Industrial Drum Market Report Scope And Overview:

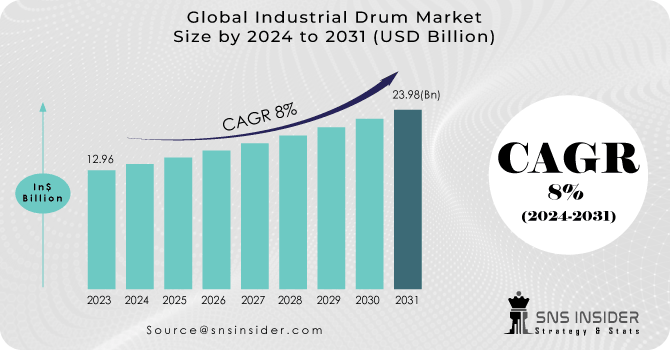

The Industrial Drum Market size was USD 12.96 billion in 2023 and is expected to Reach USD 23.98 billion by 2031 and grow at a CAGR of 8% over the forecast period of 2024-2031.

The industrial drum market is a dynamic landscape driven by innovation. Sustainability is a key focus, with eco-friendly materials gaining traction to minimize environmental impact. Automation and technology are playing an increasingly important role, optimizing production efficiency and ensuring consistent product quality. Customization is another growing trend, as businesses seek tailored solutions for their specific storage and transportation needs. International safety standards are also influencing drum design and manufacturing practices. This dynamic market is further expanding geographically, with key players strategically establishing themselves in emerging economies to meet the diverse demands of modern industries across the globe.

Get More Information on Industrial Drum Market - Request Sample Report

The Indian government expects chemical exports to reach a new high of $29.31 billion in 2021-22, a 106% increase from 2013-14. This surge in chemical exports is likely to increase demand for chemical drums. The growing use of fiber drums in the chemical industry is boosting the market. As it offer a cost-effective solution for storing and transporting chemicals, adhesives, dyes, and more, due to their recyclability and affordability compared to plastic and steel drums.

Market Dynamics

KEY DRIVERS:

-

The growing focus on sustainability and heightened environmental awareness are driving significant changes across various industries.

Driven by a surge in environmental awareness, the industrial packaging industry is witnessing a shift towards sustainable solutions. Steel and plastic drums are gaining favor due to their reusability and recyclability, making them a perfect fit for eco-conscious companies looking to minimize their environmental footprint.

-

The ongoing expansion of industries and the concentration of populations in urban centers are shaping the future of our world.

RESTRAIN:

-

High upfront costs for industrial drums, especially customized ones, can be a hurdle for budget-conscious startups and SMEs.

-

Incompatibility with automation can hinder use of industrial drums.

OPPORTUNITY:

-

The landscape of industrial packaging is evolving rapidly due to continuous advancements in technology.

-

The surging popularity of e-commerce and the continued growth of retail are shaping the demand for innovative and efficient packaging solutions.

E-commerce and retail's explosive growth have fueled the demand for efficient packaging solutions. Industrial drums play a key role here, enabling the bulk shipment of goods that keeps online stores and physical retailers stocked. Their ability to handle large quantities makes them a valuable asset in today's fast-paced distribution landscape.

CHALLENGES:

-

The industrial drum market faces stiff competition from a growing number of alternative packaging solutions.

-

Heavy industrial drums can inflate transportation costs, pushing companies, especially those shipping long distances, towards lighter packaging options.

IMPACT OF RUSSIAN UKRAINE WAR

The war in Ukraine caused a significant surge in crude oil prices, which could impact the industrial drum market in a few ways. Since these drums are essential for storing and transporting oil and gas, higher oil prices could lead to increased demand for drums in the short term. Oil companies may need more drums to store excess oil due to sanctions on Russia or logistical disruptions. In the long term, however, high oil prices could also lead to a decrease in demand for oil and gas overall, as consumers and businesses switch to more affordable energy sources. This could dampen demand for industrial drums. Additionally, higher oil prices could raise production costs for the drums themselves, potentially due to more expensive raw materials like steel or plastic. This could lead to price increases for industrial drums, potentially reducing demand from some sectors. The overall impact of the war on the industrial drum market depends on how these opposing forces play out. In the short term, the demand for drums from the oil and gas industry may outweigh the negative impacts of higher production costs. In the long term, however, a decrease in demand for oil and gas could lead to a decline in the industrial drum market.

IMPACT OF ECONOMIC SLOWDOWN

The global economic slowdown is putting pressure on the industrial drum market. Weaker demand across various sectors, particularly those sensitive to commodity prices like metals and chemicals, is leading to muted growth. This is likely due to a combination of factors including declining commodity prices of oil and metals, subdued global demand, and China's slowing economy. As these sectors are major consumers of industrial drums, a decrease in their manufacturing activity could lead to lower demand for drums used to store and transport their products. Weakening consumer and business confidence could lead to decreased production globally, reducing demand for industrial drums. This would impact both domestic manufacturers in various countries who rely on the market and international producers who export drums globally. The slowdown could also spread through global supply chains, affecting companies like 3M and Caterpillar that depend on manufacturing activity around the world. This could further reduce demand for industrial drums as manufacturing activity weakens.

KEY MARKET SEGMENTS

By Product Type

-

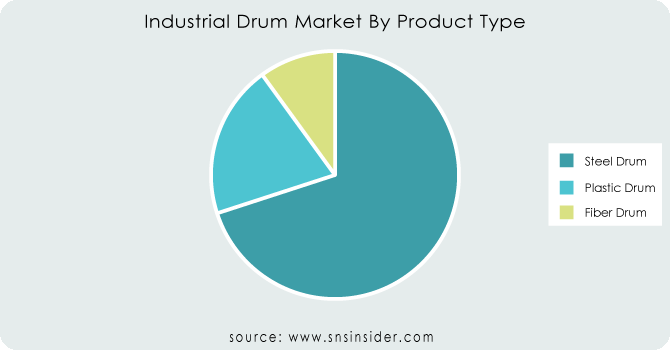

Steel Drum

-

Plastic Drum

-

Fiber Drum

Steel drums dominates in the industrial drum market, capturing 73.5% share. This dominance stems from their unmatched strength, durability, and versatility. Across industries, steel drums are the go-to choice for transporting and storing a wide range of liquids and solids, especially when the safekeeping of the contents is paramount. From withstanding the rigors of manufacturing to securing chemicals and streamlining logistics, steel drums are the trusted workhorses for companies handling diverse and demanding materials.

Get Customized Report as per Your Business Requirement - Request For Customized Report

By Capacity

-

Up to 100 Litre

-

100 to 250 Litre

-

250 to 500 Litre

-

Above 500 Litre

By End Use

-

Food & Beverages

-

Chemical & Fertilizers

-

Pharmaceuticals

-

Petroleum & Lubricants

-

Building & Construction

-

Paints

-

Inks & Dyes

-

Other

The chemical and fertilizer industries are the backbone of the industrial drum market, with significant 45.6% share. This dominance reflects the specialized packaging needs of these sectors. Industrial drums are the workhorses, ensuring safe containment and transport of hazardous and sensitive materials. Stringent regulations governing chemicals and fertilizers further solidify the importance of reliable, compliant packaging solutions like industrial drums. In essence, these drums are irreplaceable for safeguarding the integrity and safety of materials critical to the chemical and fertilizer industries.

REGIONAL ANALYSIS

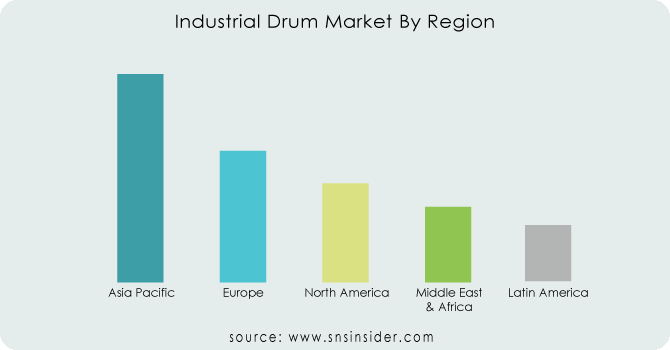

The Asia-Pacific region leads in the industrial drum market, fueled by its booming manufacturing sector. China, India, and Indonesia are leading the charge, with China even experiencing strong growth in fiber drum production. This growth is driven by a dual force such as the need for sophisticated packaging solutions from both local and established players, and the rising demand for lightweight and recyclable options like fiber drums. Furthermore, the region's flourishing export sector, particularly in wines, vegetable oil, and palm oil from China and India, is creating a strong demand for industrial drums as the preferred choice for bulk packaging.

The industrial drum market thrives in regions with robust manufacturing sectors. The US, for example, leverages these drums across various industries like chemicals, pharmaceuticals, and food processing, due to its diverse industrial landscape and extensive logistics network. Similarly, Japan's focus on precision manufacturing in electronics and automotive sectors necessitates specialized packaging solutions, making industrial drums crucial for safe transport and storage of components and chemicals. Germany, another European powerhouse in manufacturing, relies heavily on industrial drums for its chemical, automotive, and machinery sectors. Stringent quality standards and a focus on safe transport and storage across various materials further solidify the importance of industrial drums in Germany. Notably, Germany's strategic location in Europe makes these drums even more essential for seamless cross-border logistics.

REGIONAL COVERAGE:

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

Key players

Major players in the Industrial Drum Market are 3M, TPL Plastech Ltd., Sicagen, Time Technoplast Ltd, Schütz GmbH and Co. KGaA, Balmer Lawrie and Co. Ltd, BWAY Corporation, Greif, Eagle Manufacturing Company, Orora Packaging Australia Pty Ltd and others.

RECENT DEVELOPMENT

-

Mauser Packaging Solutions ramped up its China presence in March 2023 by opening a new, cutting-edge factory near Shanghai. This strategic move positions them to meet the growing demand for industrial packaging in the region.

-

SCHÜTZ Container Systems significantly boosted its open-head steel drum production in the US in January 2023 with a major expansion of its Houston facility.

TPL Plastech Ltd-Company Financial Analysis

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 12.96 Billion |

| Market Size by 2031 | US$ 23.98 Billion |

| CAGR | CAGR of 8% From 2024 to 2031 |

| Base Year | 2023 |

| Forecast Period | 2024-2031 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product Type (Steel Drum, Plastic Drum, Fiber Drum) • By Capacity (Up To 100 Litre, 100 To 250 Litre, 250 To 500 Litre, Above 500 Litre) • By End Use (Food & Beverages, Chemical & Fertilizers, Pharmaceuticals, Petroleum & Lubricants, Building & Construction, Paints, Inks, & Dyes, Other) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | 3M, TPL Plastech Ltd., Sicagen, Time Technoplast Ltd, Schütz GmbH and Co. KGaA, Balmer Lawrie and Co. Ltd, BWAY Corporation, Greif, Eagle Manufacturing Company, Orora Packaging Australia Pty Ltd |

| Key Drivers | • The growing focus on sustainability and heightened environmental awareness are driving significant changes across various industries. • The ongoing expansion of industries and the concentration of populations in urban centers are shaping the future of our world. |

| Challenges | • The industrial drum market faces stiff competition from a growing number of alternative packaging solutions. • Heavy industrial drums can inflate transportation costs, pushing companies, especially those shipping long distances, towards lighter packaging options. |