Awnings Market Report Scope & Overview:

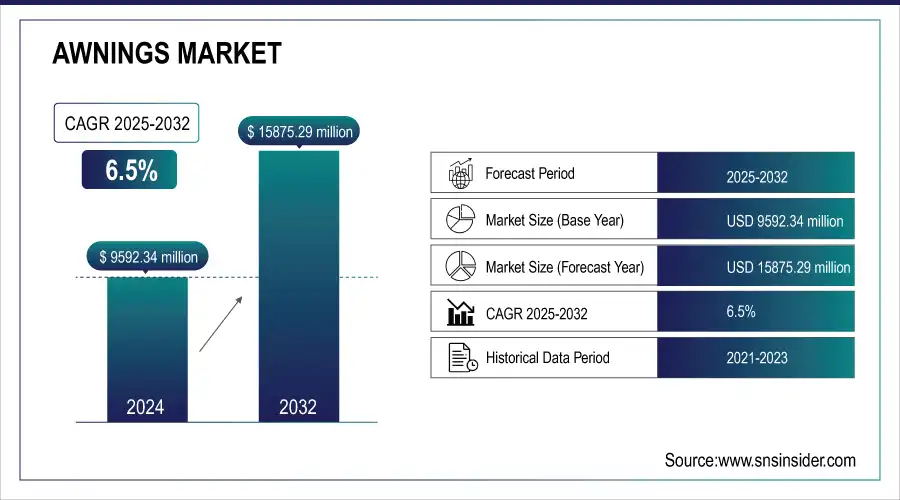

The Awnings Market size was USD 9592.34 million in 2024 and is expected to Reach USD 15875.29 million by 2032 and grow at a CAGR of 6.5% over the forecast period of 2025-2032.

The growth of the market is driven by the current urbanization trend. As cities grow, outdoor spaces such as patios, balconies and terraces have become essential living spaces. Awnings provide a solution that maximizes the usability of these spaces by providing shade and protection. Additionally, the demand for aesthetically pleasing exterior designs drives the demand for stylish and customizable awning options.

Get More Information on Awnings Market - Request Sample Report

Concerns about energy efficiency have also driven the awning market forward. By providing shade for windows and outdoor spaces, awnings help regulate indoor temperatures, reducing the need for air conditioning and there by contributing to energy savings. This aspect becomes increasingly important as sustainability and eco-friendly living habits become more and more central to consumer choices.

Advances in technology have brought innovative features to the awning market. Motorized awnings with remote control and sensors adjust to weather conditions for improved user comfort. In addition, solar-powered roofs, incorporating photovoltaic technology, have appeared, allowing for energy generation while providing shade. The retail sector plays an important role in the distribution of awnings, offering a wide range of designs, materials and sizes to meet the diverse needs of customers. From movable awnings that can be adjusted as needed to fixed awnings designed for long-term installation, the market offers options suitable for both residential and commercial environments.

Key Awnings Market Trends:

-

Increasing consumer preference for outdoor living spaces and lifestyle enhancement.

-

Rising adoption of retractable and motorized awnings for convenience and efficiency.

-

Growing focus on energy-efficient shading solutions to reduce cooling costs.

-

Expanding use of awnings in commercial and hospitality sectors to enhance customer experience.

-

Urbanization and construction growth fueling demand for durable, aesthetic shading products.

Awnings Market Growth Drivers:

-

Growing trends in urbanization and outdoor living

The awnings market is driven by rising demand for outdoor living spaces, energy-efficient shading solutions, and enhanced aesthetics in residential and commercial buildings. Growing adoption of retractable and motorized awnings, coupled with technological advancements and durable materials, boosts market expansion. Additionally, urbanization and increasing construction activities further fuel growth globally.

Awnings Market Restraints:

-

Increased costs of installation and maintenance

The awnings market faces restraints due to the high costs of installation and ongoing maintenance, which can discourage adoption among cost-sensitive consumers. Custom designs, motorized systems, and premium materials further raise expenses. Additionally, frequent upkeep to ensure durability and functionality adds to the overall cost burden, limiting widespread market penetration.

Awnings Market Opportunities:

-

Growth in the commercial and hospitality industry

The awnings market holds strong opportunities from the expanding commercial and hospitality industry. Hotels, restaurants, and cafes increasingly adopt awnings to enhance outdoor spaces, improve customer comfort, and boost aesthetics. Rising demand for outdoor dining, leisure areas, and energy-efficient shading solutions in urban centers is expected to drive significant market growth.

Awnings Market Segment Analysis:

By Type

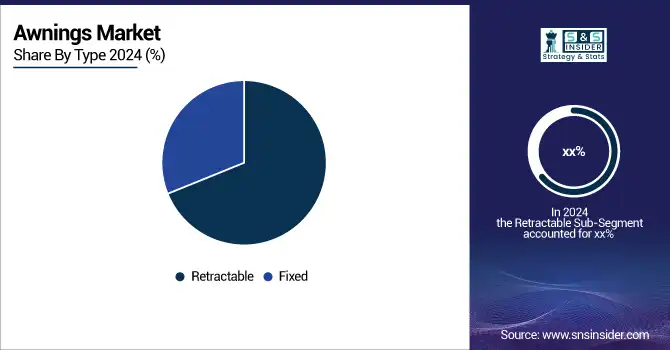

Retractable awnings dominated the market in 2024, driven by their flexibility, ease of operation, and rising adoption in residential and commercial spaces. From 2025 to 2032, retractable awnings are also expected to grow at the fastest CAGR due to increasing demand for motorized and smart-home integrated shading solutions.

By Product Type

Patio awnings held the largest share in 2024, supported by growing demand for outdoor living enhancements and energy efficiency. Freestanding awnings are projected to witness the fastest CAGR during 2025–2032, driven by their versatility, portability, and rising popularity in commercial spaces like cafes, resorts, and outdoor recreational facilities.

By Application

Residential applications dominated the awnings market in 2024, fueled by increasing home improvement trends and outdoor space utilization. The non-residential segment is expected to grow at the fastest CAGR between 2025 and 2032, supported by the hospitality, retail, and commercial sectors investing in outdoor shading to improve customer experience.

Awnings Market Regional Analysis:

Asia Pacific Awnings Market Insights

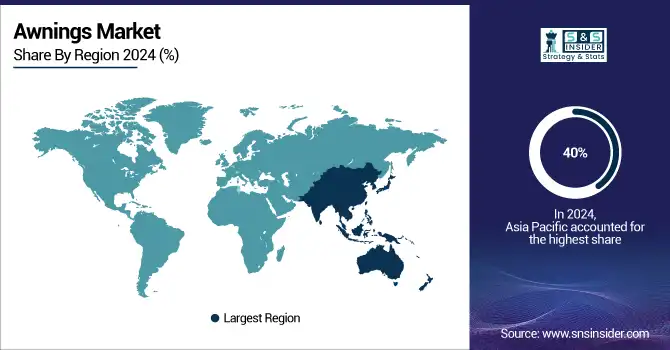

Asia Pacific accounted for the largest share of the awnings market in 2024, capturing nearly 40% of the global revenue. The region’s dominance is attributed to rapid urbanization, rising construction activities, and growing adoption of shading solutions across residential and commercial sectors. Within Asia Pacific, China emerged as the leading market, driving overall regional growth.

Get Customized Report as per Your Business Requirement - Request For Customized Report

North America Awnings Market Insights

The demand for awnings in the North American region is growing with the significant market share. Awnings is widely consumed in US and production is also high. After the pandemic the mergers and acquisition was at the peak. US Awnings market holds the largest market share in this region and US is also the fastest growing market over the forecast period.

Europe Awnings Market Insights

Europe’s awnings market is driven by strong demand for energy-efficient shading solutions, stylish outdoor living enhancements, and sustainable building practices. Widespread adoption in residential, hospitality, and commercial spaces supports growth. Countries like Germany, France, Italy, and the U.K. lead the market, benefiting from advanced manufacturing, innovative designs, and eco-friendly product development.

Latin America (LATAM) and Middle East & Africa (MEA) Awnings Market Insights

LATAM and MEA awnings markets are witnessing steady growth, supported by rising urbanization, infrastructure development, and increasing adoption of shading solutions in residential and commercial sectors. Growing hospitality and retail industries, coupled with hot climatic conditions, drive demand. Countries like Brazil, Mexico, UAE, and South Africa are key contributors to regional expansion.

Awnings Market Key Players:

Some of the Awnings Market Companies are

-

Durasol Awnings

-

Awning Company of America Inc

-

Aristocrat

-

Carrroll Awning Company

-

A&A International

-

Nulmage

-

Levens Australia

-

Eide Industries Inc

-

Orion Blinds

-

Thompson Awning Company

-

KE Outdoor Design

-

Marygrove Awnings

-

SunSetter Products Inc.

-

ShadeFX Canopies

-

Advanced Design Awnings & Signs

-

RetractableAwnings.com Inc.

-

Sunair Awnings

-

Shades Awnings

-

Solair Shade Solutions

-

Awning Works Inc.

Competitive Landscape for Awnings Market:

KE Durasol is a prominent player in the awnings market, specializing in high-quality retractable awnings, canopies, and shading systems for residential and commercial applications. The company emphasizes innovation, durability, and energy efficiency, offering customizable designs to enhance outdoor living spaces. With strong market presence and continuous product development, KE Durasol supports the growing demand for smart, stylish shading solutions.

-

In March 2024, KE Durasol Awnings announced a strategic partnership with a leading home automation company to develop IoT-enabled awning solutions. Also in the same month, SunSetter Products launched a new line of smart awnings with integrated weather sensors, and Sunair Awnings introduced eco-friendly awnings made from recycled materials

| Report Attributes | Details |

| Market Size in 2024 | USD 9592.34 Million |

| Market Size by 2032 | USD 15875.29 Million |

| CAGR | CAGR of 6.5% From 2024 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • by Type (Fixed, Retractable) • by Product Type (Window, Patio, Freestanding, Others) • by Application (Residential, Non-residential) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Durasol Awnings, Awning Company of America Inc, Aristocrat, Carrroll Awning Company, A&A International, Nulmage, Levens Australia, Eide Industries Inc, Orion Blinds, Thompson Awning Company, KE Outdoor Design, Marygrove Awnings, SunSetter Products Inc., ShadeFX Canopies, Advanced Design Awnings & Signs, RetractableAwnings.com Inc., Sunair Awnings, Shades Awnings, Solair Shade Solutions, Awning Works Inc. |