly options risk falling behind in terms of consumer acceptance, regulatory compliance, and overall market relevance.

-

Unpredictable price fluctuations can create uncertainty for both manufacturers and consumers.

OPPORTUNITIES:

-

Advanced technologies provide real-time data for better supply chain management.

Material science and manufacturing advancements are revolutionizing packaging materials. Smart packaging solutions, featuring QR codes, NFC (near-field communication), and RFID tags, are gaining significant traction. These innovations empower businesses to track and trace products throughout the supply chain, enhancing transparency and efficiency.

-

The packaging industry is witnessing a growing trend towards minimalist and functional design.

CHALLENGES:

-

Governments worldwide are tightening the rules on packaging materials by enacting stricter regulations and standards.

Governments are raising the sustainability bar on packaging with stricter regulations. These might restrict specific materials like plastic bags or polystyrene, or mandate recycling or composting capabilities. Traditional packaging that falls short of these sustainability benchmarks may struggle to comply, potentially hindering their market growth.

-

Short shelf life can restrict product movement, impacting availability.

IMPACT OF RUSSIA-UKRAINE WAR

The Russia-Ukraine war has significantly disrupted the global packaging material market, particularly in Europe. Ukraine, a major supplier of timber, metal, and finished packaging products like 900,000+ tonnes of glass bottles annually has seen its production grind to a halt due to fighting, occupation, and supply chain disruptions. Companies like PACK TECHNOLOGY Ukraine have been forced to shut down entirely due to lack of raw materials and access to their customer base. Even firms like Re-Leaf, which uses unconventional sustainable materials like fallen leaves, haven't been spared as their operations are paralyzed by a lack of activity from contractors and customers. While some Ukrainian packaging companies are trying to stay afloat to support the economy, the overall industry is expected to face a long road to recovery due to widespread infrastructure damage estimated at $63 billion. Rebuilding supply chains and restarting production will be a major challenge in the war's aftermath.

IMPACT OF ECONOMIC SLOWDOWN

Economic slowdowns can squeeze profits, forcing brands to seek cost-cutting measures in packaging. This might lead to a trend of generic, one-size-fits-all packaging solutions to save on upfront costs. Recessions often see reduced consumer spending, potentially leaving brands with excess packaging inventory that becomes obsolete. This surplus ties up cash flow and warehouse space. Furthermore, with reduced brand loyalty during economic downturns, companies need to stand out. Digital printing technologies can be a powerful tool here. By personalizing packaging with features like digital watermarks, brands can create a more engaging consumer experience and perceived value for their product, giving them a competitive edge.

KEY MARKET SEGMENTS:

By Material

-

Paper and Paperboard

-

Rigid Plastics

-

Metals

-

Flexible Plastics

-

Glass

-

Wood

-

Textiles

-

Wax

-

Leather

-

Others

Paper and paperboard hold the top spot in the packaging material market. This eco-friendly and versatile option dominated the market and is expected to keep growing. Popular for its recyclability, printability, and ability to create rigid boxes or flexible wraps, paperboard reigns supreme for everything from shipping containers to cups.

By Product

-

Containers and Jars

-

Bags

-

Pouches and Wraps

-

Closures and Lids

-

Boxes and Crates

-

Drums and IBCs

-

Others

The boxes & crates segment dominates in the packaging material market, and this dominance is expected to continue. These versatile champions offer protection, secure storage, and come in various shapes and sizes to fit almost any product. From sturdy corrugated cardboard shipping boxes to attractive display cartons, boxes are a fundamental and irreplaceable part of the packaging industry.

By Packaging Technique

-

Primary Packaging

-

Secondary Packaging

-

Tertiary Packaging

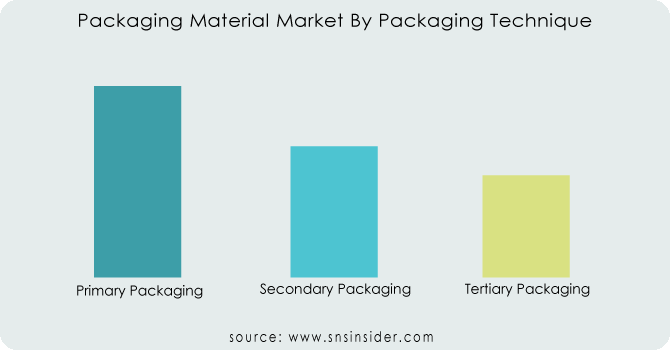

Primary Packaging dominating the packaging material market with highest revenue share of 43%. This crucial layer of protection that directly holds the product is expected to maintain its dominant position through 2030. From maintaining freshness to preventing damage, primary packaging safeguards the product's quality and ensures a safe user experience. From familiar examples like jars and pouches to closures and more, these solutions are chosen specifically to match the needs of each product, considering factors like shelf life and intended use. But primary packaging goes beyond just protection – it's also a communication channel, providing essential information to consumers through branding, usage instructions, and even nutritional details.

Need any customization research on Packaging Material Market - Enquiry Now

By End User Industries

-

Food and Beverages

-

Healthcare

-

Cosmetics

-

Household Products

-

Chemicals

-

Electrical and Electronics

-

Others

Food and beverages holds dominant position. This ever-evolving segment holds the top spot in the packaging material market and is expected to stay ahead of the pack. Packaging here's not just about holding food it's about keeping it fresh, safe, and looking good on the shelf. From flexible pouches to rigid containers, these materials are designed to meet strict quality standards and protect against everything from spoilage to sunlight.

REGIONAL ANALYSES

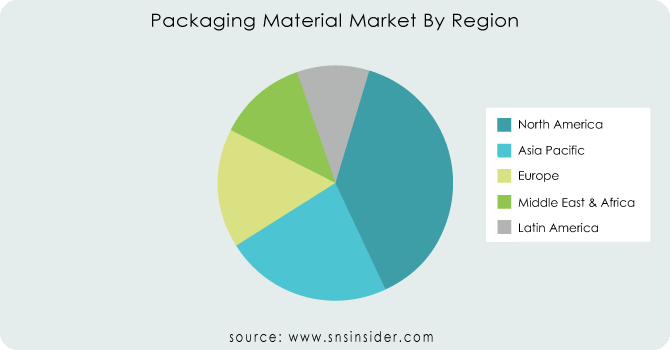

North America dominating in the packaging material market, fueled by a surge in exports and consumer trends. The rise of packaged and chilled food options is driving demand, and the e-commerce boom in the US has ignited a need for innovative, sturdy packaging to meet online retail's needs. Sustainability concerns are also a major player, with US consumers increasingly opting for recyclable, biodegradable, and eco-friendly options, prompting innovation in materials and design.

The Asia-Pacific region is poised to become the packaging industry's leader, boasting the highest growth rate. This surge is fueled by the booming consumer product sector, with various end-user industries witnessing rapid expansion. Rising disposable incomes across the region, particularly in countries like China, India, Japan, and South Korea, further act as a growth catalyst.

REGIONAL COVERAGE:

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

KEY PLAYERS

The major key players are Honeywell International Inc. (U.S.), Alcoa Corporation (U.S.), Bemis Manufacturing Company (U.S.), Graham Packaging Company (U.S.), AVERY DENNISON CORPORATION (U.S.), CKS Packaging, Inc. (U.S.), A-ROO COMPANY LLC. (U.S.), Avient Corporation (U.S.), Tetra Pak Group (Sweden), Amcor plc (Switzerland) and other key players.

Honeywell International Inc. (U.S.)-Company Financial Analysis

RECENT DEVELOPMENT

-

Amcor plc, a packaging leader, launched curbside-recyclable AmFiber Performance Paper in North America in August 2023. This eco-friendly packaging meets recycling standards, allowing brands to offer sustainable options to consumers.

-

In May 2023, the Aluminium Stewardship Initiative recognized the Portland Aluminium joint venture operated by Alcoa for its achievements in environmental, social, and governance (ESG) practices.

-

In 2023, Mondi's Eco Barrier Nature pioneered paper-based barrier packaging solution specifically designed for food products. This innovative technology eliminates the need for traditional plastic coatings, offering superior moisture and grease resistance while catering to the growing demand for sustainable packaging solutions among environmentally conscious consumers.

| Report Attributes | Details |

| Market Size in 2023 | US$ 1136 Bn |

| Market Size by 2031 | US$ 1433.47 Bn |

| CAGR | CAGR of 2.95% From 2024 to 2031 |

| Base Year | 2023 |

| Forecast Period | 2024-2031 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Material (Paper and Paperboard, Rigid Plastics, Metals, Flexible Plastics, Glass, Wood, Textiles, Wax, Leather, Others) • By Product (Containers and Jars, Bags, Pouches and Wraps, Closures and Lids, Boxes and Crates, Drums and IBCs, Others) • By Packaging Technique (Primary Packaging, Secondary Packaging, Tertiary Packaging) • By End User Industries (Food and Beverages, Healthcare, Cosmetics, Household Products, Chemicals, Electrical and Electronics, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | Honeywell International Inc. (U.S.), Alcoa Corporation (U.S.), Bemis Manufacturing Company (U.S.), Graham Packaging Company (U.S.), AVERY DENNISON CORPORATION (U.S.), CKS Packaging, Inc. (U.S.), A-ROO COMPANY LLC. (U.S.), Avient Corporation (U.S.), Tetra Pak Group (Sweden), Amcor plc (Switzerland) |

| Key Drivers | • Growing Demand for Eco-Conscious Packaging. • Consumers are increasingly concerned about food safety and traceability. |

| Key Restraints | • The rise of environmental awareness creates a complex challenge for the packaging material market. • Unpredictable price fluctuations can create uncertainty for both manufacturers and consumers. |