Industrial Fasteners Market Report Scope & Overview:

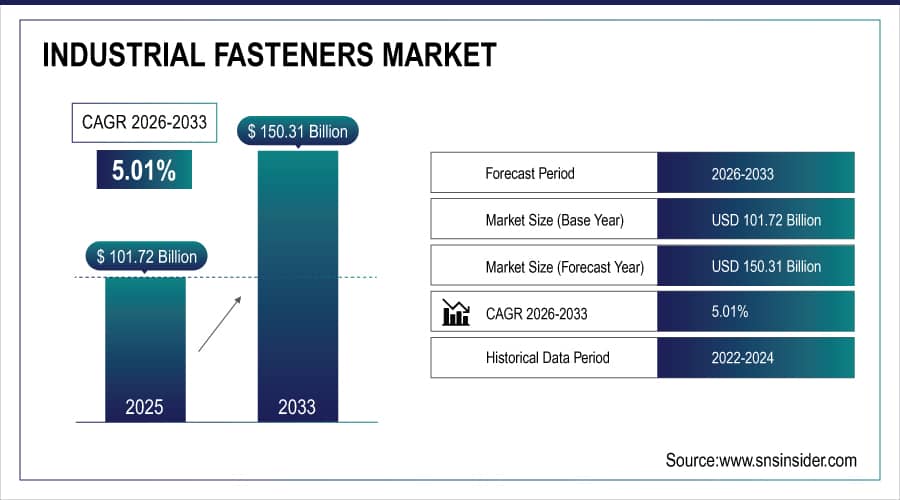

The Industrial Fasteners Market size is valued at USD 101.72 Billion in 2025 and is expected to reach USD 150.31 Billion by 2033 and grow at a CAGR of 5.01% over the forecast period 2026-2033.

The Industrial Fasteners Market analysis, due to increasing demand from key end-use industries such as automotive, construction, aerospace, machinery, and electronics, where fasteners play a critical role in assembly, structural integrity, and safety. Rising industrialization, urbanization, and infrastructure development are driving the need for reliable fastening solutions for buildings, machinery, and transportation systems.

According to study, High-strength and specialty fasteners now represent about 30–35% of the market, reflecting adoption in lightweight vehicles, renewable energy installations, and machinery automation.

Market Size and Forecast:

-

Market Size in 2025: USD 101.72 Billion

-

Market Size by 2033: USD 150.31 Billion

-

CAGR: 5.01% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get More Information On Industrial Fasteners Market - Request Free Sample Report

Industrial Fasteners Market Trends:

-

Automotive sector remains the largest consumer of industrial fasteners.

-

Construction industry drives demand for high-strength and corrosion-resistant fasteners.

-

Aerospace sector increasingly using lightweight and heat-resistant fasteners for efficiency.

-

Emerging economies in Asia-Pacific and Latin America show rapid fastener adoption.

-

Advanced coatings and alloy fasteners gaining popularity across industrial applications.

-

Automation and precision manufacturing boosting demand for specialized and high-value fasteners.

The U.S. Industrial Fasteners Market size is USD 17.78 Billion in 2025E and is expected to reach USD 28.10 Billion by 2033, growing at a CAGR of 5.90% over the forecast period of 2026-2033,

The U.S. industrial fasteners market is expanding rapidly, driven by growth in automotive, aerospace, and infrastructure sectors. Demand for high-strength, corrosion-resistant fasteners, advanced manufacturing technologies, and industrial automation supports increased adoption across construction, transportation, and manufacturing industries.

Industrial Fasteners Market Growth Drivers:

-

Rising automotive, aerospace, and construction activities drive industrial fasteners demand

A primary driver for the industrial fasteners market growth is the increasing demand from key end-use industries such as automotive, construction, aerospace, and heavy machinery. Industrial fasteners, including bolts, screws, nuts, rivets, and washers, are essential for assembly, structural integrity, and safety in various applications. The rising production of vehicles, urban infrastructure projects, and aerospace components is boosting fastener consumption. Moreover, trends such as lightweight vehicle construction, modular building designs, and high-precision aerospace manufacturing are driving the need for advanced, high-strength fasteners, accelerating market growth.

Construction industry contributes nearly 25–30% of fastener consumption and Heavy machinery and industrial equipment account for about 10–12% of fastener consumption.

Industrial Fasteners Market Restraints:

-

Raw material price volatility and supply chain disruptions restrain market growth.

A major challenge lies for the industrial fasteners market is the fluctuating cost of raw materials such as steel, aluminum, and titanium, combined with supply chain challenges. Price volatility impacts manufacturing costs and profit margins for fastener producers. Additionally, disruptions in the supply of raw materials, transportation delays, and trade restrictions can affect timely delivery to end-user industries. These challenges particularly impact small and medium-sized fastener manufacturers and may hinder market growth in cost-sensitive regions.

Industrial Fasteners Market Opportunities:

-

Emerging markets and advanced fastener technologies offer significant growth opportunities

A major opportunity lies in the rising industrialization in emerging economies and adoption of high-performance fasteners with advanced coatings and materials. Fasteners with anti-corrosion coatings, heat resistance, and lightweight alloys are increasingly demanded in automotive, aerospace, and electronics sectors. Rapid urbanization, infrastructure development, and increasing industrial projects in Asia-Pacific, Latin America, and the Middle East are creating large new markets. The trend toward automation and precision assembly in manufacturing also presents opportunities for specialized and high-value fastener products, enabling manufacturers to diversify their offerings and capture new growth areas.

High-performance fasteners with anti-corrosion coatings projected to capture 25–30% of future demand.

Industrial Fasteners Market Segmentation Analysis:

-

By Raw Material: In 2025, Metal Fasteners led the market with a share of 89.50%, while Plastic Fasteners is the fastest-growing segment with a CAGR of 5.40%.

-

By Fasteners Type: In 2025, Bolts led the market with a share of 34.47%, while Rivets is the fastest-growing segment with a CAGR of 5.75%.

-

By Product: In 2025, Externally Threaded Fasteners led the market with a share of 48.30%, while Aerospace Grade Fasteners is the fastest-growing segment with a CAGR of 6.03%.

-

By Application: In 2025, Automotive led the market with a share of 33.10%, while Aerospace is the fastest-growing segment with a CAGR of 6.14%.

By Raw Material, Metal Fasteners Lead Market and Plastic Fasteners Fastest Growth

Metal fasteners segment lead the market, due to their high strength, durability, and wide applicability across automotive, construction, and industrial machinery. Steel, stainless steel, and aluminum fasteners are preferred for high-load applications, corrosion resistance, and reliability, making them the dominant choice in traditional and large-scale manufacturing sectors.

Plastic fasteners are the fastest-growing segment, driven by demand for lightweight, corrosion-resistant, and non-conductive solutions in electronics, consumer goods, and specialized industries. Increasing adoption in automotive and aerospace sectors for weight reduction and design flexibility is accelerating growth.

By Fasteners Type, Bolts Lead Market and Rivets Fastest Growth

Bolts lead the market, as they are essential for mechanical assembly, structural integrity, and industrial maintenance. Their versatility, standardization, and ease of installation ensure consistent demand across multiple industries including automotive, construction, and machinery.

Rivets are the fastest-growing segment, supported by rising applications in aerospace, aviation, and lightweight metal assembly. Rivets offer permanent fastening solutions and are increasingly used in industries focused on durability, precision, and safety standards, driving rapid adoption.

By Product, Externally Threaded Fasteners Lead Market and Aerospace Grade Fasteners Fastest Growth

Externally threaded fasteners dominate segment, due to their widespread use, ease of application, and compatibility with standard nuts, washers, and assemblies. They form the backbone of industrial mechanical fastening and are critical in automotive, construction, and machinery applications.

Aerospace-grade fasteners are the fastest-growing product segment, fueled by increasing demand for high-performance, lightweight, and corrosion-resistant components in aerospace, defense, and advanced manufacturing. Regulatory standards, precision requirements, and high-value applications are driving rapid growth.

By Application, Automotive Lead Market and Aerospace Fastest Growth.

Automotive segment leads the market, as vehicles require high volumes of fasteners for assembly, structural integrity, and component fixation. The dominance is supported by large-scale production, aftermarket demand, and stringent quality requirements in the automotive sector.

Aerospace applications are the fastest-growing, driven by growth in commercial aviation, defense programs, and spacecraft manufacturing. Lightweight, high-strength, and precision-engineered fasteners are increasingly critical, accelerating adoption in aerospace and related high-tech industries.

Industrial Fasteners Market Regional Analysis:

Asia Pacific Industrial Fasteners Market Insights:

The Asia Pacific dominated the Industrial Fasteners Market in 2025E, with over 44.10% revenue share, driven by high industrialization, booming automotive and construction sectors, and large-scale manufacturing hubs in China, India, and Japan. Expanding production facilities, increasing infrastructure projects, and rapid urbanization support strong demand. Local manufacturers and players focus on innovation, quality improvement, and supply chain expansion. Rising exports and growing industrial applications in electronics, energy, and transportation sectors further strengthen the region’s market leadership.

Get Customized Report as Per Your Business Requirement - Enquiry Now

China and India Industrial Fasteners Market Insights

China and India dominate industrial fastener demand in Asia Pacific, driven by automotive, construction, and manufacturing sectors. Rapid urbanization, infrastructure projects, and industrial modernization fuel adoption of high-performance, durable fasteners across diverse industrial applications.

North America Industrial Fasteners Market Insights:

The North America region is expected to have the fastest-growing CAGR 5.95%, driven by expanding automotive, aerospace, and construction industries. Rising demand for high-strength, lightweight, and corrosion-resistant fasteners fuels adoption. Advanced manufacturing technologies, increased infrastructure development, and modernization of industrial facilities accelerate market expansion. Growth is further supported by the adoption of automation, robotics, and advanced assembly processes, enhancing productivity and quality. Rising investments in renewable energy and defense sectors also contribute to strong demand for specialized fasteners across the region.

U.S and Canada Industrial Fasteners Market Insights

The U.S. and Canada show fast-growing adoption due to expanding automotive, aerospace, and infrastructure sectors. Demand for corrosion-resistant, high-strength fasteners and advanced manufacturing technologies accelerates market growth.

Europe Industrial Fasteners Market Insights

Europe maintains a strong presence in the ICS security market, supported by automotive, aerospace, and construction sectors. Demand for high-quality, durable, and precision-engineered fasteners is rising due to stringent safety and performance standards. Growth is enhanced by industrial modernization, adoption of advanced manufacturing processes, and emphasis on sustainable materials. Expansion in renewable energy projects, infrastructure upgrades, and industrial automation initiatives further fuels demand across the region.

Germany and U.K. Industrial Fasteners Market Insights

Germany and the U.K. lead Europe in industrial fastener usage, driven by automotive, aerospace, and industrial machinery requirements. Compliance with quality standards and technological innovations support strong adoption.

Latin America (LATAM) and Middle East & Africa (MEA) Industrial Fasteners Market Insights

Latin America and the Middle East & Africa are gradually expanding in the industrial fasteners market. Brazil and Mexico drive growth in Latin America through construction, automotive, and industrial sectors. In the Middle East, countries like Saudi Arabia and UAE focus on infrastructure, oil & gas, and energy projects. Adoption of high-performance fasteners is supported by industrial modernization, urbanization, and infrastructure investments. Although growth is slower than in Asia Pacific and North America, increasing manufacturing activities, construction development, and regional industrial expansion provide long-term market potential.

Industrial Fasteners Market Competitive Landscape:

Hilti Corporation is a leader in high-performance fastening systems for construction and industrial applications. Its portfolio includes mechanical and chemical anchors, screws, bolts, and direct fastening technologies. Hilti focuses on durability, safety, and productivity, supported by strong R&D and digital tools such as BIM integration. With a direct sales model and service network, Hilti delivers reliable fastening solutions that enhance efficiency and structural integrity across industrial and infrastructure projects.

-

In January 2024, Hilti launched a new range of high‑strength anchors designed for large‑scale infrastructure projects, improving durability and performance for construction‑heavy applications.

Nifco Inc. specializes in precision-engineered plastic and metal fasteners for automotive, electronics, and industrial applications. The company is known for innovative fastening solutions that reduce weight, improve assembly efficiency, and enhance product design. Nifco emphasizes advanced molding technologies, material innovation, and customized solutions. With strong manufacturing capabilities and close collaboration with OEMs, Nifco plays a significant role in supporting lightweight and high-performance fastening requirements in the industrial fasteners market.

-

In May 2025, Nifco launched innovative lightweight plastic fastening solutions for electric vehicles, supporting automakers’ sustainability goals while reducing overall vehicle weight and improving assembly efficiency.

MW Industries, Inc. is a leading manufacturer of engineered fasteners, springs, and precision components serving aerospace, automotive, medical, and industrial sectors. The company offers custom fastening solutions designed for high-performance and demanding applications. MW Industries focuses on engineering expertise, quality assurance, and advanced manufacturing processes. With a broad product portfolio and strong customer collaboration, the company supports complex industrial fastening needs and maintains a competitive position in the industrial fasteners market.

-

In February 2025, MW Industries enhanced its custom fastener and precision component offerings through capacity upgrades, addressing rising demand from medical devices, industrial machinery, and aerospace sectors.

Industrial Fasteners Market Key Players:

-

Illinois Tool Works, Inc.

-

Arconic Fastening Systems and Rings

-

LISI Group - Link Solutions for Industry

-

Nifco Inc

-

MW Industries, Inc.

-

Birmingham Fastener and Supply, Inc.

-

SESCO Industries, Inc.,

-

Elgin Fastener Group LLC

-

Slidematic

-

Dokka Fasteners A S

-

Eastwood Manufacturing

-

Acument Global Technologies, Inc.

-

ATF, Inc.

-

Bossard Group

-

Stanley Black & Decker, Inc.

-

Fastenal Company

-

Associated Fasteners, Inc.

-

Trifast plc

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 101.72 Billion |

| Market Size by 2033 | USD 150.31 Billion |

| CAGR | 5.01% From 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Raw Material (Metal Fasteners, Plastic Fasteners) •By Fasteners Type (Bolts, Screws, Nuts, Washers, Rivets, Others) •By Product (Externally Threaded Fasteners, Internally Threaded Fasteners, Non-threaded Fasteners, Aerospace Grade Fasteners) •By Application (Automotive, Aerospace, Building & Construction, Industrial Machinery, Home Appliances, Lawns & Gardens, Motors & Pumps, Furniture, Plumbing Products, Renewable Energy, Silo, Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Illinois Tool Works, Inc., Arconic Fastening Systems and Rings, Hilti Corporation, LISI Group - Link Solutions for Industry, Nifco Inc., MW Industries, Inc., Birmingham Fastener and Supply, Inc., SESCO Industries, Inc., Elgin Fastener Group LLC, Slidematic, Dokka Fasteners A S, Manufacturing Associates, Inc., Eastwood Manufacturing, Acument Global Technologies, Inc., ATF, Inc., Bossard Group, Stanley Black & Decker, Inc., Fastenal Company, Associated Fasteners, Inc., and Trifast plc |