INDUSTRIAL LASERS MARKET SCOPE & OVERVIEW:

To Get More Information on Industrial Lasers Market - Request Sample Report

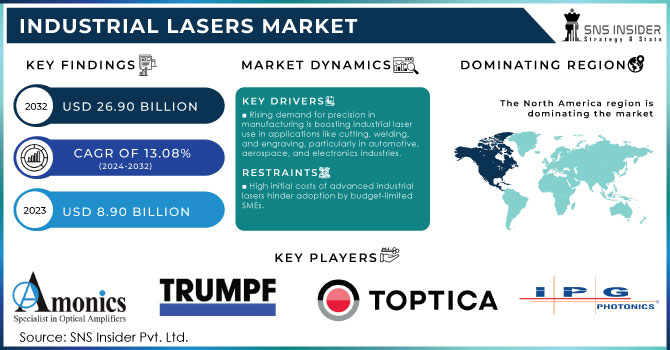

The Industrial Lasers Market size was estimated at USD 8.90 Billion in 2023 and is expected to reach USD 26.90 Billion by 2032 at a CAGR of 13.08% during the forecast period of 2024-2032.

The Industrial Lasers Market is attributed to the increasing use of laser technology in various industrial sectors. Industrial lasers play a vital role in activities such as cutting, welding, marking, engraving, and additive manufacturing. Industries like automotive, aerospace, electronics, and healthcare have played a significant role in stimulating demand by needing precise manufacturing to improve productivity and efficiency. As automation in manufacturing grows, industrial lasers are becoming more important in advanced processes such as 3D printing and micro processing. Manufacturers can use these lasers to create smaller, more detailed parts, especially in rapidly changing industries like consumer electronics and medical devices. Furthermore, fiber lasers are becoming increasingly popular because of their energy efficiency, easy maintenance, and extended operational lifespan, making them a favored option compared to older laser technologies. Numerous new developments are impacting the market for industrial lasers. The incorporation of lasers in Industry 4.0 is revolutionizing conventional production processes, with lasers playing a more prominent role in automated and interconnected manufacturing setups. This pattern mirrors the wider trend towards intelligent manufacturing.

Another significant development is the reduction in size of lasers. The demand for compact high-precision lasers is high, especially in industries such as healthcare and electronics where smaller, more accurate components are needed. This is particularly seen in fields like semiconductor manufacturing and medical devices. Moreover, the increasing utilization of green and UV lasers in industries that need to avoid excessive heat generation, like solar panels and flexible electronics, is becoming more popular. These advancements coincide with the increasing focus on sustainability, with lasers providing eco-friendly and waste-reducing options compared to traditional manufacturing methods.

MARKET DYNAMICS

DRIVERS

- The rising demand for precision and efficiency in manufacturing is driving the increased use of industrial lasers in high-precision applications like cutting, welding, and engraving, especially in industries like automotive, aerospace, and electronics.

The rising demand for precision and efficiency in manufacturing is significantly boosting the adoption of industrial lasers. These lasers are essential for high-precision applications such as cutting, welding, engraving, and marking, offering unparalleled accuracy in complex manufacturing processes. Industries like automotive, aerospace, and electronics are at the forefront of this trend, as they face growing pressure to produce more intricate and efficient components while minimizing material waste.

In the automotive sector, industrial lasers are used to precisely cut and weld parts for electric vehicles (EVs), ensuring tight tolerances and enhancing the overall quality of the final product. Aerospace manufacturers rely on lasers for producing lightweight, high-strength components, which are critical for fuel efficiency and safety in aircraft. In electronics, lasers play a crucial role in the production of smaller, more complex devices like microchips and circuit boards, where traditional methods may not achieve the necessary accuracy. The ability of lasers to deliver clean, precise cuts and welds with minimal material wastage is a key factor driving their adoption. This efficiency not only enhances product quality but also reduces production costs, as less material is wasted during manufacturing. Additionally, lasers can work on a wide range of materials, from metals to plastics, making them versatile tools for various industries. As companies strive for more automated, precise, and sustainable manufacturing processes, the demand for industrial lasers will continue to grow, solidifying their role in advanced manufacturing.

- Technological advancements in fiber, green, and ultraviolet (UV) lasers have enhanced performance and energy efficiency, expanded their applications and increased adoption across various industries, including semiconductor manufacturing and medical devices.

Recent innovations in laser technology, particularly in fiber lasers, green lasers, and ultraviolet (UV) lasers, have significantly expanded the range of applications for industrial lasers. Fiber lasers, known for their compact size and high power, deliver excellent beam quality and efficiency, making them ideal for cutting and welding metals, as well as for precise marking applications. Their ability to operate at high speeds with minimal energy consumption enhances productivity while reducing operational costs, positioning them as a preferred choice in industries such as automotive and aerospace. Similarly, green lasers are gaining traction due to their ability to effectively process a variety of materials, including metals and plastics. They are particularly beneficial in applications requiring high precision, such as electronics manufacturing and medical device production. The wavelength of green lasers enables better absorption in certain materials, resulting in cleaner cuts and higher quality finishes.

UV lasers are also making strides in the industrial sector. Their short wavelength allows for fine detailing and minimal thermal impact on materials, making them ideal for applications like micro-machining and delicate engraving tasks. The use of UV lasers is particularly valuable in semiconductor manufacturing, where precision is paramount. These advancements contribute to longer operational lifespans and reduced maintenance requirements compared to conventional laser systems, further enhancing their appeal. Overall, the versatility and improved performance of modern laser technologies drive their adoption across diverse industries, fueling market growth and innovation in manufacturing processes.

RESTRAIN

- High initial costs for advanced industrial laser systems, including installation, training, and integration expenses, pose a significant barrier to adoption for small and medium-sized enterprises (SMEs) with limited budgets.

The high initial costs associated with advanced industrial laser systems present a formidable challenge for small and medium-sized enterprises (SMEs). These sophisticated systems, known for their precision and efficiency in various applications such as cutting, welding, and engraving, require substantial upfront investments that often exceed the financial capabilities of many SMEs. The purchase price of the laser equipment itself is only the beginning; additional expenses related to installation, system integration, and employee training must also be considered. Installation costs can be significant, as they may involve the customization of the production environment to accommodate the new technology. Moreover, the complexity of laser systems necessitates specialized training for operators and maintenance personnel, further driving up costs. This financial burden can be particularly daunting for SMEs, which often operate on tighter budgets compared to larger corporations. As a result, many potential users may hesitate to adopt these technologies, fearing that the return on investment will not justify the initial expenditure. This hesitancy can stifle innovation and limit growth opportunities within sectors that could greatly benefit from laser technology.

MARKET SEGMENTATION ANALYSIS

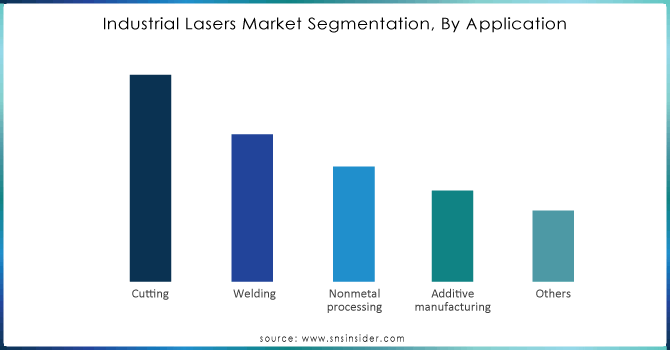

By Application

The Cutting segment accounted for largest market share of over 32.04% in 2023. The technology of industrial laser cutting systems emphasizes precision, low weight, and strong long-term processing stability during high-speed and high-precision tasks. Numerous sectors are always seeking more reliable and faster methods to manufacture precise cuts in thin metals. Fibre laser technology is the top choice for cutting applications in the machine tool sector and other industrial markets due to its high-power levels, simpler maintenance, and improved functionality.

Do You Need any Customization Research on Industrial Lasers Market - Inquire Now

REGIONAL ANALYSIS

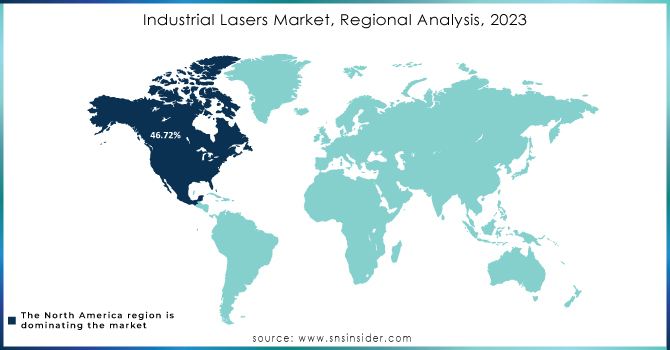

The North America Industrial Lasers Market dominated this market in 2023 over 46.72%. Advancements in technology, including in manufacturing, aerospace, and automotive industries, have led to the development of cutting-edge laser technology solutions by various vendors in the region like IPG Photonics and Coherent Inc. Many companies, SMEs, and startups have raised substantial capital for this purpose.

The Asia Pacific Industrial Lasers market is expected to register significant growth from 2024 to 2032. Asia-Pacific is where some major market players are located, such as Han's Laser Technology Industry Group and others. The market in the area is expected to grow due to its strong presence in the automotive and medical industries. With the Asia-Pacific region expected to experience the highest growth rate in the market, many companies are also focusing on enhancing their growth and advancement.

Key players

Some of the major players in the Industrial Lasers Market:

- Amonics Ltd. (Fiber Lasers, Amplifiers)

- Apollo Instruments Inc. (Diode Lasers, Laser Diodes)

- TRUMPF (Disk Lasers, CO2 Lasers)

- Toptica Photonics AG (Tunable Diode Lasers, Femtosecond Lasers)

- Quantel Group (Pulsed Nd, Lasers, Fiber Lasers)

- Jenoptik Laser GmbH (Solid-State Lasers, Diode Lasers)

- IPG Photonics Corporation (Fiber Lasers, Diode Laser Systems)

- CY Laser SRL (Fiber Laser Cutting Machines)

- NKT Photonics A/S (Supercontinuum Lasers, Femtosecond Lasers)

- Coherent Inc. (Excimer Lasers, Fiber Lasers)

- Lumentum Holdings Inc. (Diode Lasers, Pump Lasers)

- Fanuc Corporation (Laser Cutting Systems, Fiber Lasers)

- ROFIN-SINAR Technologies Inc. (Fiber Lasers, CO2 Lasers)

- Bystronic Laser AG (Laser Cutting Systems, Fiber Lasers)

- Han's Laser Technology Industry Group Co. Ltd. (CO2 Lasers, Fiber Lasers)

- Amada Miyachi Co. Ltd. (Laser Welding Systems, Fiber Lasers)

- Laserline GmbH (Diode Lasers, High-Power Lasers)

- Lasea SA (Ultrafast Lasers, Precision Lasers)

- Prima Power (Laser Cutting Systems, Fiber Lasers)

- Epilog Laser (CO2 Lasers, Fiber Laser Engraving Systems)

RECENT TRENDS

In January 2024: ACSYS Lasertechnik GmbH (Kornwestheim) presented various technological innovations at this year’s “World Money Fair” from February 1-4, 2024. At Stand D4, Hall 2, the supplier of high-precision standards and special machines in the field of laser technology, presented innovative solutions for flexible, resource-saving de-coating, engraving, and polishing in the Mint industry, among other things.

In November 2023: IPG Photonics Corporation and Miller Electric Mfg. LLC, a manufacturer of arc welding products, announced a strategic partnership with a goal to promote laser solutions for handheld welding applications further. Both companies bring unique expertise to develop specific solutions to address customer challenges, and together, they will further advance and bring to market products that are easy to learn and operate while offering unmatched benefits.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 8.90 Billion |

| Market Size by 2032 | USD 26.90 Billion |

| CAGR | CAGR of 13.08% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Macro processing, Micro processing) • By Power (Less than 1 kW, more than 1.1 kW) • By Application (Cutting, Welding, Nonmetal processing, Additive manufacturing, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Amonics Ltd, Apollo Instruments Inc, TRUMPF, Toptica Photonics AG , Quantel Group , Jenoptik Laser GmbH , IPG Photonics Corporation , CY Laser SRL , NKT Photonics A/S, Coherent Inc, Lumentum Holdings Inc, Fanuc Corporation , ROFIN-SINAR Technologies Inc, Bystronic Laser AG , Han's Laser Technology Industry Group Co. Ltd, Amada Miyachi Co. Ltd, Laserline GmbH , Lasea SA ,Prima Power ,Epilog Laser |

| Key Drivers | • The rising demand for precision and efficiency in manufacturing is driving the increased use of industrial lasers in high-precision applications like cutting, welding, and engraving, especially in industries like automotive, aerospace, and electronics. • Technological advancements in fiber, green, and ultraviolet (UV) lasers have enhanced performance and energy efficiency, expanded their applications and increased adoption across various industries, including semiconductor manufacturing and medical devices. |

| RESTRAINTS | • High initial costs for advanced industrial laser systems, including installation, training, and integration expenses, pose a significant barrier to adoption for small and medium-sized enterprises (SMEs) with limited budgets. |