Indoor 5G Market Report Scope & Overview:

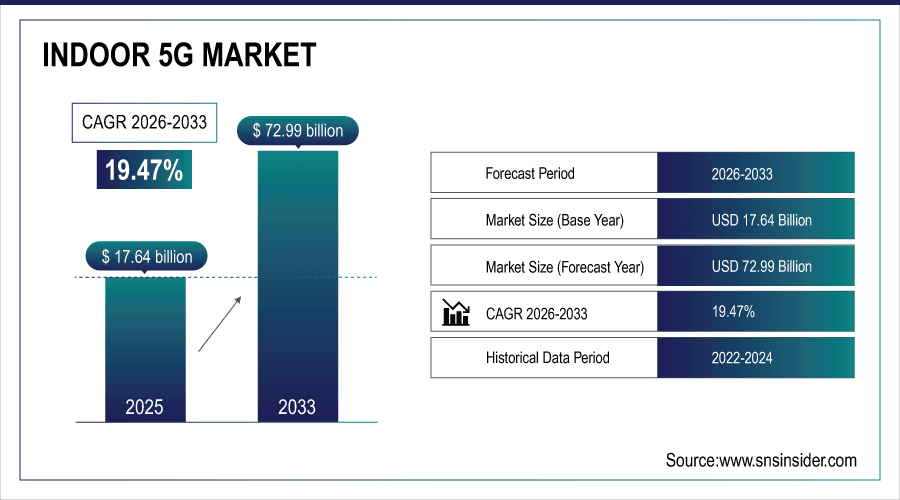

The Indoor 5G Market Size was valued at USD 17.64 Billion in 2025E and is expected to reach USD 72.99 Billion by 2033 and grow at a CAGR of 19.47% over the forecast period 2026-2033.

The Indoor 5G Market is primarily driven by the increasing demand for high-speed, low-latency wireless connectivity in enterprise and commercial environments. Businesses and organizations are rapidly adopting private 5G networks to support smart offices, industrial automation, and IoT-enabled operations, which require reliable and secure indoor coverage. The proliferation of connected devices, the rise of Industry 4.0 initiatives, and the growing need for real-time data analytics in commercial and industrial buildings are further fueling market expansion. Additionally, the deployment of Sub-6 GHz and mmWave frequency bands enables better coverage and higher throughput, making indoor 5G an attractive solution for high-density environments such as offices, factories, and public venues. According to study, over 60% of enterprises adopting private 5G cite high-speed, low-latency connectivity as a key requirement.

To Get More Information On Indoor 5G Market - Request Free Sample Report

Market Size and Forecast:

-

Market Size in 2025: USD 17.64 Billion

-

Market Size by 2033: USD 72.99 Billion

-

CAGR: 19.47% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

Indoor 5G Market Trends

-

Rapid adoption of private 5G networks is transforming enterprise and industrial operations.

-

Deployment of Sub-6 GHz and mmWave bands enhances indoor network coverage.

-

Increased use of IoT-enabled smart offices, factories, and healthcare facilities.

-

Growing reliance on managed services and Network-as-a-Service (NaaS) solutions.

-

Expansion of real-time data analytics and low-latency applications indoors.

-

Focus on secure, scalable, and reliable indoor 5G infrastructure deployment.

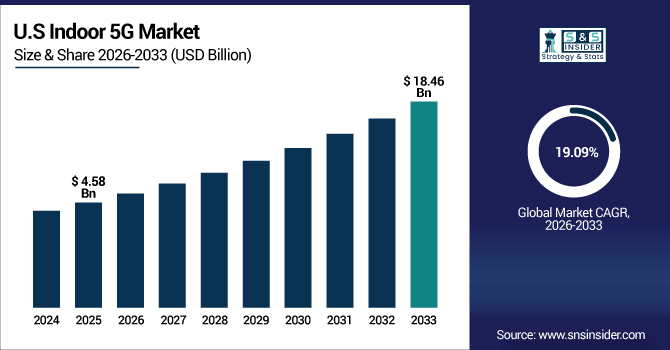

The U.S. Indoor 5G Market size was USD 4.58 Billion in 2025E and is expected to reach USD 18.46 Billion by 2033, growing at a CAGR of 19.09% over the forecast period of 2026-2033, primarily Rapid enterprise adoption of private 5G networks, smart office and industrial automation initiatives, high demand for low-latency connectivity, widespread IoT integration, and strong investments in advanced wireless infrastructure drive robust indoor 5G growth across the U.S.

Indoor 5G Market Growth Drivers:

-

Enterprises Demand High-Speed, Low-Latency Indoor 5G Connectivity Everywhere

A major factor driving the growth of the Indoor 5G Market is the increasing demand for high-speed 5G and low-latency wireless connectivity in enterprises, commercial buildings and industrial environments. More enterprises are embracing private 5G networks for smart offices, data in real-time, industrial automation, and IoT. Indoor 5G ensures dependable coverage in high-density usage areas, including indoors offices, factories, hospitals, malls where Wi-Fi or legacy networks often don't transmit well. Sub-6 GHz and mmWave frequency band along with higher throughput and larger capacity allows many devices to be connected together. Such a pattern is further driving enterprise and industrial utilization, with entities craving for seamless interaction, enhanced productivity, and quicker information processing.

Approximately 25% of manufacturers plan to use indoor 5G for smart factories and automation.

Indoor 5G Market Restraints:

-

High Deployment Costs Challenge Indoor 5G Adoption Across Enterprises

Despite the benefits, the high cost of deployment and maintenance is a big restraint limiting Indoor 5G Market. Deploying indoor 5G entails costs related to small cells, distributed antenna systems (DAS), network design, and such to be connected to current IT infrastructure. Proving the CAPEX is too often a challenge to enterprise and small business SROI calculation, particularly where indoor 5G is made available with Wi-Fi or 4G networks in parallel. Adding costs of OPEX for managed services, costs for spectrum licensing, and costs for network maintenance increase the financial burden. This high-cost barrier can slow down adoption in small and medium enterprises, hindering market growth in regions where organizations are budget oriented.

Indoor 5G Market Opportunities:

-

Private 5G Networks and Managed Services Unlock New Market Potential

The rise of adoption in private 5G networks and Network-as-a-Service (NaaS) is a key opportunity for a large section of the Indoor 5G Market. Managed or subscription-based solutions which minimize upfront investment by offering scalable and secure indoor coverage have been favoured by Enterprises, Industrial Parks, Hospitals, and Airports alike. Private 5G provides companies with improved data security, low latency, and high reliability, which is necessary for industrial automation, smart factories, and crucial operations. Moreover, telecom operators and technology vendors will be able to provide end-to-end solutions for planning, deployment, and maintenance, paving the way for revenue opportunities. That is a great opportunity, especially in the Asia Pacific regions where demand for indoor 5G connectivity is being driven by rapid industrialization and smart city developments.

30% of new indoor 5G deployments are projected to use managed or subscription-based NaaS models.

Indoor 5G Market Segmentation Analysis:

-

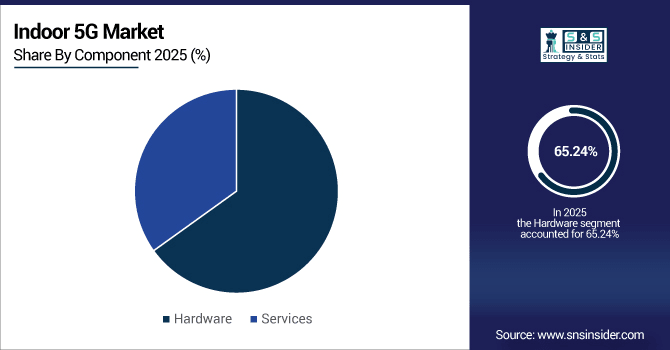

By Component: In 2025, Hardware led the market with share 65.24%, while Services are the fastest-growing segment with a CAGR 18.30%.

-

By Frequency Band: In 2025, Sub-6 GHz the market 55.26%, while mmWave fastest-growing segment with a CAGR 19.86%.

-

By Building: In 2025 Commercial led the market with share 55.48%, while Industrial the fastest-growing segment with a CAGR 20.12%.

-

By Deployment Mode: In 2025, Private 5G networks led the market with share 40.08%, while Network-as-a-Service (NaaS) is the fastest-growing segment with a CAGR 18.87%.

-

By End Use: In 2025, Enterprises led the market with share 35.40%, while Manufacturers is the fastest-growing segment with a CAGR 18.54%.

By Component, Hardware Leads Market and Services Fastest Growth

By Component, Indoor 5G Market is categorized into Hardware, Software & Services. Hardware is the leading segment, due to large scale deployment of small cells, distributed antenna systems (DAS), routers, and other required infrastructure components essential for reliable setup of indoor 5G connectivity. The largest bit of the market share is attributable to hardware, which is an indication of the high initial setting-up costs of private and commercial indoor networks. Conversely, Services, is the fastest-growing segment due to growing demand for managed services, Network-as-a-Service (NaaS), installation, maintenance, and optimization solutions. The services component will witness strong CAGR growth during the forecast period as organizations opt for subscription-based or managed service models that help in reducing capital expenditures whilst providing scalable, secure and high-performance indoor 5G networks.

By Frequency Band, Sub-6 GHz Leads Market and mmWave Fastest Growth

Sub-6 GHz currently holds the largest share in the Indoor 5G Market regarding By Frequency Band due to its greater coverage, wall penetrating power, and low-cost deployment in enterprises, commercial buildings, and industrial facilities. The frequency is perfect for a high-density indoor environment, indicating that large amounts of devices are connected while maintaining reliable and consistent connectivity. On the other hand, mmWave is the most rapidly expanding market segment, mainly owing to increasing need for ultra-broadband and low latency applications which include applications such as real-time analytics, augmented reality, and industrial automation. MmWave offers very high data throughput, but with limited range, which makes it well-suited for use cases such as smart factories and large commercial spaces, like airports.

By Building, Commercial Leads Market and Industrial Fastest Growth

Currently, Commercial buildings dominate the Indoor 5G Market in the By Building category owing to the swift advancement of private 5G networks within offices, shopping malls, hospitals, and educational campuses. Commercial buildings are expected to be the largest revenue contributor, due to the need for reliable connectivity in high-density environments to support enterprise operations, engage with customers, and enable smart building technologies. On the other hand, Industrial buildings are the fastest growing part due to Industry, automation and IoT based smart factories. Indoor 5G in Industries enables real-time monitoring & machine-to-machine communication with low-latency operation, thereby increasing the productivity & operational efficiency.

By Deployment Mode, Private 5G Networks Lead Market and Network-as-a-Service (NaaS) Fastest Growth

Private 5G Networks currently dominate the Indoor 5G Market in the By Deployment Mode, as enterprises, industrial parks, hospitals, and even large commercial buildings are deploying these dedicated networks for seamless secure low latency high-performance connectivity. In terms of revenue share, private networks are the most revenue contributor owing to the large degree of control that organizations can hold over data, increased reliability, and optimized coverage in high-density indoor deployments. At the same time, Network-as-a-Service (NaaS) is the fastest-growing segment due to increasing demand for subscription-based, managed solutions that minimize upfront capital expenditure but provide scalable deployment, ongoing maintenance, and operational flexibility.

By End Use, Enterprises Lead Market and Manufacturers Fastest Growth

The Enterprises segment in By End Use is dominating the Indoor 5G Market, as enterprises across IT, BFSI, healthcare and commercial verticals are acquiring private 5G as a service with the intent for higher connectivity, operational efficiency as well as smart office and IoT enabling applications. Demand for low-latency, high-throughput communication, seamless collaboration, and real-time analytics in high-density indoor environments – all enterprise use cases – is the primary driver of enterprise adoption. On the other hand, the fastest-growing segment is Manufacturers owing to Industry projects, industrial automation and smart factory implementations. Indoor 5G allows manufacturers to streamline production by providing production inspection, real-time equipment monitoring and machine-to-machine communication which the segment is expected to witness significant growth during the forecast period and accounted a lucrative CAGR over the forecast period.

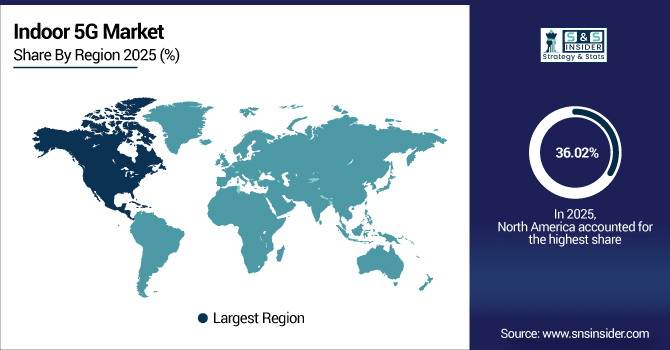

Indoor 5G Market Regional Analysis:

North America Indoor 5G Market Insights:

The Indoor 5G Market in North America held the largest share 36.02% in 2025, owing to the region's adoption of advanced wireless technologies, strong telecom infrastructure, and a solid enterprise demand for high speed and low latency connections. The growth is driven by large-scale adoption of private 5G network in commercial buildings, office, hospital and industrial premise along with NaaS and managed solution investment. Indoor 5G is being adopted by enterprises to enable smart offices, rapid data-driven decision making, and IoT integration for industrial automation. In North America, presence of top-notch technology vendors, favorable government initiatives, and increased demand for secure, reliable, and scalable connectivity in high-density indoor environments are some additional factors making this region a leading revenue market, which is likely to witness strong adoption across the forecast period.

Get Customized Report as Per Your Business Requirement - Enquiry Now

U.S. Dominates Indoor 5G Market with Advanced Technological Adoption

U.S. Dominates Indoor 5G Market with Advanced Technological Adoption Early private 5G deployments, robust infrastructure, and enterprise demand for low-latency, high-speed connectivity drive market leadership and rapid indoor 5G adoption nationwide.

Asia-Pacific Indoor 5G Market Insights

In 2025, Asia-Pacific is the fastest-growing region in the Indoor 5G Market, projected to expand at a CAGR of 20.74%, driven by rapid industrialization, smart city initiatives, and rising enterprise adoption of advanced wireless technologies. Countries such as China, Japan, South Korea, and India are investing heavily in private 5G networks to support industrial automation, IoT-enabled smart factories, hospitals, airports, and commercial buildings. The region benefits from a growing number of technology vendors offering Network-as-a-Service (NaaS) and managed solutions, reducing capital expenditure for enterprises while enabling scalable deployment. Increasing demand for high-speed, low-latency connectivity, coupled with government support for digital infrastructure and smart manufacturing, is fueling robust growth, positioning Asia-Pacific as a key hotspot for indoor 5G adoption over the forecast period.

China and India Propel Rapid Growth in Indoor 5G Market

China and India Propel Rapid Growth in Indoor 5G Market through Accelerated industrialization, smart city projects, and enterprise adoption of private 5G networks drive high-speed, low-latency connectivity and strong regional market expansion.

Europe Indoor 5G Market Insights

Europe Indoor 5G Market is projected to grow at a steady rate owing to the early adoption of next-generation wireless technologies among enterprises, commercial buildings, and industrial facilities. Private 5G networks to improve connectivity in smart offices, factories, hospitals, and public sites are being deployed by the likes of Germany, the UK and France. Government initiatives boosting digital infrastructure, IoT integration, and Industry 4.0 adoption further assist the growth of the region. we believe that our industry will increasingly see managed services, Network-as-a-Service (NaaS) and end-to-end deployment as offerings from telecom operators and technology vendors that help customers save capital expenditure assuring them with scalable, secure and reliable indoor coverage.

Germany and U.K. Lead Indoor 5G Market Expansion Across Europe

Germany and the U.K. lead Indoor 5G Market expansion in Europe, driven Strong enterprise adoption, private 5G networks, and smart infrastructure initiatives drive high-speed, low-latency connectivity, boosting indoor 5G deployment across the region.

Latin America (LATAM) and Middle East & Africa (MEA) Indoor 5G Market Insights

The Latin America (LATAM) and Middle East & Africa (MEA) Indoor 5G Markets are experiencing gradual growth, driven by increasing investments in digital infrastructure and enterprise adoption of advanced wireless technologies. In LATAM, countries like Brazil and Mexico are deploying private 5G networks in commercial buildings, offices, hospitals, and industrial facilities to enhance connectivity, support IoT integration, and enable smart operations. Similarly, MEA regions such as the UAE, Saudi Arabia, and South Africa are focusing on smart city initiatives, industrial automation, and high-density commercial deployments. Adoption of Network-as-a-Service (NaaS) and managed solutions helps enterprises reduce capital expenditures while achieving scalable, secure, and reliable indoor coverage, supporting steady market expansion across both regions.

Indoor 5G Market Competitive Landscape

Ericsson leads the indoor 5G market with its Radio Dot System and private network solutions. By integrating AI-driven automation, energy-efficient small cells, and precise indoor positioning, Ericsson enhances connectivity in high-density areas like offices, hospitals, and malls, enabling enterprises to implement smart infrastructure and Industry 4.0 initiatives effectively.

-

In April 2025, Ericsson partnered with Proximus to enhance 4G/5G indoor coverage in Belgium using the Radio Dot System, aiming to meet high data demands in enterprise environments.

CommScope accelerates indoor 5G adoption through its ONECELL small cell and RUCKUS Wi-Fi 7 solutions. The company provides scalable, multi-operator coverage for enterprise and industrial spaces, focusing on low-latency, high-throughput connectivity. CommScope’s AI-driven network management and streamlined deployment solutions enhance operational efficiency and network reliability.

-

In July 2025, CommScope Launched ONECELL, an innovative indoor small cell system designed to deliver seamless multi-operator, multi-band LTE and 5G coverage through a streamlined, Wi-Fi-like architecture.

JMA Wireless focuses on delivering high-performance indoor 5G solutions through its Distributed Antenna Systems (DAS) and small cells. The company enables multi-operator, low-latency connectivity in enterprise, commercial, and industrial environments, supporting IoT integration, smart offices, and mission-critical applications, driving adoption of reliable indoor 5G networks globally.

-

In August 2025, JMA Wireless introduced its 5G-ready Distributed Antenna System (DAS) platform, designed for high-performance indoor coverage. This platform supports multiple operators and is adaptable for event-based deployments, ensuring scalable and efficient connectivity solutions.

Indoor 5G Market Key Players:

Some of the Indoor 5G Market Companies are:

-

Ericsson

-

Huawei

-

Nokia

-

Samsung Electronics

-

ZTE Corporation

-

CommScope

-

Corning Incorporated

-

Comba Telecom Systems

-

AT&T Inc.

-

Airspan Networks

-

SOLiD, Inc.

-

JMA Wireless

-

Fujitsu Limited

-

PCTEL, Inc.

-

Huber+Suhner AG

-

Nextivity, Inc.

-

Proptivity AB

-

LiteOn Technology Corporation

-

Boingo Wireless, Inc.

-

Cisco Systems, Inc.

| Report Attributes | Details |

|---|---|

| Market Size in 2025 | USD 17.64 Billion |

| Market Size by 2033 | USD 72.99 Billion |

| CAGR | CAGR of 19.47% From 2026 to 2033 |

| Base Year | 2025 |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Hardware, Services) •By Frequency Band (Sub-6 GHz, mmWave, Others) •By Building (Residential, Commercial, Industrial) •By Deployment Mode (Private 5G networks, Hybrid networks, Carrier-provided indoor solutions, Neutral host networks, Network-as-a-Service (NaaS)) •By End Use (Enterprises, Telecom operators, Government, Healthcare providers, Manufacturers, Hospitality and retail, Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Ericsson, Huawei, Nokia, Samsung Electronics, ZTE Corporation, CommScope, Corning Incorporated, Comba Telecom Systems, AT&T Inc., Airspan Networks, SOLiD Inc., JMA Wireless, Fujitsu Limited, PCTEL Inc., Huber+Suhner AG, Nextivity Inc., Proptivity AB, LiteOn Technology Corporation, Boingo Wireless Inc., Cisco Systems Inc., and Others. |