Plastic Fasteners Market Report Scope & Overview:

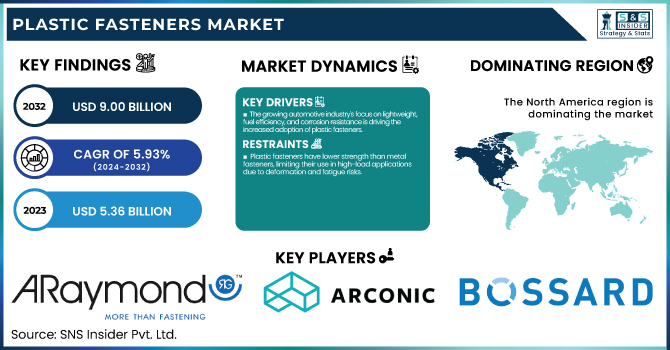

The Plastic Fasteners Market Size was estimated at USD 5.36 billion in 2023 and is expected to arrive at USD 9.00 billion by 2032 with a growing CAGR of 5.93% over the forecast period 2024-2032.

To Get more information on Plastic Fasteners Market - Request Free Sample Report

This report offers a unique perspective on the Plastic Fasteners Market by analyzing production output and utilization rates across key regions, highlighting capacity trends and efficiency benchmarks. It provides insights into raw material consumption patterns, assessing supply chain dynamics and sustainability shifts. Additionally, the study examines technological advancements and adoption rates, showcasing the rise of high-performance polymers and automation in manufacturing. The report also delivers export/import data, identifying trade imbalances and leading suppliers. Furthermore, it includes regulatory impact analysis and recyclability trends, offering a forward-looking view on compliance challenges and eco-friendly innovations in plastic fasteners.

The U.S. plastic fasteners market is projected to grow from USD 1.76 billion in 2023 to USD 2.85 billion by 2032, registering a CAGR of 5.55%. The market is driven by increasing demand across automotive, electronics, and construction industries due to the lightweight, corrosion-resistant properties of plastic fasteners. Continuous advancements in material technology and sustainability initiatives further fuel market expansion.

Plastic Fasteners Market Dynamics

Drivers

-

The growing automotive industry's focus on lightweight, fuel efficiency, and corrosion resistance is driving the increased adoption of plastic fasteners.

The plastic fasteners market is witnessing significant growth, driven by the automotive industry's shift toward lightweight and corrosion-resistant components. Plastic fasteners are replacing conventional fasteners made of metals as automakers look for ways to enhance the efficiency of fuel and reduce the weight of automobiles. Durability, chemical resistance and a cost-efficient price make those fasteners suitable for interior, exterior and under-the-hood applications. Market expansion is also driven by escalating demand for electric vehicles (EVs), where the use of plastic fasteners aids in reducing the weight and insulating battery systems. Further improvements in high-performance polymers have improved the strength and durability of plastic fasteners, enabling their adoption in structural applications. Market predisposition is also moulded by economies of sustainability aptness, which is driving high growth of plastic fasteners that are recyclable and bio-based to comply with stringent environmental regulations. The growth in automotive production across the Asia-Pacific and North American regions is projected to further accelerate market growth in the upcoming years.

Restraint

-

Plastic fasteners have lower strength than metal fasteners, limiting their use in high-load applications due to deformation and fatigue risks.

Plastic fasteners have a limited load-bearing capacity compared to their metal counterparts, making them unsuitable for applications requiring high mechanical strength. Unlike metal fasteners that can handle extreme tensional and shearing forces, plastic fasteners are more likely to deform or fracture when subjected to excessive stress. This limitation makes them not suitable in the industries like heavy machinery, construction, and automotive applications, where high load-bearing capacity is required. Moreover, plastic fasteners might suffer from material fatigue with time, particularly under extreme temperature conditions or prolonged vibration, which could also cause failure. Although polymer developments now allow for stronger plastic fasteners, they are still not a true substitute for metal fasteners, especially in structural and high load-bearing applications. Consequently, it is critical for manufacturers to critically assess the appropriateness of plastic fasteners according to specific operational needs. Nevertheless, plastic fasteners are still used in those sectors where the weight, corrosion resistance, and cost of fasteners are more important than their mechanical strength.

Opportunities

-

The growing demand for sustainable and biodegradable plastic fasteners is driven by environmental concerns, regulatory compliance, and the shift toward recyclable, eco-friendly materials.

The increasing focus on sustainability is driving demand for eco-friendly and biodegradable plastic fasteners. To minimize environmental damage and meet strict rules on plastic waste, industries continue to help drive the switch to recyclable and biodegradable materials. Conventional plastic fasteners, made from petroleum-derived polymers, plays pollution and waste accumulation role. It has prompted manufacturers to make fasteners from biodegrable bio-based polymers, such as polylactic acid (PLA) and polyhydroxyalkanoates (PHA), which deliver much of the same utility but more biodegradable. Such sustainable substitutes are emerging in auto, electronics and packing missions where industries want to cut their carbon footprint. Plus, a circular economy approach also encourages the use of recycled plastics in the production of fasteners, and thus reduces the need for virgin plastics. With growing awareness of environmental issues, consumers and industries will likely push for a demand for more sustainable plastic fasteners, thus creating new opportunities for innovation and market expansion in the years to come.

Challenges

-

Supply chain disruptions in the plastic fasteners market arise from petrochemical dependency, price volatility, logistical delays, and geopolitical uncertainties affecting raw material availability and production.

Supply chain disruptions in the plastic fasteners market stem from the industry's reliance on petrochemical-based raw materials, which are subject to price volatility and supply constraints. Crude oil prices affect the prices of polymers such as nylon, polypropylene and polycarbonate, thus making production costs unpredictable. In addition, geopolitical tensions, trade restrictions, port congestions, and transportation formalities and delays have worsened material availability. Companies depending on international suppliers also run the risk of currency fluctuations and shifting trade policies, expanding operational uncertainty. In an effort to address these issues, manufacturers are also seeking regional sources, diversifying suppliers and investing in sustainable alternatives such as bio-based polymers. Nonetheless, we remain concerned about the stability of supply chains in the medium- to long-term perspective given ongoing environmental regulations and geopolitical issues impacting global trade.

Plastic Fasteners Market Segmentation Analysis

By Product Type

The Rivets & Push-in Clips segment dominated with a market share of over 32% In 2023, due to their wide usage in various sectors including automotive, electronics and manufacturing. They provide a secure and efficient fastening solution, allowing components to be assembled quickly without the need for any extra tools. In the automotive industry, it can be utilized for significantly lightweight and corrosion resistant fastening solutions for both interior and exterior pieces. In electronics applications, they assist with cable routing and components mounting, providing robustness and easy implementation. Furthermore, the cost-effectiveness and adaptability with a variety of materials make them the preferred choice at industrial applications. This segment continues to dominate the market landscape due to increasing demand for lightweight and high-performance fastening solutions.

By End-User

The automotive segment dominated with a market share of over 38% in 2023, owing to the increasing focus of the industry on lightweight materials in order to enhance fuel economy and vehicle performance. Fasteners, especially those made of plastic, are increasingly favored by automakers over traditional metal alternatives for reasons of corrosion resistance, cost and ease of manufacturing. These fasteners are critical in vehicle interiors, exteriors, and under-the-hood components, increasing durability while lowering overall vehicle weight. And the increasing adoption of electric vehicles (EVs) has boosted demand even further, with plastic fasteners assisting in the optimization of battery enclosures and electrical components. As the automotive industry continues to innovate in terms of design and material, the need for high-performance plastic fasteners is likely to endure, ensuring its leading position in the market.

Plastic Fasteners Market Regional Outlook

The North America region dominated with a market share of over 42% in 2023, due to high demand from key industries such as automotive, electronics, and construction. The region has established manufacturing units, advanced technology practices, and strict quality standards, which boost the demand for durable and lightweight plastic fasteners. In the automotive industry, the transition to EVs and fuel-efficient architectures has led to greater use of plastic elements. Plastic fasteners are equally important in the electronics industry, providing lightweight and corrosion-resistant assembly options. Moreover, the growing emphasis on sustainable and cost-effective materials in the construction sector will also propel market growth. The United States, being home to many influential industry leaders, and with significant investments in R&D, plays a crucial role in maintaining the expansion of the plastic fasteners market in North America with continuous innovations.

Asia-Pacific is the fastest-growing region in the Plastic Fasteners Market, driven by rapid industrialization and expanding infrastructure projects. China, India, and Japan are showing increased demand because of booming the automotive, electronics, and construction industries. Increasing automotive production and technology shift towards lightweight components drive market growth. Furthermore, the electronics industry creates a demand for fasteners that are durable and cost-effective, especially within the realm of consumer devices and appliances. The increasing government initiatives created for manufacturing and the foreign investments additionally aid in boosting the growth of the market. The region is a good choice for production due to supply of low-cost labor and raw materials. This situation is anticipated to create opportunities for the growth of the plastic fasteners market across the Asia-Pacific, as industries will continue to thrive in the region.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key players in the Plastic Fasteners Market

-

Anil Plastics & Enterprises – Plastic screws, nuts, and washers

-

Araymond – Plastic clips, connectors, and fastening solutions

-

Arconic – Lightweight plastic and metal fasteners

-

Bossard Group – High-performance plastic fasteners for various industries

-

Bulte Plastics – Nylon screws, washers, and custom plastic fasteners

-

Canco Fasteners – Plastic bolts, nuts, and fastening accessories

-

Craftech Industries – High-strength plastic fasteners, threaded rods

-

E & T Fasteners – Custom-molded plastic fasteners, cable ties

-

Fontana Gruppo – Plastic and composite fastener solutions

-

Illinois Tool Works (ITW) – Industrial-grade plastic rivets, fasteners

-

Joxco Seals – Plastic sealing fasteners, washers

-

KGS Kitagawa Industries Co. – Insulating plastic fasteners, clips

-

Micro Plastics – Precision-molded plastic fasteners, spacers

-

MW Industries – Plastic threaded inserts, fastening solutions

-

Nifco – Automotive and industrial plastic fasteners

-

Nyltite Corporation – Nylon fasteners, snap fasteners, and bushings

-

Penn Engineering – Plastic press-fit fasteners, threaded inserts

-

Shamrock International Fasteners – High-performance plastic fastening solutions

-

Shanghai Yuanmao Fastener Co. – Custom plastic bolts, screws, and washers

-

Stanley Black & Decker – Durable plastic and composite fasteners

Suppliers for (Innovative plastic fasteners used in automotive, electronics, and industrial sectors) Plastic Fasteners Market

-

Essentra Components

-

FastenMaster

-

ITW Fastex

-

Avery Dennison Fastener Solutions

-

Panduit

-

Ningbo Hinix Hardware Industry & Trade Co., Ltd

-

BAND-IT

-

YKK

-

APLIX

-

Nifco

Recent Development

In April 2024: Bossard partnered with an OEM and Tier supplier to develop an insert-stud solution for EV truck batteries, optimizing electrical insulation and packaging while lowering tooling, molding, and assembly costs.

In March 2025: Fontana Gruppo has acquired a majority stake in India-based Right Tight Fasteners Pvt. Ltd., strengthening its global presence.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 5.36 Billion |

| Market Size by 2032 | USD 9.00 Billion |

| CAGR | CAGR of 5.93% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Product Type (Rivets & Push-in Clips, Cable Clips & Ties, Threaded Fasteners, Washers & Spacers, Grommets & Bushings, Wall Plugs, Others) •By End User (Automotive, Electrical & Electronics, Building & Construction, Supermarkets, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Anil Plastics & Enterprises, Araymond, Arconic, Bossard Group, Bulte Plastics, Canco Fasteners, Craftech Industries, E & T Fasteners, Fontana Gruppo, Illinois Tool Works (ITW), Joxco Seals, KGS Kitagawa Industries Co., Micro Plastics, MW Industries, Nifco, Nyltite Corporation, Penn Engineering, Shamrock International Fasteners, Shanghai Yuanmao Fastener Co., Stanley Black & Decker. |